BitDigest March 20 · Issue #619

Mar 20, 2020

Author

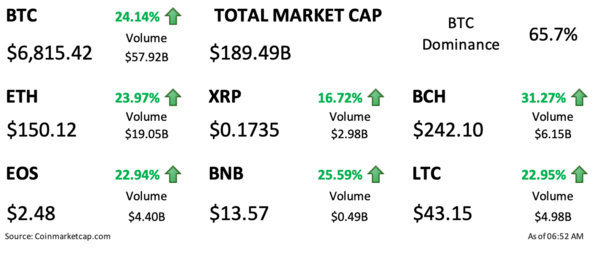

- Crypto markets jumped overnight gaining $33 billion in total market-cap, an increase of 21.8%

- Another Japanese lawmaker has expressed the need for Japan to issue a central bank digital currency to maintain the strength of its currency in global markets

- Numerous reports are appearing warning consumers to beware of fake websites and malware

| I heard a rumor earlier this week that a major bank (my bank) had limited cash withdrawals from ATMs. This turned out to be false, but banks are closing allowing employees to go into self-quarantine (Chase announced it was closing 20% of its branches and I expect more banks to follow) and there are already stories of people either withdrawing large amounts of cash (Bill Ackman) or banking systems being closed prohibiting cash withdrawals altogether (Venezuela).This obviously gives me fears of the Cyprus bank shut-down of 2013. I do not think this is going to occur – I think the same financial regulators I have questioned over their acceptance of digital currencies are actually doing a good job to help support the global financial system – but going shopping and seeing the empty shelves at my local market adds to my concern that further corona virus fears and market uncertainty could cause a mini run on the banks. The obvious risk avoidance strategy is self-custody of assets. We spoke about this in the office this week, volleying back and forth the benefits of self-custody with the cumbersome processes that still exist and the weaknesses of having a quasi-bearer instrument. The reality is that this technology has improved. We now have dashboards to help manage our assets and systems connecting your wallet to your computer no longer require a cord. More improvements are coming to digital wallet technology, but the question I am asking myself is do we actually want to live in a world where we self-custody all assets? It certainly gives me an added sense of security to know I am in full control of my assets – assuming I do not lose my wallet or forget my password – but our economy has evolved into a service oriented environment, trusted third parties do exist, and they offer great service and drive innovation with new features.For now I remain the master of my own domain and am in full control of all of my own digital currencies. I did withdraw some additional cash this week, but my fiat holdings are still held by a third party and as I sit here today, I think that although the idea of self-custody appears to be utopian, many of us will likely ask our same financial partners to custody our digital assets with our traditional market securities. Maybe using multi-sig will provide us with a false sense of security that we are still in control, but the reality is its no different than what we are doing today; we are still relying on that trusted third party to facilitate our transactions. |

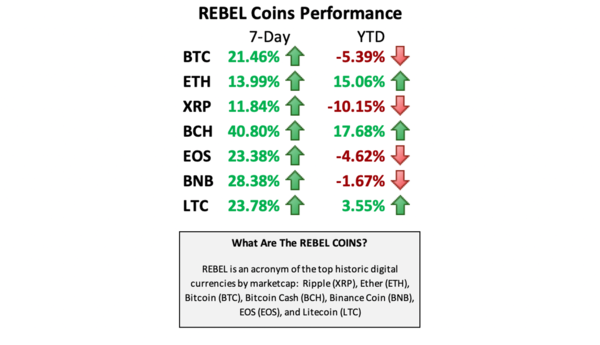

| Weekend Reading Bitcoin’s 48-hour increase coincides with $180 million of new tether (USDT) being minted. Past studies have argued that bitcoin spikes, including the 2017 run, occurred around new large issuances of USDT. The theory was that the new tether was being minted without 1:1 USD reserves. In response tether published a transparency update with a proof of funds report by Delaware based law firm Freeh, Sporkin & Sullivan LLP. Unfortunately, as of last night, the latest update to this is from June 2018 so this argument will definitely be repeated in the coming days.Here is a copy of the University of Texas study (updated) that raised the initial argument and a rebuttal from the University of Queensland that argues it is unlikely tether manipulation caused the large bitcoin moves. |