dePIN Goes Solar

Weekly Recap

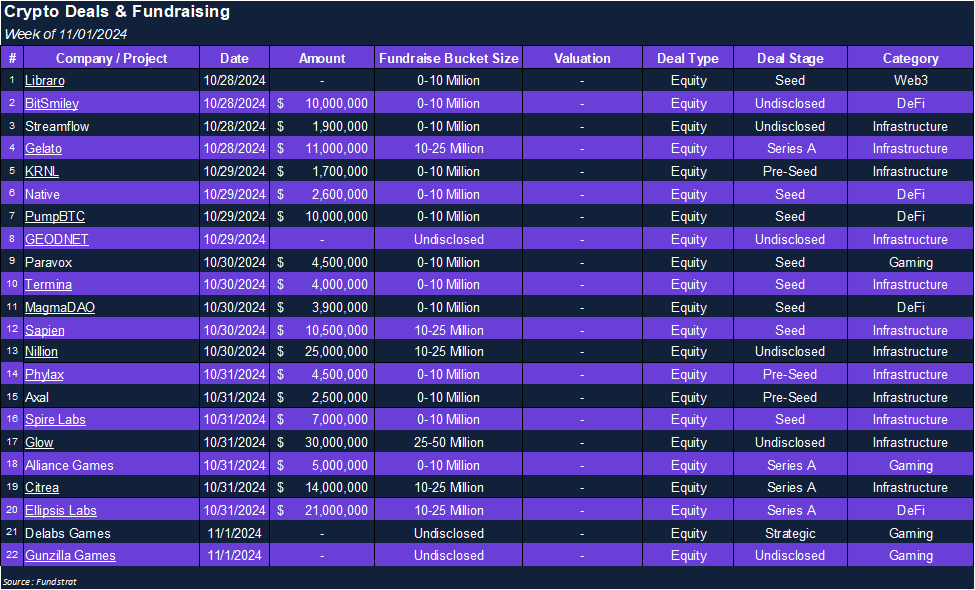

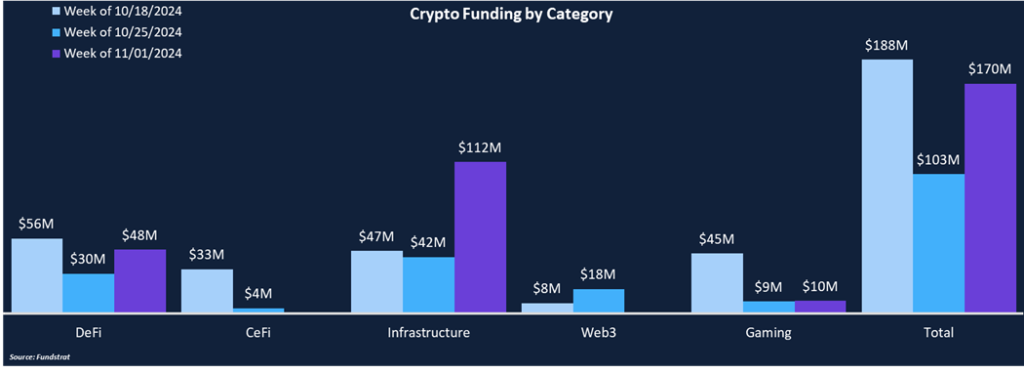

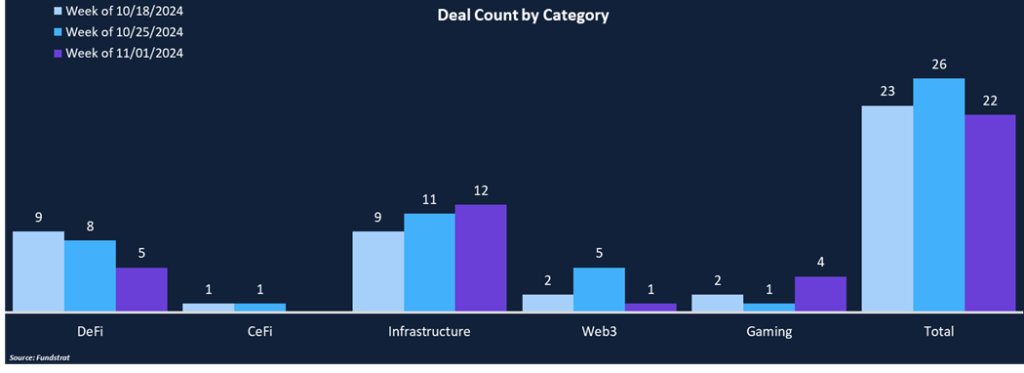

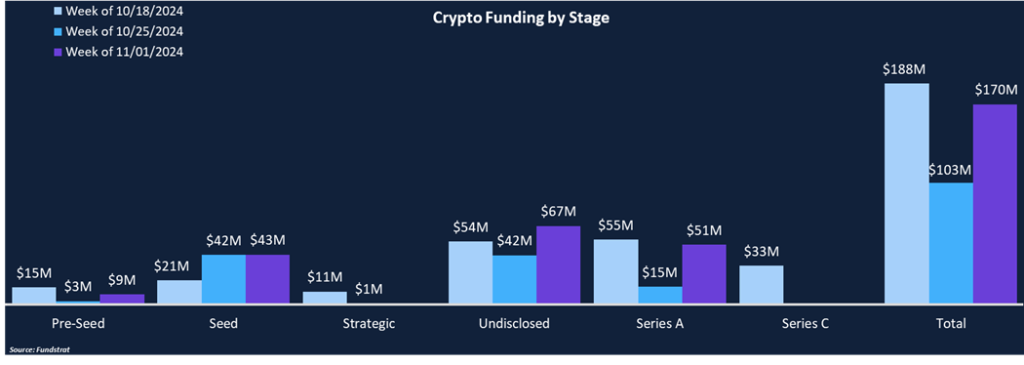

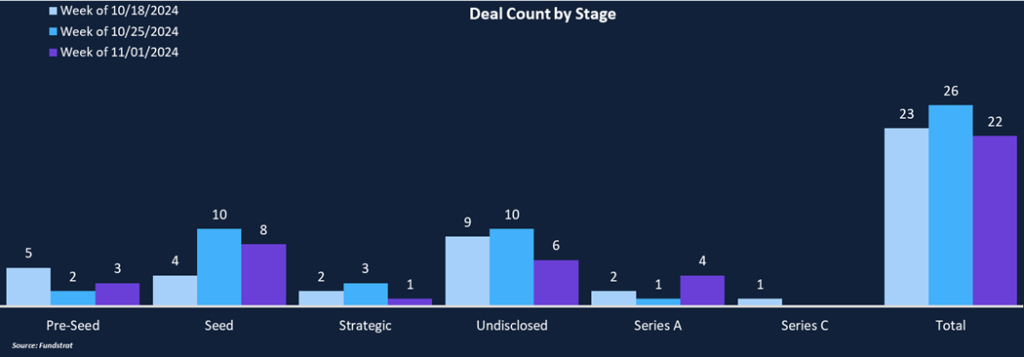

Weekly funding increased 65% from $103 million to $170 million despite the deal count falling 15% from 26 to 22. Eight companies raised $10 million or more this week, in contrast to just 10 companies combined in the last two weeks. The bulk of funding was concentrated in the Infrastructure category, with projects raising $112 million across 12 deals. DeFi was the second most funded category, with $48 million across five deals. Among the four Gaming deals, Gunzilla Games, the creator of Off the Grid, notably raised an undisclosed amount from VanEck, representing the asset manager’s second crypto-gaming investment alongside Parallel. From a deal stage perspective, Series A was the leading funding category, comprising 30% of the funding total and 18% of the total deal count. Seed rounds were the most popular deal stage, with eight deals totaling $43 million.

Funding by Category

Funding by Stage

Deal of the Week

Glow, a solar-focused dePIN project, raised $30 million in an undisclosed round led by Framework Ventures and Union Square Ventures. $6.5 million will fund Glow’s operations, while the remainder will support the expansion of solar farms being built in India. Glow hopes to reshape the energy grid by incentivizing solar construction using dePIN economics.

Why Is This Deal of the Week?

The cost of installing solar panels has decreased by five times since 2010, and solar panels have become a cheaper energy alternative compared to traditional sources. The cheapest solar farm built in Glow’s network costs less than $10,000 and produces enough energy to power an entire home. Once built, solar installations usually last for more than 25 years, and maintenance costs are less than hundreds of dollars a decade.

Glow has introduced a new rewards mechanism called “recursive subsidies,” where solar farms commit to contributing 100% of their energy savings to the Glow rewards pool, which incentivizes more solar construction. In return, participating solar farms are eligible to receive GLW and USDC rewards:

- GLW tokens are rewarded to solar farms in proportion to their protocol fee, which is based on their projected 10-year electricity value.

- USDC rewards are allocated proportionately to their carbon impact (i.e., the carbon credits a solar farm generates for Glow).

- All generated carbon credits are tokenized into Glow Carbon Credits (GCC tokens) and then auctioned weekly, paid for in GLW tokens, which are subsequently burned, adding a deflationary aspect to GLW supply.

Together, solar builders are highly incentivized to maximize the amount of money they bring to the protocol and maximize total carbon impact, resulting in significant clean energy infrastructure and a cleaner environment. Glow’s recursive subsidies create a fly-wheel for clean energy construction. Glow estimates that each dollar of its recursive subsidies generates $20 worth of brand-new solar energy. Glow’s network has been growing quickly. It now includes 69 active solar farms, which have produced 116 carbon credits and have a total monthly power production of more than 202 megawatts/hour.

Selected Deals

Nillion, a “blind computing” network, raised $25 million in an undisclosed round led by Hack VC, with participation from Hashkey, Maelstrom, Animoca, GSR, and others. The Nillion Network creates a private data ecosystem where data is processed without revealing the data’s contents by leveraging privacy technologies such as multi-party computation (MPC), fully homomorphic encryption (FHE), and zero-knowledge proofs (ZKP). Nillion believes private data will be the backbone of new technologies as centralization risks surrounding sensitive data increase with the proliferation of AI applications. Nillion’s PETNET supports Privacy-Enhancing Technologies (PETs) built directly into Nillion’s infrastructure, making it possible to store/compute sensitive or confidential data without the concern of trusting a centralized entity. NilChain is responsible for coordinating payments for storage operations and blind computations on the network. The Nillion Network has no global shared state or consensus on order. Instead, it prioritizes storage or computation over high-value data while decentralizing trust across its node network. Nillion has already partnered with blockchains, including NEAR, Aptos, Arbitrum, and others, as it inserts itself at the intersection of blockchain and AI.

Ellipsis Labs, the development company behind Phoenix, raised $21 million in an extended Series A round led by Haun Ventures. The fresh funding brings Ellipsis Labs’ total funding to $44.3 million after raising $20 million in its initial Series A round in April and $3.3 million in its 2023 seed round. Phoenix is an order-book decentralized exchange on Solana, which has supported over $50 billion in trading volume. The funding will be used to accelerate the development of Atlas, Ellipsis’ purpose-built blockchain network using a custom implementation of the Solana Virtual Machine (SVM). Atlas is being built for financial applications that require reliable transaction delivery, near-zero fees, and instantaneous pre-confirmations. Atlas is unique in being built via the SVM, but upon completion, it will be an Ethereum rollup, allowing for easy integration into both ecosystems.

Citrea, a Bitcoin zero-knowledge rollup, raised $14 million in a Series A round led by Founders Fund, with participation from Maven11, Mirana Ventures, Axiom, Echo, and others. Citrea raised $2.7 million in a seed round earlier this year, and the fresh capital will help Citrea in its journey to expand Bitcoin from a store of value to an active programmable asset. Citrea’s Bitcoin zk-rollup serves as an execution layer for Bitcoin-backed applications while keeping settlement and data availability on the Bitcoin main-chain. Citrea is also fully EVM compatible, broadening its potential developer base and allowing for easy transfer of existing DeFi applications. In conjunction with the funding announcement, Citrea has launched its exclusive developer program, Citrea Origins, which will help accelerate the development of a Bitcoin-backed economy. Citrea is still in its testnet phase, with mainnet launch expected for Q1 2025.