Our Views

This was a big week for inflation data with both critical April CPI (5/10) and PPI (5/11) coming in softer (more favorable details.) We see this as incrementally favorable for those who are positive.

- Foremost, 3 things happened this week that support the Fed’s decision to “pause”:

– soft-ish core CPI readings, particularly given “hotter” component was used cars

– core PPI came in at +0.2% (vs Street +0.3%) and food CPI now down to 2.5% YoY

– forward indicators point to future softness including Manheim April cars down -4%

– and AAA gasoline now down $0.20 from mid-April highs - Food has been one of the stickier CPI components, still at +7.7% YoY in the latest CPI report. Yet, Food PPI is down to a mere 2.5%. This is yawning gap. Obviously, it is great for profit margins, but also perhaps a sign that food inflation is set to cool sharply.

- On balance, we think this lends more fundamental credibility to the Fed “pause” — that is, skeptics might have argued last week the “pause” was solely due to regional bank stress, but this week’s data supports the idea current policy/other factors are driving an easing of inflation.

- Fed funds futures show the odds of a June hike have fallen to 1.5%, from as high as 20% earlier this week. Even bond yields fell this week, So the collective picture from this week’s data certainly seems to have convinced markets. In fact, even US govt yields fell in a convincing way, the 10-yr is now back to 3.39%, which is the level pre-April jobs report.

Markets have become a “game of inches” (from Any Given Sunday (1999)), and each incoming data point barely moves consensus viewpoints. But as noted the CPI was not a tie breaker: there are signs of progress on inflation, but then again, there is the same volatility in components that would argue show that inflation is lingering.

Nevertheless, we see this as the bullish case gaining ground. The macro remains challenging, so tread carefully. But we see positive risk/reward.

- The SPX trend is still bullish. This past week’s sideways churning should push above 4200 next week before bottoming out near 4080-90, then rally.

- The big selloff in precious metals this week doesn’t appear too serious, and should line up with buying opportunities on weakness over the next week. Silver and Gold are nearing important support and look technically attractive

- Bitcoin might weaken short-term, but that doesn’t suggest the rally from last November has run its course. $25k-$25.3k should contain weakness

- Another back-and-forth week for the overall market, and once again the S&P 500 masks the weaker performance of the broader market. The cap-weighted S&P 500 was down less than one percent but was really helped by a strong bounce by GOOGL, which was up over 10%. The equal-weighted S&P 500 and Russell 2000 were both underperformers being down over one percent.

- From my perspective, the inflation data continues to show the same things — 1) its not rising; 2) its not plummeting; 3) it is flattish, especially when using core metrics. So, the dovish Fed expectations rise and fall on nearly every economic release. My research continues to suggest that the battle to get inflation down to the Fed’s 2% target level will be hard fought and take time, especially until there is more definitive evidence of weakening in the labor market.

- Based on my earnings revisions tools, there has been little change in the backdrop and what I am expecting. Forward earnings estimates still look too high and will likely need to be lowered as the weakest economic quarters remain in front of us.

- I did my monthly single stock deep dive this week using my ERM model and there were not a lot of areas and names that look absolutely positive. A few that stood out to me (in no particular order) are — CSX, VRSK, MA, the exchanges within Financials (CBOE, CME, ICE, and NDAQ), TYL, CMCSA, legacy GAMA (GOOGL, APPLE, META, MSFT, AMZN), INTC, HC equipment (nearly all names except for MDT), hospitals (HCA & UHS), BF/B, STZ, TAP, WMT, MNST, PEP, K, CPB, and PM.

- Thus, I do not have any big changes to my longstanding unfavorable view for the overall equity market. My key indicators are still suggesting a barbell of defense and large cap, higher quality secular names while avoiding Smid, lower quality, and more cyclical areas.

- Bitcoin’s correlation with equities and gold has weakened, highlighting a change in market dynamics. On-chain indicators imply a decline in confidence among holders. These shifts could be influenced by a recent short-term peak in global market liquidity and the anticipation of an upcoming debt ceiling resolution, which may have further implications on liquidity.

- We anticipate that downside risk will be short-lived for several reasons: (1) favorable inflation data this week supports the likelihood of the Fed pausing rate hikes, (2) a supply-driven increase in market rates following the debt ceiling resolution could generate demand outside of the RRP, and (3) global factors, such as China’s economic challenges, suggest the potential for monetary expansion.

- The ongoing surge in on-chain activity resulting from the creation of Ordinals on the Bitcoin blockchain has led to increased transaction fees and miner revenue. This development is seen as positive for the stability and security of the network. Arguments against high fees are considered misguided as they fail to acknowledge the market-driven nature of fees and the necessity of full blocks. Bitcoin’s scalability will be tackled through layer 2 solutions, and platforms like Stacks may gain popularity.

- Recent on-chain spike in activity has suggested that in a sustained on-chain bull market for ETH, investors should expect a deflationary supply schedule, which socializes the usage of the network to all ETH holders. Further, the unexpected fee increases on L2 networks that occurred upon publishing data to the mainchain strengthens the fundamental need for EIP-4844 and possibly strengthens the trading narrative for L2 networks post implementation.

- Core Strategy – Despite our recommendation in late April to raise cash in anticipation of a near-term resolution to the debt ceiling and recent negative price movements, our overall outlook for the year remains positive. If the Federal Reserve follows through with a pause, it would be a positive development for assets sensitive to liquidity conditions.

- Little progress on debt ceiling during Tuesday’s White House meeting with Congressional leaders.

- Follow-up Friday meeting was postponed but White House and principal Congressional staffs continue to meet.

- White House under pressure from united Republicans, as well as some Democrats, to reach a deal with House GOP.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 fell slightly for the second consecutive week, down 0.29%, to close at 4,124.08. The Nasdaq gained 0.4% to close at 12,284.74, and bitcoin shed about 8% to roughly $26,390.

- Despite plenty of reasons to be negative on markets, major averages have held up over the past year.

- We summarize a few key takeaways from the Berkshire Hathaway annual meeting last week, with insight from Buffett & Munger.

“Opportunities – the good ones – are messy, confusing and hard to recognize. They're risky. They challenge you.” ~ Susan Wojcicki, CEO of Youtube (2014-2023)

Good evening:

Believe it or not, the S&P 500 has officially been in a bear market -- down more than 20% from its high -- for more than 230 days. It’s the longest such stretch since 1973, surpassing the selloffs of the dot-com bubble and the 2008 financial crisis. Yet, in the past twelve months, dating to May 12, 2022, the S&P is in the green, up about 4%. That’s despite the banking crisis, high interest rates, persistent inflation that peaked last June, and near-record bearish sentiment.

Powered by technology giants like Apple and Microsoft, major indexes are holding steady, in line with Tom Lee’s view for 2023. In markets and investing, Lee knows that there’s always something to worry about, always a negative headline printed on a front page or flashed across a screen. One can always come up with reasons to sell stocks. As noted by bestselling author Morgan Housel, a recent subject of our Signal From Noise column, there’s always something. Housel points out that in September 1947, fear spread about a recession because World War II-related spending plunged.

A recession began two months later, yet the stock market more than doubled over the next four years, and the S&P 500 rose more than 100-fold from 1950 to today, adjusted for inflation. Every year along the way, there were smart-sounding reasons to sell. Said investing legend Peter Lynch: “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

“We believe the bull case is prevailing,” Lee said this week, ahead of his trip to Istanbul for a conference. With the first-quarter earnings season approaching its last act, the results have been better than feared, a YoY EPS decline of ~1%. However, Lee noted that if we exclude the worst-performing sector (Healthcare, which had a YoY decline of 15%) from the calculation, EPS would actually have been up +1%. What’s more, consensus S&P 500 2023 EPS estimates have increased since April 24 (from $218.31 to $219.77). This would be the first such sustained gain since April 2022.

Mark Newton, Head of Technical Strategy agrees on the positive direction of the market. “I'm still positive and bullish,” he said during our weekly huddle. Still, he noted, “We’re seeing economic data come in a little bit weaker. We also have the debt battle ongoing, which I think could be a big deal.”

“It’s true that macro risks remain substantial,” Lee agreed, “but a lot of that was already priced in by the decline in stocks in 2022.”

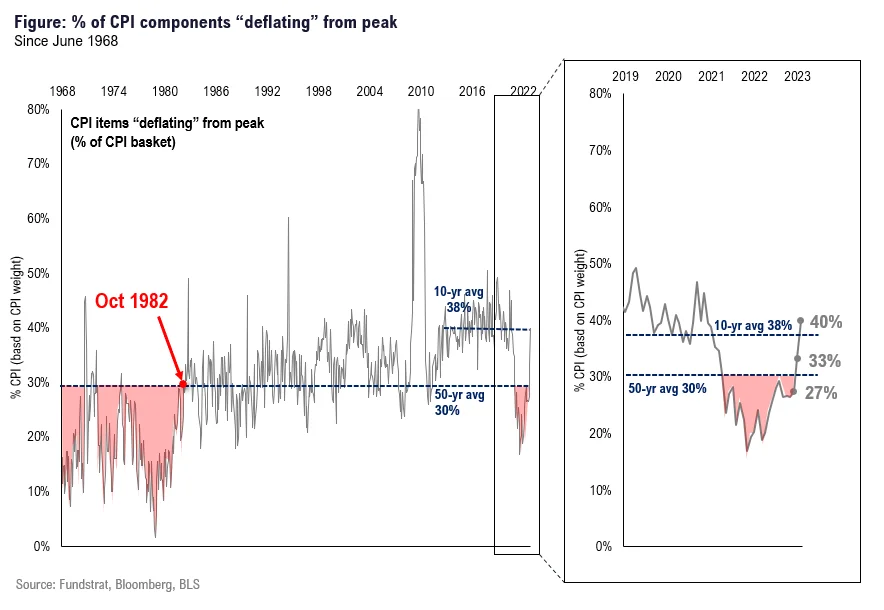

As you’ve seen in recent First Word publications, Lee remains optimistic that inflation will fall in 2023. Wednesday’s CPI report bolstered his case, showing that inflation eased to 4.9% in April, slightly less than the 5% estimate and the lowest annual pace since April 2021. The annual rate was 5% in March and, when you zoom in, it becomes even more evident that inflation has been falling steadily. About 40% of the CPI basket (by weight) is in outright deflation.

Lee’s is that, “This is a huge development.” After all, in March that number was 33%, and the 10-year average is 38%. Furthermore, while the Housing and Food components of the basket are not deflating, they lag real-time data, so another 50% of the basket is set to also deflate. This is shown in our Chart of the Week, courtesy of our research analyst John Bush:

With inflation cooling faster than expected, Lee believes the macroeconomic data will increasingly take a back seat to the regional bank crisis, which Lee believes will “continue to face structural issues until the Fed cuts rates.” Consequently, he argues that the Federal Reserve is likely done hiking rates this cycle, though a cut might not take place this year.

Could they cut this year?

“We don’t think so,” Lee responded. He explained: “One reason why Fed futures are forecasting cuts, is people are assigning a probability of an emergency from a regional bank crisis. That would not be good for stocks.” But he pointed out, although the situation is still serious, regional bank deposits and lending both increased heading into May, and last week they still managed to raise $1.3B in public debt–a small sum relative to historic levels, but nevertheless.

Lee added to his bull case: “When you consider where positioning is…people are sitting on cash on the sidelines. Retail money market cash has risen by $500 billion, a lot of it before March, just in the last year. We’ve got people sitting on cash and if we have a soft landing, we know corporate profits have been holding up nicely. It’s a scenario where the bonds are at 3.3% for the 10-year, that allows P/E to expand, and that’s why stocks could go up.”

On a technical basis, Newton cautioned: “I'm expecting a move up above 4200 likely over the next one or two weeks, but then we should encounter some stronger resistance based on wave structure and sentiment momentum.” He added, “Health care remains my top pick for the next one or two months. We're entering a very seasonally bold time for health care.”

Timeless lessons from Buffett & Munger

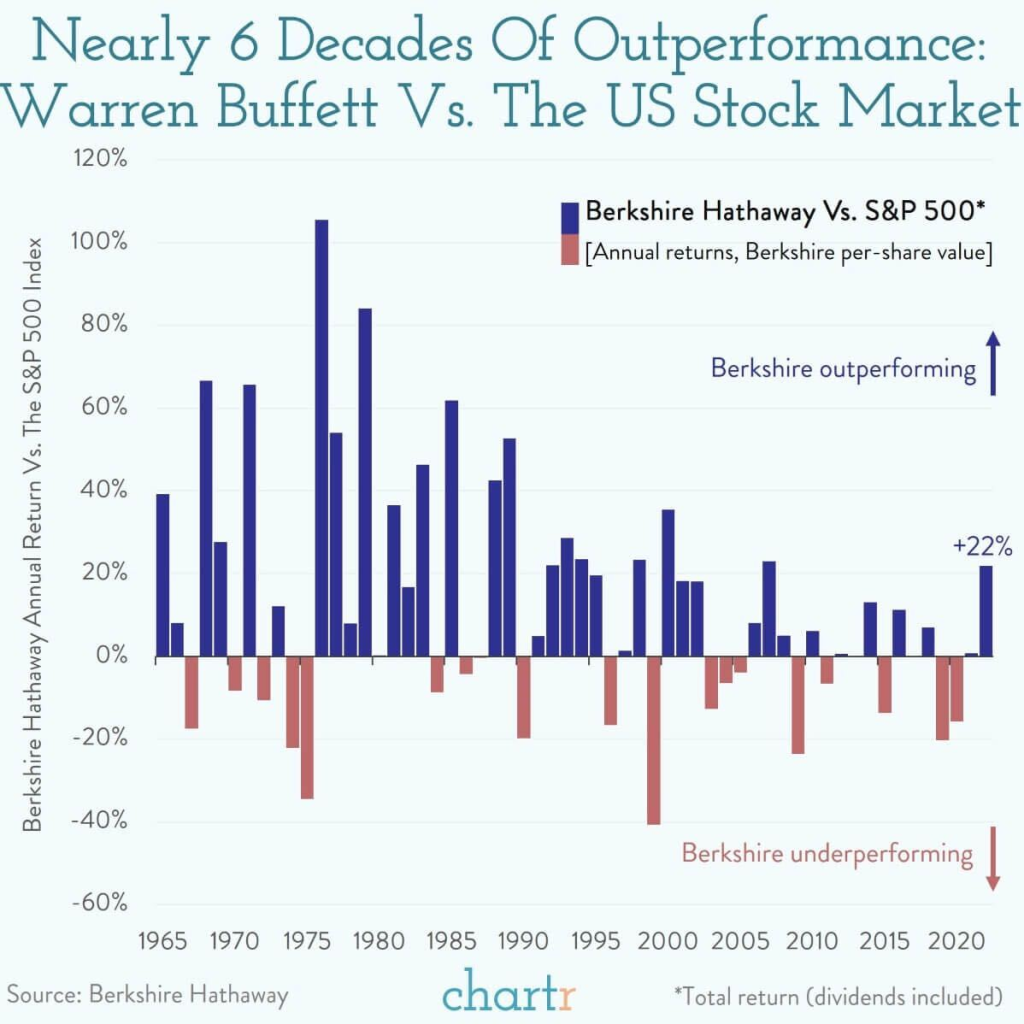

Last weekend, thousands of investors descended on Omaha, Nebraska for the Berkshire Hathaway annual meeting. Warren Buffett, 92, and his longtime business partner, Charlie Munger, 99, answered more than 40 questions in a five-hour marathon, both still sharp, witty, and insightful. We watched the entire meeting; here are our takeaways from Buffett, who has posted an average annual return of 20% since 1965.

Emotions are healthy, just not with money: “You don’t want to be a no-emotion person in all of your life. You definitely want to be a no-emotion person making an investment or business decision.”

On the banking crisis, Munger said: “I don’t think a bunch of bankers, all of whom are trying to get rich, leads to good things…Bankers should be more like engineers…avoiding trouble instead of trying to get rich.”

Buffett also addressed Berkshire’s big bet on oil stocks, making it the biggest shareholder of both Occidental Petroleum and Chevron. “We’re not going to buy control (of Occidental). We’ve got the right management running it, and we wouldn’t know what to do with it.”

Buffett praised Apple, Berkshire’s biggest stock investment, with CEO Tim Cook in attendance. “It just happens to be a better business than any we own,” Buffett said, adding that he doesn’t understand the phone’s technology but fully understands consumer behavior.

Buffett doesn’t make stock or market forecasts, but he clearly reiterated that he’s optimistic about America. While Munger is skeptical, Buffett maintains his bullishness on America. If he could start life and pick when and where he would be born, he would undoubtedly pick the U.S. today.

“The world is overwhelmingly short-term focused. I’d love to be born today and go out with not too much money and hopefully turn it into a lot of money.”

Recall that Buffett penned a New York Times op-ed in the depths of the financial crisis, in October 2008, noting that markets bottom before fundamentals, a core tenant of Tom Lee’s evidence-based research philosophy. During the Depression, the Dow bottomed in 1932, even as economic conditions deteriorated. In World War II, the market bottomed in 1942, well before Allied fortunes turned. And, in the early 1980s, the time to buy stocks was when inflation raged and the economy was in trouble. “In short, bad news is an investor’s best friend,” Buffett wrote shortly before the March 2009 market bottom. “It lets you buy a slice of America’s future at a marked-down price.”

For long-term investors like Buffett, it’s also worth zooming out and remembering that over time the S&P 500 goes upward. It often sits at or near its all-time high, which is currently 4,796.56, achieved on Jan. 3, 2022. Sometimes the market declines further for brief periods, but history tells us it makes sense to buy quality assets when the market is well below its previous high.

Challenges at the House of Mouse

Disney (DIS-0.47% ) shares sank by more than 9% this week after reporting that subscriber numbers for its Disney+ streaming service fell by 4 million customers (~2%) in its fiscal second quarter (the first three months of 2023), in stark contrast to Street expectations of a slight increase in subscribers. Disney beat on the top line and met earnings expectations. The company’s plans to reverse losses at Disney+ include raising prices, providing less original content, but adding in content from Hulu, a streaming service Disney co-owns with NBCUniversal.

Google I/O

Google’s annual developer conference was highlighted by announcements of a significant ramp-up in the company’s AI offerings–the various speakers collectively mentioned AI 143 times during their presentations. The new iterations will be anchored by the integration of a new large language model powering its Bard chatbot called PaLM 2, which (among other things) will enable interactions in 40 languages, give users the ability to create queries using photos, and generate images in its responses. Bard and AI will also be integrated into in-house services like Gmail and Google Maps, as well as third-party offerings such as Adobe Firefly, Spotify, Redfin, and Tripadvisor. Though seemingly a minor add-on, the developers in attendance were most audibly excited about the new “dark mode” interface. Investors apparently liked what they heard, pushing GOOG0.33% up more than 11% for the week.

Elsewhere

The Chinese government has made its first AI-related arrest, accusing a Cantonese man surnamed Hong of spreading a ChatGPT-generated, fictional news story about a non-existent fatal train accident. Train-related fatalities have been a sore subject for the Chinese government ever since a 2011 incident in which Chinese officials enraged citizens by waiting more than 24 hours to issue a statement about a train collision in Wenzhou that had claimed 38 lives.

Authorities in Spain are warning of an olive-oil “catastrophe” as an early spring drought and subsequent heatwave jeopardizes the 2023 olive harvest, a repeat of a similarly disastrous 2022. Many of Spain’s olive growers, which produce 50% of the world’s olive oil (> $3 billion in exports), are already on the verge of financial collapse.

Spotify removed tens of thousands of songs on suspicion that their audiences had been largely generated by bots working on behalf of the songs’ uploader, a musical generative AI company called Boomy. (Spotify pays uploaders based on how many times their songs have been streamed.) Boomy’s generative AI enables users to create songs using basic graphical inputs. The company claims that it has created nearly 15 million songs in this manner.

France’s parliament called for the Wagner Group to be formally labeled a terrorist organization. French legislators formally passed a resolution requesting that the European Union put the mercenary force, active in Russia’s invasion of Ukraine, on its official list of terrorist organizations. The United Kingdom was reportedly on the verge of also listing Wagner as a terrorist organization.

Elon Musk announced that he had found a new CEO to lead Twitter — Linda Yaccarino, who most recently was head of advertising at NBCUniversal. Musk had been under pressure to hand the reins to someone else, both from Tesla investors worried that he had become distracted and from Twitter users who voted for him to step down in an online poll he posted.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: 0.0% Prev.: 0.4%

Est.: 1815K Prev.: 1813K

Est.: -3.3% Prev.: -2.4%

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+12.99%

|

+3.88%

|

+112.93%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In a08d14-ea3b61-f0853e-76879c-c6c5ad

Already have an account? Sign In a08d14-ea3b61-f0853e-76879c-c6c5ad