Bitcoin Bounces

Key Takeaways

- Markets rebound sharply, with impressive price action across all major crypto sectors.

- On-chain and derivatives data point toward a combination of low liquidity, seller exhaustion, and short liquidations as the major catalysts for this price run.

- A disproportionate increase in price compared to realized cap suggests that low liquidity levels are exacerbating price movements.

- We review several events of the past week and discuss the major implications.

- Bottom Line: We remain bullish on the performance of Bitcoin and Ethereum through the end of this year but have yet to see sustained demand come into the fold. We think it is wise to stay long but reserve capacity to buy on dips through Q1 and Q2 as we wade through potential choppy waters brought on by macro uncertainty.

Markets Rebound

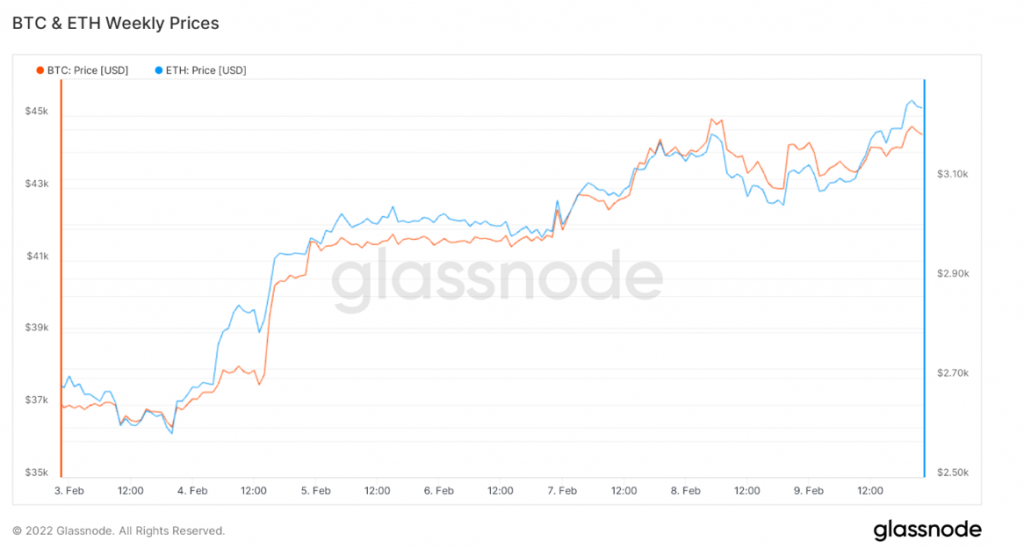

Over the past week, the global crypto market has performed impressively, with both majors and altcoins rallying despite continued increases in the US 10-year and more hawkish-leaning economic data. At the time of writing, BTC and ETH are both trading nearly 20% higher over the previous seven days, while the total crypto market cap has reclaimed the $2 trillion mark for the first time in over three weeks.

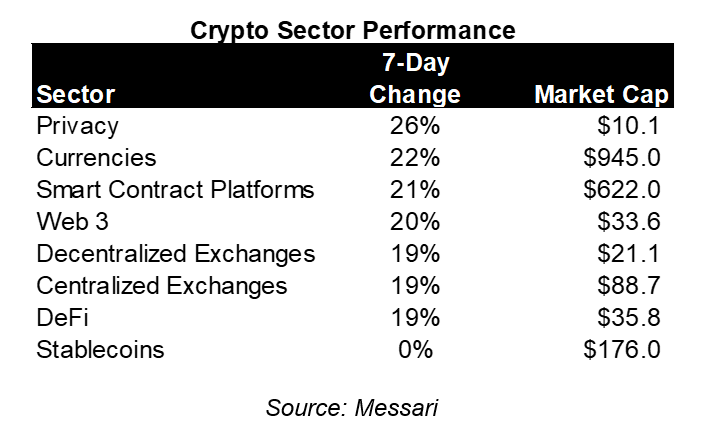

Looking across the entire crypto ecosystem, most individual sectors have recovered substantially since the market hit a local trough in late January, with privacy coins leading the way.

What Is Behind the Latest Rally?

Last week we held our Annual Outlook webinar in which we provided our thoughts on what lies ahead for crypto in 2022 and issued price targets of $200,000 and $12,000 for BTC and ETH, respectively. While we would love to take credit for the sudden change in market sentiment, we think the recent price action has other identifiable drivers. As is often the case, we can look at what is happening with bitcoin to get a feel for what is pushing the entire crypto market higher.

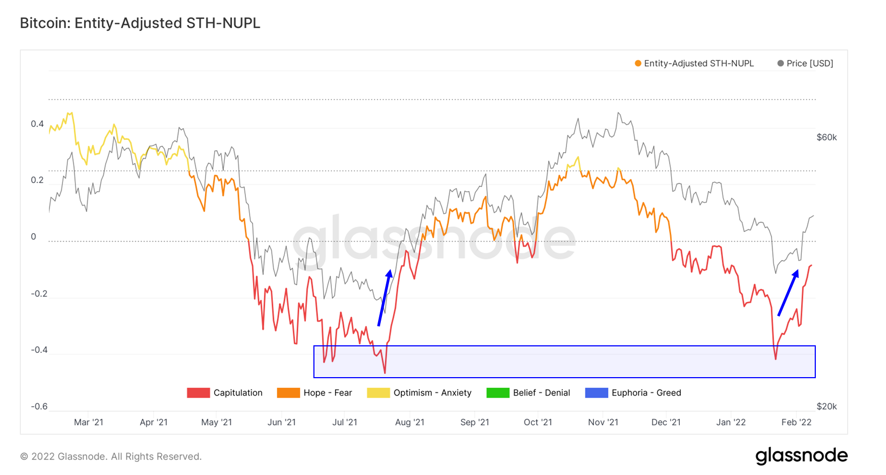

Net Unrealized Profit/Loss (NUPL) is the difference between Relative Unrealized Profit and Relative Unrealized Loss. This metric can also be calculated by subtracting realized cap (total cost basis for the Bitcoin network) from market cap and dividing the result by the market cap. It is essentially another metric that summarizes the profitability of all or specific cohorts of wallet addresses.

Below we map out short-term holder (STH) NUPL. As we have discussed at length before, short-term holder wallets are those that account for most of the capitulation during times of consolidation or tepid market demand. Over the past few months, we have witnessed many of the short-term holders that purchased bitcoin at the height of the most recent run to $69k fall to severe levels of unprofitability. We have seen these same investors capitulate on days with incrementally bullish price action while long-term holders have scooped up their liquidity at depressed prices. We can see below that STH wallets have occupied the “capitulation” zone for quite some time now. Given the duration of time these wallets have been underwater, this cohort may have run out of marginal sellers.

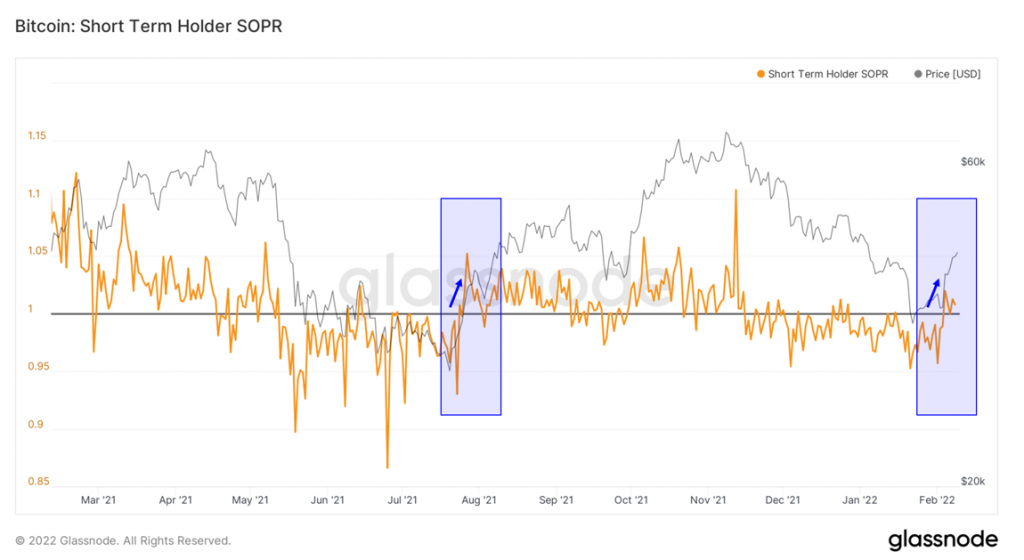

We have also seen a lack of capitulation from short-term holders reflected in SOPR, which measures the price sold divided by the price paid per bitcoin. Recently, this metric has stubbornly oscillated below 1 for the short-term holder cohort, indicating constant out-of-the-money selling from these investors.

If you recall, SOPR = 1 is viewed as a critical support level as it marks the breakeven price (price paid = price sold). If SOPR falls below 1, this means that coins are being sold at a loss, a sign of investor capitulation. Holding support at 1 and breaking above this level is an indication that investors are optimistic about near-term price action and are waiting for profitable levels to exit their positions.

We can see that STH SOPR has recently breached 1 and found support above this level, further suggesting that selling pressure from unprofitable coins has subsided for the time being.

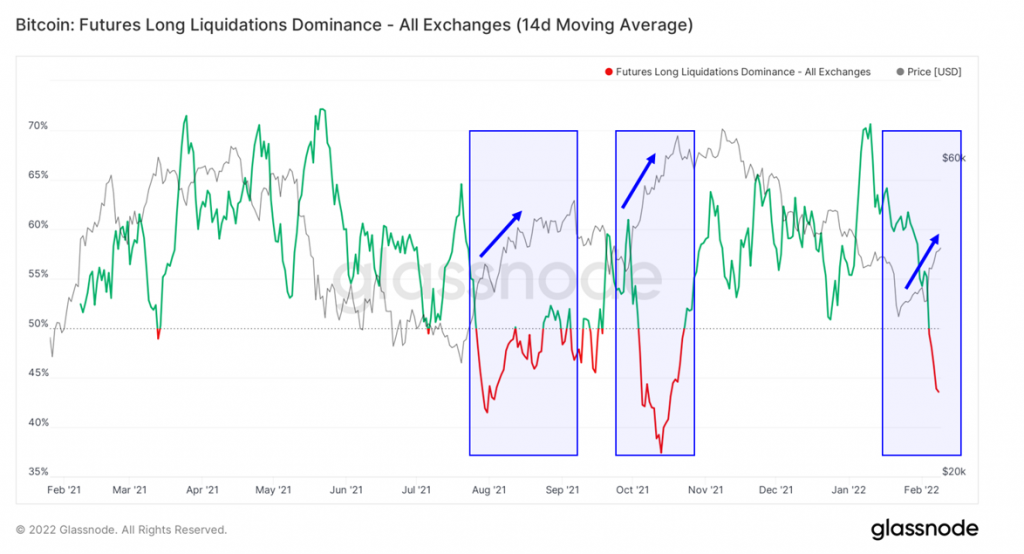

Using the chart below, we can reasonably ascertain that traders were caught offside by the lack of selling pressure from bitcoin holders, as short liquidations have started to display relative dominance over long liquidations over the past several weeks.

These conditions within the derivatives markets are similar to those witnessed in late July and October. Each of these times, the market benefitted from similarly bullish supply dynamics coupled with short-heavy liquidations.

As we mentioned in our Annual Outlook last week, we think it will be an exciting year for Bitcoin, Ethereum, and the broader crypto market. But we also mentioned that to reach $200k bitcoin, the market would need to see some sizeable demand to enter the picture to catalyze a sustained price increase.

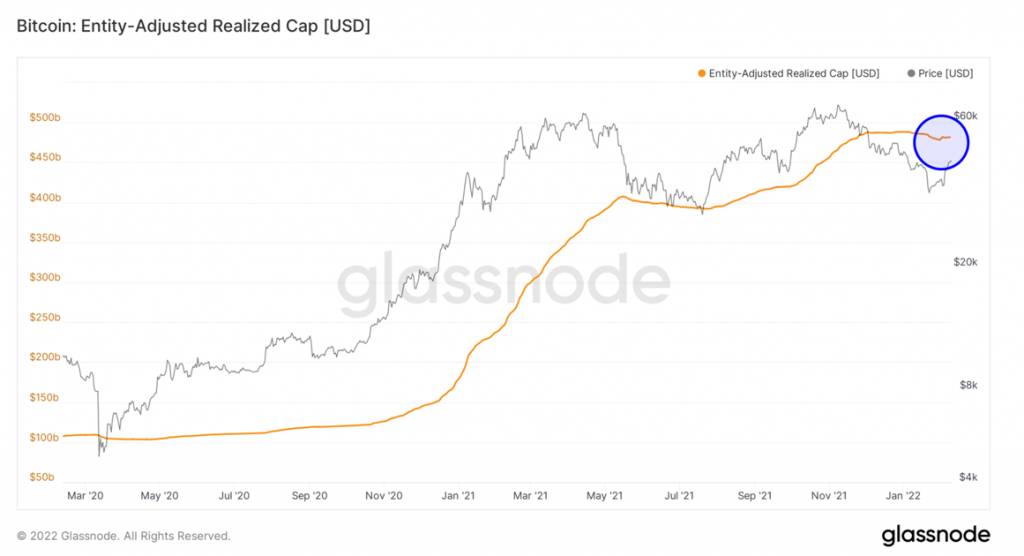

Below is realized cap, which measures the overall cost basis of all circulating BTC. We can use this as a good proxy for fund inflows (demand). As demonstrated by the chart below, the recent spike in price has not manifested in a proportional increase in realized cap, leading us to believe that we are witnessing outsized price movements on lower inflows due to a general lack of liquidity on exchanges.

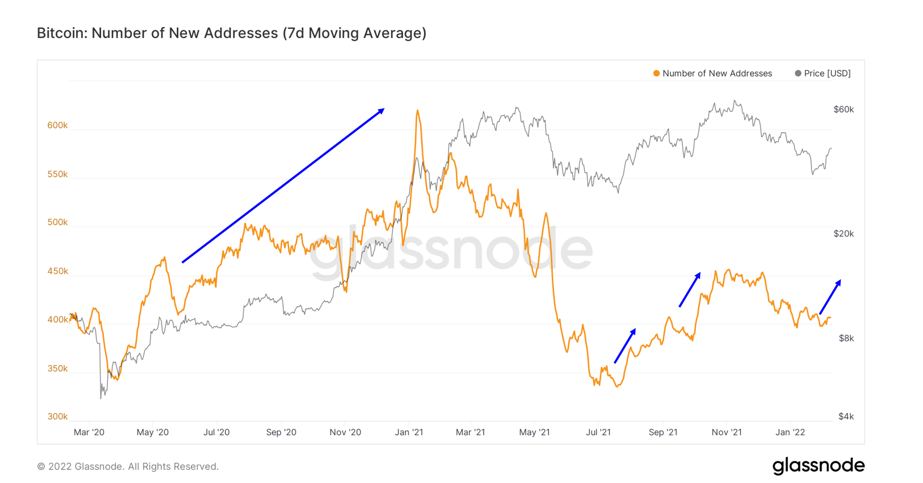

We have also lacked any substantial increase in new wallet addresses, a strong signal of demand and a hallmark of most sustained bull runs. While we see a slight tick upward in the 7-day moving average, this doesn’t necessarily suggest a massive influx of new market participants.

Given the factors outlined above, we think that this current rally smells more like a relief rally powered by mispositioned derivatives markets and bullish supply dynamics. From our vantage point, the supply dynamics continue to be enormously conducive for bitcoin’s price, but we are still waiting on a level of new demand that has characterized prior sustained bull markets.

Market Positioning

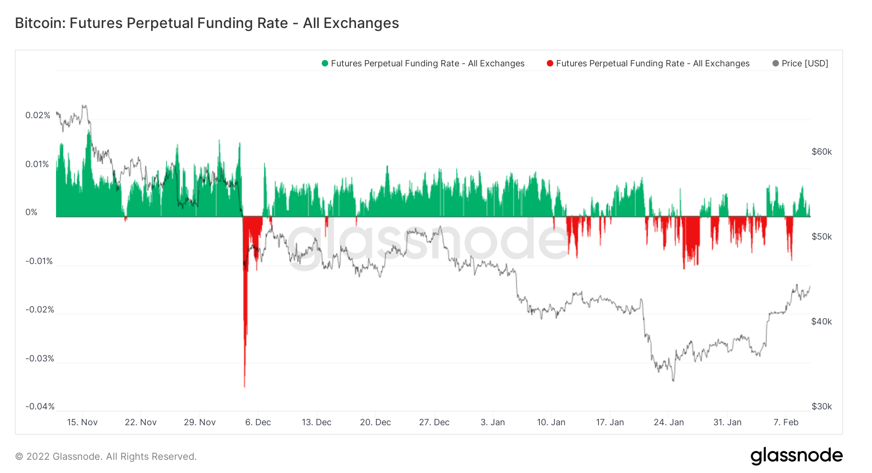

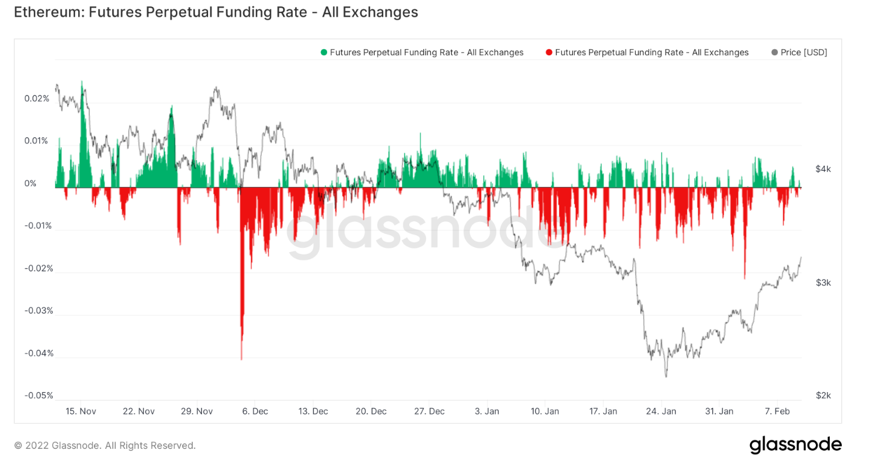

Apparent indecision in the market is also reflected in the current funding rates for perpetual futures. Starting a few weeks ago, these rates have periodically occupied negative territory for both BTC and ETH, indicating persistent demand for the short side of the trade.

In a sustained bull run with heavy demand, we would likely see these rates turn conclusively positive for extended periods.

Key Storylines and Their Implications

Despite crypto’s impressive performance, it seemed as though many in the industry were too distracted by all of the crypto-related headlines to notice. While this is not an exhaustive list of this week’s significant happenings, below are a few that caught our attention.

Bitfinex Hack

On Tuesday, the Department of Justice apprehended a couple alleged to have attempted to launder approximately 94,000 bitcoin stolen from Bitfinex in 2016. The Bitfinex hack was one of the most significant and infamous centralized exchange compromises to date. The original Bitfinex hackers got away with almost 120k BTC ($3.6 billion). The exchange made their users whole, but the details behind the hack remained shrouded in mystery and rife with conspiratorial speculation until a couple of days ago.

To paraphrase what happened, it appears that federal authorities were able to pseudonymously trace the path of the stolen bitcoin from the Bitfinex exchange wallets through a complex web of smaller wallets until they were able to associate an exposed wallet with a verifiable owner. Law enforcement agents were then able to hack into an encrypted file stored on the perpetrator’s personal cloud and retrieve the private keys for the stolen BTC. There are a couple of key items to consider here.

- Privacy – Contrary to governmental concerns about the risk of crypto increasing crime due to the ability to subvert AML provisions, Bitcoin and other distributed ledgers are open, immutable, and can (with enough resources) be traced pseudonymously. We had already seen this transpire before when the Feds captured ransomware attackers who were lazy about their mixing service back in June. We can consider this commonly issued critique of crypto discredited. That said, the other side of this argument might suggest that BTC isn’t all that private since these criminals could not get away. But that ignores the fact that these criminals committed an enormous crime with a substantial digital footprint, and it was still not an easy task for the Feds. Therefore, we think the major takeaway here is that Bitcoin ideally provides enough privacy for an individual who might want to circumvent an oppressive regime or “store cash under their mattress.” But it is also traceable enough for authorities to pursue severe or large-scale crimes (think significant ransomware attack or terrorist funding).

- Liquidity – We have fielded a couple of clients’ questions about the impact of an additional 94,000 BTC flooding the market. The government likely delivers the BTC back to Bitfinex over the counter or auctions it off OTC. Either way, it is unlikely that the new owner of the stolen BTC would liquidate in bulk, and if they did, we think that the impact would not be as severe as many would imagine. Daily exchange volumes regularly exceed $30 billion.

Accountants Ape into BTC and ETH

On Monday, KPMG Canada announced that it would be allocating a portion of its corporate treasury to bitcoin and ether through Gemini Trust Company’s execution and custody services. Managing partner, Benjie Thomas, said, “This investment reflects our belief that institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix.” While this took many, including our team, by surprise, this may make a lot more sense than people realize and might even foreshadow a change in accounting regulations.

As it stands, several corporate entities have cryptoassets on their corporate balance sheets, the most notable being MicroStrategy, with 125,051 in BTC on theirs (over $5.5 billion). However, it is widely suspected that many companies would like to add crypto to their balance sheets but are unable to due to existing accounting rules that require cryptoassets to be treated as indefinite-lived intangible assets. The existing rules stipulate that companies must write-down the bitcoin held on their balance sheet if the spot price drops below cost basis.

While there is no definitive timeline on amending these regulations, many in the industry are working to make it happen. KPMG wading into the space could be an early sign that accounting regulations surrounding crypto in corporate treasuries might be changing. Adding these assets to their corporate treasury puts them in a monetarily advantageous position if such changes were to occur. It also makes the firm a more sensible option for clients looking for auditors to guide them through the processes involved in acquiring cryptoassets for one’s corporate treasury. Regardless of the motivation, this was an exciting bit of news for the industry.

Russia Takes a Bullish Stance on Crypto

From our perspective, the most surprising news this week came from the Kremlin. Contrary to previous rumors that Russia intended to ban crypto, on Tuesday government officials announced that it plans to draw up official legislation to regulate crypto and treat it as an “analog” to currencies. The details of this legislation remain unearthed, but this could end up being an interesting chess move from a US adversary that is currently at the center of a massive geopolitical conflict.

Last week, we highlighted several potential catalysts for bitcoin in 2022, with the most significant and most underpriced catalyst being nation-state adoption. El Salvador made waves as the first country to adopt bitcoin as legal tender. We do not think they will be the last. We are not saying that regulating bitcoin is the same as adopting it as legal tender or as a reserve asset. Still, this news provides us an opportunity to explore the potential game theory that bitcoin adoption could instigate.

Suppose the western world’s number one threat against Russia is increased sanctions and removal of Russian entities from SWIFT. In that case, the logical response from Russia is to allow citizens to evade this restriction via the use of decentralized monetary systems. This would essentially dismantle the effectiveness of most economic restrictions.

Specific to Russia, one must also consider the element of bitcoin mining. We have occasionally discussed how bitcoin mining can soak up excess energy production and monetize otherwise wasted natural resources. Russia is a massive exporter of oil, and a key bargaining chip that western Europe has is energy consumption – they are the buyers of Russia’s oil. If Russia could use mining to remove the need for European consumption, it could effectively remove any economic leverage that Europe currently has on them.

To be clear, we do not sympathize with Russia in this conflict; we think it’s evident that their entire regime conflicts with the values of ownership, decentralization, and individual sovereignty that cryptoassets try to solve for. We are merely trying to outline how a global decentralized monetary system flips the current global incentive structure on its head.

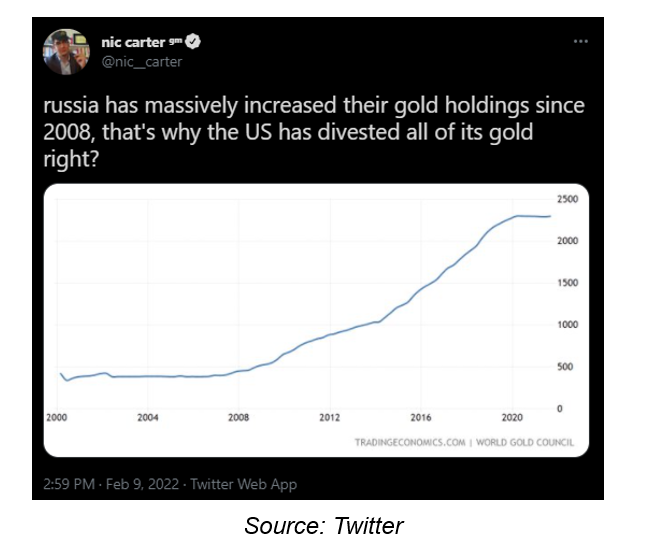

The logical next question: what would the implications of Russian bitcoin adoption be for the western world? Would the US and Western Europe try to ban it? Tax it out of existence? I think Nic Carter of Castle Island Ventures had the proper take on this question.

Just because an adversary adopts an asset does not necessarily mean that the proper strategic maneuver is to ban said asset. In fact, the strategically prudent move likely is to further invest in that asset and build an advantage in the production and custody of that asset. Besides, if Russia wanted to, they could simply require all payments for oil exports to be remitted in BTC, which would render any counter-regulation ineffective.

We still need to see how this story shakes out and if it has any actual legs. But, at the very least, this preliminary action by Russia provides a glimpse of how game-theoretical scenarios could manifest on a global scale, and we think it is something worth paying attention to.

Bottom Line

We remain optimistic on the performance of Bitcoin and Ethereum through the end of this year but have yet to see sustained demand come into the fold. We think it is wise to stay long and add on dips through Q1 and Q2 as we wade through potential choppy waters brought on by macro uncertainty.

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 4e6062-8f9104-e69006-dc68d0-949c13

Already have an account? Sign In 4e6062-8f9104-e69006-dc68d0-949c13