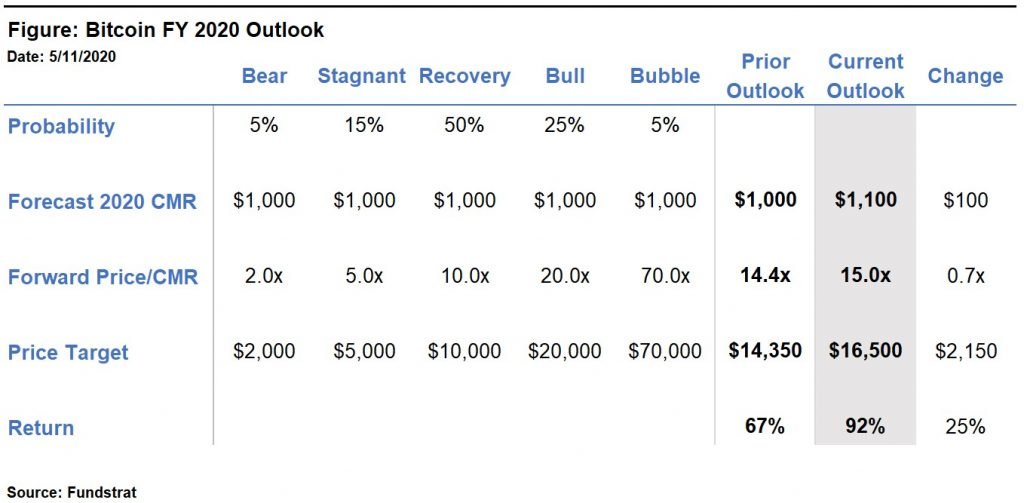

Increasing Outlook: Sentiment & FY 2020 Forecast Support a “Non-Speculative” Bitcoin Price of $16,500

Please see important disclosures at the bottom of this report

Portfolio Strategy

The conditions appear in place for a continued rally in crypto asset prices over the course of the year. Last week brought two events that 1) incrementally de-risked the downside and 2) improved the bull market case.

- We are gaining confidence in the sustainability of this rally with each day that passes after the halvening that we don’t see signs of trouble in the mining sector.

- Investor sentiment data has shown signs of strength that offer encouragement for the prospects of a continued rally.

There are risks that remain, but on balance we are seeing enough positive conditions unfold to give us room to revise our Bitcoin outlook upward to $16,500.

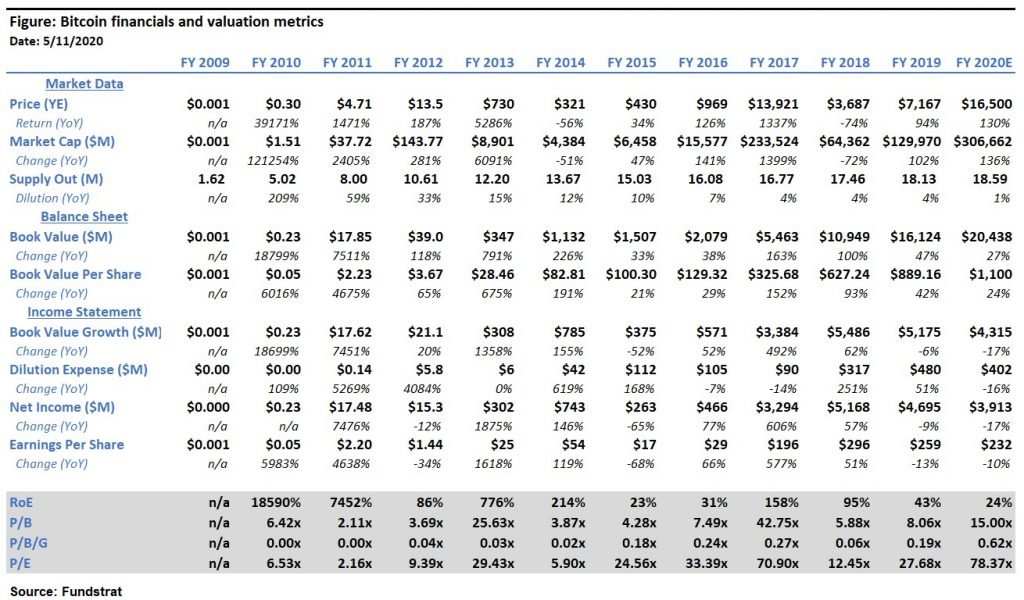

Alongside our updated outlook, we are releasing our initial FY 2020 Bitcoin financial forecasts and fundamental valuation metrics to investors – this is the first of such sell-side forecasts on the market, as far as we know.

Our FY 2020 fundamental forecasts are calling for Bitcoin’s book value per share (cumulative mining revenue per coin) to reach $1,100, which is a $100 increase from our prior expectations. Investors will recall, the Market Cap/Cumulative Miner Revenue (Mkt Cap/CMR) valuation model I developed has been a very reliable predictor of market movements. Our target is applying a 15x Price/Book multiple (Mkt Cap/CMR), which is equal to its 3-year historical average. Based on our analysis, we believe Bitcoin continues to offer a strong fundamental investment opportunity, beyond a “great speculation”.

PTJ Endorsement

The endorsement of Bitcoin from the legendary fund manager Paul Tudor Jones gave markets an added boost last week. PTJ publicly disclosed his exposure to Bitcoin and recommended investors to own 1% to 2% of the asset in their portfolio, which falls in line with the guidance we’ve been offering. The prospects for greater adoption traditional macro funds “taking bets” on the asset is encouraging for market sentiment.

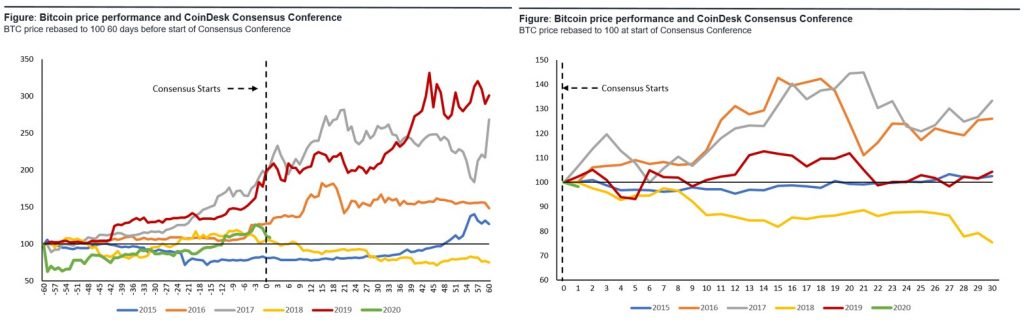

Consensus Conference Effect

Investors have focused heavily on the halvening effect of prices leading up into and after the Bitcoin block reward reduction. Now that the halvening is past us, and we are looking forward, one other event that we’ve observed producing a similar effect is the Coindesk Consensus Conference in NY that started on the 11th. Bitcoin returns surrounding Consensus have historically been strong in all years except during the bear market in 2018, which is positive for sentiment.

Cumberland Pre-Halving Survey

A survey of investors taken by the large crypto OTC market maker Cumberland mining indicated that respondents had an overwhelmingly bullish outlook on the price of Bitcoin by the end of the year, which is additionally positive for sentiment.

Bitcoin FY 2020 Estimates

Our view continues to be that crypto assets follow financial fundamentals that can be viewed from the blockchain. The cumulative mining costs (CMR) for Bitcoin, and other PoW monetary store of value crypto assets have served as a strong indicator of long-term fundamental valuations. The metric can be thought of as equivalent to the “Book Value” of Foreign Direct Investment (FDI) into each digital economy for building infrastructure.

Our model forecasts our expected FY 2020 Book Value (CMR) and its resulting Book Value Per Share (CMR/Coin). We take the change in Book Value as the Book Value Growth. We subtract that dilution of new supply as an expense at the rate of the prior Book Value Per Share. We derive a net income to initial shareholders as the net accretion (or dilution if negative) during the period. We adjust the net income by the outstanding supply to arrive at Earnings Per share.

The FY 2020 forecasts represent a Return on Equity (Book Value) of 24%, which is conservative compared to prior year results. The Book Value multiple of 15x represents Bitcoin’s 3-year average historical Mkt Cap/CMR valuation ratio. On a growth adjusted basis, the Price/Book/Growth ratio is toward the higher end of the historical range but well below prior bubbles.

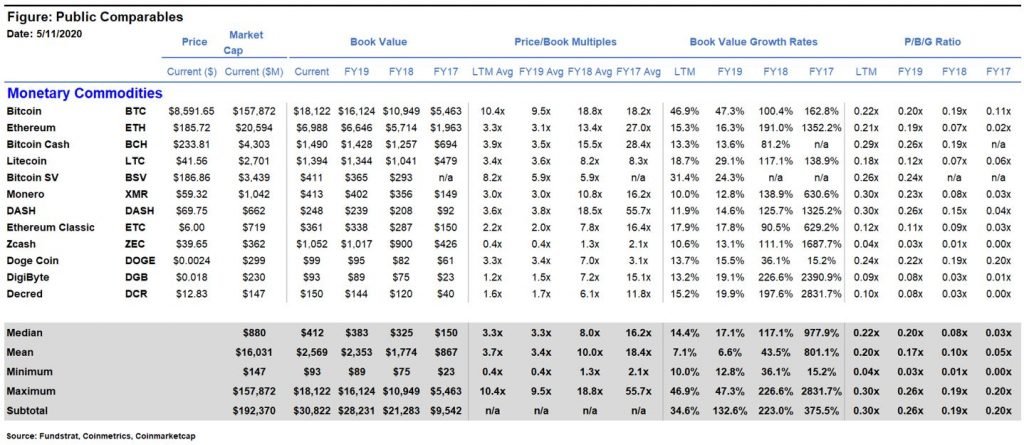

Comparable Analysis

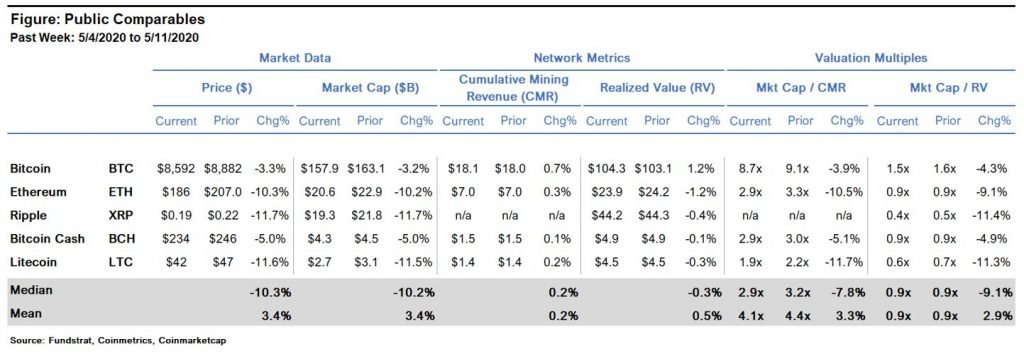

Comparing Bitcoin on a historical basis to its public peers gives us comfort that our assumptions are well within a reasonable range of expectations. We believe Bitcoin deserves to trade at a consistent discount to most of its peers due to its size, growth, and historical valuation ranges.

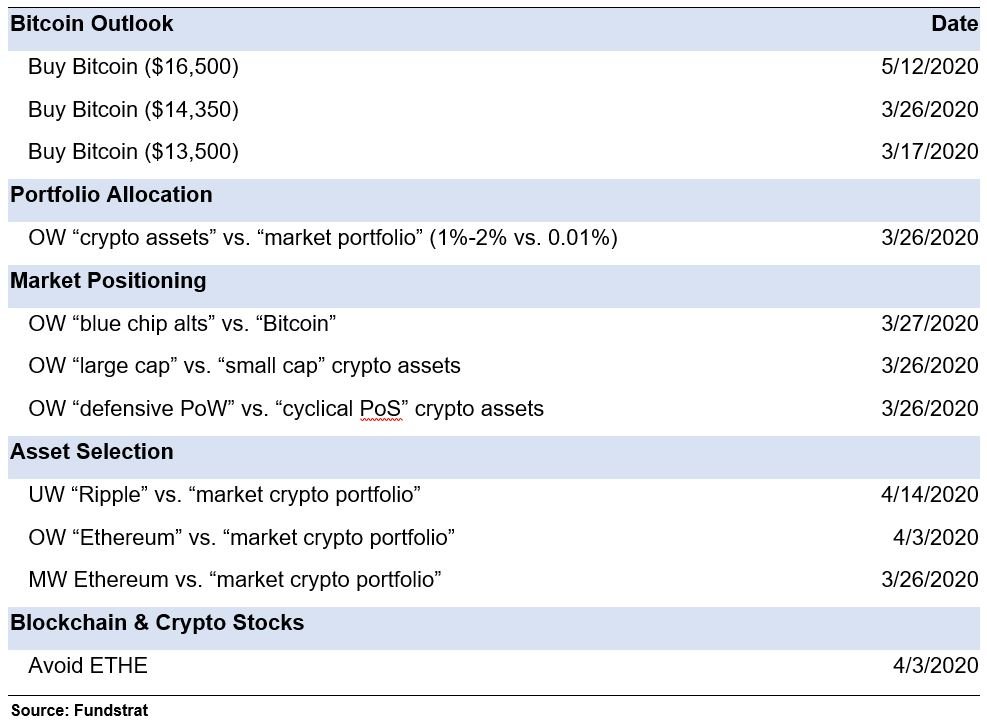

Bitcoin Outlook

The results of our $1,100 Book Value Per Share forecast and our 15x Price/Book forward multiple produces our $16,500 Bitcoin price target. Comparison of our current and prior outlooks are below.

Investment Themes

Market Analysis

In last week’s note our guidance to investors was the following:

“We are still looking for prices to rally up into the halvening and will start to look more critically at the market in the immediate days before and weeks after for any signs of weakness. Based on current market conditions, we would not be surprised to see Bitcoin reach the $10k level before the event, and possibly have some retracement after.”

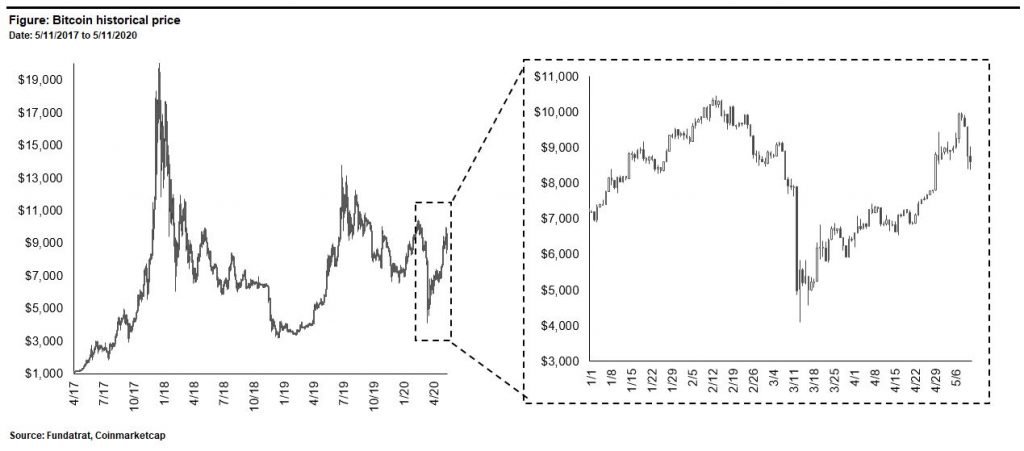

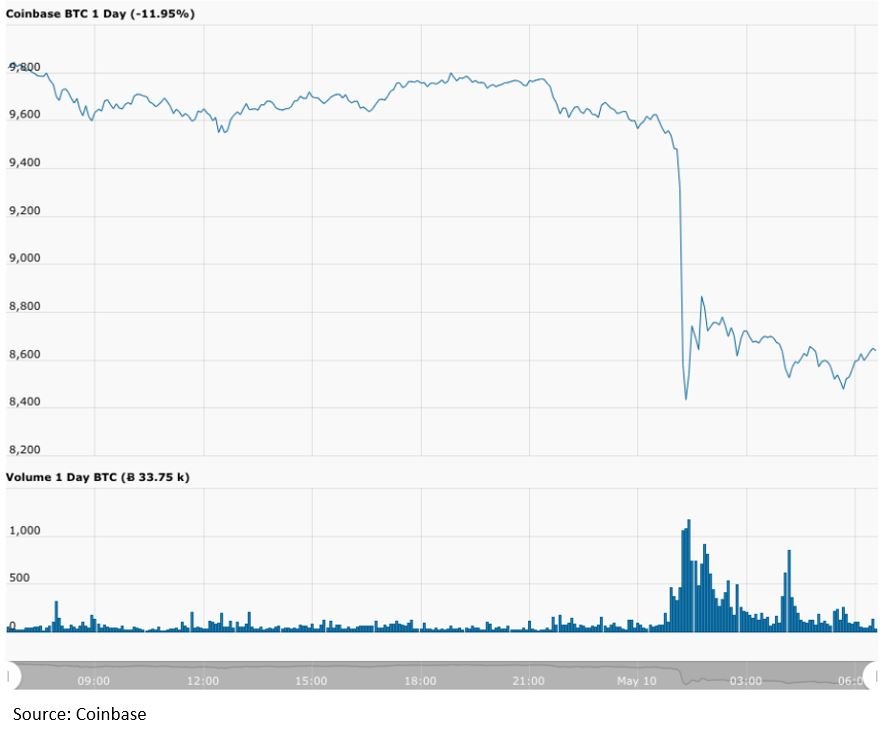

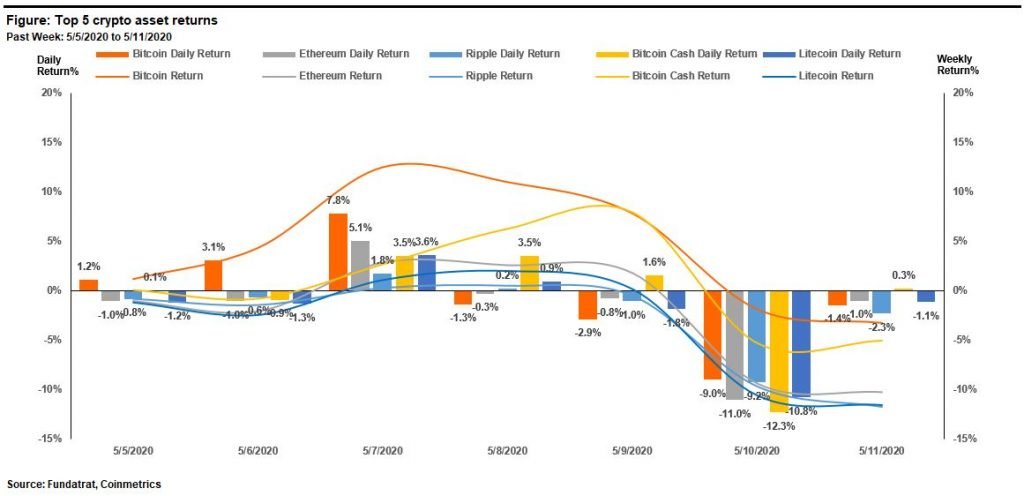

We got something surprisingly close to that over the last week. Bitcoin rose to touch $10,079 four days before the halvening on the 7th, and quickly sold off to $8,106 two days before the event on the 9th, eventually closing down 3% on the week at $8,591 on Tuesday 5/11.

Saturday night’s flash crash erased all of the week’s gains. The crash lasted about 15 minutes, cratered Bitcoin’s price about $1,000, and resulted in temporary downtime on Coinbase’s network.

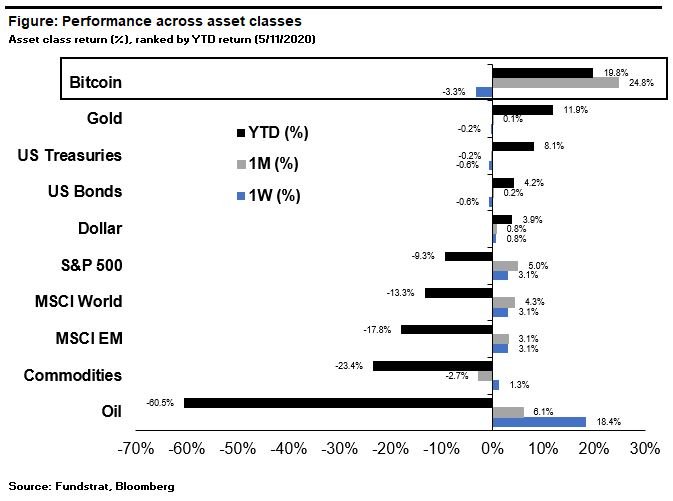

Despite this steep sell-off over the weekend, Bitcoin remains the best performing asset class on a YTD basis.

Top crypto assets all lagged Bitcoin this week. Bitcoin Cash had the strongest relative performance lagging Bitcoin by about 2% while other major assets declined 10%-12% on the week.

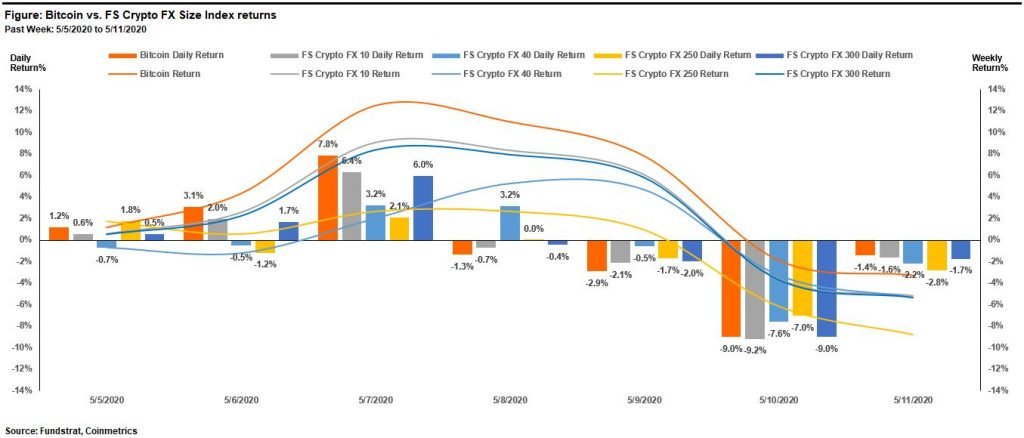

All size-based indices lagged Bitcoin this past week. FS Crypto FX 250 was the worst performing index and was down 8.7% on the week.

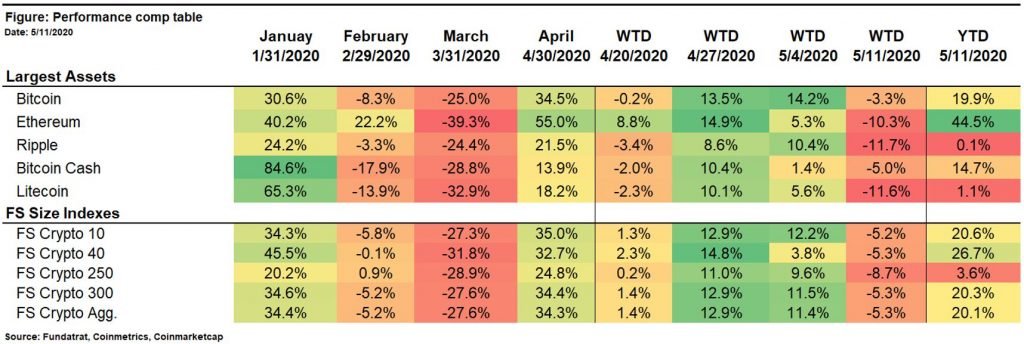

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

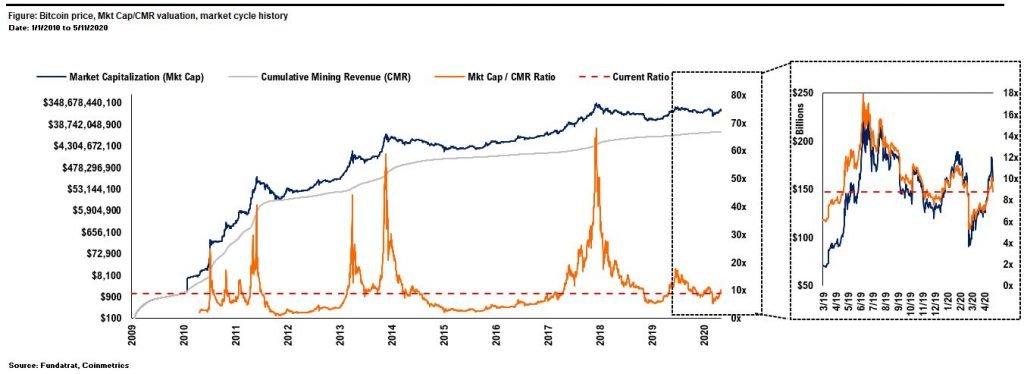

Bitcoin’s P/CMR valuation stood at 8.7x as of 5/11 vs 9.0x as of last week. This value remains slightly below the levels from Mar-19 through present.

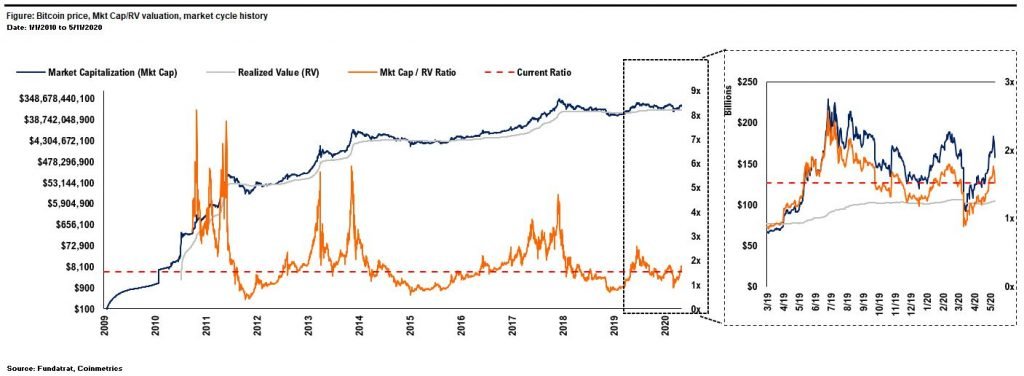

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.5x as of 5/11 vs 1.6x last week.

The comp table for large cap crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

Blockchain & Crypto Stocks

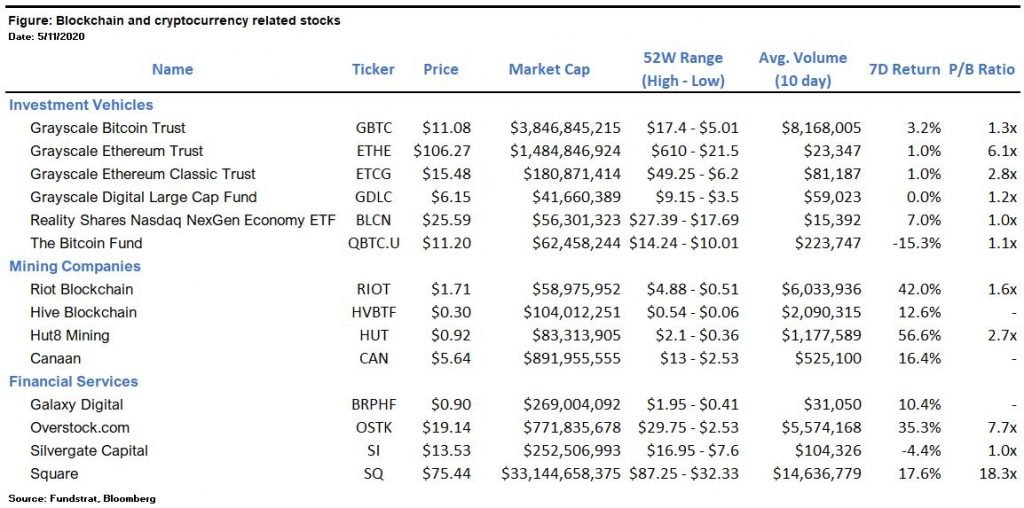

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Mining Companies: In line with Bitcoin’s strong run up to $10K last Wednesday, mining stocks saw strong performance into Friday night before opening significantly lower on Monday following Bitcoin’s precipitous decline from about $9,600 on Saturday night to as low as $8,550 on Sunday. Nevertheless, performance on the week was strong and smaller cap stocks Riot and Hut8 significantly outperformed, rising 42% and 57% on the week, respectively.

Financial Services: According to a report from the Wall Street Journal, JPMorgan is now offering banking services to two well-known digital asset exchanges: Coinbase and Gemini. The banking giant’s move into the industry warrants close watching as crypto focused banks such as Silvergate Capital could see increased competition or become attractive acquisition targets.

Winners & Losers

Winner: f2pool – Prior to the halving event, f2pool mined the final Bitcoin block with a subsidy of 12.5 BTC and included the following message in its coinbase transaction: “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue”. The message is an allusion to one left by Satoshi in Bitcoin’s first block mined over a decade ago in the midst of the 2008/9 financial crisis.

Loser: TON – Telegram officially abandoned its TON blockchain project. The withdrawal follows a decision by a US judge prohibiting the TON platform’s GRAM token from being distributed not only in the US, but also globally.

Financing Activity

Abra – The San Francisco based crypto financial services app raised $5MM from the Stellar Development Foundation (SDF). The partnership will shift some of Abra’s services onto the Stellar Blockchain and comes on top of a $12MM Series C round which took place in early April and was led by American Express Ventures.

Lolli – The New York based e-commerce rewards startup raised $3.0MM in seed funding. The round was led by Peter Thiel’s Founders Fund with participation from Bain Capital Ventures, Craft Ventures and Digital Currency Group.

Coinme – The Seattle-based digital currency ATM company raised $5.5MM in a financing round led by Pantera Capital.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 2

- Robert Sluymer: Crypto Technical Analysis: BTC challenges 9-9.5K resistance making new 7-month highs vs S&P 500

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: Digital Assets Weekly