CRYPTO SPECIAL REPORT: Horizen Update: ZEN Moving Higher As Halving Approaches

Click Here for the full copy of this report in PDF format.

At the beginning of Q4, we released our report Horizen: Web 3.0 Platform Targeting Big Tech Super App Disruption. Horizen (ZEN) is a next-generation internet platform structured as a cryptonetwork that gives users control over their online data with its blockchain cloud computing platform for money, messages, media, and third-party decentralized applications. During the quarter, the ZEN token appreciated 145%, benefited by a 70% gain in Bitcoin, new partnership deals with Horizen and leading crypto companies, and the narrative around Horizen’s network nearing its first Halving Event, which is scheduled for today, Wednesday December 2nd, 2020.

- Horizen is a fast-growing decentralized cloud app ecosystem aiming to challenge Big Tech. Web 3.0 decentralized internet alternatives like Horizen have the potential to become disruptive over the next decade by solving many issues plaguing Big Tech. Web 3.0 is a vision for a better and more open internet where crypto protocols replace centralized application companies. Horizen offers a smart contract capable and fully customizable decentralized cloud network that allows any developer to build trustless decentralized applications that are not controlled by any organization.

- Recent partnerships with leading crypto companies showcase Horizen’s technology. In November, Horizen announced their partnership with Celsius, one of the leading “CeFi” (Centralized Finance) crypto credit and loan facilities. Celsius and Horizen will work together to build Celsius its own fully decentralized and privacy-preserving blockchain using Horizen’s zero-knowledge toolkit and Zendoo sidechain interoperability protocol. The proof of concept will be built in its own entirely decentralized environment, and enable the functionality currently available on the platform, including user account creation, a debt registry, linking registered debt to user profiles, and executing state-transition operations such as posting collateral, initiating loans, making payments, and updating status of debt instruments. Additionally, DeFi identity and credit system Sikoba announced their intention to build a customized sidechain on Horizen to safeguard financial data transactions. Integrating Horizen’s sidechain technology, Zendoo, into Sikoba’s platform will allow for an added layer of security and transparency for Sikoba’s users. By layering the two chains and utilizing Zendoo, Sikoba can establish trust that its users’ debts and credits are properly registered.

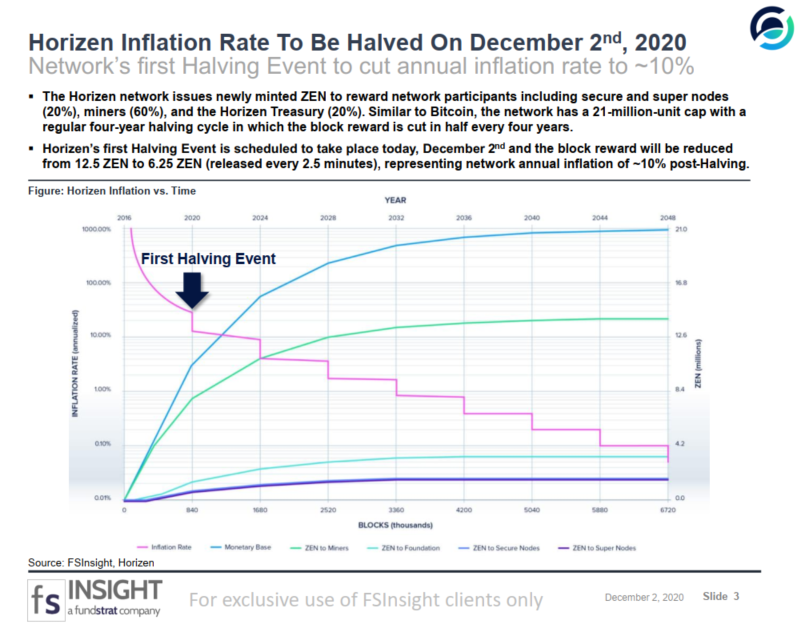

- First supply Halving event for Horizen network on Wednesday December 2nd, 2020. In order to incentivize network participants and bootstrap growth of the network, the network issues a block reward of newly minted ZEN every 2.5 minutes awarded to secure and super nodes (20%), miners (60%), and the Horizen DAO Treasury (20%). Similar to Bitcoin, the network has a 21-million-unit cap with a regular four-year halving cycle in which the block reward is cut in half every four years. The network’s first halving will cut the block reward in half from 12.5 ZEN to 6.25 ZEN, representing network annual inflation of ~10% post-Halving. Our analysis of halving events for other cryptonetworks indicates the event could be a positive price catalyst over the coming year if historical trends continue.

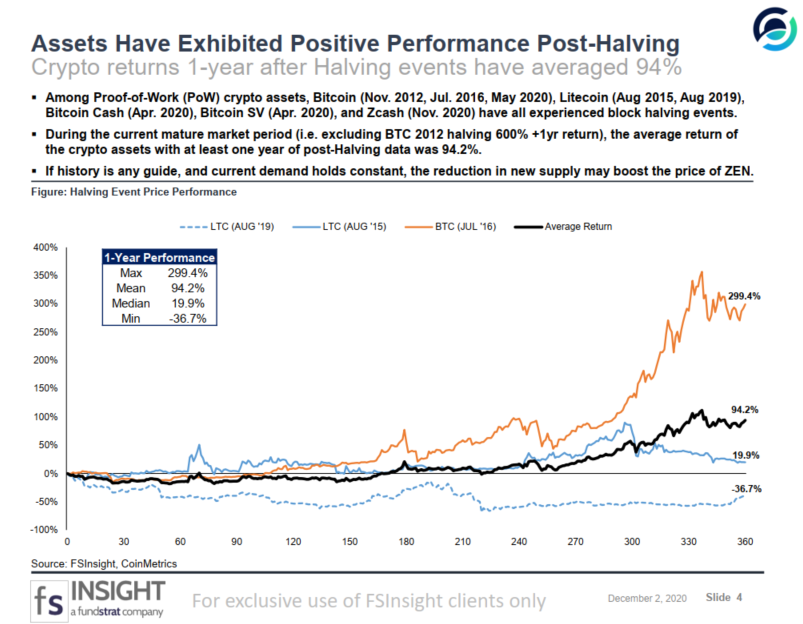

- Crypto returns 1-year after Halving events have averaged 94% which could bode well for Horizen. Among Proof-of-Work (PoW) crypto assets, Bitcoin (Nov. 2012, Jul. 2016, May 2020), Litecoin (Aug 2015, Aug 2019), Bitcoin Cash (Apr. 2020), Bitcoin SV (Apr. 2020), and Zcash (Nov. 2020) have all experienced block halving events. During the current mature market period (i.e. excluding BTC 2012 halving 600% +1yr return), the average return of the crypto assets with at least one year of post-Halving data was 94.2%. If history is any guide, and current demand holds constant, the reduction in new supply may boost the price of ZEN.

- What could go wrong? Horizen post-Halving returns could be different from the historical returns of other comp crypto assets.

Bottom line: Horizen is a new type of internet platform that’s a competitor to watch in the race to replace Big Tech. Recent price performance indicates the market is starting to take notice. Horizen’s progress towards building out its ecosystem and forming partnerships to deliver real world use cases suggest the ZEN token could see increased organic demand in 2021. An increase in demand alongside reduced supply post-Halving could serve as tailwinds for positive performance.

High Profile Partnerships Delivering Real World Utility (Slide 2)…

Horizen Inflation Rate To Be Halved On December 2nd, 2020 (Slide 3)…

Assets Have Exhibited Positive Performance Post-Halving (Slide 4)…