Our Views

The March Core PCE deflator, the Fed’s preferred measure of inflation, came in better than expected at +0.28% MoM, below consensus of +0.3% and +4.6% YoY. The internals were better as well. Here are 3 takeaways:

- First, Core PCE MoM at +0.28% is the best figure since November 2022 and has been visibly decelerating since Jan high watermark of +0.56%. Recall, the consternation by markets and Fed over the “hot” Jan CPI and PCE and the visible deceleration since shows that Jan was the aberration. And inflation has been cooling steadily since Sept 2022. This is also when equity markets bottomed.

- Second, the Fed has recently focused on “Core Services ex-housing” and this figure showed similar progress coming in at +0.24% and down from +0.35% in Feb and +0.55% in Jan. The latest figure is an annualized rate of +2.8%, which is right around Fed target of 2%. Thus, one could argue the PCE inflation as Fed sees it, is essentially at target.

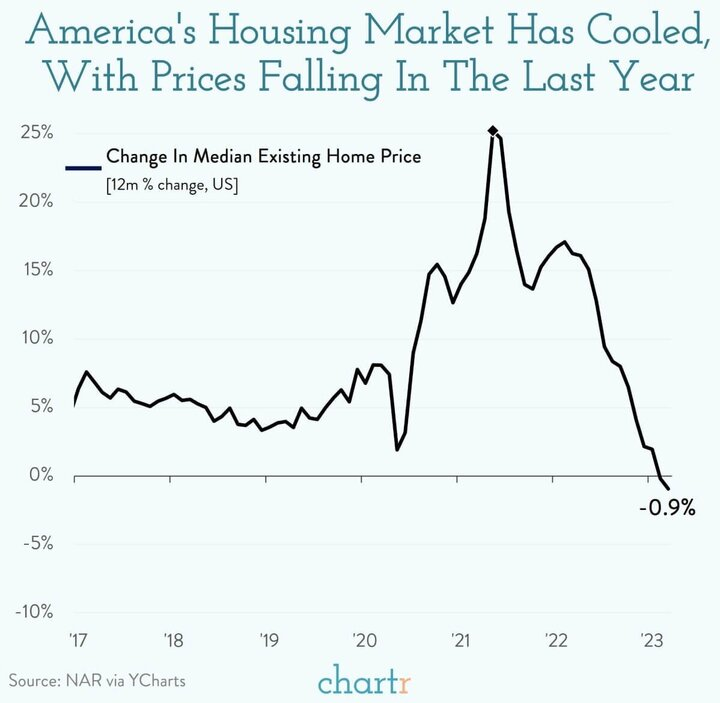

- Third, the biggest driver of PCE inflation remains housing coming in at +8.3% YoY and accelerating from 8.24% last month. But is this what anyone still believes? That housing is inflation at 8% YoY? Case-Shiller this week showed it was 0% and Redfin shows rent was down for the second consecutive month on YoY change.

- Outside of housing, hospital services are the second-largest contributor to PCE inflation at +6bp (+0.7% MoM and 3.28% YoY). FYI, Fed hiking rates will not really impact hospital/healthcare inflation.

Bottom line: The internals of this March PCE deflator report are encouraging. This shows more progress on inflation than the headline suggests.

- SPX and QQQ’s highest weekly closes of the year pave the way for additional strength.

- Bond yields have begun to rollover and likely decline to new monthly lows.

- Technology has some work to do to recover technically. Healthcare should be favored.

- The combination of better than expected big Tech earnings and the pushing out of the debt ceiling “X” date has once again turned the tactical environment away from bearishness. Although the S&P 500 has reversed what looked like the beginning of pullback, my indicators are far from supporting a bullish outcome.

- There was some inflation data that came out this week and my view is that the battle to get back to the Fed’s 2% target remains fierce and is far from over. With the overall labor market data not showing signs of outright weakness, the combination of these factors will likely keep Chair Powell and Gang from the dovish expectations that are currently priced into the fixed income markets.

- The overall profit backdrop remains resilient, but my work suggests it is still weakening and that forward earnings will need to be lowered. When looking deeper, my expectation for Larger Cap, Higher Quality, and Secular growth areas posting results better than expectations (MSFT, GOOGL, META, etc.) has played out as I have been discussing for several months.

- My earnings revisions work continues to flag Smid cap, Lower Quality, and more economically sensitive as the areas of the equity market with the most risk as their forward outlooks still look too optimistic.

- I have no changes to my ongoing views as I see the reward/risk of the overall equity market as unfavorable, and risk remains elevated. Thus, I am willing to remain patient with a barbell positioning of defensive areas and some secular growth while being underexposed to cyclicality. I will look to be more aggressive either at lower price levels and/or once my key indicators flash more favorable signals.

- House Republicans can now claim to be the only group to have passed a bill to increase the debt ceiling, putting the ball in the court of the White House and Senate Democrats.

- However, House Speaker Kevin McCarthy’s razor-slim margin of victory means the final proposal will require Democratic support in order to pass.

- As promised, Speaker McCarthy’s proposal left Social Security, Medicare, and defense untouched, instead opting to cut clean-energy measures, veterans programs, and social welfare.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 rose 0.87% to 4,169.48 this week, while Big Tech helped the Nasdaq climb 1.28% to 12,226.58. Bitcoin rose more than 6.4%, to about $29.385.30.

- Tech companies posted resilient earnings beats this week as 35% of SPX reported results.

- Exxon and Chevron also registered robust profit, despite falling oil prices.

“To be independent of public opinion is the first formal condition of achieving anything great.”

~ Georg Wilhelm Friedrich Hegel

Good evening:

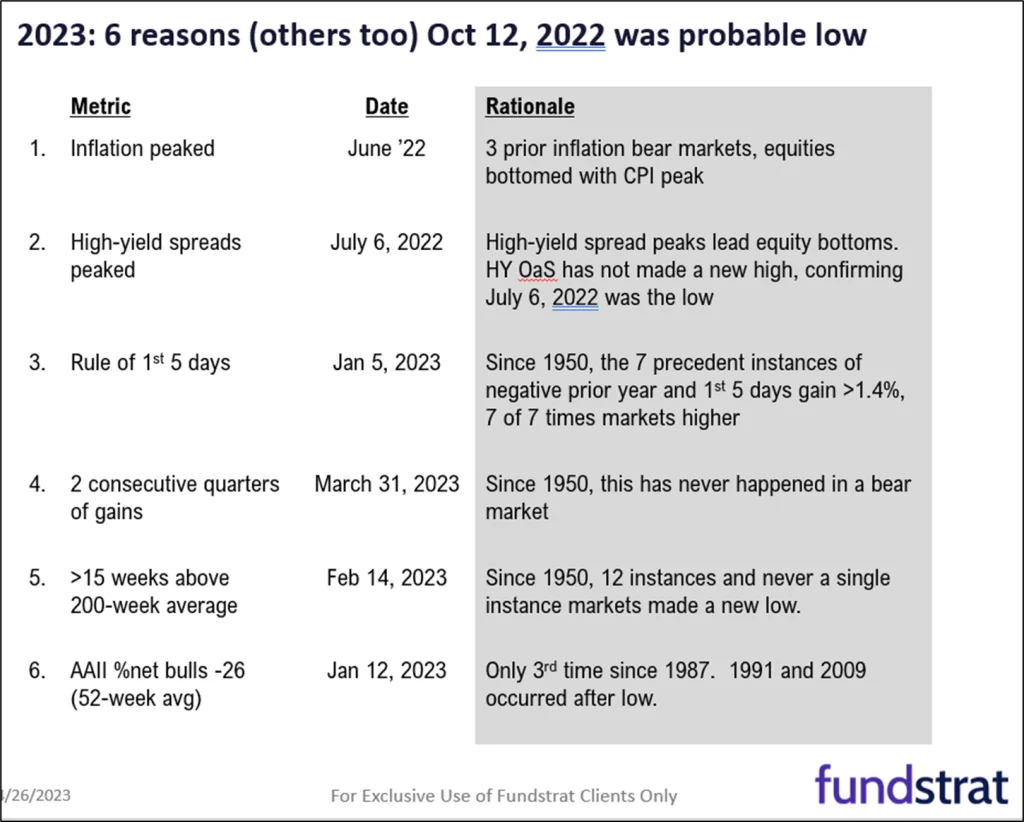

Trading is over for April, with the SPX up about 1.46% for the month and the Nasdaq up 0.04%, in line with historical norms. Although markets did not gain as strongly as anticipated this month, Head of Research Tom Lee continues to see strong gains ahead for the rest of the year. During a live webinar this week about spotting the end of bear markets, Lee used our Chart of the Week to summarize his arguments as to why we are already six months into a bull market:

Approximately 35% of the S&P, including some of the most-watched Tech names and Granny Shots, reported earnings this week. ExxonMobil (XOM) and Chevron (CVX0.75% ) also released quarterly results.

Though not a large cap giant, First Republic’s quarterly results were just as closely watched. The troubled bank disclosed a larger Q1 drop in deposits than expected (about $72 billion, or 41%). Although First Republic reported that outflows had slowed, FRC went into a freefall, leading other regional bank stocks down and sparking an initial drop of nearly 5% on the S&P regional banking ETF (KRE0.50% ). KRE retraced most of that to end the week down 0.40%.)

Banking-sector worries also drove money into crypto, particularly BTC and ETH. As Friday began, rumors circulated of a possible private-sector rescue of First Republic, but Lee expressed doubts: “Private capital will be reluctant to step in right now. Regional bank operating models are challenged, given the current level of interest rates.” After market close several news outlets reported that FDIC could place First Republic in receivership as soon as this weekend.

In Washington, Speaker of the House Kevin McCarthy managed to get his proposal tying a $1.4 trillion increase to the debt ceiling to a raft of significant spending cuts through the House, albeit by just two votes. Washington Policy Strategist Tom Block points out that this means a ONE-vote margin of victory, since bills die on tie votes. Consensus is that McCarthy’s proposal has no chance of winning approval from the Senate, nevermind the White House, but any movement on this issue is likely to be seen by investors as a positive development. Lee doesn’t think the U.S. will actually default, but this will be a “huge” problem in the short term. “We should all worry,” he said, noting that several clients had also brought up concerns about debt ceiling-related risks in recent meetings.

Tech opened its portion of the earnings cycle strongly, with Alphabet (GOOG0.33% ), Microsoft (MSFT-1.90% ), and Meta (META1.40% ) each beating on their respective top and bottom lines. All three companies highlighted their AI efforts in discussing their results. Microsoft CEO Satya Nadella mentioned “A.I” or “OpenAI” at least 24 times in his 15-minute introduction on the company’s earnings call, while Alphabet’s CEO, Sundar Pichai, touted his company’s investments and breakthroughs in A.I. over the last decade, promising to incorporate generative A.I. advances to “make search better in a thoughtful and deliberate way.”

For his part, Meta’s Mark Zuckerberg promised AI-driven initiatives in every Meta product, as well as Meta’s own generative AI to be released in the coming months. All three companies are part of our newly updated Granny Shots stock list, and all three are up strongly YTD, outpacing the SPX by a wide margin.

Another longtime Granny Shot, Amazon (AMZN-0.99% ), rose sharply after also beating on top and bottom lines, but the stock later surrendered some of those gains on warnings of slower cloud growth for the rest of the year. Amazon, which is up 23% YTD, noted that its retail business returned to profitability in Q1 2023.

Thursday’s tech rally led Head of Technical Strategy Mark Newton to conclude that “the near-term price action still looks to point higher, and might not reverse until late May,” though he noted that the sector’s risk-reward picture in the intermediate term was not as constructive. “I’m not saying Tech can’t work for the year, but it certainly makes sense to consider maybe some diversification at this stage in the rally,” he suggested. One possibility? “Coke is one of my favorite Consumer Staple stocks right now. It's right to favor Coke technically. I've read the fundamental reports that are quite positive as well.”

From a sector perspective, Newton noted, “We’ve had really good movement in sectors like Healthcare. Specifically, pharmaceuticals and medical devices are ‘phenomenal’ places to be right now.”

With ExxonMobile and Chevron both exceeding top- and bottom-line expectations, Lee remains bullish on the Energy sector. Falling gas prices helped to prevent Exxon and Chevron from matching the all-time record profits they achieved last year (Q3 for Exxon and Q2 for Chevron), but both companies reported first-quarter results that were significantly higher YoY. Lee pointed out in his webinar that the energy sector accounts for over 10% of the S&P 500 in net-income terms, but only about half of that in terms of market cap.

“Whenever we’ve been at higher and rising net-income share, the market cap tends to catch up. So this implies that energy stocks have the potential to double,” he observed.

Macro wise, as Lee has pointed out throughout 2023, the Fed’s aggressive interest-rate campaign in 2022 is still trickling into markets, including the housing market. Over the past few months, it’s cooled considerably in virtually every market not named Miami. What the Fed has done is drive inflation lower and put the brakes on what was an exploding housing market:

Speaking of the Fed, all eyes will be on the May 2-3 FOMC meeting. Lee believes the Fed has plenty of reason to regard the inflation fight as over. Friday’s March Core PCE deflator came in soft as well, at +0.28% MoM, below consensus of +0.3% and +4.6% YoY. Noted Lee, “This is the best MoM figure since November 2022, further showing that inflation has been cooling steadily since September 2022.”

In fact, Lee said, “I think there’s a chance that inflation could be posting some zero prints this year.” He added: “So only if the Fed is backwards looking will this support ‘higher for longer.’”

Elsewhere

The Biden administration announced the formation of the National Semiconductor Technology Center, an agency that would operate under the auspices of the Commerce Department to foster cooperation between academia and industry and streamline research and development into the next generation of semiconductors.

AI takes on the Fed: JPMorgan Chase unveiled its new “Hawk-Dove Score,” a Fed policy generated by ChatGPT and trained–with the help of the firm’s economists–on 25 years of Fed statements and speeches. The model is scaled so that each point increase (decrease) in the Hawk-Dove score corresponds to a one-percentage-point increase (decrease) in the probability of a 25 basis point hike at the Fed’s next policy meeting. The firm has similar models for the ECB and Bank of England.

Microsoft’s gaming efforts were thwarted by British antitrust regulators who blocked the Redmond-based company’s attempt to acquire Activision and take control of popular gaming franchises such as Candy Crush, Call of Duty, and World of Warcraft.

The Walt Disney Company sued Florida Governor Ron DeSantis and the five members he placed on the special Reedy Creek tax-district oversight board for allegedly “weaponizing” government power in their “targeted campaign of government retaliation,” infringing on the company’s free speech rights.

Phrasing matters: Bank of England Chief Economist Huw Pill enraged Britons this week by telling them to just “accept that they’re worse off,” if they want inflation to fall. Even those who agree with his views about the effect of rising wages winced at the manner in which he expressed them.

Going electric: One in five cars sold this year will be electric, according to the International Energy Agency. Worldwide demand for battery-powered vehicles has risen to record levels after sales already passed the 10 million mark for the first time globally. The surge in demand means EVs will account for about 18% of new vehicle sales in 2023 vs. only 4% in 2020.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: 50.4 Prev.: 50.4

Measures the performance of the manufacturing sector, as calculated from a survey of purchasing managers at 600 industrial companies.

Est: 5.00%-5.25% Prev.: 4.75%-5.00%

The FOMC’s decision on the Fed Funds rate.

Est. 175K Prev.: 236K

A monthly report on the employment, hours, and earnings of U.S. workers on non-farm payrolls.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+12.99%

|

+3.88%

|

+112.93%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||