Private Market Ends November on a High Note

Weekly Recap

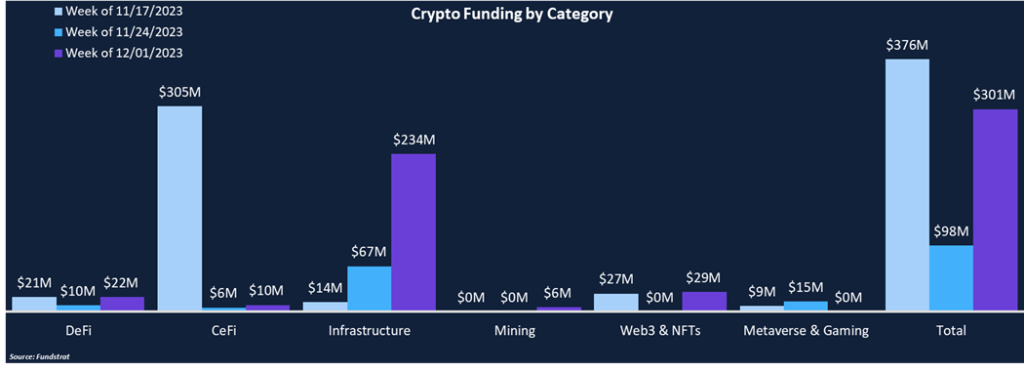

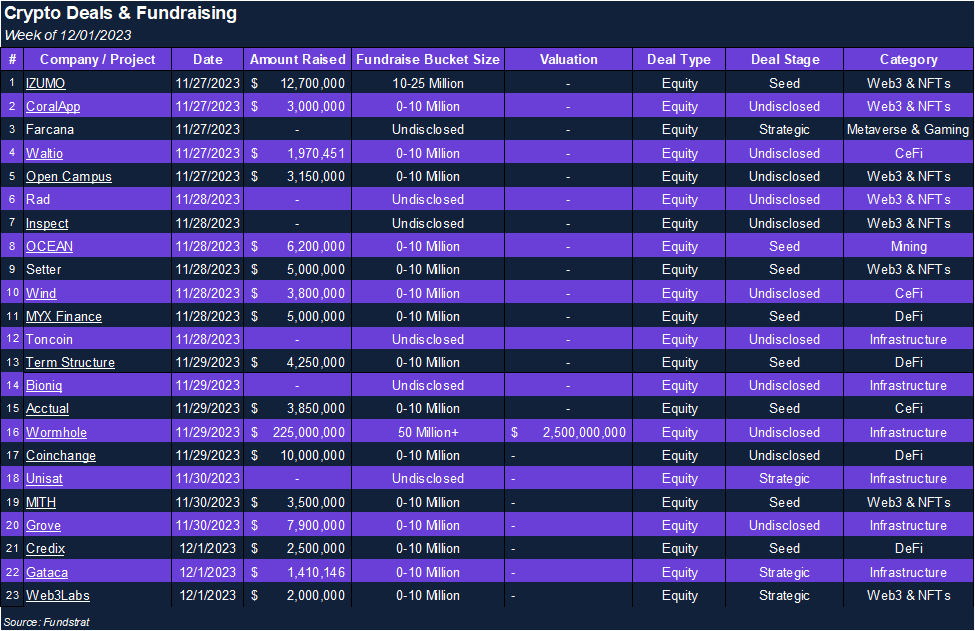

Crypto funding ended November on a high note, tripling last week’s funding total, rising to $301 million. This marks the second week out of the last three that saw over $300 million in total funding. Throughout November, crypto firms raised approximately $904 million, representing the highest monthly figure since April. Similarly, November saw 87 different deals, the highest count since May. It is encouraging to see private market activity increasing along with liquid asset prices.

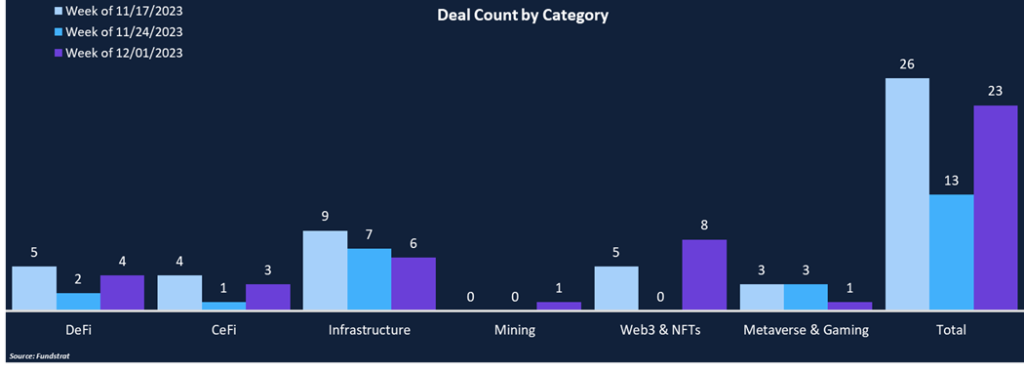

Over two-thirds of this week’s total funding fell within the Infrastructure category, largely due to Wormhole’s $225 million round (DotW), valuing the cross-chain messaging protocol at $2.5 billion. Web3 & NFTs was the second most funded category at $29 million and was the most popular from a deal count perspective, representing about one-third of all deals. Mining notched its first deal since September as Jack Dorsey led a $6.2 million Seed round with a decentralized mining company, Ocean.

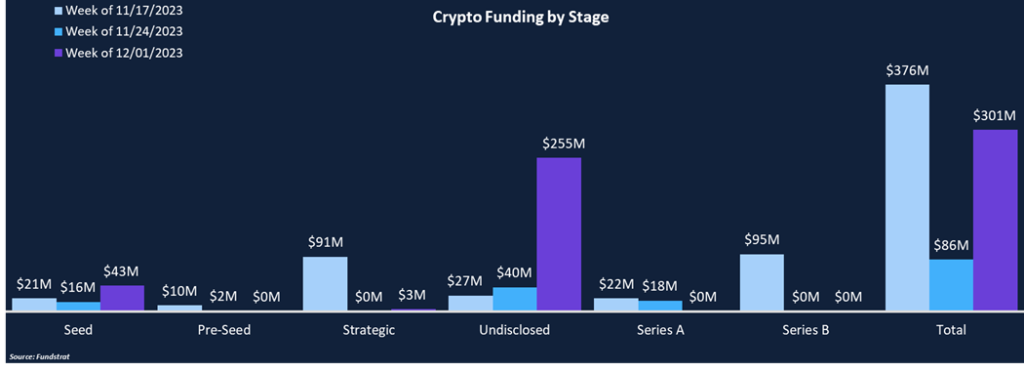

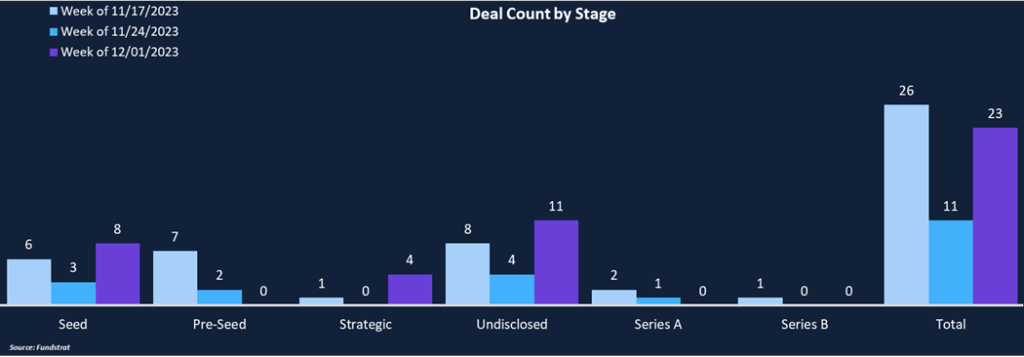

About half of this week’s rounds failed to disclose the deal stage, while the remaining deals were split between Seed (8) and Strategic (4) rounds. Of the disclosed investment amounts, $43 million was raised across the eight seed rounds and $3 million across the four strategic rounds.

Funding by Category

Funding by Stage

Deal of the Week

Cross-chain messaging protocol Wormhole has raised $225 million in an undisclosed round with investor participation from multiple big names like Coinbase Ventures, Brevan Howard, Multicoin Capital, Jump Trading, among others. The funding round values Wormhole at $2.5 billion, marking the second-highest valuation of 2023, only behind LayerZero, another cross-chain messaging protocol. In addition to disclosing the funding round, Wormhole has announced the creation of Wormhole Labs, a separate entity specializing in cross-chain product development and implementation.

Why is this Deal of the Week?

The future is shaping up to be multi-chain as more layer-1 and layer-2 networks launch, with some choosing to specialize in specific activities or sectors. As the universe of blockchains expands, liquidity and activity become fragmented, reducing the efficiency of the entire ecosystem. Cross-chain messaging protocols are the solution to this problem, helping to enable seamless and secure cross-chain transfers or transactions. Wormhole is already a significant contributor in supporting interoperability, processing over 2 million cross-chain transactions daily and connecting more than 30 different chains. As demand for cross-chain activity grows, it becomes increasingly crucial that bridging protocols are secure. Bridges have been a popular target for malicious actors within the space, and Wormhole is no exception, as they were hacked for over $300 million in 2022. The funding round should ensure that Wormhole can effectively advance product development and remain a prominent figure in the multi-chain future.

Selected Deals

Coinchange, a DeFi yield platform, raised $10 million in an undisclosed round led by G1 Ventures, Spirit Blockchain, Good News Ventures, K2.CA, and Atoia Ventures. Coinchange’s Earn API allows clients to integrate DeFi yields into their platforms without dealing with asset management. Coinchange handles yield opportunities via its risk-managed platform for stablecoins, Bitcoin, and Ether and passes yields on to its clientele. In addition to offering clients DeFi yields, Coinchange offers regulated brokerage services in the U.S. and Europe. Coinchange plans to use the funding to grow its operations and onboard new clients.

Open Campus, a Web3 education platform, has raised $3.2 million in an undisclosed round from Binance Labs. Open Campus tokenizes educational content and enables creators to monetize their creations. With Open Campus’ scalable infrastructure, they hope to serve as the gateway for millions of educational content creators and learners to join Web3. All revenue generated by creators will be stored within smart contracts where owners can withdraw revenue proportional to their contributions. The educational content market is estimated to total $5 trillion, and Open Campus hopes to leverage the funding to continue growing its market share and onboard users to Web3.

Grove, a decentralized physical infrastructure (DePIN) provider, raised $7.9 million in an undisclosed round from Avon Ventures, Placeholder Capital, and Druid Ventures. Grove provides developers with decentralized RPC infrastructure backed by over 20,000 independent globally distributed nodes. Grove supports over 40 blockchains, streamlining multi-chain connectivity and optimizing request handling, allowing developers to simplify their tech stacks and improve the user experience. Grove is already processing more than a billion daily relays, supporting all aspects of the crypto ecosystem including gaming, wallets, DeFi, and developer tooling. Grove plans to use the funding to build more partnerships and grow the adoption of its DePIN products.

Coral, a Web3 fitness and wellness app, raised $3 million via a strategic round led by TealLink. Coral was one of the finalists of Binance’s incubation program in 2022 and is focused on aggregating fitness and social data to create a gamified metaverse experience. Users will own all their data, earn rewards, and connect with different communities, while fitness creators can upload and monetize their content using NFTs. The fitness industry is somewhat of an untapped sector within Web3, and Coral hopes to be an early-mover in the space. Coral will use the funding for technology development and operational growth.

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 0021ae-390790-615d9b-ae80da-068ead

Already have an account? Sign In 0021ae-390790-615d9b-ae80da-068ead