Our Views

The consensus view is that because inflation is “sticky,” the Fed needs to keep rates “higher for longer” to make sure inflation is “deader for surer,” just as in the 1970s. Stocks remain in “whack-a-mole” mode with the Fed.

In contrast, our “unpopular” view is that equities bottomed on 10/12 (below) when inflation hit a wall, proving that inflation was largely transitory and the Fed is now behind the curve. This is akin to August 1982, and if our view is correct, equities will gain >20% this year.

The incoming data for the past few weeks is supportive of our view and hence, equities are showing far more resilience than the consensus narrative. On Friday, December Core PCE came in at the consensus +0.3% MoM, which also implies that the Fed significantly overshot and made an “unforced error” in December by raising its 2022 inflation outlook to 4.8% in 2022.

Arguably, this means the Fed has to course correct in February, either a “pause” or change in terminal rates. Regardless, we see this leading to a significant easing of financial conditions.

Take a look below and we can see the S&P 500 is now 5 days above the 200D moving average. This is the longest stretch since the start of this “inflation induced bear market” and really argues that what many call our “unpopular view” is in fact the new central case.

- US Equity market extension helps weekly close confirm the breakout above downtrend

- Intel’s woes don’t detract from Semiconductor space. Above $30.50 necessary to embrace

- Bitcoin’s rally likely stops initially upon nearing its Ichimoku cloud near $29k

- As I discussed in my Annual Technical Outlook this week, momentum and breadth have begun to improve materially at a time when Technology has begun to show evidence of clawing back. This is important and positive during a time when many longer-term gauges of sentiment remain quite negative.

- The U.S. equity market continues to move higher and was fueled by strong Treasury auctions that bolstered growing bullish sentiments that the Fed will be dovish next week. The onus has certainly shifted from the doves/bulls to the hawks/bears.

- Will the Fed follow these market expectations, or will the market get hit with a big blast of cold water by Chair Powell and Gang? I expect a 25bps rise in the funds rate, and hawkish commentary during the post meeting press conference that defies the doves and will likely communicate that more work needs to be done to win the inflation fight and that the markets need to temper their expectations for a return to accommodation.

- Regardless of the outcome of the FOMC meeting, the corporate profit backdrop continues to weaken as domestic growth is set to slow, and the forward guidance being provided during the ongoing earnings season showed that the sequential deterioration has not ended. Hence, my indicators suggest that forward earnings projections are too high and need to be revised lower. Importantly, my analysis shows that additional negative earnings revisions are not yet fully discounted.

- At the risk of missing a significant shift in Fed policy and the start of a new powerful bull market, my analysis continues to signal that the current equity-market bounce is a countertrend bear rally that will ultimately fail. Furthermore, my research and view of the macro environment is still looking for the S&P 500 to revisit the October lows, and there remains a high probability of making new lows. My longstanding downside target forecast stays at 3200-3000.

- Thus, I continue to advise caution and that investors remain patient while using rallies to raise cash, reposition, increase hedges, and increase shorts because the road ahead is windy and full of potholes.

- We use a residual income model to value the S&P 500. This framework indicated that the equity market was expensive last March and that poor equity returns would likely follow.

- While the model sees the equity market as overpriced, it has become slightly less expensive in recent weeks, which we view as marginally positive for stocks.

- A sharp increase in spot and futures volumes has been a welcome sight for crypto investors. A plummeting skew suggests that investors who missed the pump over the past few weeks may be compensating for lost time by piling into call options.

- Encouraging on-chain data, including an increase in realized cap and SOPR, suggest capital inflows into the bitcoin network and increasingly bullish sentiment among existing holders.

- We dive into the prevailing market liquidity conditions, discuss the potential effects of the debt ceiling on these conditions, and examine the potential impact on crypto prices.

- Strategy – In the matter of a week, we have seen (1) Genesis file for bankruptcy with a prepackaged offering to creditors, which indicates a lack of imminence in any potential forced selling from assets tied up in the larger DCG entity, and (2) the debt ceiling be reached, and an apparent impasse between legislators form, suggesting that despite the potential for tough talk out of the FOMC, liquidity conditions should be more favorable for risk assets over the next few months than they otherwise should be. With that in mind, and with the understanding that there is still risk in longing a crypto market that remains somewhat unsubstantiated by on-chain activity, we are reducing our Core Strategy stablecoin exposure to 25% and increasing allocation to other crypto assets pro rata.

- Yellen officially notified Congress debt ceiling has been reached.

- Republicans call for talks with White House as exit strategy for debt ceiling crisis.

- FOMC meeting next week, is 25bps increase likely outcome?

- Hearings are main tool for Republicans with control of the House.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 finished up 2.32% this week to close at 4,070.56. The Nasdaq jumped 4%, keeping it on pace for its best month since July 2022. Bitcoin rose another 2%, on pace for its best month since December 2020.

- About 25% of the S&P market cap reported earnings this week, led by Microsoft, Chevron, and Tesla. Elon Musk’s Tesla, a Granny Shot, posted a monster 31% gain this week alone on record profit.

- All eyes turned to the FOMC meeting next week. Most economists expect a 25 bps rate hike after the Fed raised its benchmark overnight interest rate by 425 basis points last year, with the bulk of the tightening coming in 75- and 50-basis-point moves.

Good evening:

“After a stock market decline, people may perceive more risk than before when, in fact, the decline may have taken some of the risks out of the market.” – Robert Shiller

Twenty-six percent of S&P 500 market cap reported this week, and the results were largely better than expected, punctuated by Tesla’s record-setting revenue and profit. After a tumultuous close to 2022, stocks have risen in three of the past four weeks on the belief that inflation is easing enough for the Fed to begin slowing the pace of interest rate increases. Whether this is another classic bear market rally or a new bull run remains to be seen, but the S&P 500’s 6.44% gain this year has some investors wondering if the worst is already behind us.

In short, the market is sending many mixed signals between solid earnings, forecasts of economic slowdown, and stronger-than-expected GDP growth.

That was the core of our weekly research meeting. Here are the highlights:

Mark Newton, Head of Technical Strategy, said markets remain resilient, led by sectors that lagged last year: discretionary, communication services, and technology. (The latter is a top pick by Tom Lee and Newton for 2023.) Most of Newton’s work is constructive, showing the market should turn sharply higher between now and March. Seasonally, the first quarter of a pre-election year is strong.

“It's been encouraging to see technology really snap back into shape,” Newton said.

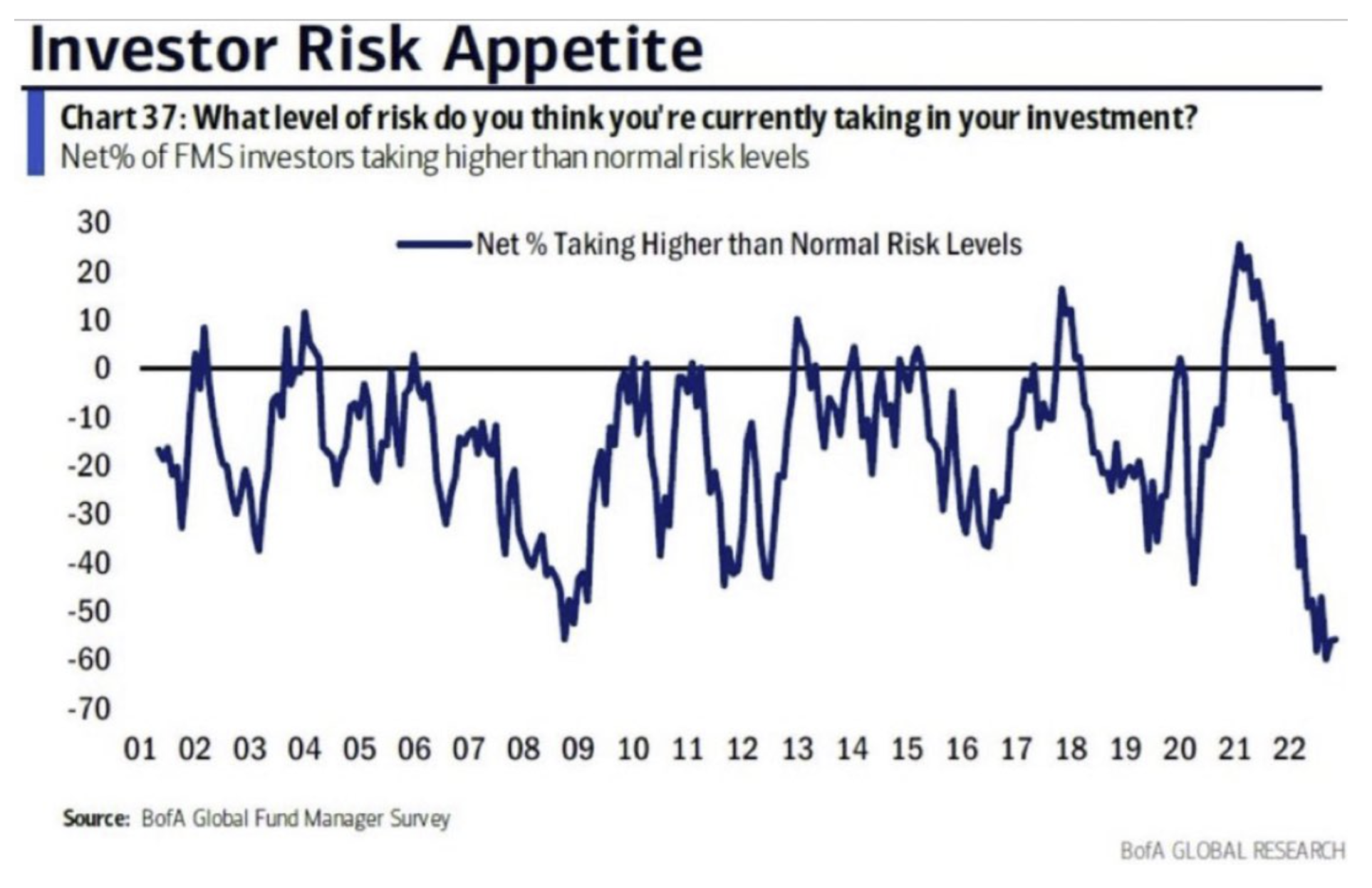

And yet investor risk appetite is at the lowest it has been in almost 20 years. “It’s extraordinarily low,” Newton said. “People are on the sidelines, they’re not taking risks. They are looking at a Fed hiking, a recession. All of this creates a pessimistic mood and a wall of worry. Equities have rallied through that. I don't see that changing.”

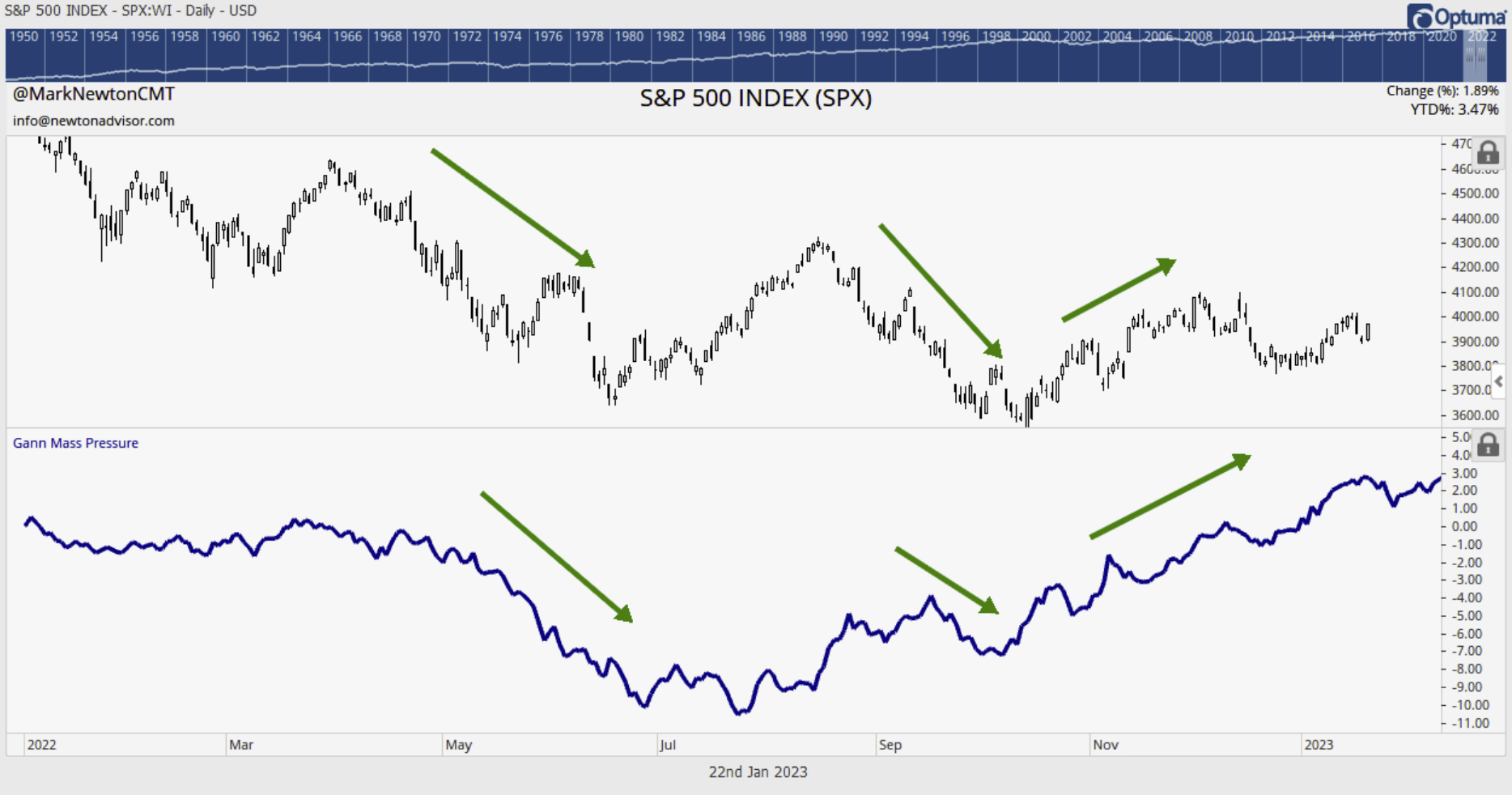

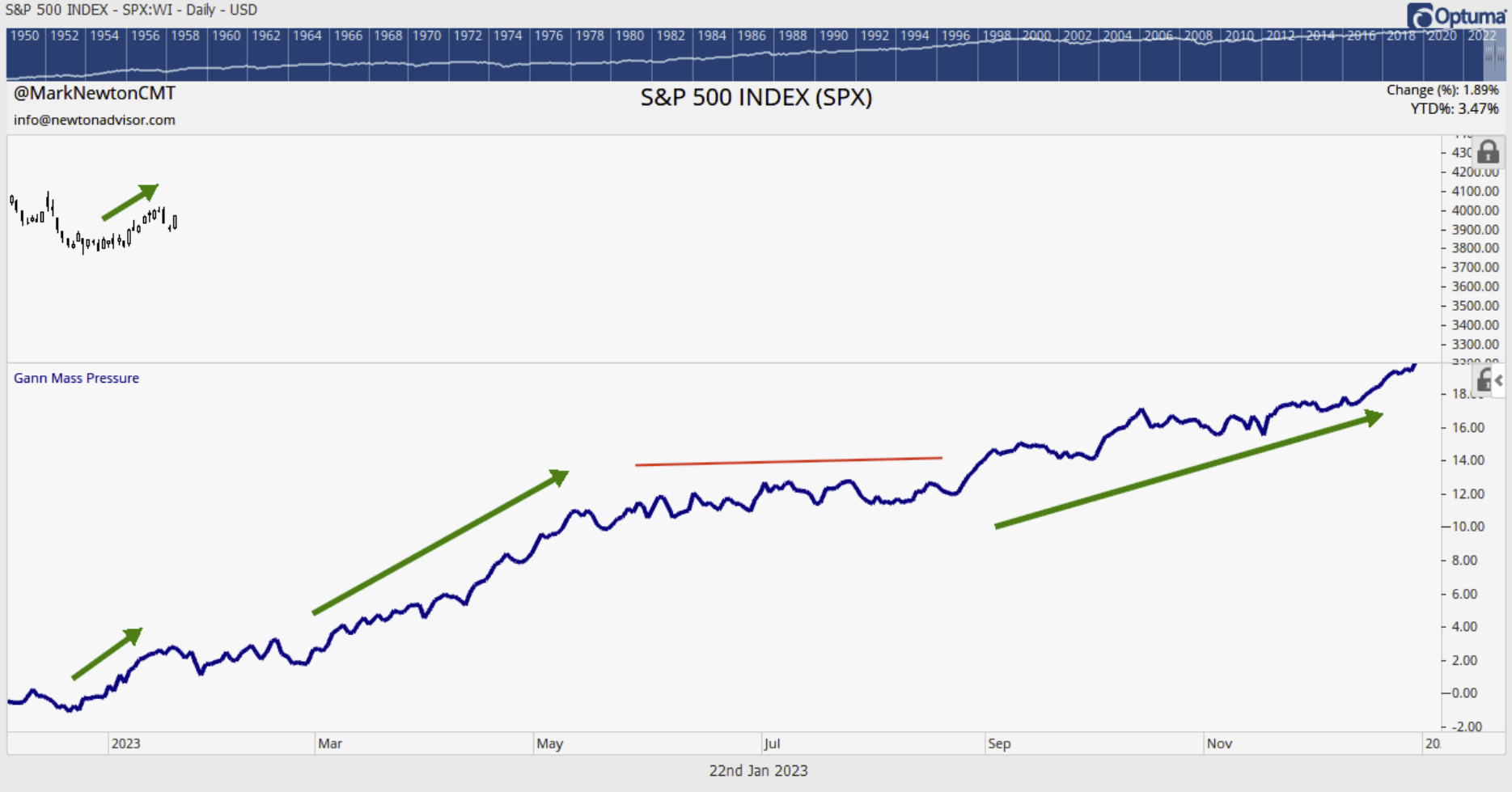

Newton shared a few charts showcasing how last year’s market decline into June and October fit with seasonality:

In his 2023 market outlook, Newton shared his forecast of 4,500 for the S&P. He said:

“Most weakness could be concentrated in the second quarter before sharp rallies into fall and a stair-stepping rally into year-end. Increasingly, it’s right to expect that markets have made their bear market bottoms last October.”

Newton’s annual forecast is rooted in the expectation that investors will be encouraged by falling inflation rather than discouraged by the prospect of negative earnings revisions. “Energy’s dominance should continue this year,” he said. “It could be joined by materials and industrials, with technology showing most of its strength in the second half.”

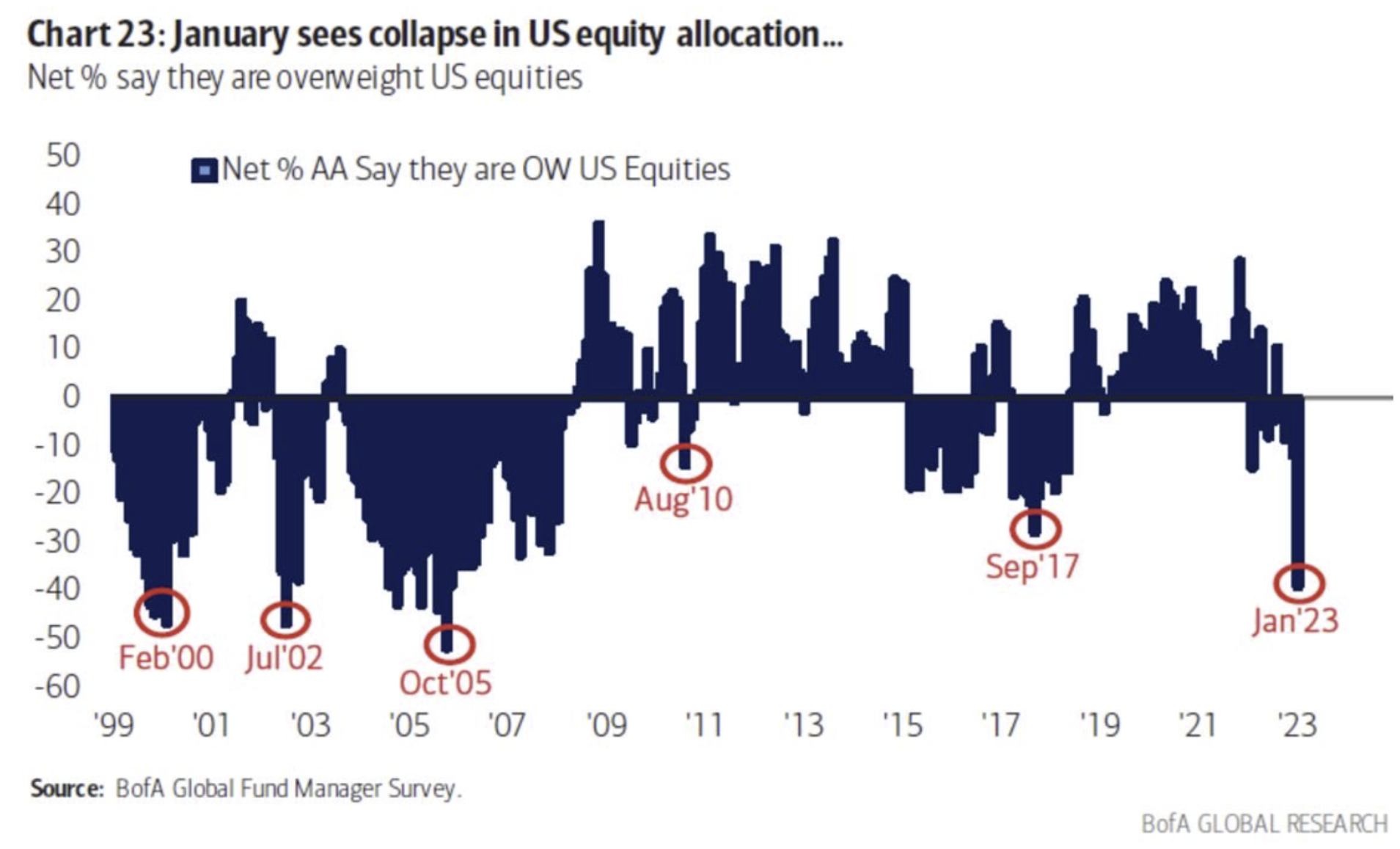

Newton also points out that global portfolio managers’ allocation to U.S. equities is at its lowest levels since 2005:

Newton said the market lows are in, partly because the S&P 500 has rallied more than 500 points from its October 13 intraday low, with more than 60% of the index’s components trading higher than their 200-day moving averages.

“This year and next year, I think, have the potential to be good years, per my cycle work,” Newton said. “Consumers might not be in great shape, but we can avoid a real calamity. Most long-term cycles show this could be a good year but choppy. The back half of February could be nasty, but this quarter seasonally is so bullish.”

And investor sentiment is at decade lows in terms of exposure to equities:

Newton’s work is at odds with that of Brian Rauscher, our Head of Global Portfolio Strategy and Asset Allocation, who said his process doesn’t support this rally. Rauscher stayed bearish during all of 2022's bear market rallies and said this rally won't last either. He says it's too early to celebrate inflation cooling, and earnings (guidance) is concerning.

“Make no mistake: the earnings backdrop is weakening,” Rauscher says. “Though absolute reports are beating estimates, which always happens, guidance has been very bad. I have to be patient and stay where I am. So many names look terrible.”

Every evening after the close, Rauscher chats with money managers and economists for hours. He said he’s never heard this much confusion in his 30-year career.

During our weekly meeting, Newton asked Rauscher:

“The economy seems to be in an interesting spot, right? Unemployment isn't a big deal yet, and GDP growth hasn't been affected, I know that's backward-looking. Still a lot of open jobs. If the market is sniffing a soft landing, wouldn't that support a rally even if earnings temporarily are still moving lower?”

Rauscher said Newton could be right, but he’s sticking with his process. Rauscher’s work shows the October low will be broken at some point in the coming months. “I have to stick with my process for now unless something changes,” Rauscher said. “We could rally into this Fed meeting next week and then sell off. It's hard for me to abandon 32 years and a 6-for-6 record. Could it be wrong? Absolutely. But that's why I stick with my process.”

In earnings this week, four popular Granny Shots reported. Tesla posted a monster beat that sent the stock soaring after Elon Musk struck an upbeat tone about demand for the company’s vehicles and its ability to navigate a potential economic downturn. Microsoft recorded its slowest sales growth in more than six years last quarter as demand for its software and cloud services cooled on concerns about the global economy's health. Chevron posted a record $36.5 billion profit for 2022 that was more than double year-earlier earnings, but the bottom line fell shy of Wall Street estimates. American Express shares rose despite an earnings miss, thanks to an upbeat outlook.

US GDP grew at a real, annualized pace of 2.9% in Q42022, beating expectations (though down from Q3).

Core PCE was up an annualized 4.4% in December, down from 4.7% the prior month. Headline PCE fell to 5% from 5.5%.

Elsewhere

Ukraine will get what it has long asked for in its homeland defense: Germany and the United States both agreed to send modern tanks (Leopard 2 tanks and M1 Abrams tanks, respectively) to replace the Soviet-era tanks that both Ukraine and Russia have been using thus far.

The chief epidemiologist of China’s CDC estimated that approximately 80% of China’s population had been infected with COVID since the country began loosening pandemic restrictions in December.

Next week is big, with earnings due from Meta, Amazon, Google, and Apple. It’s also Fed week.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: 108.9 Prev.: 108.3

A measure of consumers’ optimism (pessimism) about the current and future financial environment.

Est.: 160K Prev.: 235K

A monthly measure of non-farm private-sector jobs added (lost) based on data from payroll processor ADP.

Est.: 4.50%-4.75% Prev.: 4.25%-4.5%

The Federal Reserve Open Market Committee will announce its decision regarding the federal funds rate and Fed Chair Jerome Powell will provide an overview of the Fed’s views and expectations.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+12.99%

|

+3.88%

|

+112.93%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||