CRYPTO SPECIAL REPORT – Horizen: Web 3.0 Platform Targeting Big Tech Super App Disruption

For a full copy of this report in PDF format, click this link.

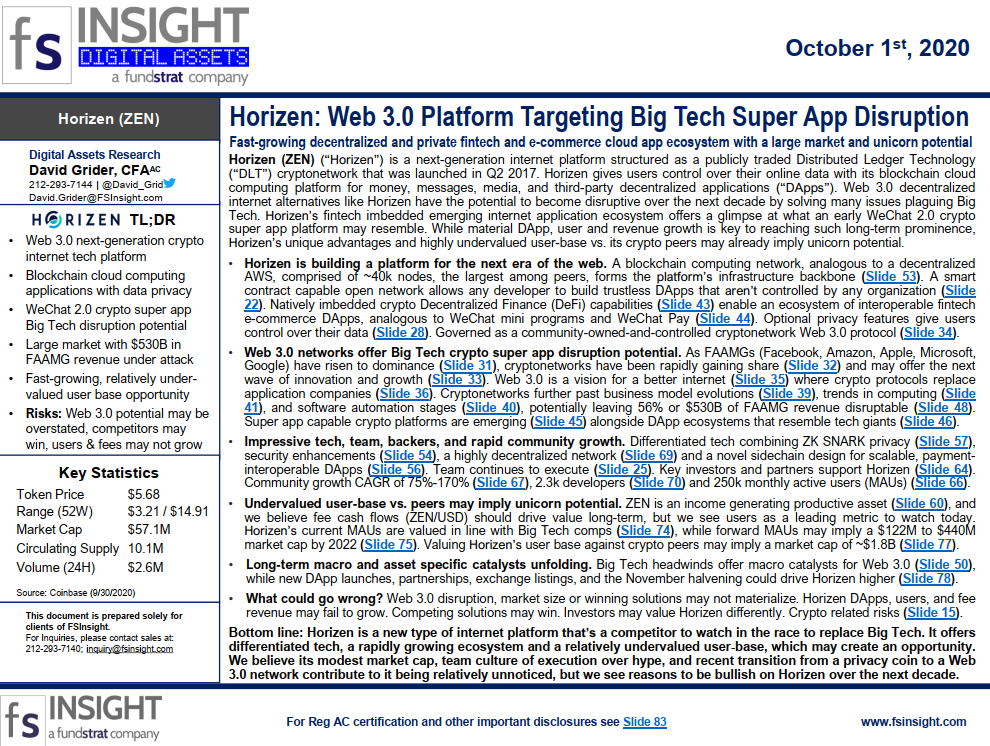

Horizen (ZEN) (“Horizen”) is a next-generation internet platform structured as a publicly traded Distributed Ledger Technology (“DLT”) cryptonetwork that was launched in Q2 2017. Horizen gives users control over their online data with its blockchain cloud computing platform for money, messages, media, and third-party decentralized applications (“DApps”). Web 3.0 decentralized internet alternatives like Horizen have the potential to become disruptive over the next decade by solving many issues plaguing Big Tech. Horizen’s fintech imbedded emerging internet application ecosystem offers a glimpse at what an early WeChat 2.0 crypto super app platform may resemble. While material DApp, user and revenue growth is key to reaching such long-term prominence, Horizen’s unique advantages and highly undervalued user-base vs. its crypto peers may already imply unicorn potential.

- Horizen is building a platform for the next era of the web. A blockchain computing network, analogous to a decentralized AWS, comprised of ~40k nodes, the largest among peers, forms the platform’s infrastructure backbone (Slide 53). A smart contract capable open network allows any developer to build trustless DApps that aren’t controlled by any organization (Slide 22). Natively imbedded crypto Decentralized Finance (DeFi) capabilities (Slide 43) enable an ecosystem of interoperable fintech e-commerce DApps, analogous to WeChat mini programs and WeChat Pay (Slide 44). Optional privacy features give users control over their data (Slide 28). Governed as a community-owned-and-controlled cryptonetwork Web 3.0 protocol (Slide 34).

- Web 3.0 networks offer Big Tech crypto super app disruption potential. As FAAMGs (Facebook, Amazon, Apple, Microsoft, Google) have risen to dominance (Slide 31), cryptonetworks have been rapidly gaining share (Slide 32) and may offer the next wave of innovation and growth (Slide 33). Web 3.0 is a vision for a better internet (Slide 35) where crypto protocols replace application companies (Slide 36). Cryptonetworks further past business model evolutions (Slide 39), trends in computing (Slide 41), and software automation stages (Slide 40), potentially leaving 56% or $530B of FAAMG revenue disruptable (Slide 48). Super app capable crypto platforms are emerging (Slide 45) alongside DApp ecosystems that resemble tech giants (Slide 46).

- Impressive tech, team, backers, and rapid community growth. Differentiated tech combining ZK SNARK privacy (Slide 57), security enhancements (Slide 54), a highly decentralized network (Slide 69) and a novel sidechain design for scalable, payment interoperable DApps (Slide 56). Team continues to execute (Slide 25). Key investors and partners support Horizen (Slide 64). Community growth CAGR of 75%-170% (Slide 67), 2.3k developers (Slide 70) and 250k monthly active users (MAUs) (Slide 66).

- Undervalued user-base vs. peers may imply unicorn potential. ZEN is an income generating productive asset (Slide 60), and we believe fee cash flows (ZEN/USD) should drive value long-term, but we see users as a leading metric to watch today. Horizen’s current MAUs are valued in line with Big Tech comps (Slide 74), while forward MAUs may imply a $122M to $440M market cap by 2022 (Slide 75). Valuing Horizen’s user base against crypto peers may imply a market cap of ~$1.8B (Slide 77).

- Long-term macro and asset specific catalysts unfolding. Big Tech headwinds offer macro catalysts for Web 3.0 (Slide 50), while new DApp launches, partnerships, exchange listings, and the November halvening could drive Horizen higher (Slide 78).

- What could go wrong? Web 3.0 disruption, market size or winning solutions may not materialize. Horizen DApps, users, and fee revenue may fail to grow. Competing solutions may win. Investors may value Horizen differently. Crypto related risks (Slide 15).

Bottom line: Horizen is a new type of internet platform that’s a competitor to watch in the race to replace Big Tech. It offers differentiated tech, a rapidly growing ecosystem and a relatively undervalued user-base, which may create an opportunity. We believe its modest market cap, team culture of execution over hype, and recent transition from a privacy coin to a Web 3.0 network contribute to it being relatively unnoticed, but we see reasons to be bullish on Horizen over the next decade.

Key slides from this report…

Horizen: Web 3.0 Platform Targeting Big Tech Super App Disruption (Slide 1)...

What is FS Insight?

FS Insight is a market-leading, independent research boutique. We are experts in U.S. macro market strategy research and have leveraged those fundamental market insights to become leading pioneers of digital assets and blockchain research.

Tom Lee's View

Proprietary roadmap and tools to navigate and outperform the equity market.

Macro and Technical Strategy

Our approach helps investors identify inflection points and changes in equity leadership.

Deep Research

Our pioneering research provides an understanding of fundamental valuations and risks, and critical benchmarking tools.

Videos

Our macro and crypto videos give subscribers a quick and easy-to-understand audiovisual updates on our latest research and views.

US Policy Analysis

Our 40-year D.C. veteran strategist cuts through the rhetoric to give investors the insight they need.