Crypto VC Funding Follows Market

Weekly Recap

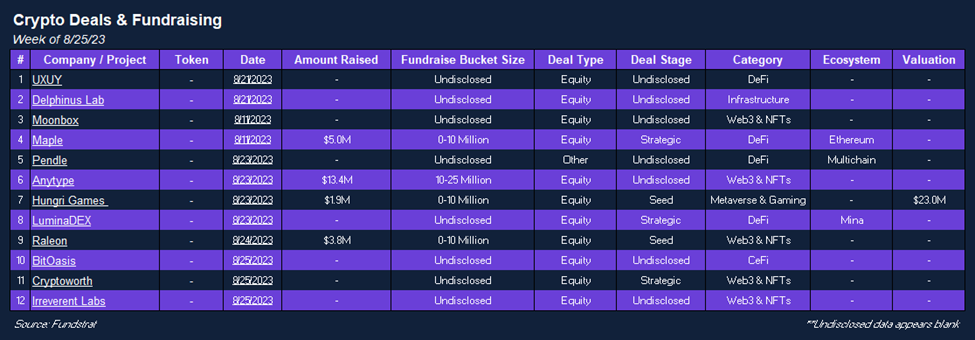

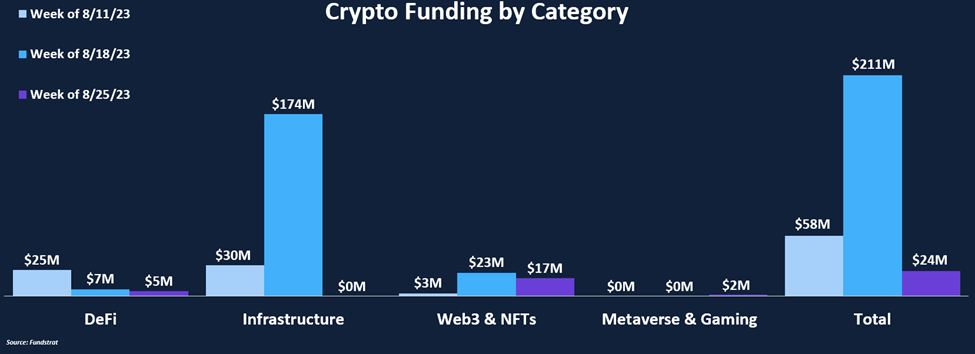

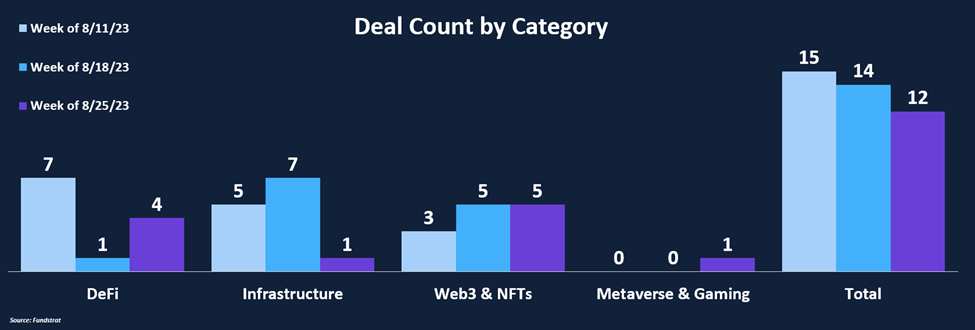

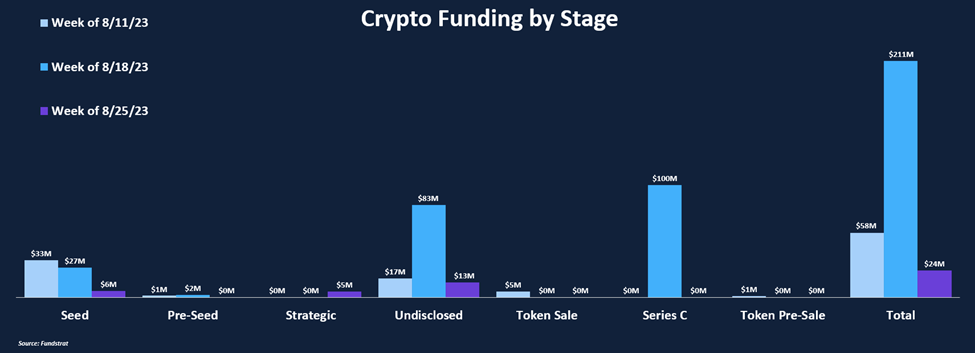

Last week was a big week for funding, with $211 million raised by crypto companies. While a pullback was expected from these levels, given recent market sentiment, the magnitude of this pullback is telling. Only $24m in deals were closed this week, a nearly 90% drop in one week. Over half of the funds were raised by Anytype, which closed $13.4 million in an undisclosed round. Anytype calls itself an “everything app” focused on rebuilding internet apps that are inclusive, private, and allow for user-owned data through blockchain. There was a surprising lack of infrastructure deals, with most funds raised in the DeFi and Web3 & NFTs categories. Two DeFi deals continued the trend of raises from protocols that have already actively traded tokens and working products. These two projects are Maple and Pendle, which saw follow-on investments in what likely included aspects of equity and token sales, although these details were undisclosed. There were many undisclosed raises, with 8 of the 12 deals choosing not to release funding amounts. Perhaps this has distorted the size of the funding pullback. We will monitor funding levels in the upcoming weeks to see if funding appetite remains muted.

Funding by Category

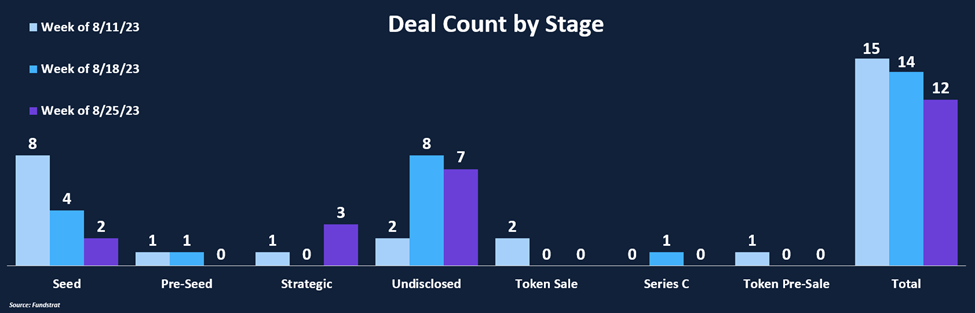

Funding by Deal Stage

Deal of The Week

This week’s Deal of the Week is Raleon, which raised a $3.8 million seed round led by Blockchange, with participation from Play Ventures, Alliance DAO, and Portal Ventures. Raleon functions as a web3 engagement tool, assisting brands, games, and dApps in activating and maintaining their user base. Their Software as a Service (SaaS) solution incorporates growth analysis, Web3 marketing automation, and integrated quests, utilizing a combination of blockchain and traditional data to enhance user retention and boost conversion rates. Funding will be used to hire, build their platform, and scale their newest product, Embedded Quests.

Why is this the Deal of the Week?

While the crypto industry is full of technologists who frequently build and ship new products, most products lack users and product market fit. Current user incentivization campaigns primarily generate inorganic demand through vague airdrop rewards. While some protocols have succeeded with this approach, many dApps distort whether they have achieved market fit as they fail to retain users who were just airdrop farmers. This inorganic demand results in farmers selling and leaving the product after receiving tokens.

Typically, dApps set “quests” of activities users can do to explore a product and potentially receive an airdrop. Many existing Web3 quests usually redirect users to external platforms to complete tasks, resulting in a fragmented user experience and low chances of users returning to the original brand’s website. Raleon’s Embedded Quests feature enables decentralized applications (dApps) to effortlessly set up unique quests within their dApp without requiring coding skills. This maintains the entire process within a single location, creating a seamless and captivating user journey. It also allows targeting specific users by tailoring tasks based on web2 and web3 data, specifying various actions (from in-app activities to on-chain transactions or NFT ownership), and offering rewards upon successful quest completion.

Marketing and user retention models for Web3 are nascent. Companies like Raleon are pioneering tools for effective monetization and product growth, which will be needed for decentralized applications’ next leg of growth.

Selected Deals

Binance Labs, the venture capital and incubation division of Binance, has made an undisclosed investment in Pendle Finance, a DeFi protocol facilitating the tokenization and trading of yield. This investment underscores Binance Labs’ dedication to influencing the future of DeFi. The funds will allow Pendle Finance to expand its presence in different blockchain networks, opening up opportunities for both individual and institutional users to have inclusive access to DeFi yield opportunities.

Maple has successfully concluded a strategic funding round, raising $5 million. BlockTower Capital and Tioga Capital led this round, with participation from Room40 Ventures, Cherry Crypto, Spartan Capital, GSR Ventures, and Veris Ventures, along with continued support from previous backers Maven 11 and Framework Ventures. This funding marks the beginning of an ambitious, multi-year growth plan for Maple, aiming to extend its influence from DeFi into the traditional financial sector as a prominent lending marketplace and technology platform. The team will leverage their early accomplishments to seize upcoming opportunities, focusing on expanding into the APAC and LATAM regions, where substantial demand for institutional and compliant on-chain lending and borrowing exists.

Cryptoworth has secured a strategic investment round led by CMT Digital, with support from Kyber Ventures, Saison Capital, ODA Capital, and Polygon Ventures. The primary product offered by Cryptoworth has revolutionized how professionals in the Web3 finance sector manage digital on-chain data, particularly for accounting, AR/AP, and high-level financial reporting purposes. Cryptoworth has set a new industry standard by providing automated crypto reporting that complies with IFRS and US GAAP standards. More than 100 prominent blockchain companies worldwide, including Axie Infinity, Solana Foundation, Celo Foundation, Avara Labs (Aave), Kava Labs, Big Brain Holdings, and The Moonbeam Foundation, rely on Cryptoworth’s services for their web3 corporate financial compliance and audit readiness.