Robinhood Acquires Bitstamp, Coinbase Releases Smart Wallets

Market Update

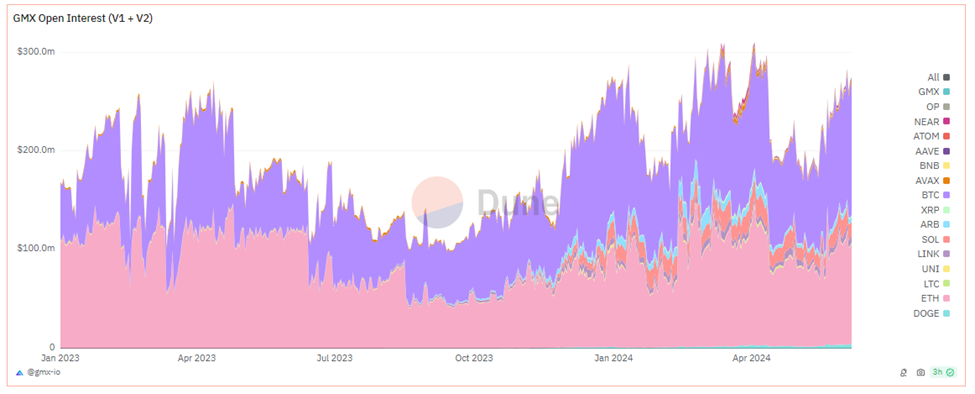

Equities are showing modest declines today after reaching new all-time highs yesterday. The SPY 0.26% and QQQ 0.05% have declined approximately 0.20%, while rates are finding some relief despite jobless claims coming in higher than expected and Q1 unit labor costs coming in at 4.0% versus the estimated 4.9%. Investors will be watching tomorrow’s non-farm payrolls report to provide further direction of yields. The crypto market is trading in line with equities, with total market capitalization falling 0.34% to $2.56 trillion. BTC 2.58% is trading slightly below $71k, while ETH 12.38% is showing more pronounced losses, hovering around $3,820. GMX 5.89% is outperforming today, as it has experienced a resurgence in price over the last month after deciding to launch its v2 product on Solana. GMX has gained 80% since the proposal was posted, and open interest on the platform is quickly approaching all-time highs of approximately $300 million.

Robinhood Acquires Bitstamp

Trading platform Robinhood has struck a deal to acquire crypto exchange Bitstamp for approximately $200 million in cash. Bitstamp was founded in 2011 and is one of the longest standing crypto exchanges. The acquisition will help Robinhood scale its crypto business across the EU, UK, US, and Asia with the help of the 50+ active licenses and registrations Bitstamp holds globally. Bitstamp’s core spot exchange offers 85 tradable assets, averaging approximately $5.9 billion in monthly trading volume over the last year. Robinhood saw $10.1 billion in April crypto trading volume, so the Bitstamp acquisition could add almost 60% to its crypto volumes. Additionally, Robinhood will begin serving institutional investors with the help of Bitstamp’s trusted trade execution, deep liquidity, and industry-leading API connectivity. Robinhood will adopt Bitstamp’s other institutional services, including lending, staking, and a white-label solution for companies to integrate crypto into their products. The deal is expected to close in the first half of 2025, and shares of HOOD have reacted positively to the news, rising to $23 and helping the stock gain 40% since mid-May.

Coinbase Smart Wallets

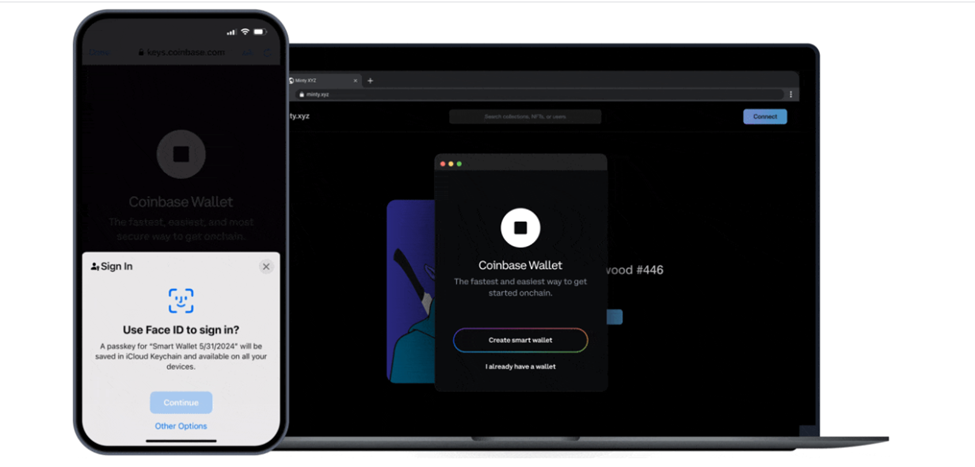

Coinbase has released its new “smart wallets, ” hoping to revolutionize the on-chain experience and bring 1 billion users on-chain. A few of the large pain points for crypto users are complex onboarding, gas fees, and maintaining seed phrases. Smart wallets address all three areas by simplifying onboarding, removing seed phrases, and eliminating gas fees. Customers can create self-custodial wallets using face ID, fingerprints, Google credentials, or other passkey tools to secure their wallets while connecting to their Coinbase Exchange balances, removing the need to fund external wallets. Coinbase is sponsoring a Base Gasless Campaign, where developers can apply for up to $15k in gas credits to pay for users’ transactions, allowing them to interact on the Base network without worrying about gas fees. Smart wallets currently support eight chains with plans to add additional networks.

Technical Strategy

Stafi’s push back over $0.5368 represents a short-term technical breakout which has lifted price to the highest levels since mid-April. Daily FIS -3.80% charts show this move above a very narrow two-month base which happened officially today, 6/6 on above-average volume. Additional gains look likely which might initially reach $0.74, but eventually FIS should reach $0.835 which lines up with the 50% retracement of its entire decline from late March. Momentum has begun to turn higher, while not being overbought, and today’s move likely leads to additional upside acceleration. Dips should find strong support near $0.52-$0.53 before pushing higher.

Daily Important MetricsAll metrics as of 2024-06-06 12:00:28 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-06 11:51:27 Exchange Traded Products (ETPs)

News

|

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 172c85-add0ff-2d399f-5b2503-285053

Already have an account? Sign In 172c85-add0ff-2d399f-5b2503-285053