MaiCoin: A full-suite compliant exchange poised for growth

Click HERE for the full copy of this report in PDF format.

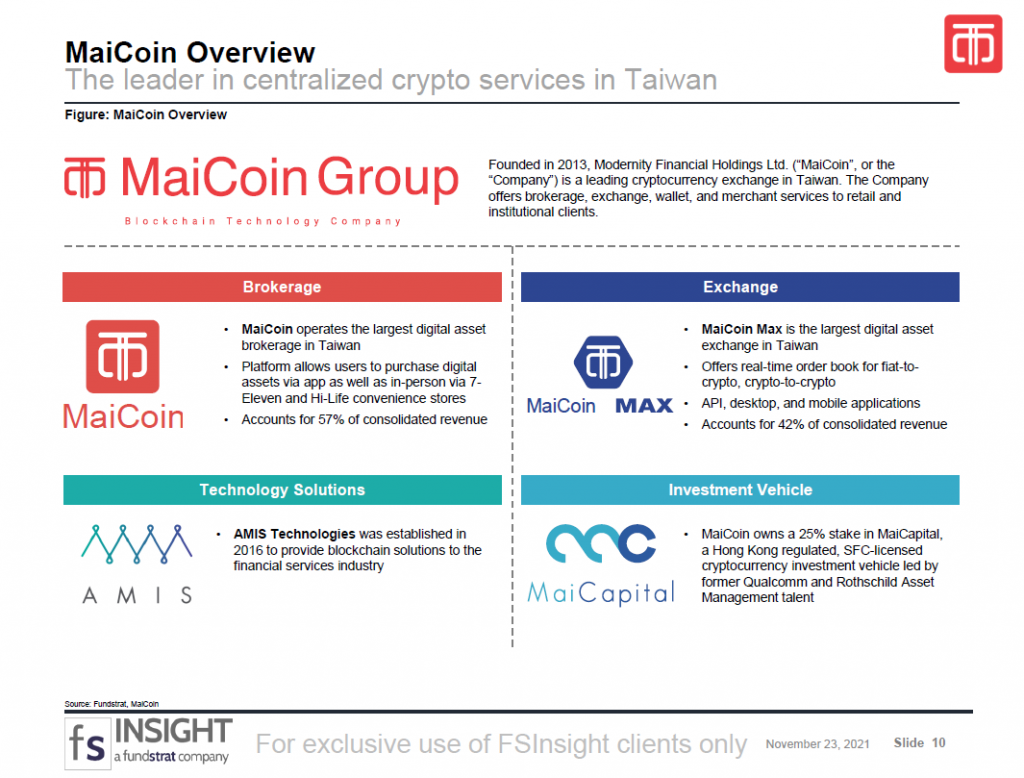

Founded in 2013, Modernity Financial Holdings Ltd. (“MaiCoin,” or the “Company”) is a leading cryptocurrency exchange in Taiwan. The Company offers brokerage services through MaiCoin, wallet and exchange services via MaiCoin Max, and merchant services to retail and institutional clients through AMIS Technologies. MaiCoin also owns a minority stake in MaiCapital, a regulated cryptocurrency investment vehicle.

- Adoption tailwinds. The global digital assets market has transformed from a monetary thought experiment to a fully-fledged financial ecosystem, crossing $2.5 trillion in market cap in 2021. Top crypto assets have outperformed traditional financial assets, garnering significant interest from retail and institutional investors alike (Slide 3). This growth is also reflected in private funding, with venture capital deals showing 13.2x YoY growth (Slide 4). Centralized exchanges like MaiCoin are well-positioned to capitalize on this, serving as fiat on/off ramps into other decentralized exchanges while complying with local regulators (Slide 6).

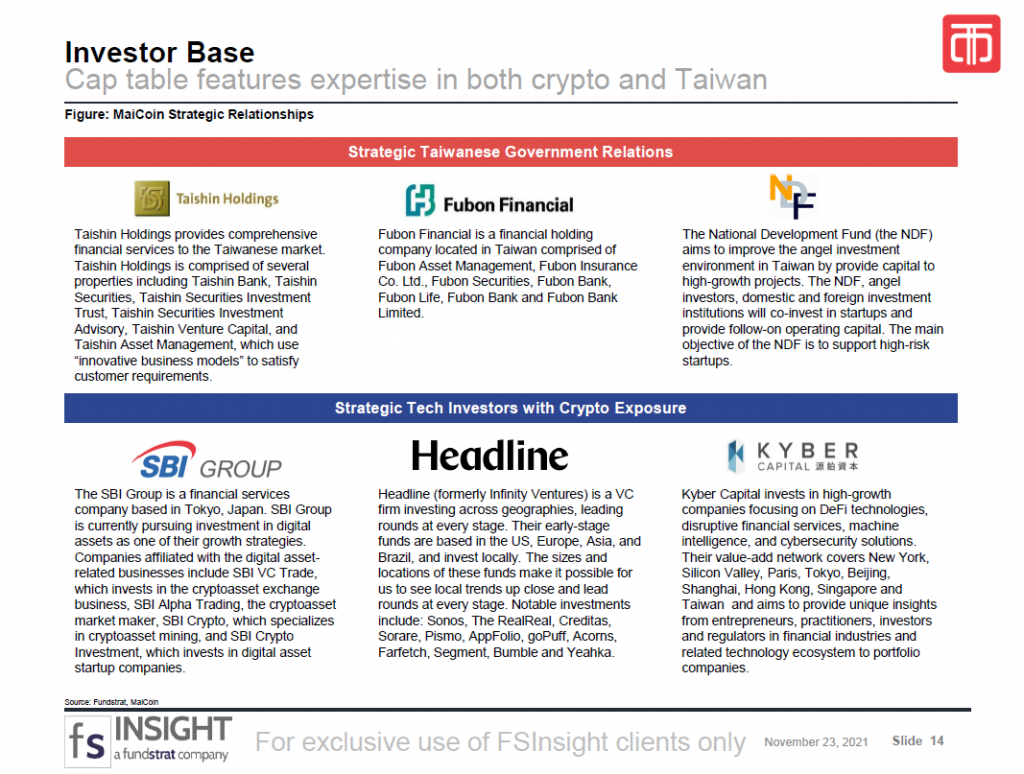

- Differentiated by strong leadership and strategic relationships. In a competitive market for talent, MaiCoin’s management team holds extensive experience from top tier technology and finance institutions (Slide 11). The Company’s executive team is also supported by crypto-native leaders such as Vitalik Buterin (co-founder of Ethereum) and Charlie Lee (creator of Litecoin) (Slide 12). MaiCoin’s strategic connections to the Taiwanese government and other tech investors with crypto exposure serve as a key area of differentiation in a space where regulatory compliance is paramount for business longevity.

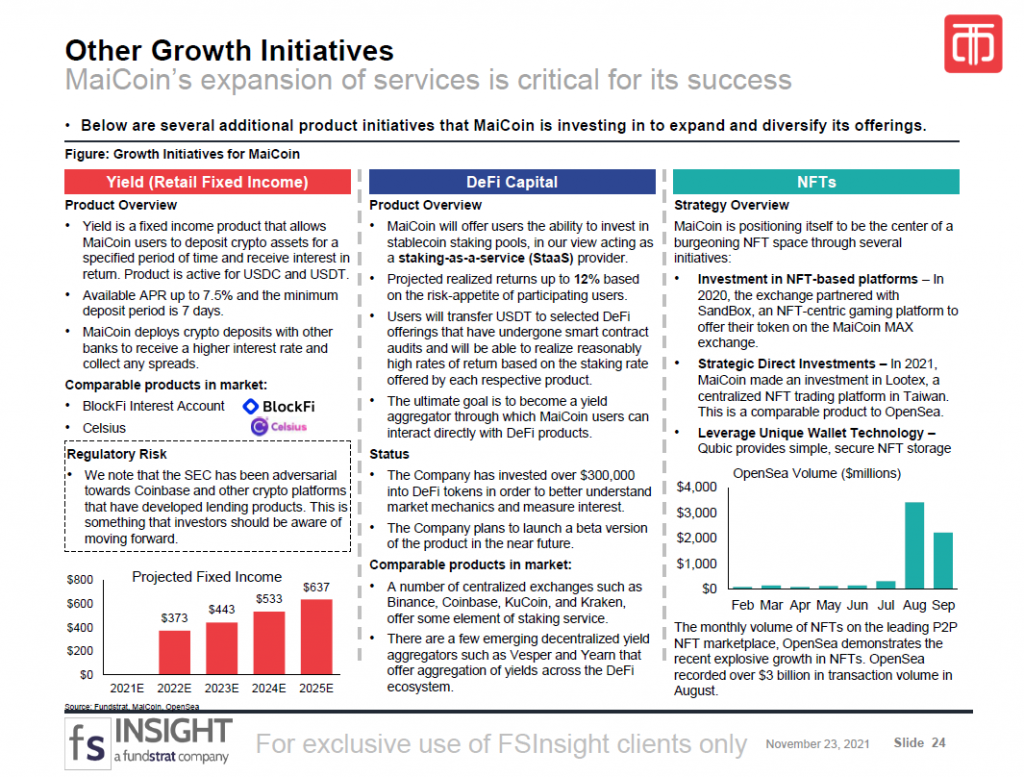

- Expansion of full-suite crypto products to further fuel growth. The Company is building on early features and adapting to market demand to offer its users a full-service crypto platform. MaiCoin’s flagship brokerage service will begin offering crypto-to-crypto trading pairs (Slide 16) on the back of 278% growth in KYC-compliant accounts. MaiCoin Max will add margin trading, sub-accounts, passive investment products, and savings accounts (Slide 17) to bolster north of $4 billion in 2021 trading volume. Given the rising popularity of Decentralized Finance (DeFi), AMIS will add institutional staking (Slide 21) to its custodial services. MaiCoin also made a strategic investment in a centralized NFT trading platform, responding to market demand in the space.

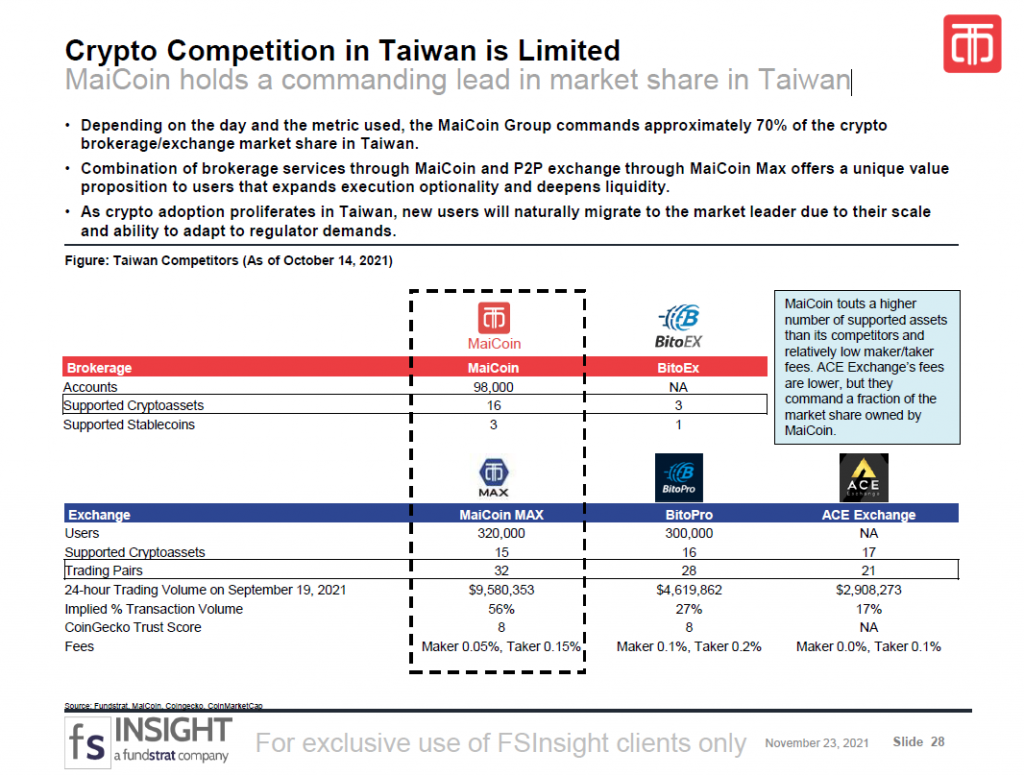

- Resilient economy coupled with limited local competition. Taiwan maintains a highly skilled workforce. Due to their established technology and financial sectors, the country is home to 0.3% of the world’s population but has 1.12% of the world’s total wealth (Slide 26). This surplus in savings rate is also reflected in securities markets, where YTD August 2021 trading volume increased by 107% from 2020. Moreover, crypto competition in Taiwan is limited – MaiCoin currently commands approximately 70% of crypto brokerage/exchange market share in Taiwan. As new users tread further out on the risk curve towards cryptoassets, market leaders like MaiCoin will stand to benefit as a source of credibility due to its dominance (Slide 28).

- Compliance-first approach. Crypto exchanges have historically had the option to prioritize growth or compliance. While Binance has reaped rewards from growth early on, it has recently been forbidden from operating in several countries and missed out on a $100 million financing round due to regulatory concerns. Similar to Coinbase, we view MaiCoin’s compliance-first approach to be more sustainable in the long term, especially as regulation catches up to adoption in the nascent space (Slide 29).

- What are the risks? Geopolitical risks as Mainland China encroaches on Taiwan and maintains a hawkish stance on crypto, unfavorable industry-wide regulatory rulings, slower than expected Taiwanese market adoption, stiff competition by global competitors (Slide 37).

- Bottom line: MaiCoin is well-positioned to build on early-stage traction to capture market share as the Taiwanese demand for crypto exposure increases. Through its different business divisions, exposure to MaiCoin translates to a diversified bet on crypto markets in Asia. Their regulation-friendly approach gives them a longer-term edge over global competitors who sacrifice compliance for early-stage growth.

Key slides from this report…

The leader in centralized crypto services in Taiwan (Slide 10)

Cap table features expertise in both crypto and Taiwan (Slide 14)

MaiCoin’s expansion of services is critical for its success (Slide 24)

MaiCoin holds a commanding lead in market share in Taiwan (Slide 28)

Underserved market and a leader in government relations (Slide 36)

Geopolitical, regulatory, adoption, and competition risk (Slide 37)