Wave Financial: An Innovative Digital Asset Wealth Manager

Click HERE for the full copy of this report in PDF format.

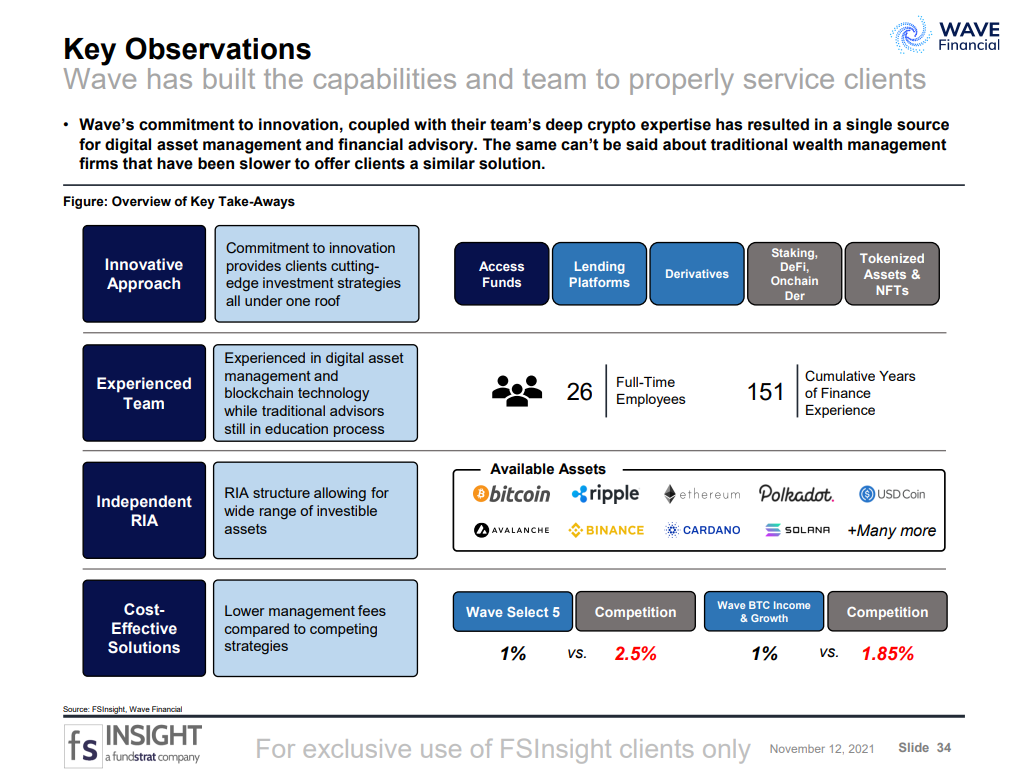

Wave Financial (“Wave” or the “Company”) is an SEC registered digital asset wealth manager and fund provider for individual investors and crypto protocols with over $1 billion in assets under management (AUM). Since its launch in 2018, Wave’s capabilities have expanded to include a full-service wealth management platform and a suite of in-house crypto investment funds. The Company is leveraging traditional investing and risk management strategies in innovative ways to offer solutions to crypto investors who desire differentiated strategies not currently offered by financial incumbents.

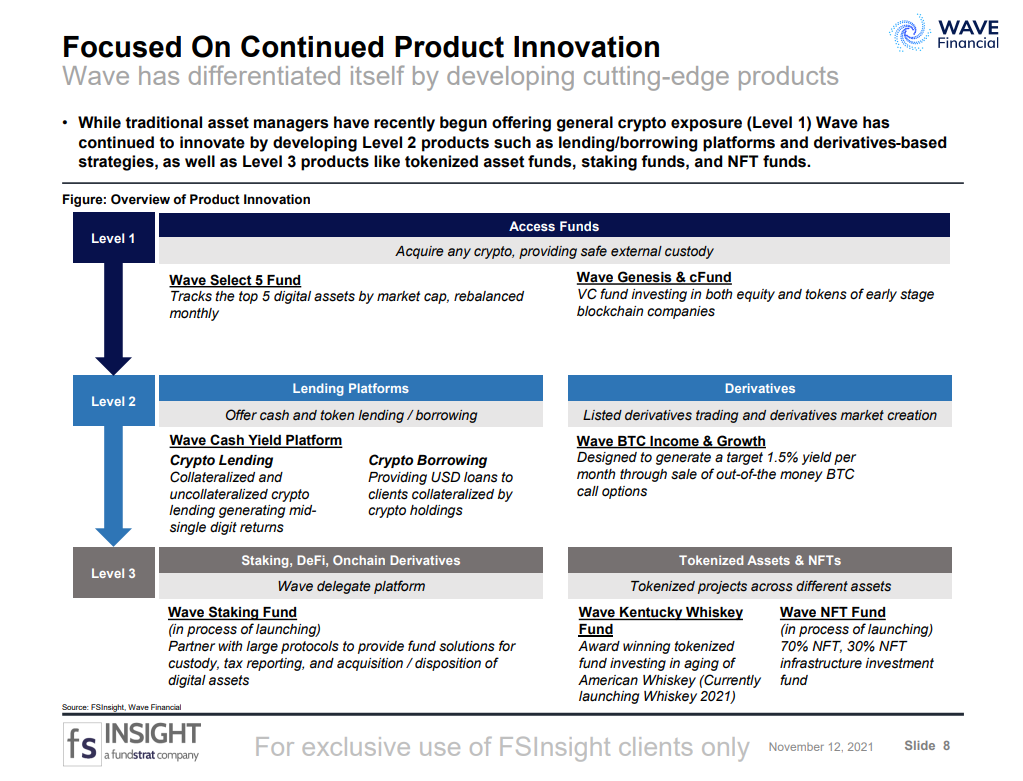

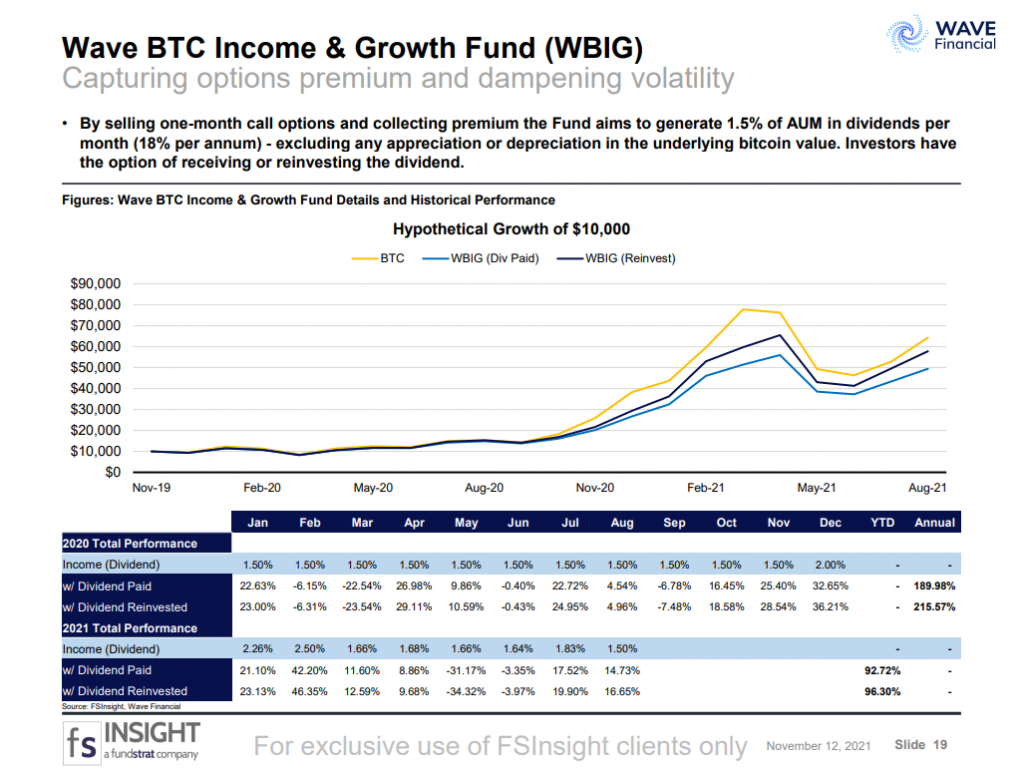

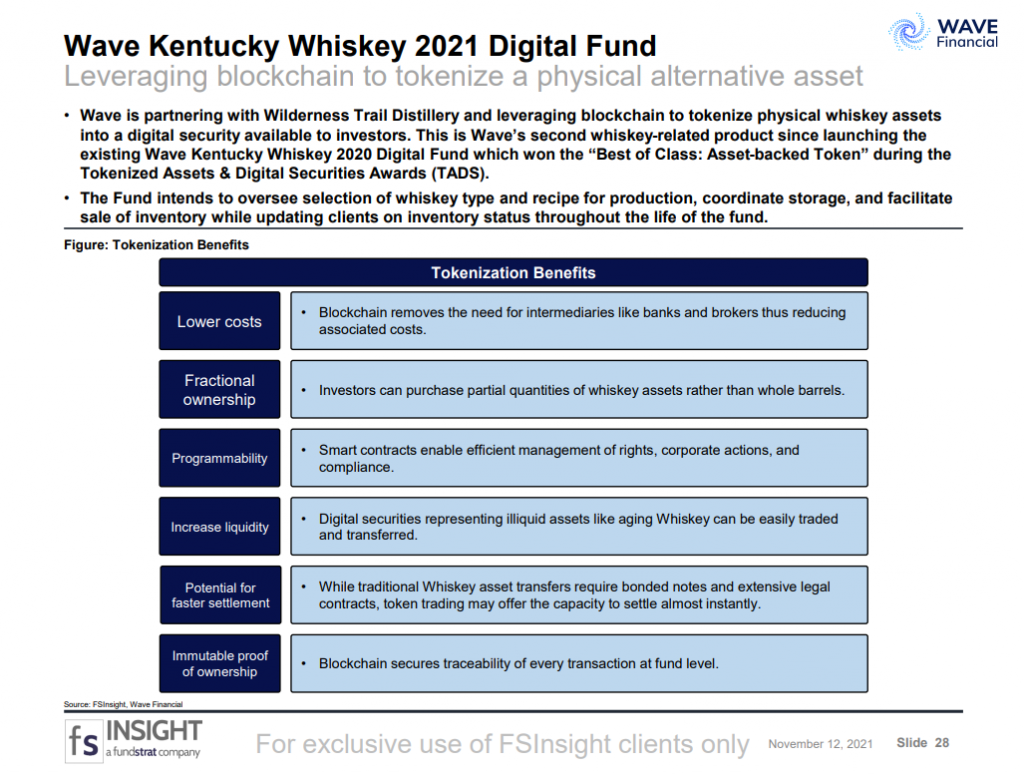

- Wave focuses on product innovation. While traditional asset managers have begun offering general crypto exposure funds (Level 1) (Slide 4) like those pioneered by Wave in 2018 (Slide 9), the Company has continued to innovate by developing Level 2 products such as the Wave Cash Yield Platform – a borrow-lend product that allows clients to generate mid-single-digit returns on custodied assets or provide USD loans by collateralizing their holdings. Wave’s Level 2 products also include derivatives-based strategies like the Wave BTC Income & Growth (WBIG) fund which aims to dampen the effects of Bitcoin’s volatility while preserving significant upside (Slide 18). Most recently, Wave has focused on introducing Level 3 products including tokenized asset funds such as the Wave Kentucky Whiskey 2021 Digital fund, which leverages blockchain tech to provide investors exposure to one of the fastest-growing spirits markets (Slide 28). Level 3 products currently in development include a staking fund to further support protocol clients and an NFT fund that will provide investors exposure to both NFT infrastructure and individual NFTs (Slide 8).

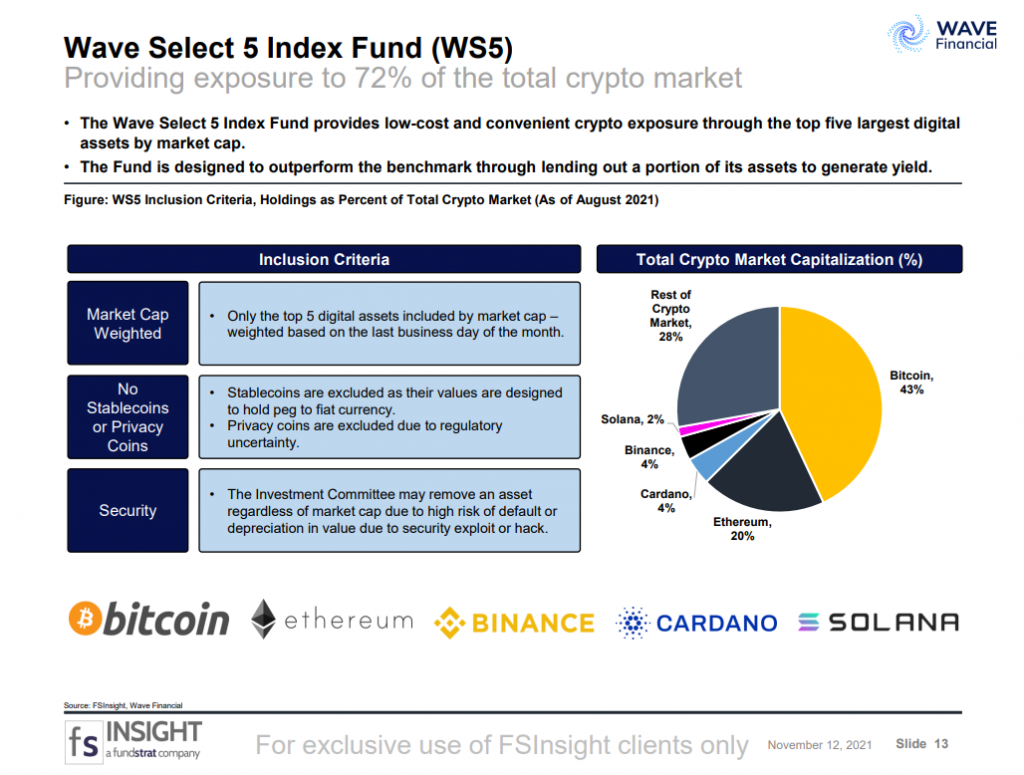

- Wave offers low-cost, broad exposure to crypto through its in-house funds. Competitors charge management fees upwards of 2.5% for broad crypto exposure, while the Wave Select 5 (WS5) fund provides exposure to 72% of the total crypto market for 1.0% per annum (Slide 17). Similarly, the Wave BTC Income & Growth Fund employs a covered call strategy that is 41-50% cheaper than competing strategies (Slide 20).

- Wave’s SEC Registered RIA structure allows for wide range of crypto investment options. Wirehouse financial advisors are limited to investing client assets in a small number of outsourced crypto fund managers and an even smaller number of digital assets (Slide 5). Given its independent RIA structure, Wave has the freedom and ability to act as a true fiduciary by investing client capital across the most accretive strategies and assets (Slide 35).

- Experienced team combines traditional finance with deep crypto expertise. Wave CEO David Siemer entered the crypto space in 2016 after spending over a decade in venture capital, while President Benjamin Tsai brings deep experience in traditional finance having worked as Head of Alternative Investments Asia at AllianceBernstein and Managing Director at Bank of America before founding LA Blockchain Labs. President (International) Matteo Dante Perruccio brings 30 years of experience in investment management, highlighted by his previous roles as Global Head of Key Clients & Strategic Partners at Jupiter Asset Management, CEO of Pioneer Investments, and CEO & Founder of Hermes BPK Partners (Slide 10).

- Key Risks. Investing in digital assets on your own or with a trusted advisor such as Wave comes with similar risks including government and regulatory risks, and hacking and cyber security risks, among others. Please refer to Slide 36 for additional risks when investing in digital assets and investment funds.

Bottom line: Wave Financial’s suite of crypto investment products provides clients with differentiated options for exposure to digital assets while being support by a deep bench of financial professionals with decades of combined crypto and traditional financial experience.

Key slides from this report…

Focused On Continued Product Innovation (Slide 8)…

Wave Select 5 Index Fund (WS5) (Slide 13)…

Wave BTC Income & Growth Fund (WBIG) (Slide 19)…

Wave Kentucky Whiskey 2021 Digital Fund (Slide 28)…

Key Observations (Slide 34)…