Digital Assets Weekly: April 14th, 2020

Please see important disclosures at the bottom of this report

Readers Note: The crypto weekly newsletter was not published last Friday due to the Easter holiday and has been moved to today instead.

Portfolio Strategy

Crypto markets have seen price swings over past weeks, but despite the choppiness, markets have largely ended where we left them in prior weeks with Bitcoin sitting around $6,900 today.

Crypto Allocation: For this reason, our tactical crypto exposure recommendations haven’t changed since our last note, but we will provide investors more color on certain portfolio allocations this week.

Size Allocation: Higher beta small caps have picked up the pace lately, as we mentioned would happen during a broader market uptrend, but we still believe it’s best to keep a managed risk approach towards smaller names at this time to hedge against any potential market reversal.

Defensives/Cyclicals: We remain overweight defensives PoW assets vs. cyclical PoS assets this week but acknowledge we are incrementally warming up to cyclicals and may move to market weight if the recovery continues to play out.

Bitcoin: Our outlook for Bitcoin remains bullish, but it continues to be our view that investors have the opportunity to capture more upside as the market recovers by overweighting other blue-chip alts.

Ethereum: Has seen strong outperformance as of late. During our Digital Asset Launch call we recommended investors “gradually shift towards overweight [Ethereum] for the next 6 to 12 months as technicals improve further” and in last week’s note we said:

“It’s our view that Ethereum would be justified in trading at a consistent premium to Alt Coin peers, in a range near Bitcoin, given its strong and growing adoption and robust crypto economy activity.”

We maintain our positive view on Ethereum and are even more encouraged by the 2020 Q1 DAPP Market Report released last week showing it topping the charts across volume ($5.6B) users (422k), new (127), active (646) and total (2265) Dapps. We still think ETH’s strong fundamentals and more attractive valuation means it has greater upside relative to BTC over the next 6 to 12 months.

Ripple: We touched on some concepts for thinking about XRP’s valuation last week but stopped short of providing any recommendations. This week we’ll advise clients to underweight XRP relative to other blue-chip alts based on the following:

1) Macro Price Cycle Stage: During this same early point in the prior Bitcoin macro market price valuation cycle XRP’s performance largely lagged until BTC broke prior ATH’s.

2) Ripple Selling Pressure: Ripple, the company behind the digital currency and its largest holder has been a continuous seller of XRP and future sales could weigh on the price.

3) Regulatory Uncertainty: We are not making a statement on XRP’s legal status, but we believe security lawsuit claims could leave a regulatory uncertainty overhang on the price.

4) Central Bank Digital Currencies: We are encouraged by the traction XRP has gained with banking & international payment clients lately, but we see long term threats to its competitive advantage as CBDC enter the market.

5) Valuation: The fundamental valuation of XRP appears rich relative to its historical transaction usage and network transaction fee buyback value.

Macro Bitcoin Outlook: Our outlook for Bitcoin over the next 12 months remains unchanged, but we have updated our table to include a column showing our probability-weighted average expectation:

Investment Themes

- Remain OW crypto assets vs. market portfolio

- Remain OW large cap vs. small cap crypto assets

- Remain OW defensive PoW vs. cyclical PoS crypto assets

- Remain OW blue-chip alts vs. Bitcoin as recovery confirms

- OW Ethereum vs. market crypto portfolio

- UW Ripple vs. market crypto portfolio

Market Analysis

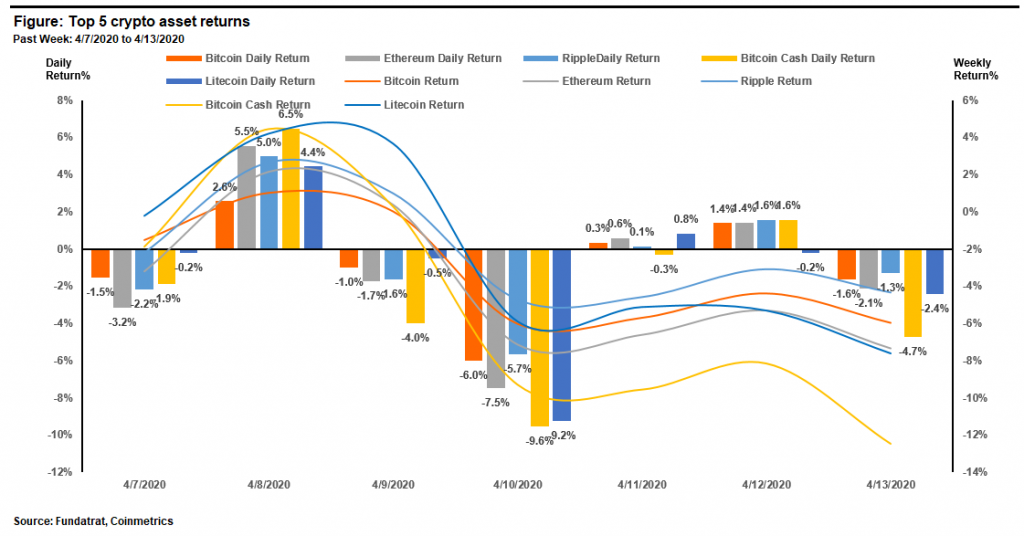

The price of Bitcoin fell by 6% over the prior weekly period of 4/6 to 4/13 and finished up by 1.7% since our last note was published on 4/3.

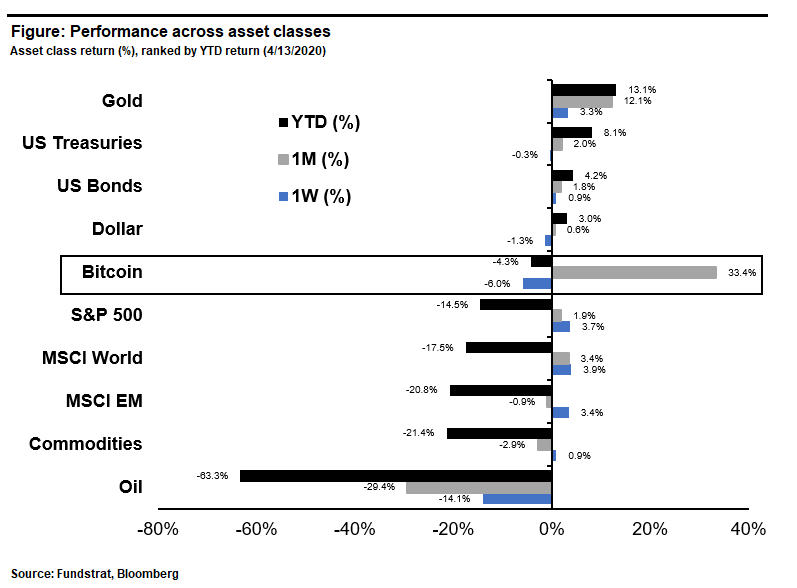

Bitcoin has seen strong performance on the month, up 33% after recovering from the March 12th sell-off. It remains in 5th place among macro asset categories based on year to date performance.

Ethereum was a notable outperformer since our past note driven by gains on Monday of last week (not shown in chart) but has been trading in line with other large caps as of late.

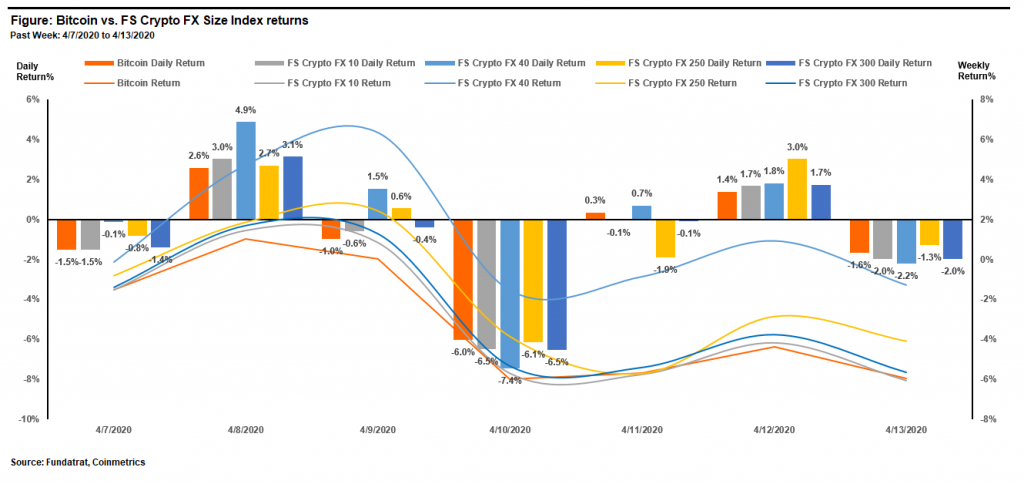

The small caps incrementally outperformed over the prior week by about 2% to 4% vs other size indexes which largely traded in line with each other.

Fundamental Valuations

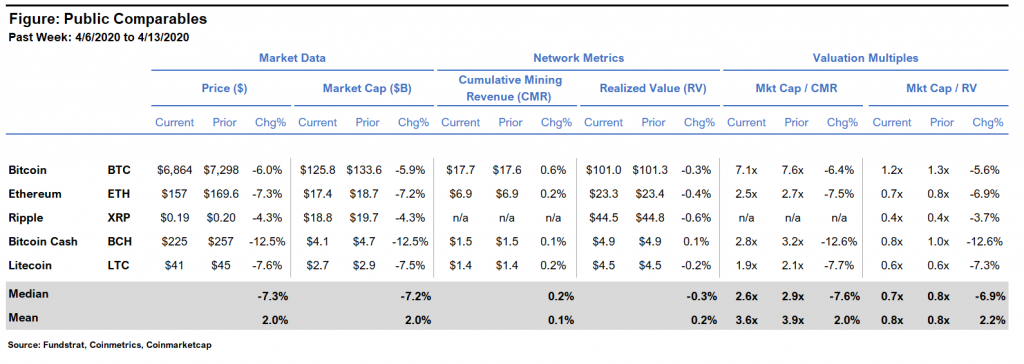

Large cap crypto asset prices and fundamental valuations fell on the week but rose incrementally since our last note on 4/3.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RM ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics give an approximate measure of unrealized profit, and therefore an investor’s incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. It’s best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

Blockchain & Crypto Stocks

The table shows publicly traded blockchain and crypto-related stocks, which offer a vehicle for an investor who is constrained from owning underlying crypto assets themselves.

Industry Insights

There’s been a lot of discussion lately about what central bank liquidity means for the dollar, inflation and Bitcoin’s price. Mike Novogratz (Galaxy), Arthur Hayes (Bitmex) and a host of crypto bulls are calling for inflation while some Wall Street bulge bracket banks and Fed economists warn of deflation.

I’m not a dollar bear, personally. Fed balance sheet increases alone may not drive inflation if they’re offsetting reduced debt in the overall economy or if global uncertainty drives safe-haven dollar demand, but I recognize the drivers are complex and elusive at times, so I try to stay in my own lane.

Fortunately, my thesis on Bitcoin and crypto is focused on its emerging economy and disruptive technology secular growth story and doesn’t need to take a view on the dollar.

However, if inflation does emerge in the US or abroad, it’s worth discussing how Bitcoin and crypto assets prices should be fundamentally affected. The short answer is most crypto prices should rise… But the reason WHY they rise is what’s more commonly misunderstood in my view.

Counter to many crypto proponents, I’ve never believed Bitcoin, or any crypto asset, is valuable because its supply is fixed or deflationary. The data tells us this is a myth. Skeptics are right in my view to point out Bitcoin’s 21M supply isn’t capped since it can be infinitely forked/copied (BCH, BSV, etc.). Likewise, reducing new supply inflation alone doesn’t mean the price must go up as perpetually bullish stock to flow models ascribe while ignoring incentives for existing supply and the entire demand side of the equation.

That doesn’t mean crypto bears see the picture 100% correctly either. The underlying intrinsic value drivers for Bitcoin and other crypto assets come from: 1) the scarce real-world resources of money and labor that go into them, 2) the market incentives of owners to support the price, and 3) the energy that vested stakeholders put behind selling the digital products and growing the crypto economy.

Data has shown that the price of the minable crypto assets like Bitcoin (80% of the market) all track the amount of dollars that have been consumed in producing them, telling us that the value is more closely related to the incentives of real world resources consumed in their production, rather than the actual supply of the digital coins themselves. For this reason, many of these assets resemble digital real estate in their store of value property.

Now, just because you build a digital house doesn’t mean that anyone wants to move to that neighborhood. The reason that any of these digital assets have value is because people have a vested interest in their success and put forth enough effort convincing others to find them valuable.

This doesn’t mean that only minable crypto assets have value creation incentives. There are several other crypto assets that resemble decentralized companies and their value is derived from the value of their products and their user’s ability to convince others to join their ecosystem.

Bottom line: crypto assets will likely rise for the same reason products, stocks, and real estate rise during inflationary times – but likely faster due to their own added idiosyncratic tailwinds. This may beg the question – if crypto acts as a hedge against inflation does it matter why?

Winners & Losers

Winner: The Steem community is the winner this week after Steem Witnesses Freeze $3.2M in Latest Tit-for-Tat With Hard Fork Insurgents, putting a total of 17.6 million Steem in limbo. This gives us an interesting insight into the future of how financial sanctions could look like on an open-source public blockchain world in situations where the community effectively takes political action against a counterparty they do not agree with.

Loser: The losers this week are 11 top crypto exchanges, token issuers that were named in a series of class-action lawsuits claiming they eluded investors by selling unlawful securities in the form of digital tokens to unknowledgeable US residents and failed to share full disclosure of information to all investing parties. The 11 suits were filed by a New York law firm against Binance, KuCoin, BiBox, BitMEX and its owners HDR Global Trading Limited, Block.one, Quantstamp, KayDex, Civic, Protocol, and Tron. Read more

Weekly Rant

The headline “Bitfinex ventures into staking space, offering 10% annual return on three tokens at launch” makes me cringe. The crypto industry marketing terminology around staking returns is often misleading since they do not qualify that the returns are denominated in the native asset. Retail investors expecting a yield, as staking returns are often called, will be disappointed when they are paid extra tokens that are worth much less in dollar terms.

The headline “BitMax will host CasperLabs’ Exchange Validator Offering (EVO) and allow retail investors to get hold of the network’s CLX tokens” makes me cringe as well. The crypto industry marketing for coming up with new terms for token sales has gone from Initial Coin Offering (ICO) to Initial Exchange Offering (IEO), to now Exchange Validator Offering (EVO), but the fundamental nature of these capital raises has not changed.

Financing Activity

Sila The Portland-based company seeking to use Ethereum to replace ACH raised a $7.7M Seed financing led by Hope Cochran of Madrona Venture Group and Rick Holt of Oregon Venture Fund. Read more.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Robert Sluymer: Crypto Technical Analysis: BTC’s short-term trend turns positive – 7K next hurdle followed by 8K

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review