Horizen Builds Toward Goal Of Secure, Private & Scalable Ecosystem

Click HERE for the full copy of this report in PDF format.

Horizen is a blockchain platform structured as a cross-chain network that provides infrastructure and tools to support the creation of third-party decentralized applications (“dApps”) with elective privacy features. At the beginning of Q4 2020, we released our primer report Horizen: Web 3.0 Platform Targeting Big Tech Super App Disruption, followed by an update note at the end of Q4 2020 Horizen Update: ZEN Moving Higher As Halving Approaches. Since our last note’s publication, Horizen has witnessed consistent growth in nodes deployed and a substantial increase in the number of wallets holding Horizen’s native ZEN token. Horizen is now entering a new development phase as Zendoo, Horizen’s sidechain solution, is launched on a public testnet and prepares for a mainnet launch.

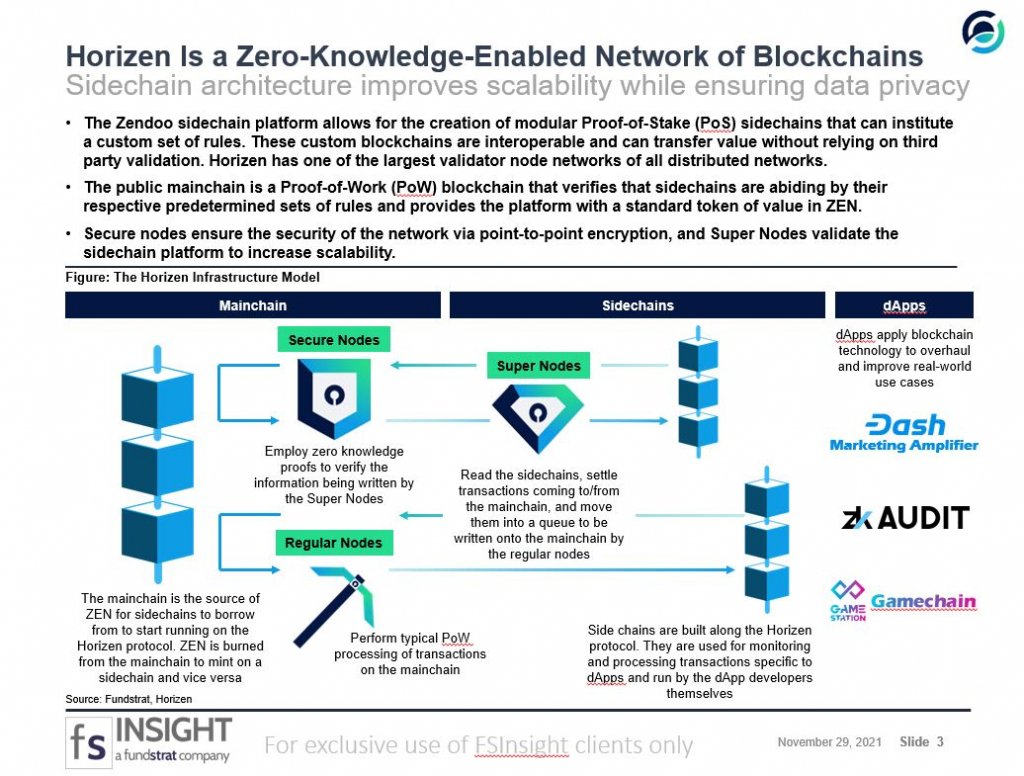

- Horizen’s unique sidechain architecture aims to bridge scalability with privacy and security. Horizen utilizes modular Proof-of-Stake (PoS) sidechains to institute custom sets of rules on top of a central, secure proof-of-work (PoW) public mainchain. The custom sidechains are interoperable and can transfer value without requiring verification from the public mainchain, thus introducing a unique element of privacy and scalability to the ecosystem. The public mainchain is a PoW blockchain that verifies that sidechains abide by their respective predetermined sets of rules and provides a standard token of value (ZEN) (Slide 3).

- Zendoo is Horizen’s next significant platform development. Zendoo is a customizable sidechain protocol that allows dApp developers flexibility in building products. The scaling solution was recently moved into the production environment testnet, the last step before going fully public. Zendoo is expected to bring new products to the Horizen ecosystem (Slide 6). As a demonstration of its capabilities, Horizen launched zkAudit, the first application built on Zendoo, in partnership with crypto-lending firm Celsius.

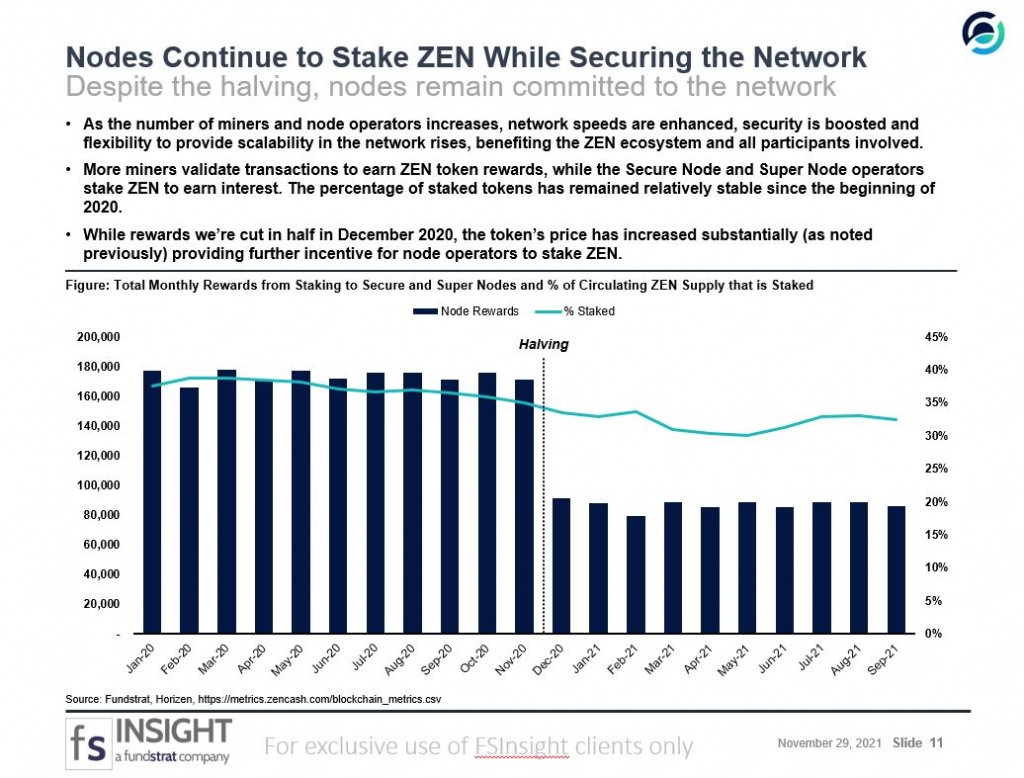

- Horizen’s native token ZEN has realized positive price action since its most recent halving event in December 2020. The Horizen halving event reduced the reward for mining or creating new blocks by 50%. This occurs every 840,000 blocks, or approximately every four years, meaning the next halving is targeted for December 2024. In addition to network-specific developments and industry tailwinds, such favorable supply dynamics have likely contributed to recent price increases (Slide 9).

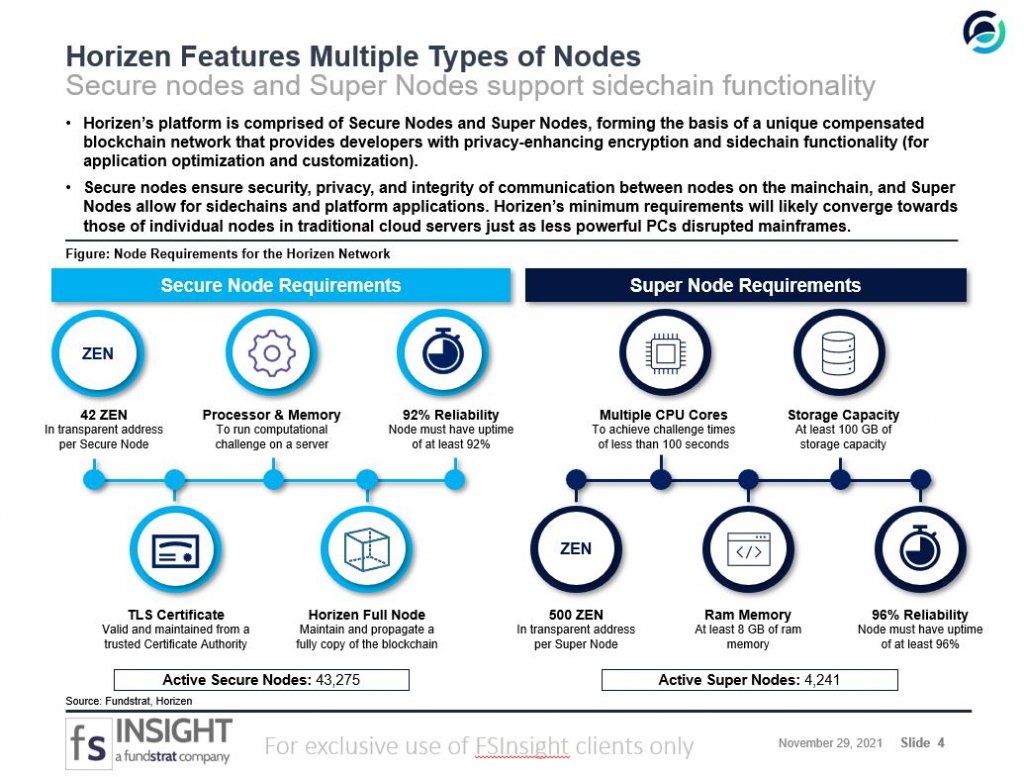

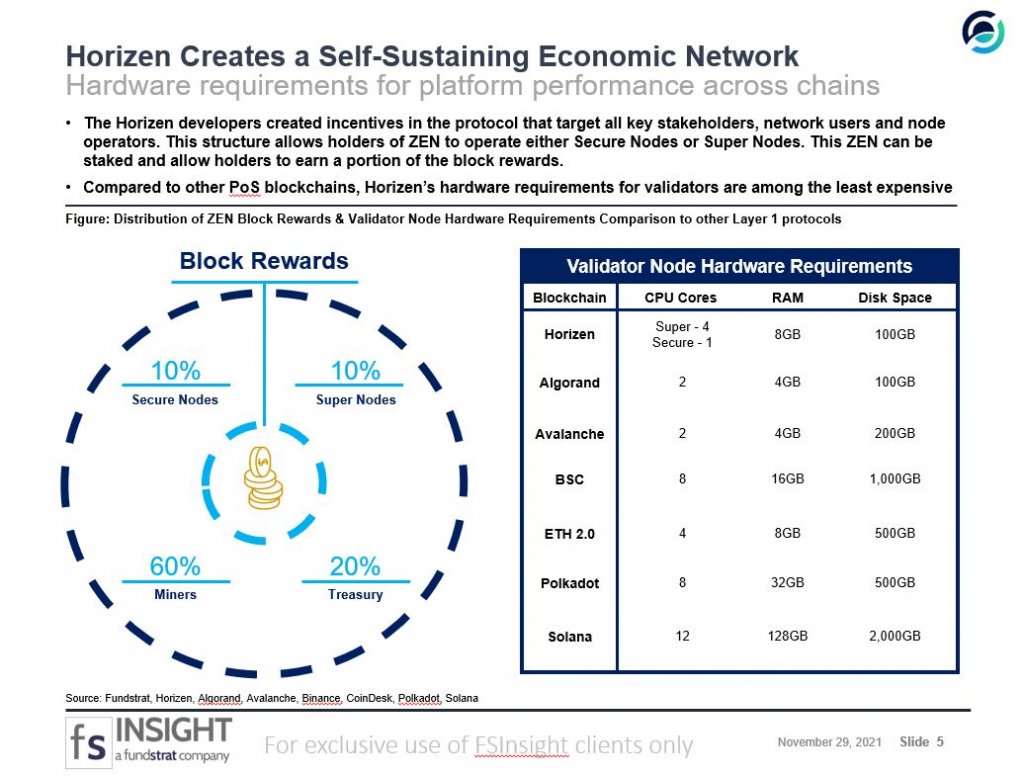

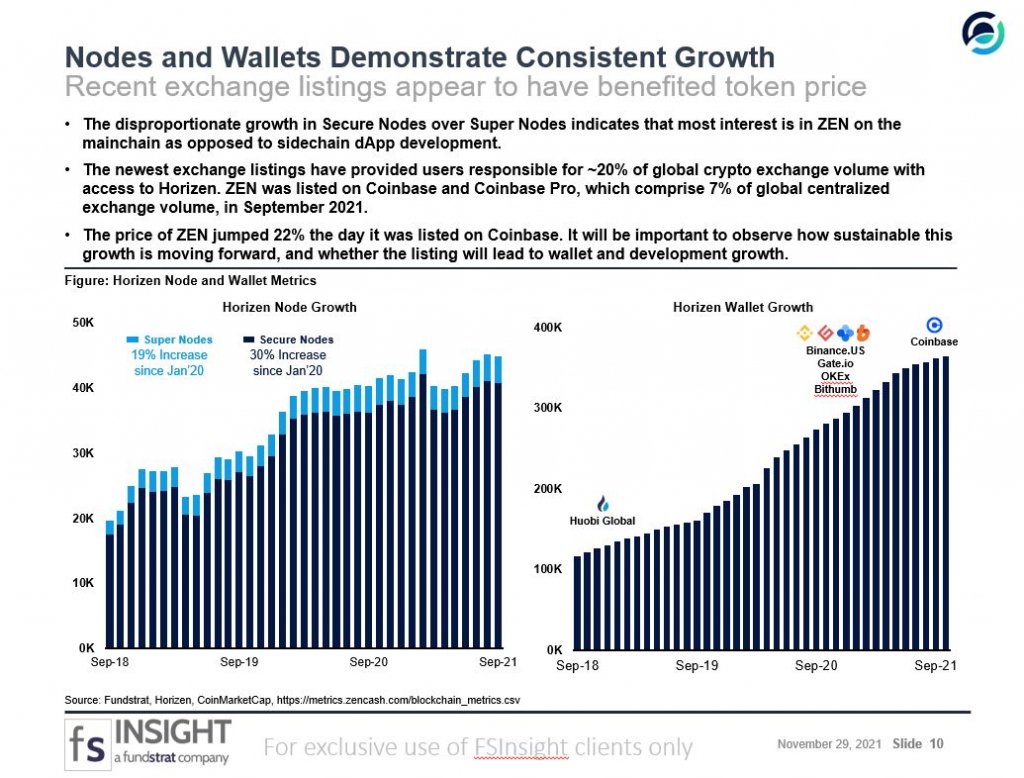

- Horizen continues to expand its node network. Holders of ZEN can operate Secure Nodes and Super Nodes to ensure network security and earn a portion of the block rewards. Secure Nodes ensure security, privacy, and integrity of communication between nodes on the mainchain, and Super Nodes allow for sidechains and platform applications (Slide 4). Compared to other PoS blockchains, Horizen’s hardware requirements for validators are among the least expensive, lowering the barrier to entry for node operators and encouraging decentralization (Slide 5). Since January 2020, the network has achieved a 19% increase in Super Nodes and a 30% increase in Secure Nodes (Slide 10).

- Key partnerships support the expansion in critical business areas and provide a greater level of access to investors. Recently, the ZEN token was listed on several top exchanges, including Binance, OKEx, Bithumb, Gate.io, and Coinbase (Slide 10). The world’s largest digital asset manager, Grayscale, added its Horizen Trust (HZEN) to the OTCQX market, allowing investors to buy and sell freely-tradeable HZEN shares through investment accounts (Slide 15). Such liquidity avenues provide a new crop of investors access to the ZEN token. Horizen has also forged technical and R&D partnerships with entities that will enable unique applications and accrue value to the Horizen platform (Slide 14).

- Key Risks: Failure to achieve developer adoption upon public rollout of Zendoo, lack of lock-up period among staking entities may result in outsized price decrease in the face of any macro headwinds, inability to capture market share from existing layer 1 competitive landscape.

Bottom line: Horizen’s platform is unique and offers developers a level of data privacy that most other smart contract platforms do not. The following months will serve as a critical litmus test for the Horizen ecosystem as the network readies itself to fully deploy its sidechain capabilities and start to welcome blockchain and dApp developers to the platform.

Horizen Is a Zero-Knowledge-Enabled Network of Blockchains (Slide 3)

Horizen Features Multiple Types of Nodes (Slide 4)

Horizen Creates a Self-Sustaining Economic Network (Slide 5)

Nodes and Wallets Demonstrate Consistent Growth (Slide 10)

Nodes Continue to Stake ZEN While Securing the Network (Slide 11)