CRYPTO SPECIAL REPORT - Bitwise: Leading Crypto Index Funds & New Alpha Opportunity

For a full copy of this report in PDF format, click this link.

Bitwise Asset Management, Inc. (“Bitwise” or “Company”) is a San Francisco-based specialist asset manager founded in 2017. The Company pioneered the first and largest cryptocurrency index fund and is a rising-star provider of liquid, low-cost crypto funds. Bitwise is moving to have its flagship Bitwise 10 Crypto Index Fund and Bitwise Bitcoin Fund publicly tradable. Comparable products have traded at sustained premiums to fund Net Asset Value (NAV) ranging from 40% to 200%, with maximums as high as 2,000%. If listed, we believe Bitwise’s products could justify trading with premiums corresponding to comps, creating a new potential alpha opportunity for funds & accredited investors. This report outlines approaches for capitalizing on such an opportunity (Slide 30).

- Bitwise’s professional organization resembles The Vanguard of crypto. Bitwise has a strong team (Slide 8) managing a professionalized firm (Slide 3) that’s well capitalized with backing from leading VCs (Slide 9). The Company’s cutting-edge research (Slide 11) has allowed it to pioneer a robust index methodology (Slide 17) and best-in-class smart beta funds (Slide 5). Bitwise has institutional-grade operations (Slide 4), industry-leading service providers (Slide 10) and an ongoing dialogue with top regulators (Slide 6). These factors offer signs that point to industry leadership and should instill investors’ trust in the firm.

- Funds are attractive passive vehicles for convenient, long-term exposure. Bitwise 10 Crypto Index Fund (Slide 21), Bitwise Bitcoin Fund (Slide 26) and Bitwise Ethereum Fund (Slide 39) offer compelling ways to capture the long-term growth of crypto assets as a category. The funds charge no performance fee and have all in expense ratios below comparable crypto products (Slide 40). We believe low-cost beta products deserve a core place in investors portfolios (Slide 7) and see Bitwise as a leading solution for professionally managed, audited, custodial-insured crypto exposure via a traditional vehicle.

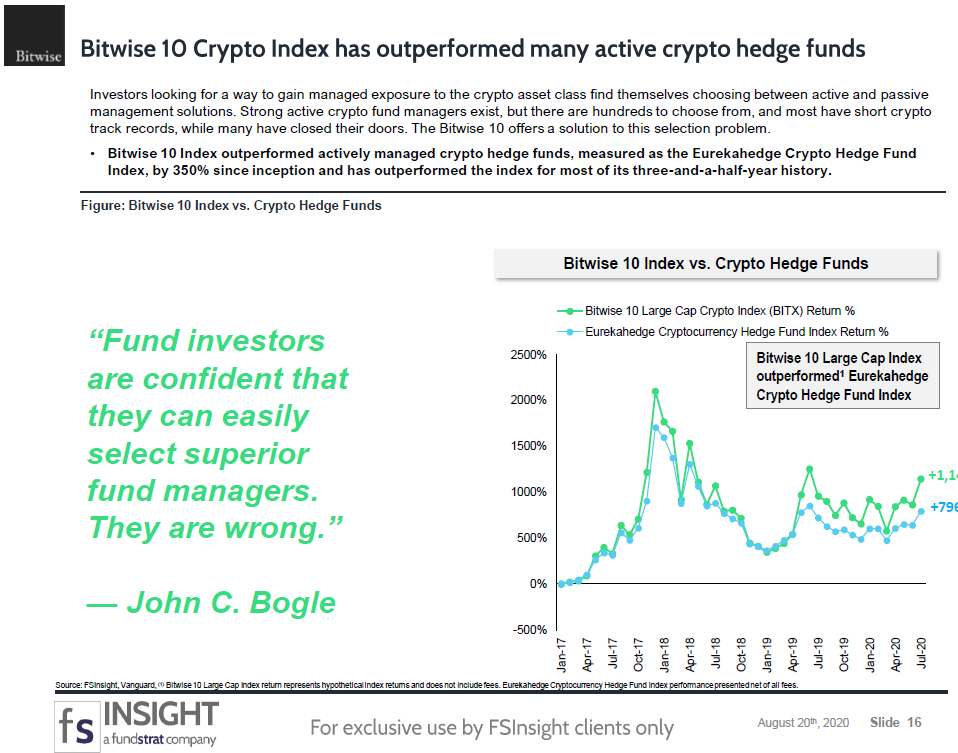

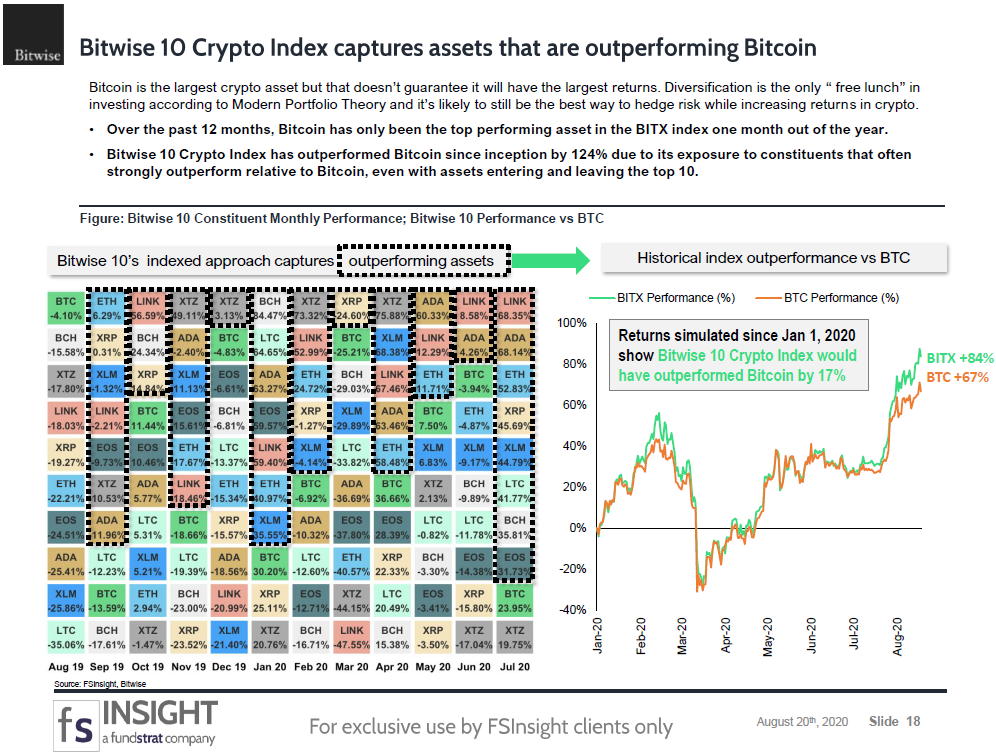

- Bitwise 10 Crypto Index Fund offers smart beta exposure to large cap crypto winners. Selecting the top performing assets or active fund managers is challenging. Bitwise 10 Crypto Index Fund offers market cap weighted passive exposure to ~80% of the market. A robust rules-based monthly rebalancing methodology provides exposure to large cap assets outperforming Bitcoin (Slide 18) while the index has outperformed the Eurekahedge Crypto Hedge Fund Index by 350% since inception (Slide 16).

- Publicly listing Bitwise shares would open the door for retail and financial advisors. Investors in the US have limited means for gaining convenient crypto exposure due to structural constraints (Slide 28). Bitwise is pursuing approval to have shares of its Bitwise 10 Crypto Index and Bitwise Bitcoin Fund publicly quoted and tradable in traditional brokerage accounts (Schwab, E*TRADE, etc.) via OTCQX (Slide 42).

- Shares have potential to trade at NAV premiums corresponding to GBTC and ETHE. Bitwise’s listed funds most comparable products would likely be GBTC & ETHE due to similar structures and ~90% – 100% underlying asset overlap. GBTC & ETHE have NAV premiums that currently sit at 24% and 102%, respectively, while both have sizable market caps and trading volume that evidence real demand (Slide 29). Listed Bitwise funds could trade at corresponding premiums.

- Multiple Bitwise alpha strategies exist for hedge funds and accredited investors. Investors could capitalize on a possible premium by purchasing Bitwise funds’ shares in a private placement at NAV and selling them on the open market once tradable. We illustrate a range of hypothetical opportunistic, long-term, and crypto-hedged trade scenarios (Slide 31, Slide 32, Slide 33).

- What could go wrong? Listing approval delays or failure. Lack of secondary market liquidity. Negative or lower than expected NAV premiums. Actual returns may differ from our simplified hypothetical model. Crypto volatility. Hedging basis (Slide 34)

Bottom line: Bitwise has an industry leading team and organization. Professionally managed passive products like Bitwise’s have a core place in a portfolio. Bitwise 10 Crypto Index Fund offers a differentiated and attractive solution. Plans to list Bitwise funds create an opportunity for traders and hedge funds. Bitwise funds have NAV premium alpha potential.

Key slides from this report…

Bitwise: Leading Crypto Index Funds & New Alpha Opportunity (Slide 1)…

Offering cutting-edge investable products, indices and research (Slide 5)…

Bitwise 10 Crypto Index has outperformed many active crypto hedge funds (Slide 16)…

Bitwise 10 Crypto Index captures assets that are outperforming Bitcoin (Slide 18)…

Bitwise plans to list its Bitwise 10 Crypto Index & Bitcoin Funds’ shares for trading (Slide 28)...

Bitwise funds offer an opportunity for investors across several strategies (Slide 30)…

Reports you may have missed

EXECUTIVE SUMMARY Solana is a high throughput smart contract platform (SCP) engineered for user friendly and efficient decentralized applications (dApps). The platform's primary objective is to establish a unified global state chain via its unique architecture enabling the parallel processing and rapid confirmation of transactions. Osprey Funds is a digital asset manager aiming to build low-cost digital asset investment products that are simple, secure, and transparent. Osprey's Solana Trust (OSOL)...

EXECUTIVE SUMMARY Founded in February 2018, Blockchain Investment Group (BIG) is a fund of funds that identifies, evaluates, and manages investments in crypto and blockchain hedge funds. BIG leverages deep industry connections, a proven manager selection process, and prioritizes diversification across a wide range of crypto sectors and investment strategies. Click HERE to download the full report. KEY SLIDES FROM THIS REPORT COMPANY OVERVIEW (SLIDE 11) BIG LEADERSHIP (SLIDE 12)...

KEY SLIDES FROM THIS REPORT MAJOR MARKET DISCONNECT (SLIDE 3) REALFI: A DATA-DRIVEN PRIVATE CREDIT MARKETPLACE (SLIDE 4) DEMAND FOR CREDIT IN EMERGING MARKETS (SLIDE 9) CHALLENGES FOR IMPACT INVESTORS (SLIDE 11) REALFI AT THE INTERSECTION OF CREDIT, IMPACT, & EM (SLIDE 13)