Off The Chain Capital: A Unique Approach to Crypto Investing

CLICK HERE for the full copy of this report in PDF format.

Off The Chain Capital, LLC (“OTC,“ or the “Company”) is a value-oriented investment manager that invests in digital assets and blockchain companies. OTC leverages industry relationships to acquire shares in late-stage private blockchain companies at early-stage valuations and uses innovative methods to source Bitcoin at discounted prices. Off the Chain, LP’s (“the Fund”) strategy has resulted in outperformance relative to common investment benchmarks and comparable private funds since its inception in 2016.

- As crypto adoption increases, investors will demand more investment options. In 2021, the total crypto market cap surpassed $2 trillion, and recent data suggests that there are over 100 million cryptoasset users globally (Slide 3). As digital assets emerge as a standalone asset class, institutional investors will look to gain an edge via unique investment strategies. Currently, the most commonly available strategies include trusts (e.g., Grayscale), index funds (e.g., Bitwise), hedge funds (e.g., Arca), and venture funds (e.g., a16z) (Slide 4).

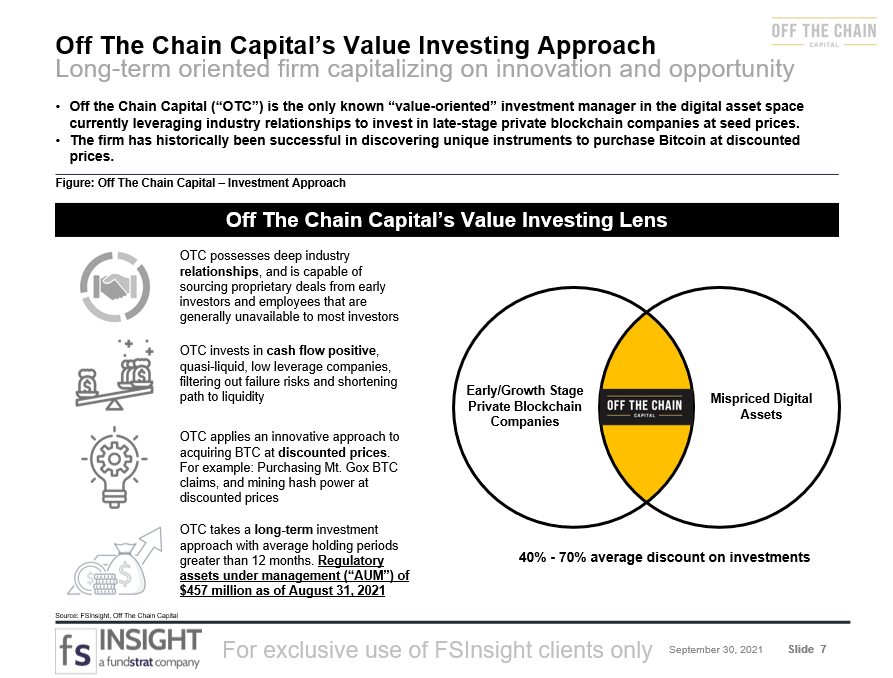

- The OTC approach brings a traditional value lens to a burgeoning industry. Off The Chain aims to provide a unique, value-centric investment solution for those looking for differentiated exposure to digital assets. As it pertains to its investments in private blockchain companies, OTC sources its deals from early investors and employees to create positions in cash-generating, low-leverage companies at early-stage prices, filtering out failure risk and shortening the path to liquidity. Similarly, OTC employs creative solutions to procure bitcoin at discounted prices (Slide 7).

- Examples of OTC’s investment strategy applied:

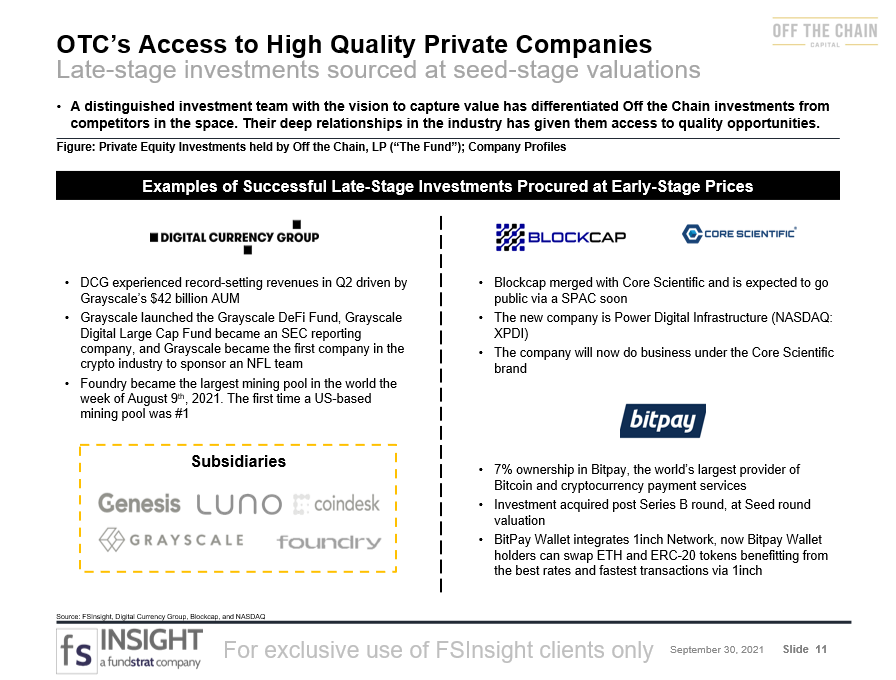

- Blockchain company equity – The Fund was able to secure a 7% ownership in Bitpay, a large provider of Bitcoin and cryptocurrency payment services, at Seed round pricing after it had closed its Series B round (Slide 11).

- Bitcoin at a discount – Mt. Gox, an early crypto exchange that was hacked and drained of its custodied cryptoassets is currently subject to bankruptcy proceedings. OTC leveraged its industry knowledge to acquire said bankruptcy claims via the Fund and procure BTC at an estimated 46% discount to market prices (Slide 12).

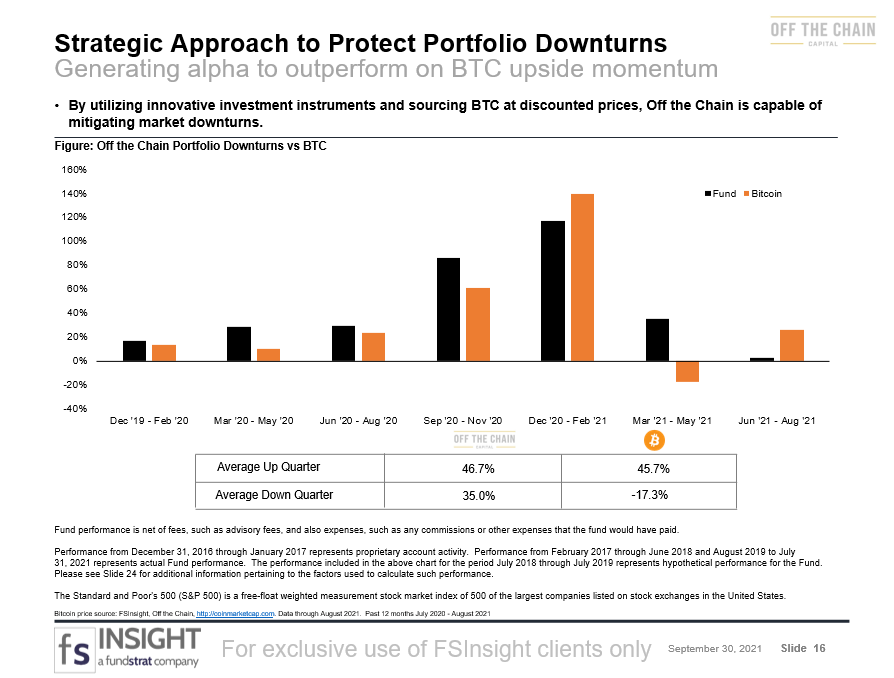

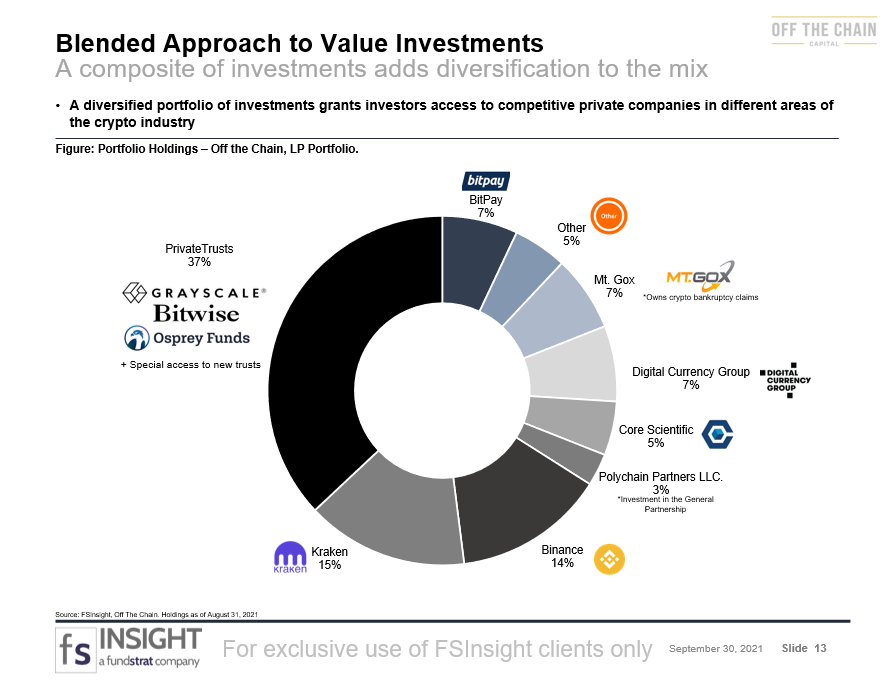

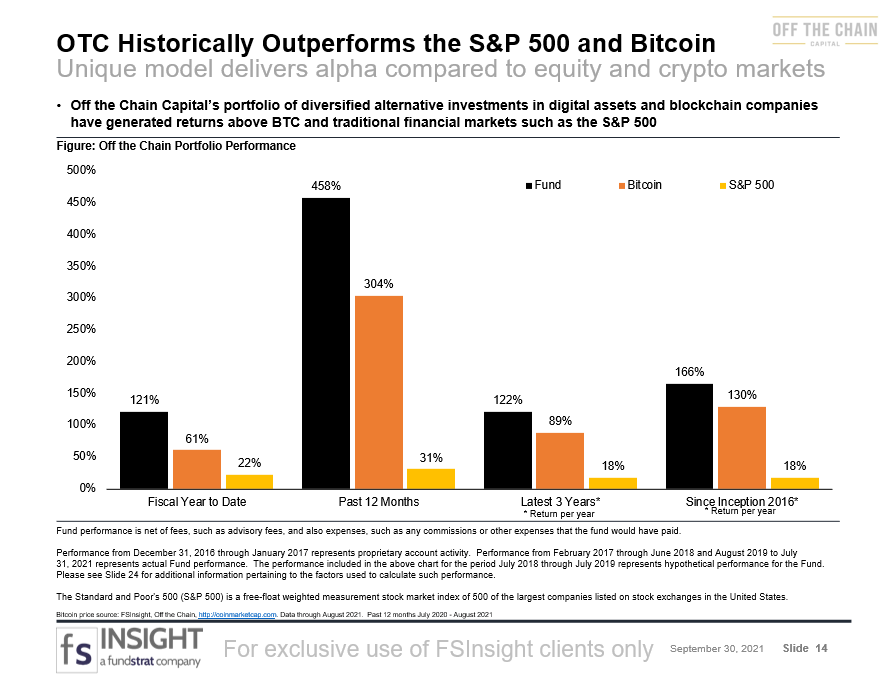

- The OTC strategy has resulted in a blended portfolio demonstrating historical outperformance. The OTC approach has resulted in a portfolio of investments across different areas of the crypto industry (Slide 13). Since inception, the Fund has outperformed both the S&P 500 index and Bitcoin (Slide 14).

- Key Risks: Industry relationships deteriorate, the market to acquire BTC at discounted prices becomes crowded or disappears for regulatory or economic reasons, increased competition from other digital asset investment firms decreases alpha derived from its strategy, changes in the regulatory climate that impede the progress of the crypto industry and/or the ability to invest in cryptoassets (Slide 19).

Bottom Line: OTC provides institutional investors access to a unique digital asset investment solution. Its innovative approach has a proven track record and a model that is difficult to replicate due to the Company’s crypto expertise and deep industry relationships. While past performance is not indicative of future results, OTC presents a unique opportunity to buy into a high-growth industry at a discount.

Key slides from this report…

Cover Page (Slide 1)…

Off The Chain’s Value Investing Approach (Slide 7)…

OTC’s Access to High Quality Private Companies (Slide 11)…

Blended Approach to Value Investments (Slide 13)…

OTC Historically Outperforms the S&P 500 and Bitcoin (Slide 14)…

Strategic Approach to Protect Portfolio Downturns (Slide 16)…