BTC challenges 9-9.5K resistance making new 7-month highs vs S&P 500

A pause for most Alts but BTC remains resilient, challenging 9.5K heading into its halving – Most cryptocurrencies paused or pulled back over the past week after rallying into resistance bands with short-term momentum peaking at overbought levels. BTC also paused but has been impressively more resilient notably over the past two days, challenging resistance between 9-9.5K as the widely anticipated May 12 halving draws near.

So what to do? While the debate regarding how BTC will react to its halving rages, our recommendation remains straight forward based on BTC’s current technical setup.

BTC remains above its tactical uptrend at its 15-dma – From a tactical standpoint, BTC is overbought short-term after punching above its widely watched 200-dma last week. However, BTC also remains in an uptrend defined by its rising 15-dma at 8.4K. Until that moving average is broken, we recommend tactical investors and traders remain long. A move above 9.5K would likely see a move to next resistance at 10.5K.

BTC makes new 7-month highs versus the S&P 500 with uptrends intact versus Gold and Bonds One noteworthy milestone that developed over the past two days was BTC rallying above its Q1 2020 and Q4 2019 relative performance highs versus the S&P 500. BTC also remains in short-term relative performance uptrends to both Gold and the TLT bond ETF from its March lows. Here again, for tactical traders, we would remain overweight BTC versus these three asset classes using the 15-dma of the relative performance as a stop loss level.

BTC’s long-term profile is repairing – As we have discussed here recently, BTC is slowly repairing the long-term technical damage that developed during the March breakdown that torpedoed every risk asset. The long-term trend remains positive and supportive of buying pullbacks when and if they develop. A move above the 2020 highs near 10K resistance, should it develop, would be an important first step confirming a new longer-term uptrend with 13.8K the next important resistance hurdle.

ETH and ETHBTC – ETH is overbought and stalling short-term at resistance near its 62% retracement level (212) but continues to hold first key support at its 15-dma (199) which we recommend as a trading stop loss level. Next support is near 176. Similarly ETHBTC has pulled back sharply but is quickly becoming oversold and nearing support at .022, coinciding with an uptrend that began in January 2020.

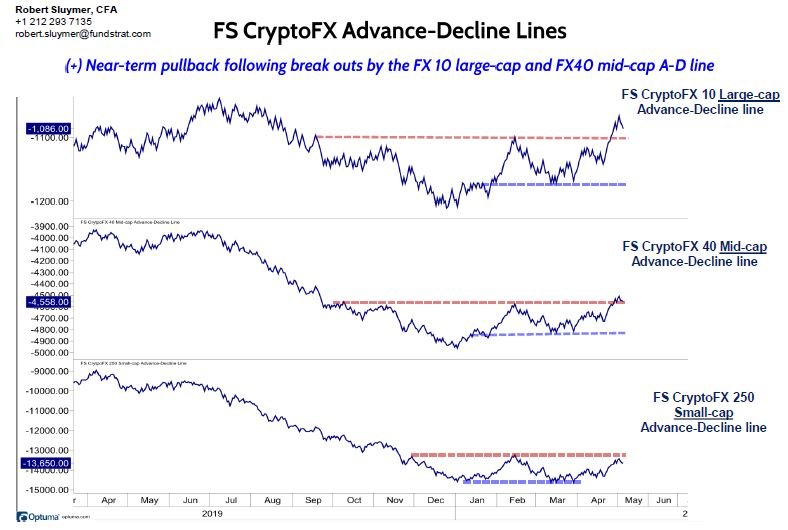

Fundstrat CryptoFX indices and A-D lines – Not surprisingly short-term pullbacks are underway across all three FS CryptoFX A-D lines – We expect pullbacks to be relatively shallow and short lived.

Articles Read 1/2

Enjoyed the read? Subscribe now for unlimited access!

Get invaluable analysis of the market and stocks. Cancel at any time.

Already have an account? Sign In 65959c-79ec12-210b90-4ae999-8e6c64

Already have an account? Sign In 65959c-79ec12-210b90-4ae999-8e6c64