Q2 2024 Funding Report

Jul 12, 2024

Author

Key Takeaways

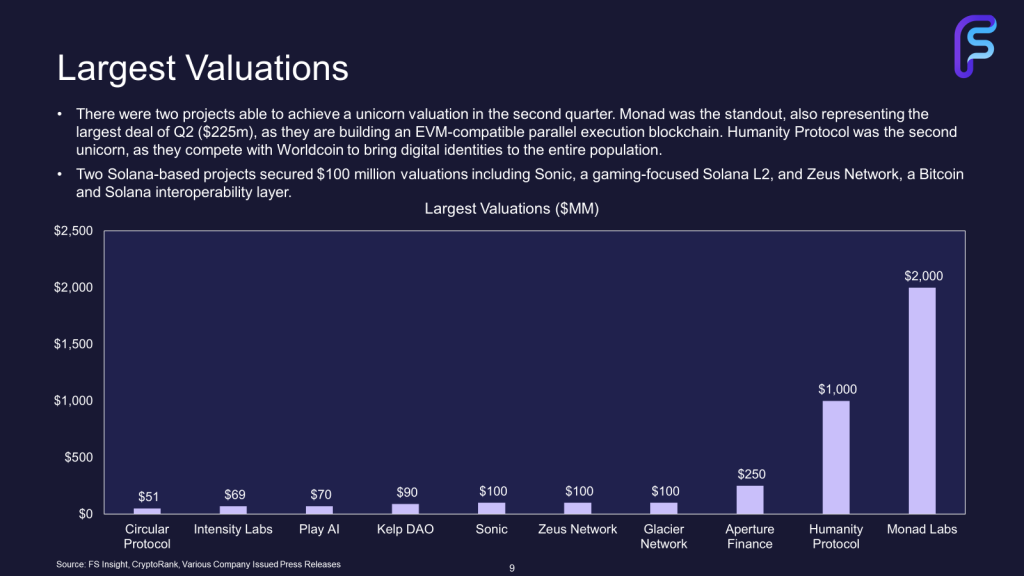

- Slight Increases in Q2: Q2 2024 saw a 12% increase in fundraising and a 4% increase in deal count compared to Q1, totaling $2.46 billion in funding across 383 deals. Q2 marked the second consecutive quarter with over $2 billion in cumulative funding and over 350 deals.

- Deal Count Surpasses 2021 Levels: Although deal sizes remain suppressed compared to 2021 and 2022, Q2 and 1H deal counts surpassed that of 2021, speaking to a purge of frothy valuations but continued growth in developer activity.

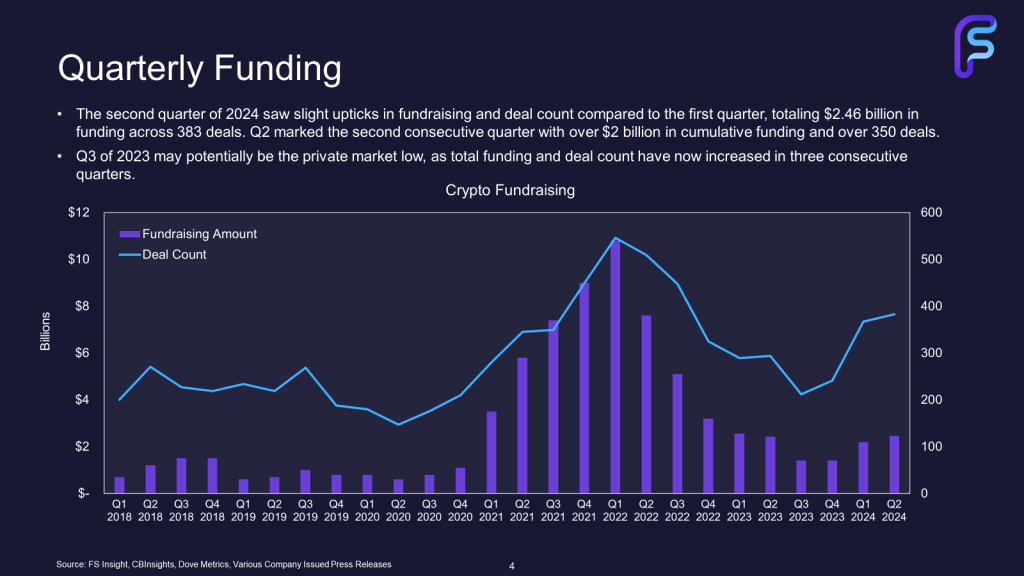

- Infrastructure Remains King: Infrastructure projects continue to dominate from both a fundraising and deal flow perspective. Infrastructure deals garnered approximately $1.3 billion in fundraising across 158 deals, over 3.5x the next largest category.

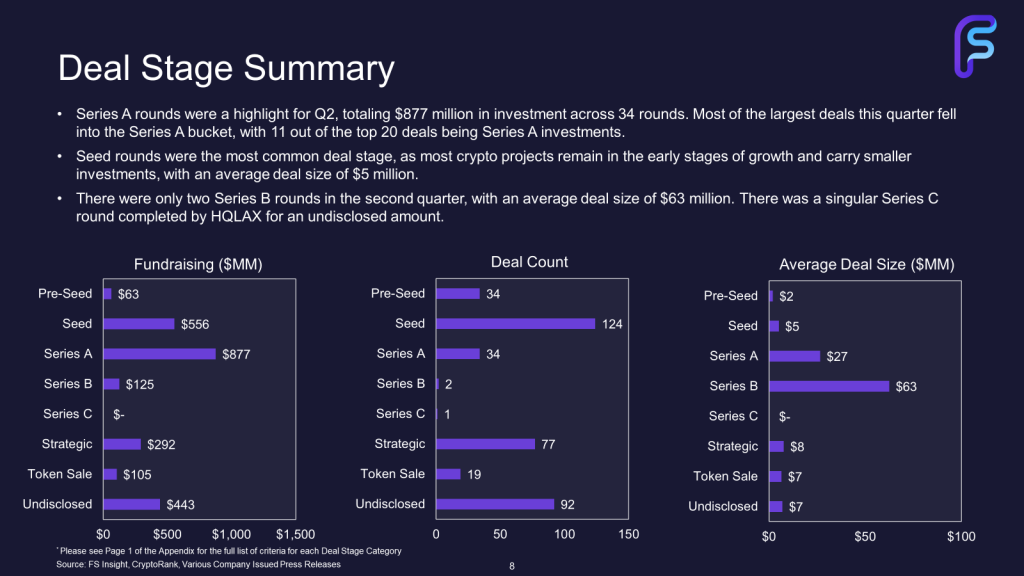

- Smaller Valuations: Only six projects achieved valuations greater than $100m in Q2, compared to fourteen in Q1. Similarly, only Monad and Humanity Protocol received $1+ billion valuations in Q2, whereas four projects accomplished that feat in Q1.

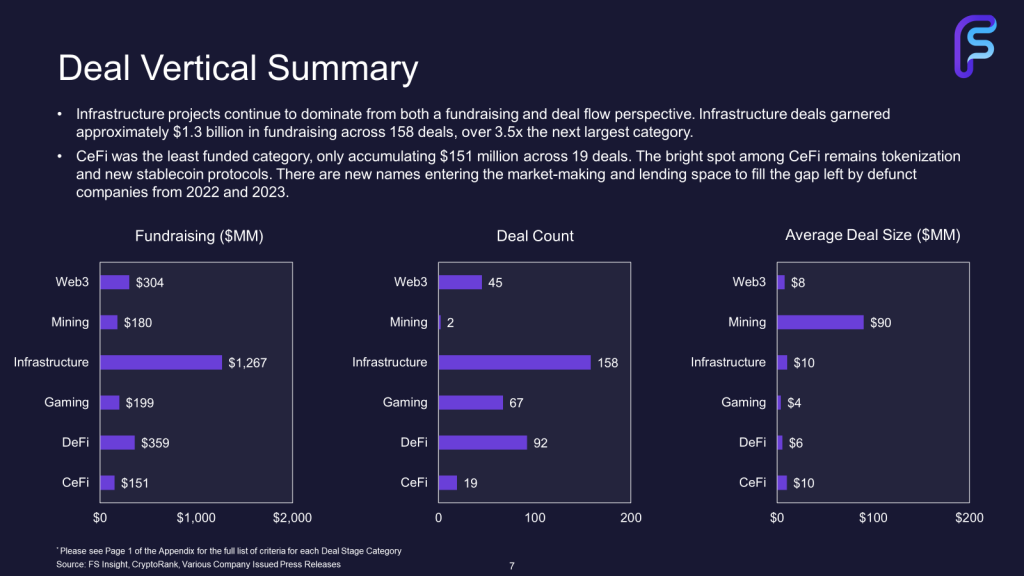

- Series A Rounds Represent 36% of Funding: Series A rounds were a bright spot for Q2, totaling $877 million in investment across 34 rounds. Most of the largest deals this quarter fell into the Series A bucket, with 11 out of the top 20 deals being Series A investments.

Key Slides from This Report

Click HERE the full report.

Quarterly Funding

Deal Vertical Summary

Deal Stage Summary

Largest Valuations