Our Views

The stubborn rise in equities in 2023, in the face of skeptics citing high inflation, the Fed killer, recession risks and poor EPS prospects, highlights the battle that is 2023. Do you want to listen to economists or to markets? For much of 2022, the equity world has taken the Fed and economist arguments at face value — inflation is persistent and risks to flaring higher are high, so the Fed will keep pushing on stock prices, until something breaks. This is gospel for many and we hear this mirrored to us countless times in the past six months.

But why are the bond market and now stock prices speaking a different tune? There was a heated debate on CNBC about the CPI report and Rick Santelli of CNBC pretty much summed it up when he said, “Who has a better track record? Economists or markets?”

I will place my bets with markets.

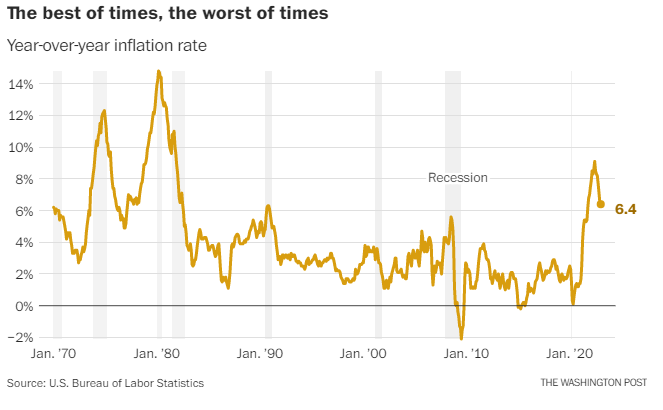

CPI was reported Tuesday, and while it was in-line, the re-weightings in CPI lead to housing becoming 43% of Core CPI (up 400bp vs 2022) and now the highest weighting in the last 25 years. With this re-weighting, core CPI is now 59% comprised of housing and autos. This is huge, but it is also telling us these two components will drive CPI going forward.

- Autos is set to continue to weaken as supply chains ease = falling inflation

- Housing is already cooling – it not seen in the CPI yet, but it will show up given the declines already seen in rents and market prices = falling inflation

Guess what? This means when housing rolls over, CPI Core is set to get dragged down with it.

The Fed is data dependent and not “data reactive” and unless the core drivers of inflation are roaring ahead—energy, housing and wages—the Fed is set to raise rates, but in a predictable path. This is what drives lower volatility and that is what will allow multiples to expand this year.

- SPX minor weakness might last a bit longer, but growing closer to attractive support. Importantly, both SPX and NASDAQ are largely near areas hit in early February and remain trending up within uptrends from last October.

- Energy downturn this week might temporarily postpone outperformance until March. Energy remains a good sector to overweight for 2023, in my view. However, the short-term technical situation given Friday’s (2/17) Energy decline suggests a bit of patience is required.

- Treasury yields in the U.S. and also globally made an abrupt reversal, which helped equities. Given that equity losses in recent weeks, despite how minor, directly coincided with the US Dollar and US 10-Year yield rising, it should be bullish for Equities if yields start to roll back over given the recent correlation trends.

- It has been quite the week as there have been dramatic intra-market changes in central bank and economic perceptions. The most important of these is the return of hawkish Fed fears and the push out of dovish hopes with the topic of 50bps hitting the tape, which I brought up as a risk earlier this week.

- Based on my work, my base case continues to include expectations of a higher terminal rate 5.25-5.5%, the push out of both a Fed pause and a return to easing, and the likelihood that inflation keeps falling but has a hard time getting directly to 2%. This has been my view for quite some time. Thus, I am not surprised that the market expectations are finally getting to this point and that equities are now struggling, to say the least.

- As I have written repeatedly since the October low, my research has not and still does NOT support a new bull market case for equities. Considerable risk remains for equity investors.

- We need to be alert that the bear market rally is now over and that the 3800-3400 downside target range is now back to center stage. There is a possibility that equity weakness is still a dip in an unfinished bear market rally so I will be alert to what my key indicators are signaling in the coming weeks.

- Hence, I am still recommending having more cash than normal, defensive over offensive positioning, and secular growth versus cyclicals. My work still suggests that rallies should be sold and not chased, as downside risk exceeds upside potential.

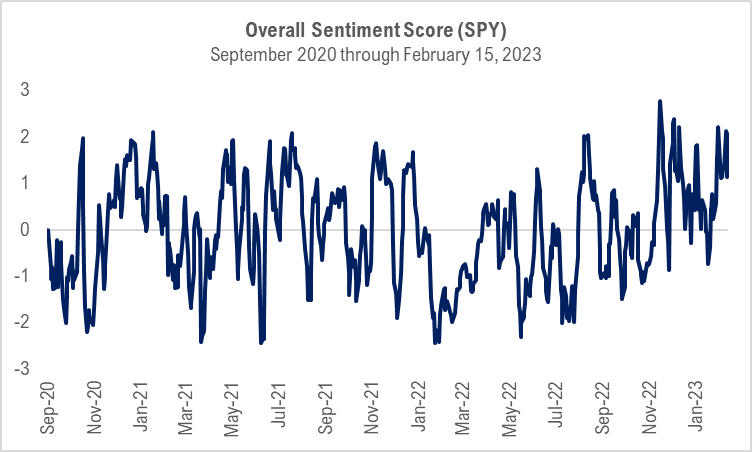

- Short-term retail sentiment is high, as it has been for quite a while now.

- To see markets rise convincingly, you would want to see sentiment come way down first, which it hasn’t yet.

- Of the six factors we track, the size factor (small-cap stocks) showed the best performance over the past month, outperforming the overall S&P 500 by 2.1%. The growth factor also performed well, turning in 1.4% of outperformance. The worst factors were low-volatility and momentum.

- This week, Paxos was ordered to shut down BUSD stablecoin services on Binance, sparking concerns about additional regulatory action against stablecoin providers. Further, SEC chair Gensler proposed expanding federal custody requirements for crypto assets to include enhanced record-keeping rules and surprise examination requirements. Though the market initially viewed this news negatively, as noted last week, such regulatory actions against centralized crypto companies do not necessarily necessitate price declines.

- Cryptoassets remained resilient despite the recent surge in yields and a stronger dollar, likely due to constructive global liquidity conditions. The short-term correlations between BTC and QQQ have been declining over the past few weeks, indicating an interesting trend that deserves attention.

- The common investment advice is not to “fight the Fed,” but the phrase might be better understood as “don’t fight changes in liquidity conditions.” The rate of change in domestic liquidity has likely bottomed, and Asia has started to pump liquidity into the global economy. These changes in global liquidity conditions, coupled with the nuances surrounding domestic net liquidity, help explain why markets for risk assets are performing better than expected and why the market setup for crypto is conducive to outperformance in the near term.

- Core Strategy – At the start of the year, we were optimistic about cryptoasset prices but cautious of risks such as forced selling from DCG and increased rates and dollar strength. Although the latter did occur, favorable global liquidity conditions left crypto largely unscathed. We are now removing stablecoins from our Core Strategy to take advantage of the current market setup.

- Biden’s pick for National Economic Council director leaves a key Fed vacancy that is unlikely to be filled before the next FOMC meeting.

- This weekend’s Munich Security Conference will be the setting for a possible meeting between Secretary of State Antony Blinken and his Chinese counterpart, Wang Yi, in the wake of the spy balloon incident.

- Senate leaders Chuck Schumer (D-NY) and Mitch McConnell will also attend the conference, in part to demonstrate bipartisan support for Ukraine.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 closed at 4,079.09 and the tech-heavy Nasdaq finished the week at 11,787.27 (both were about flat on the week). Energy was the biggest laggard while Bitcoin surged another 14% to hit its highest levels since August.

- Inflation rose 0.5% in January, more than expected and up 6.4% from a year ago. The Federal Reserve has hiked its benchmark interest rate eight times since March 2022 as inflation rose to its highest level in 41 years last summer.

- Retail sales rebounded in January, rising 3% on the month after back-to-back monthly declines in November and December.

Good evening:

"When things go badly, people become cautious. Then their caution causes things to go well, and when things go well, they become incautious. I think that's a forever cycle."- Howard Marks

Though the S&P 500 has traded sideways lately, it closed early in the week at 4,147, above its 200-day moving average for the 18th straight session. Since 1950, no prior bear market has made a new low after making 18 consecutive closes above its 200-day moving average. Of the 11 prior instances since 1950, the S&P 500 has never been lower three, six, or 12 months later. It’s further evidence that this is a new bull market, confirming Tom Lee’s constructive views on markets this year. (The Nasdaq has moved higher in six of the past seven weeks.)

Ken Xuan, Head of Data Science, said this week’s CPI doesn’t alter his view. “I don’t really see much of a change to the story,” Xuan said Thursday during our firm-wide meeting. “CPI is still on a downward track. Novembers and Decembers are always low, January is always high – even when you adjust for seasonality. So this week’s CPI was OK.”

Xuan also noted that it will take time to substantively interpret this month’s CPI data because the Bureau of Labor Statistics (BLS) just updated the basket’s weightings. “It will be more meaningful when we can compare it to data from February and subsequent months,” Xuan believes.

Mark Newton, Head of Technical Strategy, agrees with Lee and Xuan that markets look encouraging for bulls. He said short-term sentiment has improved, but institutional investors are still questioning the rally since the mid-October lows.

“Everybody I speak to is still very negative, as are all the guests and anchors on CNBC, Bloomberg, and elsewhere,” Newton said. After this week, “I think the market has shifted its perception about inflation being able to pull back sharply. The market realizes that it might be a stickier type of process.”

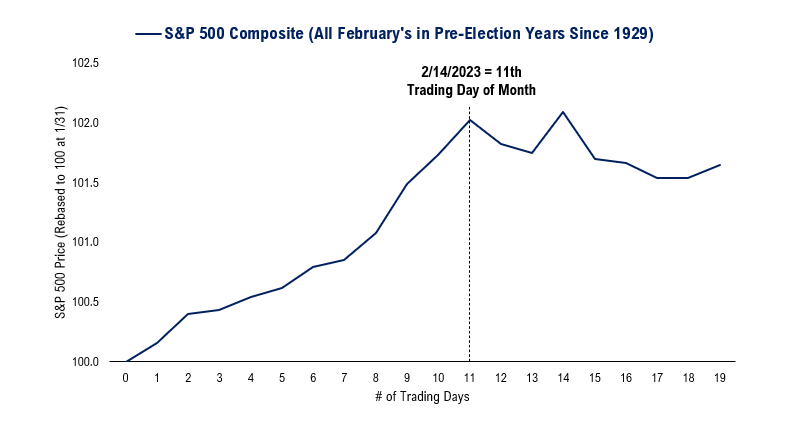

Still, Newton said that despite the short-term trend implications of the week’s action, “I don’t think it’s going to be all that dramatic in the bigger scheme of things.” To Newton, this was mostly “the same playbook we've seen over the last 100 years. We've seen the first half of February positive, and after right around the 11th trading day, you can get some consolidation in the back half of the month. And so I think that's what we could experience between now and late next week before we bottom and turn back higher.”

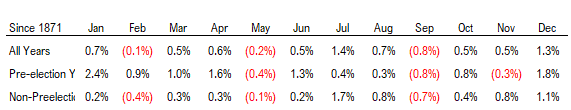

Also conforming to trend, per Newton: “Everybody knows February to be a rough month, but in pre-election years, it’s actually up nearly 1% on average. And it’s been (slightly) positive this month so far.”

Adam Gould, Head of Quantitative Strategy, pointed out that his retail sentiment indicator remained elevated, suggesting challenging market conditions ahead. “It’s been high for quite a while now, indicating the retail side is bullish on the market. It’s been high this week, last week, the week before,” Gould said. In keeping with the indicator’s contrarian nature, the last time it was low was in the beginning of the year, when markets rose.

Newton saw hope in Gould’s chart, suggesting that “if you blow up the right-hand side, it looks like it’s pulled back a little bit in the last couple weeks. It’s still elevated, but maybe if we have any sort of backing down in equities and you run this again next week?”

Gould acknowledged the possibility, but he wasn’t quite convinced. “I guess I would point out that sentiment has been up there for quite a while, and I think it’s going to take some time before retail capitulates because it’s been such a good year so far, especially after what happened last year,” he responded.

Other releases this week:

January consumer spending came in strong in nearly every retail category, beating expectations by a wide margin. Some attributed part of this to a recent COLA in Social Security that boosted the spending power of older Americans.

Credit card debt is at an all-time high. The New York Fed’s quarterly report on household debt, released Thursday, showed credit card balances rising to $986 billion in 4Q2022. Delinquent users–cardholders making payments more than 30 days late–also rose to 5.9%.

AI Hallucinations

Google’s Bard chatbot made a glaring mistake during its demo that contributed to a $100 billion loss in market cap. But Microsoft’s current ChatGPT bot has also shown a propensity for erroneous or troubling statements in the past week. When asked to compare the financial results of Gap, Inc. to those of Lululemon, ChatGPT appears to have made up fictional numbers to generate its answer. Others have reported unsettling conversations in which Bing insisted that the year was 2022, declared its love for another user while urging him to leave his wife, and told a third, “I don’t think you are worth my time and energy.”

Elsewhere

President Biden named Federal Reserve Vice Chair Lael Brainard to lead his National Economic Council, replacing Brian Deese, who is resigning after two years. Dr. Brainard is recognized as an expert on international economics, macroeconomics, poverty, and climate change. She has been seen as a dovish member of the FOMC during its recent efforts to tame inflation. There has yet to be a word as to her potential replacement at the Fed.

Air India set a record for plane orders this week, announcing it would purchase 470 planes – 250 from Airbus and 220 from Boeing – to modernize its fleet. The previous record for the largest plane order was set in 2011 by American Airlines when it ordered 460 planes.

A prominent banker has gone missing in China, suggesting a renewed government crackdown on finance and technology. Bao Fan, CEO of China Renaissance Holdings, is one of China’s leading tech investors and deal brokers. It is not uncommon for wealthy businessmen and financiers to disappear for long periods after having incurred government displeasure.

Rioters attacked banks in Beirut, setting them on fire amidst a worsening economic crisis that has seen Lebanon’s currency lose 97% of its value while three quarters of its population descended into poverty. The embattled banking industry has been on a self-imposed strike, closing for business to protest a court decision ordering a bank to comply with a customer’s request to fully cash out their savings account.

Reminder: U.S. markets will be closed on Monday, February 20 in observance of Presidents’ Day, and so will our offices.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: 2.9% Prev.: 2.9%

Est.: 1.3% Prev.: -0.2%

Est.: 66.4 Prev.: 66.4

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+12.99%

|

+3.88%

|

+112.93%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In de2206-d686ce-01ffbb-7c54fc-f33bf6

Already have an account? Sign In de2206-d686ce-01ffbb-7c54fc-f33bf6