Crypto Market Update - 3/13/2020

Please see important disclosures at the bottom of this report

Back in December 2019, I started saying we’re in a “crypto Goldilocks economy” that’s “not too hot and not too cold” – meaning, markets weren’t expensive, but they weren’t cheap either.

That changed this week.

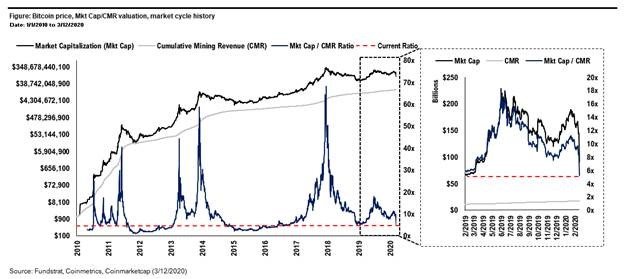

Corona. Macro. Panic. Reason aside, Bitcoin’s price retraced to a low of $3,858 and now sits around $5,400, and its Market Cap / Cumulative Mining Revenue Ratio has fallen to 5.3x.

As an investor in any asset, crypto included, it’s not the price you pay that matters, it’s the relative value you get.

Bitcoin has not been this attractively priced, on a relative fundamental valuation basis, since February 2019, when it bottomed out around $3,400. Prior to that, we had not seen similarly attractive levels since November 2016, when Bitcoin was heading into the last bull market cycle and trading under $700!!!

Think about that.

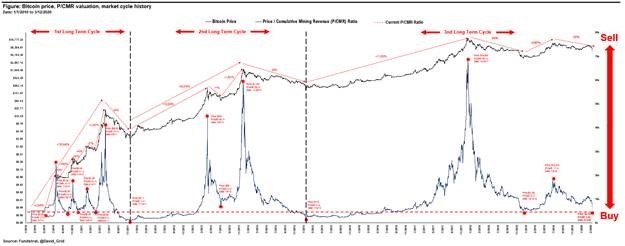

There’s an 80/20 rule in everything. The chart above has been my 80. Crypto has historically moved in boom and bust market cycles. If you got these macro cycles right, it hasn’t mattered as much what you owned, it’s explained 80% of your success. This valuation model has been a strong predictor of all prior Bitcoin cycles, which is why I give it a heavy degree of importance in my analysis.

There are four potential future scenarios over the next 12-18 months:

- Bear: We’re headed for a full-on protracted crypto bear market where prices have another 50% left to fall and we head towards all time low valuations in the 2x range putting BTC around $2k.

- Stagnant: We sit here around $5k for a drawn-out period while the broader market works it’s self out and any capital put to work is dead money.

- Recovery: We turn around, slowly grinding our way back upwards over the course of the year and get some multiple expansion back to the historical average of 9.5x taking us above $9k.

- Bubble: We get a quick recovery, perhaps even a v-bottom (may by happening already), that bounces us back into another bubble with frothy multiples similar to prior cycle highs that imply prices around $50k-70k.

The chart above should give perspective on the potential risk / reward for each scenario, assuming, the trend hasn’t been broken entirely. My view- history won’t repeat but it will rhyme. The rough probabilities of each scenario in my view right now are:

- Bear: 5% probability

- Stagnant: 15% probability

- Recovery: 70% probability

- Bubble: 10% probability

Let’s walk through each one.

Bear: There’s a low probability we go to 2x P/CMR trough multiples. If we do, it puts the price around $2,000 (~55% downside). But keep this perspective, the last time Bitcoin touched a 2x P/CMR multiple was in January 2015 at a price of $175 following the Mt. Gox hack, and it has never fallen below a 1x P/CMR, ever!!!

I’m not saying the market can’t flinch, panic, and then quickly move here. I’m saying, that if it does, it should be brief, and viewed as a massive temporary opportunity to buy.

Unless, we get some type of “crypto specific event”, that causes the fundamental market environment to change. Not a broader market event like corona, or global recession. Those should fundamentally impact crypto in a mixed, but incrementally positive way in the long term, as I discussed in last week’s newsletter.

The short list of (known, unknown) event risks I see that could make this happen are:

- Exchange Crackdowns: Regulators hit offshore exchanges like Binance, Bitmex, Bitfinex for servicing US/UK customers and it causes a liquidity shock (unlikely IMHO: these guys have been getting their act together and have a lot of money to fight legal battles).

- Trump: Treasury department decides they don’t like crypto and try to cut it off. Tom’s talked about this. Election year less likely. Plus, there’s a growing crypto lobby in Washington now.

- Manipulation Enforcement: The CFTC pursues actions against some large crypto whales for market manipulation. Study here from the Journal of Monetary Economics about Price Manipulation in the Bitcoin Ecosystem back in 2014. It’s been my view, that this still exists, but likely to a lesser degree now that the market is bigger. But it’s still a risk. Remember, the Hunt Brothers manipulated the much larger silver market in the 1980’s.

- Others Lesser Risk: The IRS could take actions against large early whales, but they’d likely pay a fine and go, SEC could move harder on ICOs, but that’s a small part of the market these days, FINCIN tries to kill privacy coins, but they’re fairly insignificant as well.

- Unknown, Unknowns: What virus could be out there that causes crypto to unexpectedly catch a cold like corona has done to the global economy? Only time will tell. All you can do is price some risk premium in for it.

Stagnate: There is some chance we could see a long, drawn out flat-to-choppy, sideways market over the next 12-18 months. That means Bitcoin and crypto is a dead money investment like it was during 2012 and 2015. With all the market turmoil, all the panic, all the central bank and government intervention – how likely is that?

As perspective, even if you’d historically bought a prior multi-year crypto price stagnation period, assuming you held, the magnitude of each prior bull market meant you eventually vastly outperformed on an annualized basis.

History doesn’t have to repeat, but again, I think it’s more likely than not it rhymes. Crypto moves in its own macro market cycles. Look at the chart above again. See a trend? It doesn’t happen by accident either in my view. It happens in large part, due to structural market factors that drive the supply / demand imbalances. I’m seeing signs these imbalances are forming again, as I’ll discuss in my next point.

Recovery: The most likely scenario is, we see a recovery period, where valuation multiples return to their historical life-time average of 9.5x, and prices move back above $9,000 or higher.

- Sentiment: It’s impossible to know what the entire market is thinking, but I can say, with a high degree of perspective, despite the pull back, the market sentiment today is nowhere near as negative as it was during December 2018.

- Catalysts: We see three likely catalysts on the horizon: 1) elections, 2) geopolitical risks, and 3) halvening.

- Structure: The market structure of underwater coin holder should reduce supply on the market as prices move higher. Coin holdings have likely consolidated as well in the prior shake outs. Meaning, many get rich quick folks have been scared out by December 2019 volatility, and large traditional smart money institutional investors may have been forced out by the broader market turmoil. Who is left? Early crypto supporters and die-hard believers, that mentality has historically limited the supply side of the market until prices have reached much healthier levels during recoveries.

Bull: The probability I’m placing on a bull market might surprise people. It’s never a good idea, and especially not a sound investment decision, to bet on there being a period of irrational price movement. But some markets are not rational. This is crypto. This market is paradoxically, rationally irrational. Bitcoin and crypto is a product. As a product, it’s historically acted as a Giffen good. Meaning it’s a product that consumers demand more, as its price moves higher. Its rationally irrational.

Bottom Line: If you were on the sidelines, now is the time to start buying in earnest. It’s impossible to know with absolute certainty what the market will do next, but what I do know is, if history is any guide, and I firmly think it is, the odds are on your side.