Swan Bitcoin: The Case for a Bitcoin-only Focus

Mar 8, 2022

• 2

Min Read

CLICK HERE for the full copy of this report in PDF format.

Executive Summary

- The digital assets space has witnessed a Cambrian explosion of alternative crypto networks over the past few years, with many projects experimenting on concepts pioneered by Bitcoin. Despite the new options for crypto investors, we believe Bitcoin remains differentiated as the only sound monetary cryptoasset due to its unique technical characteristics around decentralization, consensus, and supply. Bitcoin is also fundamentally superior to other existing monetary assets such as the U.S. dollar and gold, its only weakness being its early stage of adoption.

- Swan Bitcoin (“Swan” or the “Company”) is a Bitcoin-only digital asset platform that recognizes bitcoin as the reserve asset of the future and wants to be the preeminent service provider around this asset as it transitions from a risk-on to a risk-off investment. By leveraging a Bitcoin-only focus, Swan is well-positioned to service a critically underserved cohort of potential and existing Bitcoin investors through a robust suite of products, services, and educational content.

- The Company’s current offerings primarily center around the procurement of bitcoin, such as instant buys, dollar-cost averaging solutions, and facilitating large OTC orders. But its product roadmap features consumption-related tools, including asset-backed loans, wallet services, and credit & debit cards.

- Importantly, Swan’s narrow focus allows it to build a trusted brand as the foremost expert on Bitcoin. This encourages more people to front-run Bitcoin’s maturation and helps the Company to establish a long-term relationship with its client base. From an operational perspective, a single-asset offering removes the need for expensive hardware and labor required to service multiple assets. This frees up capital to build out its content packages and allows the Company to offer lower fees at attractive margins.

- Risks – Any centralized entity whose success is centered on the performance of an objectively volatile asset is subject to market risk. Beyond volatility, risks center around the security of user funds and regulatory headwinds that could temper the pace of adoption.

- Bottom Line – In an industry seemingly always searching for the “next big trade,” Swan differentiates itself by focusing on the cryptoasset with the largest addressable market. Although early in its development, Swan has already established itself as a leading voice in Bitcoin circles and is positioned to guide individuals, advisors, and institutions on their journey with Bitcoin.

Key slides from this report…

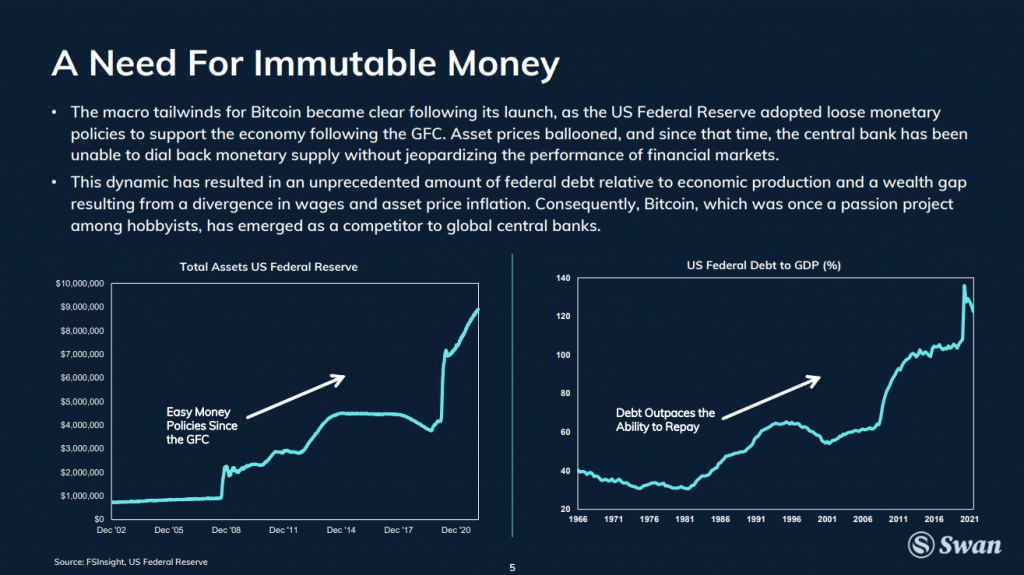

A Need For Immutable Money (Slide 5)

Company Overview (Slide 15)

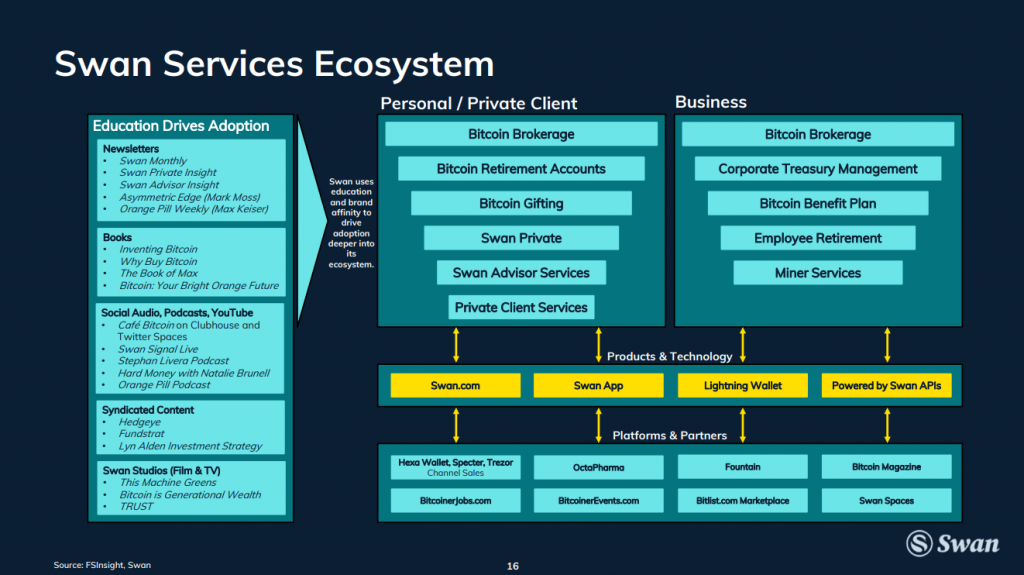

Swan Services Ecosystem (Slide 16)

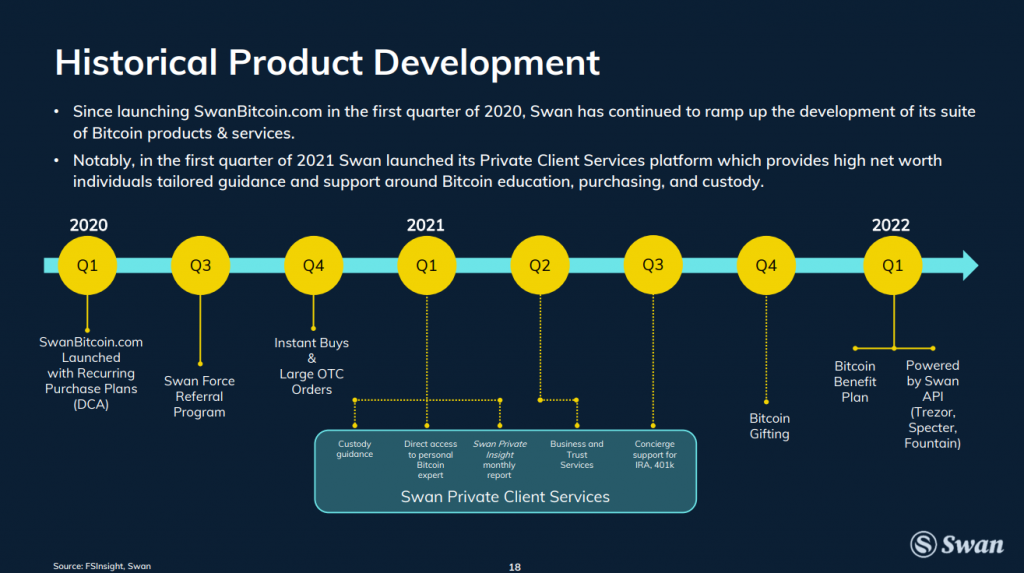

Historical Product Development (Slide 18)

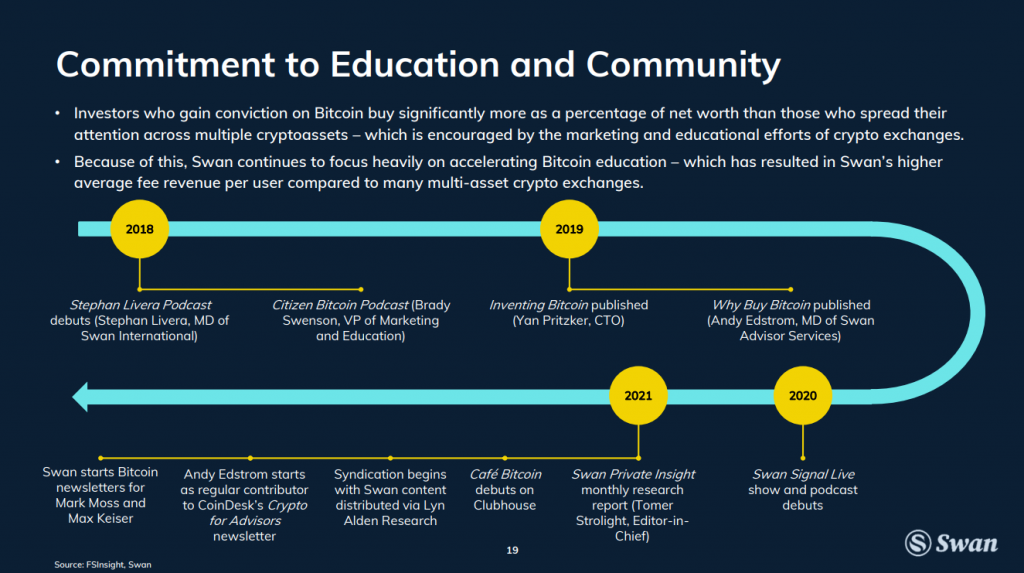

Commitment to Education and Community (Slide 19)