Blockchain Investment Group: A Fund of Funds Providing Access to Top Digital Asset Managers

Apr 26, 2022

• 2

Min Read

To download the full report, click here.

Executive Summary

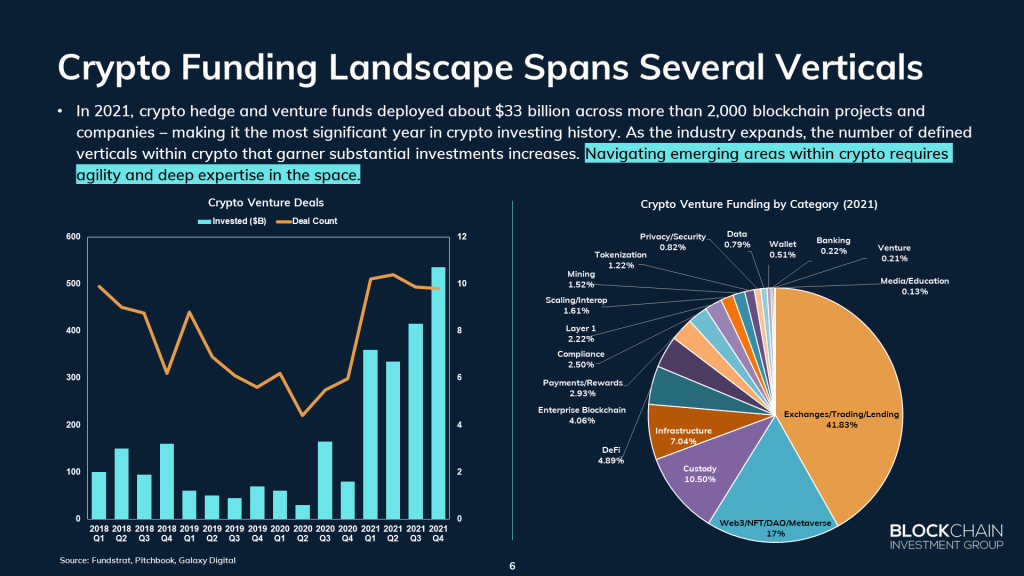

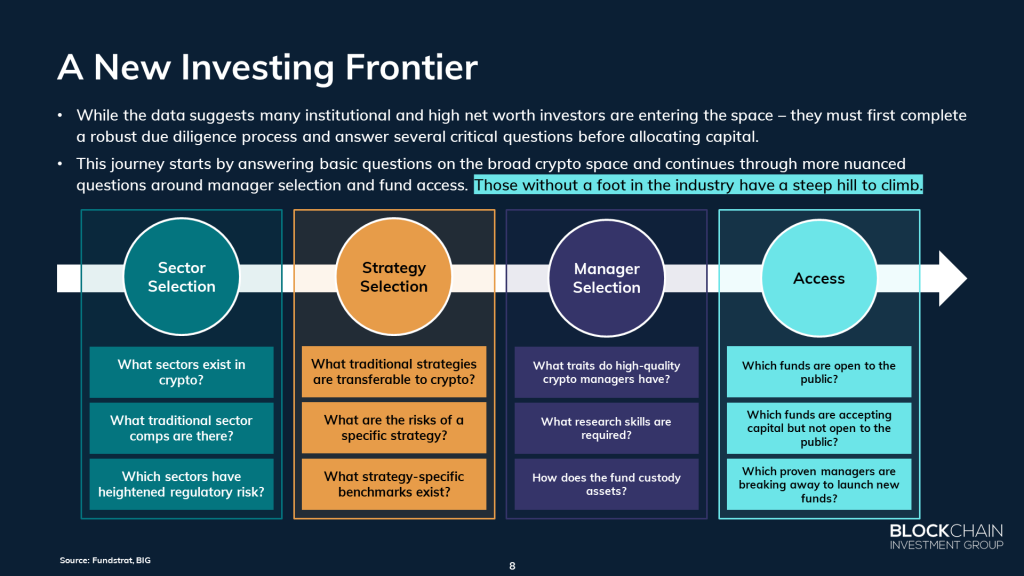

- Alongside its exponential growth, the crypto market has become increasingly complex over the past several years. Blockchains have proven to be imperative underlying infrastructure for the next generation of internet applications. In turn, a wave of businesses has set out to develop institutional and consumer products that leverage or service blockchain infrastructure. Capital allocators have taken notice, investing over $33 billion across 2,000 blockchain projects and companies in 2021. As of Q4 2021, ~863 crypto investment funds have launched to meet this demand for crypto exposure. However, new entrants looking to allocate capital across crypto funds have several hurdles to overcome, including high minimums, sector & strategy selection, manager selection, and access.

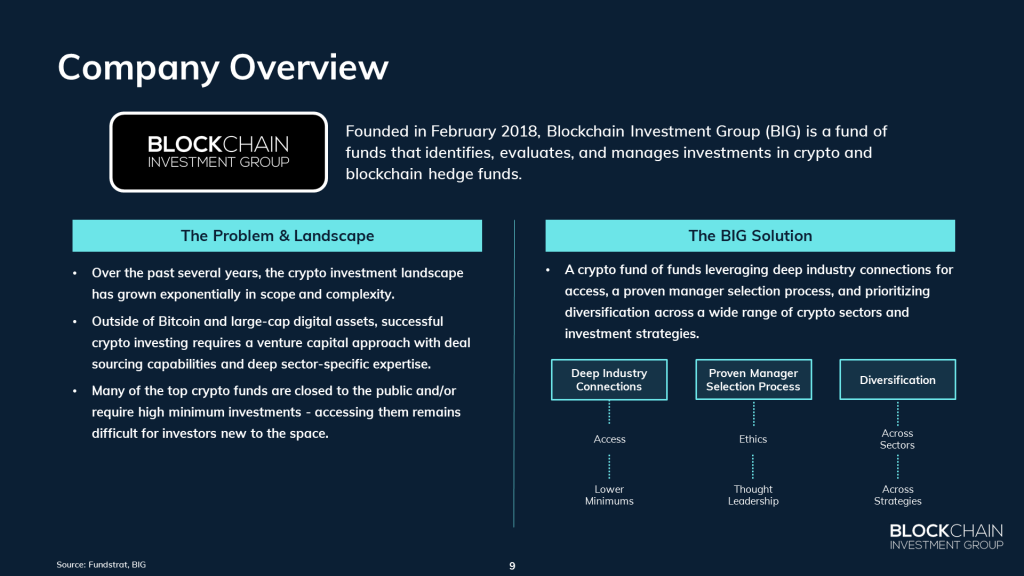

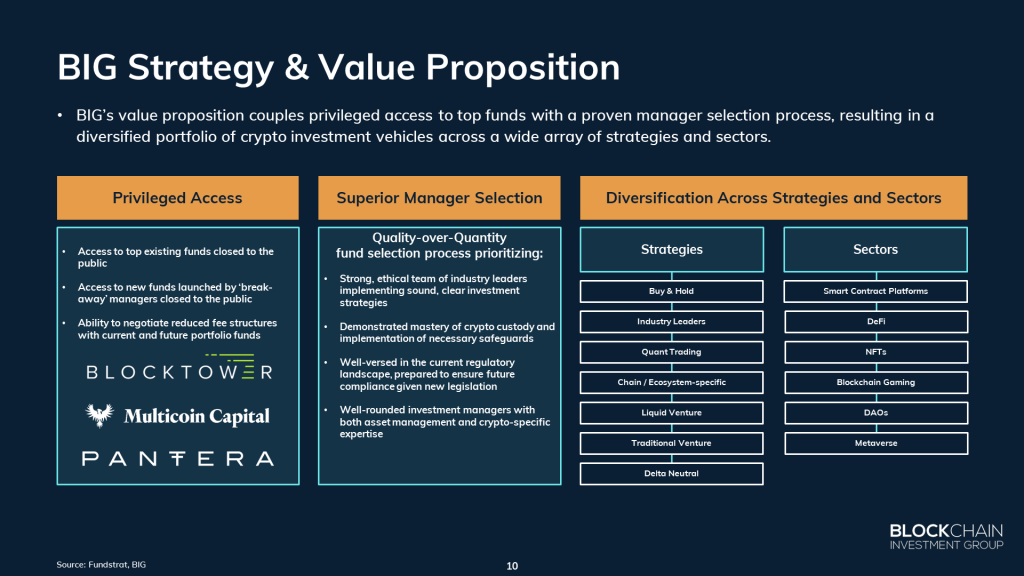

- Blockchain Investment Group (“BIG” or the “Fund”) is a crypto fund of funds (“FoF”) that identifies, evaluates, and manages investments in crypto and blockchain-focused hedge funds. BIG’s core value propositions include (1) privileged access to top funds with proven track records, (2) a robust manager selection process for identifying ethical and well-rounded investment managers, and (3) diversification across an expanding landscape of crypto sectors and investment strategies.

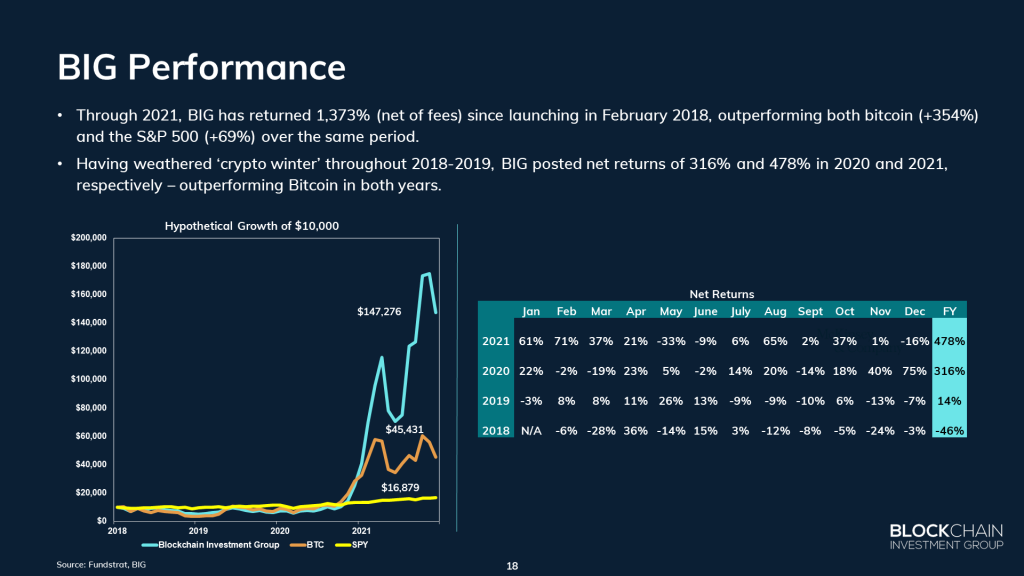

- BIG boasts a noteworthy track record since launching in February 2018, having outperformed bitcoin by 1,019%. Much of the outperformance came in 2020 and 2021 when the Fund returned 316% and 478% on a net basis, respectively.

- Risks – Execution risk as the Fund will need to adapt and evolve its investment process to keep pace with the exponential innovation occurring in crypto, liquidity risk, given the types of assets held by portfolio funds, as well as regulatory and technological risk.

- Bottom Line – Leveraging a ‘quality-over-quantity’ manager selection process, BIG’s fund of funds provides capital allocators diversified exposure to the burgeoning crypto space through access to top funds and portfolio managers.

Key slides from this report…

Crypto Funding Landscape Spans Several Verticals (Slide 6)

A New Investing Frontier (Slide 8)

Company Overview (Slide 9)

BIG Strategy & Value Proposition (Slide 10)

BIG Performance (Slide 18)