CRYPTO SPECIAL REPORT: Zilliqa: Making a competitive play to capture the ASEAN Open Finance Market

For a full copy of this report in PDF format please click this link.

Zilliqa Research Pte. LTD. (“the Company”) is the software and services company behind development of the Zilliqa DLT Network. The Singapore-based Company was founded in 2017 and is focused on refining Zilliqa’s DLT technology and deploying the platform with a focus on financial services applications in the ASEAN (“Association of Southeast Asian Nations”) region. Zilliqa (ZIL) is a public Distributed Ledger Technology (“DLT”) platform for decentralized applications (“dApps”). It employs sharding technology to achieve high levels of throughput and maintain low transaction fees.

- Zilliqa’s DLT offers a differentiated Blockchain-as-a-Service (BaaS) computing infrastructure platform. DLTs like Zilliqa allow businesses to leverage cloud-based solutions to build, deploy and use apps, smart contracts and other blockchain functions without hosting the infrastructure. Zilliqa’s sharded DLT enables high transaction throughput, with historically low fees, and offers a new smart contracting language, Scilla, to make its network safer for deploying enterprise-grade applications.

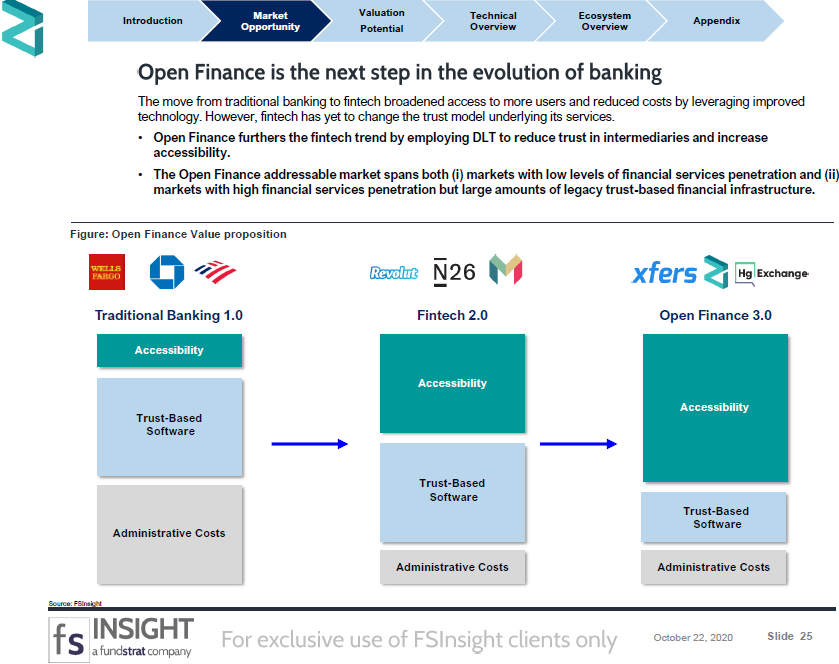

- First from Banking to Fintech, and now from Fintech to OpFi, Zilliqa looks focused on the right place. Zilliqa’s DLT is designed to support a range of use cases, but the team is currently laser focused on targeting the biggest one, banking. DLT based financial services, which we refer to collectively as Open Finance (“OpFi”), represent a cost-effective way to reach underserved markets and improve upon current infrastructure, while delivering unimagined financial applications through open APIs and new data access models. Disruption opportunities span payments, remittances, lending, investing, insurance and more.

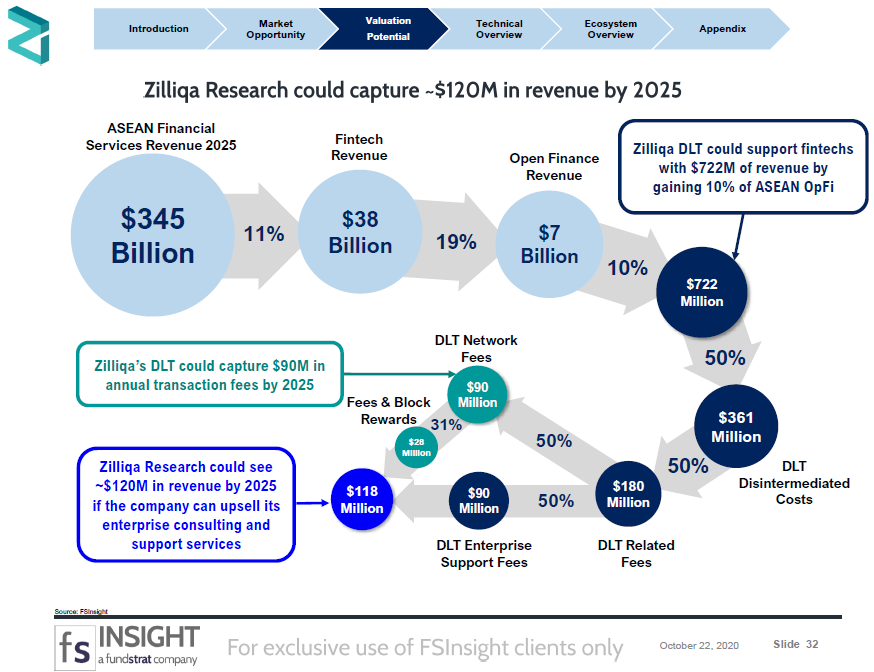

- ASEAN OpFi represents a $7.2B revenue opportunity for ecosystems like Zilliqa by 2025 (Slide 34). We estimate that OpFi companies employing DLT in the region could capture 19% share from the digital banking market which represents a meager 2% of the overall ASEAN financial services market. ASEAN’s financial services market is ripe for disruption. Despite being collectively the 5th largest global economy, with rapid economic growth rates and high levels of internet penetration, ASEAN suffers from low levels of financial inclusion, with 75% of the population either unbanked or underbanked.

- Enterprises within the Zilliqa ecosystem could be worth $3.6B in 2025 by capturing 10% of ASEAN OpFi (Slide 35). Companies in the Zilliqa DLT ecosystem would generate $722M in revenue if our base model input is correct. We estimate the total value of areas where Zilliqa’s DLT can reduce costs to be ~$360M. Of these costs, we estimate enterprises save 50% using DLT, with the remaining $180M paid as fees to the Zilliqa DLT Network and Zilliqa Research. We assume industry net profit margins of 20% and a 25x P/E for our ecosystem valuation.

- Zilliqa’s DLT network and the ZIL token could be worth $3.9B and $0.22 using our 2025 model assumptions (Slide 37). From an assumed $64B serviceable market using Zilliqa’s DLT, we assume 30% use the ZIL token to facilitate the financial function(s) being served (i.e. using ZIL for payments or as loan collateral) and a 5x model velocity to reach our valuation. We assume 50% or $90M of DLT fees go to network nodes.

- As RedHat is to Linux, Zilliqa Research is to its DLT, which could earn the Company $118M in revenue and value it at $590M by 2025, should it successfully execute to our base model inputs (Slide 41). If Zilliqa Research can capture 50% of the DLT related fees (25% of savings) through provision of consulting and support services to companies building on its open-sourced network, it would earn the Company $90M in Enterprise Support revenue. The Company could earn an additional $9M in network fees and $19M in block rewards, for a total of $28M in BaaS revenue from its expected 10% Zilliqa DLT node ownership. Valuation assumes 20% profit margins on $118M in revenue with a 25x P/E.

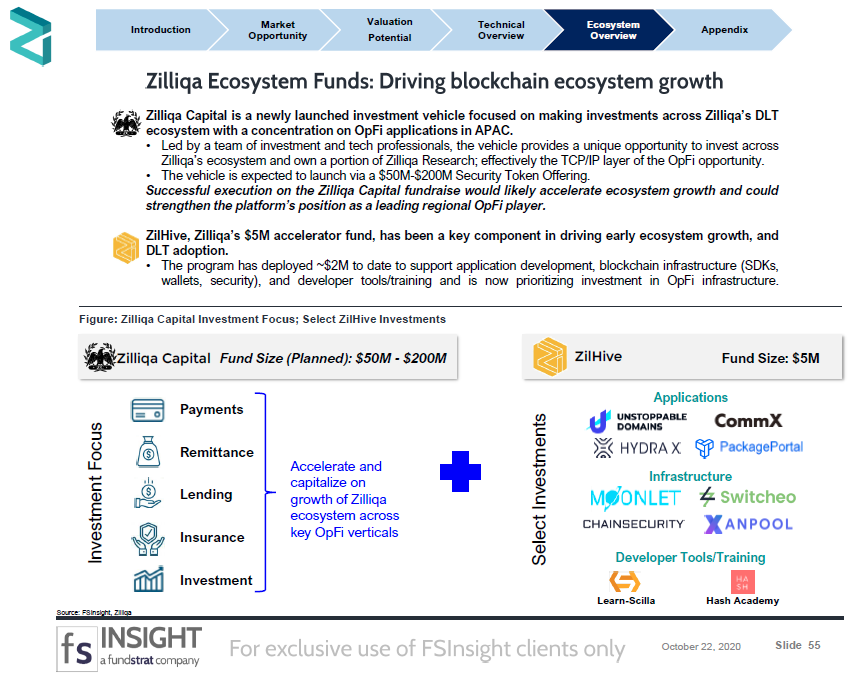

- Blockchain accelerator funds drive ecosystem growth. The launch of Zilliqa Capital, a proposed $50M – $200M ecosystem fund, holds the potential to strengthen the platform’s position as a leading regional player in ASEAN and APAC OpFi markets, if successfully launched (Slide 55).

- What could go wrong? DLT adoption in general could lag, resulting in underperformance. Zilliqa could fail to gain market share against competing DLT platforms with greater traction or alternative features. Failure to reach our assumptions (Slide 42). It’s early to estimate the market size and our approach may prove to be inaccurate as new markets emerge or fail to materialize. The Company may fail to gain product market fit and generate revenue from customers. Crypto is a volatile asset class with the potential for any token network to eventually lose significant value.

Bottom line: Successful deployments in 2020 would validate the Company’s go to market strategy and the DLT’s utility in a production environment. We’ll continue looking for signs of increasing fundamental network growth, while keeping an eye on how strategic partnerships evolve over the coming months.

Key slides from this report…

Zilliqa: Making a competitive play to capture the ASEAN Open Finance Market (Slide 1)…

Zilliqa Research could capture ~$120M in revenue by 2025 (Slide 32)…

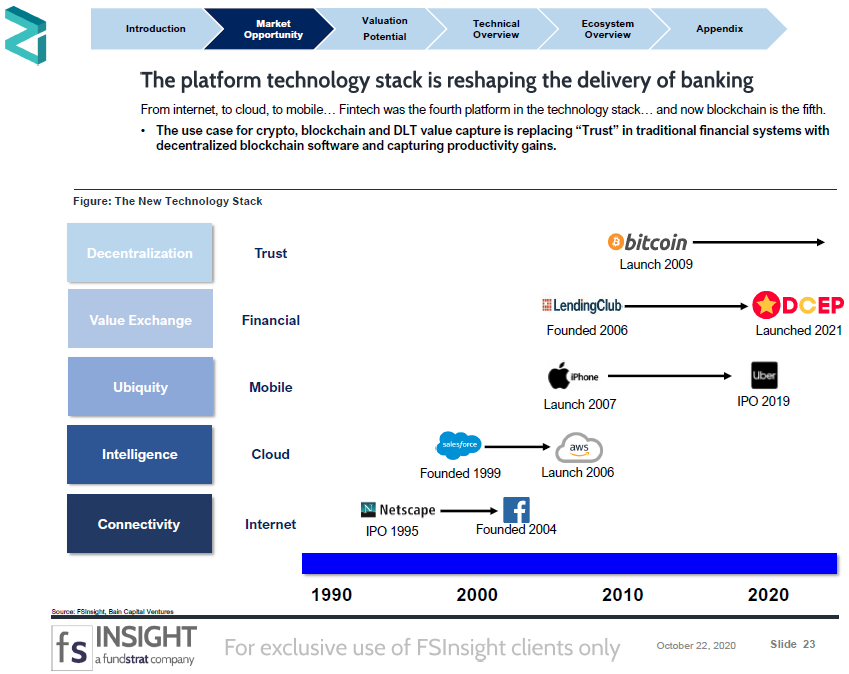

The platform technology stack is reshaping the delivery of banking (Slide 23)…

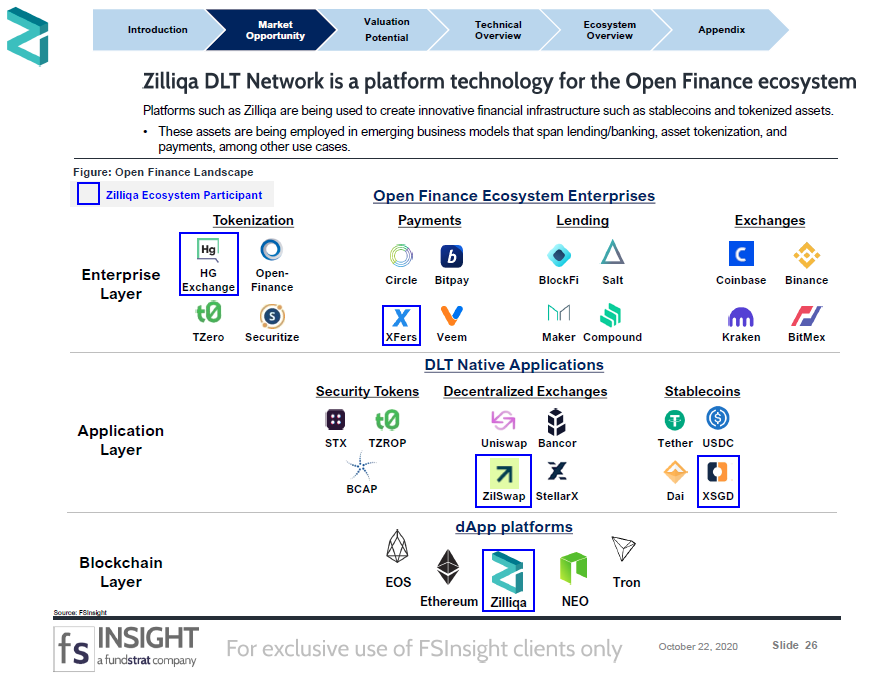

Zilliqa DLT Network is a platform technology for the Open Finance ecosystem (Slide 25)…

Zilliqa DLT Network is a platform technology for the Open Finance ecosystem (Slide 26)…

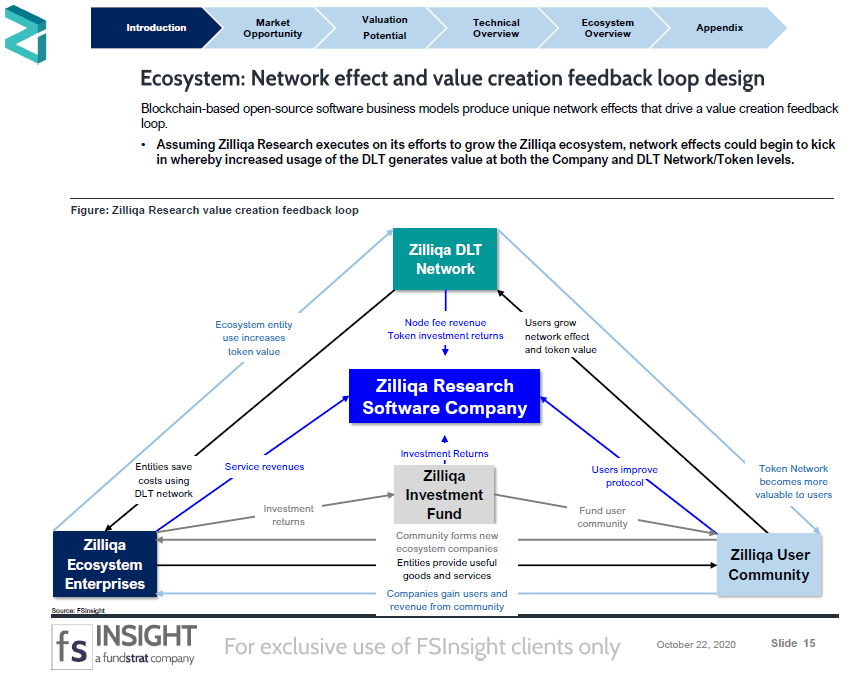

Ecosystem: Network effect and value creation feedback loop design (Slide 15)…

Zilliqa Ecosystem Funds: Driving blockchain ecosystem growth (Slide 55)…