Stocks Notch Best Week Since November As Nasdaq Winning Streak Extends to Six Days

Our Views

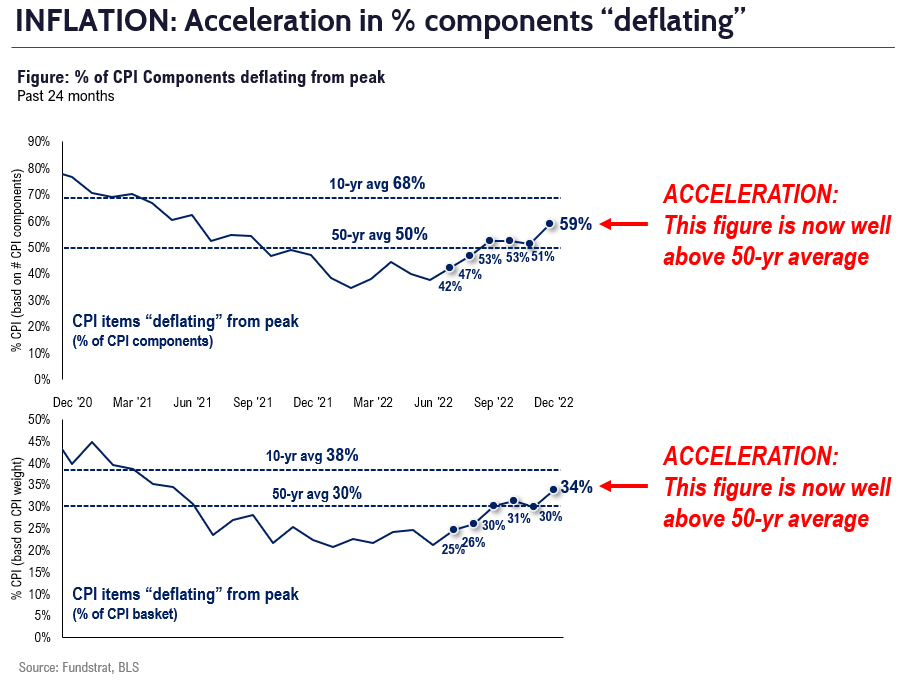

The “big news” in December CPI is 59% of components are now in deflation. Ultimately, the December CPI report is a net positive, in our view, as we think investors will increasingly conclude the Fed can declare “mission accomplished” on inflation.

- December Core CPI (1/12 at 8:30am ET) came in “soft” at +0.30% core MoM%, the 3rd consecutive month of soft inflation readings. The 3M annualized (SAAR) Core CPI is down to 3% and as we noted in prior reports, is more important than YoY rate (5.7%) because of the slowness of YoY% to reflect changes.

- Disinflation (aka “deflation”) is accelerating. A whopping 59% of CPI components are now in outright deflation, a leap of 800bp in a single month (see below). The 50-year average is 50%, so the pace of items “deflating” is also well above the long-term average. We view this as repeatable low CPIs.

- Applying the same MoM% to Dec Core PCE (Fed preferred measures) implies Core PCE inflation likely comes in at 4.2%-4.3% YoY% when released on 1/27. This is 60bp lower than Fed’s Dec forecast for 2022 (aka SEP) at 4.8%. 60bp is whopping downside surprise vs Fed forecast

- The latest Atlanta Fed wage tracker was released and the YoY% fell to 5.5% in Dec, the lowest reading since Jan 2022. The YoY% dropped for both “job switchers” (7.7% vs 8.1% Nov) and “job stayers” (5.3% vs 5.5% Nov). Another data point corroborating that wage inflation has slowed sharply in the past few months.

- Wage gains and job growth visibly slowed, developments favorable to the Fed perspective which has been targeting slowing wage pressures. Recall last week, total income (payrolls * avg hourly earnings) are now growing at a mere 3.6% or so, in line with levels needed to sustain 2% inflation.

- The Fed narrative on inflation has focused on “core services ex-housing” as of particular concern, since this category (medical, entertainment, cell phones, education, auto repair) has a heavy wage component. For December, the inflation rate was 0.211% MoM%, the third consecutive soft reading. The 3M SAAR figure is down to 2.12%.

These economic reports arguably show the bond market got it right. Inflation is undershooting the Fed and consensus view. This explains why UST 2-yr yields (4.145%) and UST 10-yr (3.444%), are far below the 5% Fed terminal rate.

For an equity investor, what is evident is inflation is falling faster than expected. And the Fed’s motivation to push for a “hardish” landing is diminishing given the softening of the labor market. We believe conditions are becoming more conducive for the Fed to allow financial conditions (FCI) to ease, and in turn, the environment for equities will be sustainably firmer.

Thus, we expect stocks to act far more resiliently in 2023 than consensus expects.

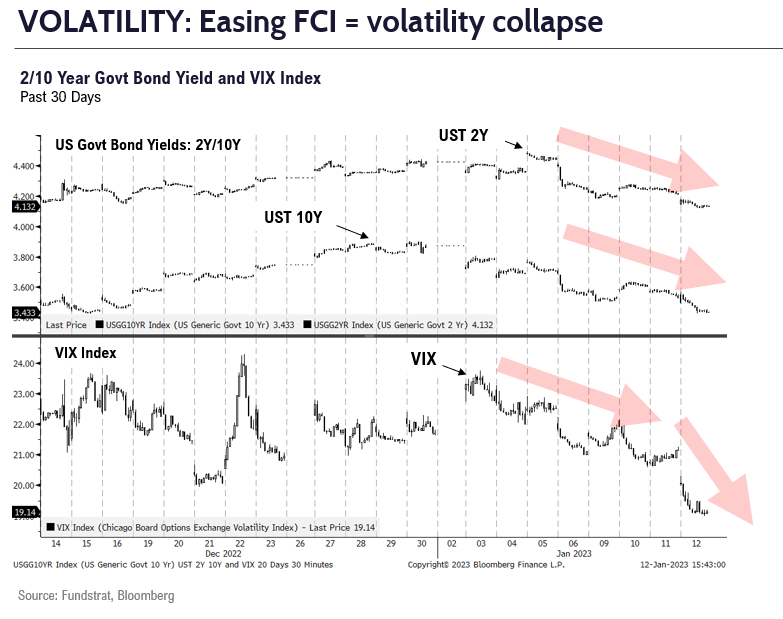

This means there are more reasons for volatility to fall – the Fed has less pressure to re-accelerate hikes, bonds already sniffing a “pause” than for EPS estimates to tank – weaker USD supportive and softish landing possible if labor is slowing.

- As we noted in our 2023 Outlook and in subsequent pieces, the key to 2023 is more dependent on the former. That a drop in VIX will be more influential for stock returns than EPS (see analysis below). And the VIX averaged 25 in 2022, and we think it could fall below 20 for most of 2023.

- It already is happening. With yesterday’s CPI report, the VIX fell 9% to sub-19. Our past analysis shows that in the past, this implies stocks could gain >20% in 2023. And with the strength in first 5 days, this case seems stronger.

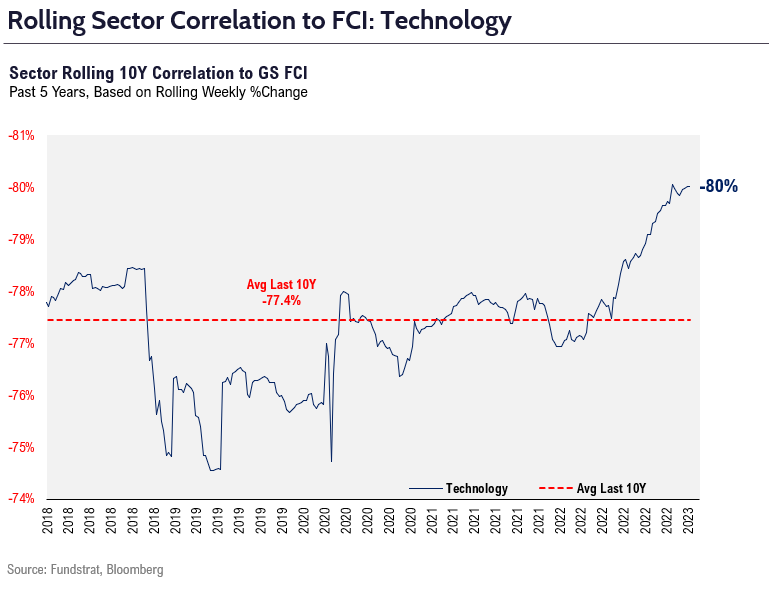

By the way, Technology has increasing sensitivity to easing FCIs, meaning if financial conditions ease, Technology should rally the hardest.

- SPX’s minor weakness really hasn’t done much damage. Upside resistance is 4120.

- I remain optimistic on Energy and on WTI Crude. I feel that lows very well could be in place for WTI Crude, and pullbacks after recent strength likely turn out to be excellent opportunities to buy dips.

- This new year has brought about a nice bump in small-caps which many feel should kick off a period of outperformance given their widely known discount to large-caps approaching the biggest in years. However, daily charts don’t support that small-caps have made enough progress to make this call.

- The U.S. equity market generally had a strong week on the back of additional inflation-related data that showed that the trend in moderation has continued, which has led to financial conditions easing quite a bit, as well as lowered expectations regarding the Fed and how much policy response is still remaining.

- In addition, the VIX has fallen nearly 15% since last Friday, also creating a tailwind for stocks. This certainly puts the hawkish/bearish forecasts under question.

- As we move forward, the news flow will begin to shift somewhat away from macro towards micro as the 4Q22 earnings season is now underway. There are some concerns from investors that the corporate-profit backdrop may be deteriorating. I am expecting the actual reports will not be a disaster and to be better than expected as is nearly always the case, but my main focus will be on the forward guidance that corporate managements will be providing for the coming quarters.

- Although it is challenging and frustrating to have the equity market go against one’s main thesis, my key indicators are not supporting the current bounce let alone significant upside potential from current price levels. Thus, I remain cautious and worried about downside risk.

- As I stated in my 2023 Year Ahead Outlook that I released this past week, there will be tactical opportunities for aggressive traders. Importantly, however, my work continues to flash that there is still unfinished business to the downside, and that strategic investors will need patience. The tug of war between Doves/Bulls vs Hawks/Bears is likely going to be playing out for at least a few more months based on my work.

- After a December in which they outperformed the SP 500 by as much as 3%, we see conditions in January continuing to favor value stocks.

- Similarly, conditions for growth stocks seem to be steady for this month; they underperformed, and we do not see that changing.

- Momentum continues to favor low volatility stocks, and we continue to recommend overweighting them this month.

- As earnings season gets underway, with the continuing growth in importance in stock picking, we think the large differences in how the market treated “beats” and “misses” in 2022 will persist into 2023.

- Cryptoassets performed well following the soft CPI print, suggesting that crypto’s correlation to macro is not going away anytime soon.

- We continue to monitor the discount to NAV of GBTC, Grayscale’s bitcoin trust, which has compressed from nearly 50% to 35% at the time of writing. It could very well be the case that inflows are due to speculation of an impending redemption event.

- This week’s follow-through in price action is certainly encouraging, and barring any forced liquidations from DCG, there is a high probability that the absolute bottom is in for crypto prices.

- Treasury Secretary Janet Yellen has officially advised the House that the United States will hit the statutory debt ceiling on January 19, though she did not provide a “drop dead” date.

- The House approved the creation of a new Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party in a bipartisan vote.

- It is mostly a formality, but new House Speaker Kevin McCarthy officially invited President Biden to appear before Congress on February 7 to deliver the State of the Union address.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- Markets posted their best week since November, with the Nasdaq up six days in a row to close the week up 4.82% to 11,079.16. The S&P rose 2.67% this week to 3,999.09.

- Thursday’s December CPI release showed inflation continuing to moderate, marking the third consecutive month of downside reads.

- Earnings season officially began on Friday, with big banks kicking things off by warning of challenging economic conditions for 2023.

Good evening:

The markets opened strongly this week in hopes that Thursday’s CPI reading would be soft and convince the Fed that previous rounds of rate hikes had achieved the desired effect. The release met Street expectations, marking three consecutive months of downside reads. Yields dipped, with the 2-year falling to 4.151% within a couple hours of the release.

As Head of Research Tom Lee has previously noted, the 2-year is considered a proxy for where the bond market thinks the Fed needs to be; it remains to be seen whether the Fed will be convinced. Head of Portfolio Strategy Brian Rauscher is not so sure. In his 2023 Portfolio Strategy Outlook webinar, which took place on Thursday, Brian shared that he believes that the Fed will continue to stay on a “higher for longer” course, with a terminal rate between 5.25% and 6.0%. Brian also cited corporate earnings concerns as he forecast a challenging 1H2023, with the market approaching what he calls “THE bottom” before heading back upward later in the year.

Head of Technical Strategy Mark Newton acknowledged the possibility that a meaningful rally has begun this week, but he observed, “Treasury yields look to have bottomed, and the rally in many sub-industry groups like Retail, Autos, Casinos looks to be nearing resistance to sell.”

Meme stocks made a comeback this week. Although Bed Bath & Beyond warned last week that bankruptcy was a very real possibility, and then opened Tuesday with a quarterly report that significantly missed (already low) expectations, the stock bounced, up 136% for the week (though down significantly from Thursday’s high) as meme-stock traders once again piled into the markets, lifting previous meme names like AMC Entertainment (up 30% for the week) and Gamestop (up 23% for the week) while they were at it.

Earnings season began on Friday, with big banks opening the quarterly reporting. For the most part, they beat profit expectations but warned of challenging economic conditions for 2023. JPMorgan and Bank of America both saw a high likelihood of a mild recession and the possibility for worse. Though the warnings weighed on stocks temporarily, investors decided that the news had already been priced into the markets, and they rebounded to close the day up.

Raising the debt ceiling became a more pressing matter for Congress on Friday as Treasury Secretary Janet Yellen officially notified Congress that the United States would reach its statutory debt limit of $31.381 trillion on Thursday, January 19, 2023. Yellen said that after that limit was reached, the Treasury Department would be forced to “take certain extraordinary measures to prevent the U.S. government from defaulting on its financial obligations.” Our Washington Policy Strategist Tom Block warned us that these measures “can only stop the inevitable for a few months.”

Elsewhere

The World Bank said the world was “perilously close” to a recession, with 2023 global economic growth forecast at 1.7%, the lowest since 1991, excluding the 2008 GFC and 2020. The predictable factors were blamed for this: the COVID pandemic, the Russian invasion of Ukraine, and higher interest rates.

The central bank of Switzerland reported the largest loss in its history in 2022, losing CHF 132 billion ($143 billion), roughly 18% of the country’s GDP. The loss, which eclipsed the previous record of CHF 23 billion ($24.8 billion), was attributed mostly to the Swiss National Bank’s foreign currency positions.

Britain’s Office of National Statistics reported that the UK GDP grew unexpectedly in November, by 0.1% MoM. The boost was attributed to the World Cup, which resulted in many Britons going to restaurants and pubs to watch the games.

Emmanuel Macron began another attempt at reforming France’s generous pension system and lowering its burden on the economy. Macron on Tuesday proposed raising France’s retirement age from 62 to 64. His last attempt at pension reform, in late 2019, sparked nationwide protests that forced him to back down as the COVID pandemic arose, and the country’s powerful labor unions have promised more of the same this time, with strikes planned next week.

Western allies appear to be considering assisting Ukraine with more powerful armaments in its fight against Russia, despite earlier worries that doing so might be seen as provoking Russia and escalating the situation. In addition to recent decisions to send Patriot anti-missile systems and armored combat vehicles, news outlets are reporting that plans are afoot to send modern tanks as well.

Still more storms are scheduled to menace northern California this weekend, as they have nearly non-stop since late December. Many parts of the state have been hit by as much as 30 inches of rain, along with hail and windstorms, since the catastrophic weather began. The weather has been blamed 19 deaths and as much as $1 billion in damage. Some can expect as much as eight inches more in the next five days. President Biden has declared a state of emergency, freeing the way for federal disaster relief.

For those of our subscribers in affected areas, all of us hope you stay safe.

And finally …

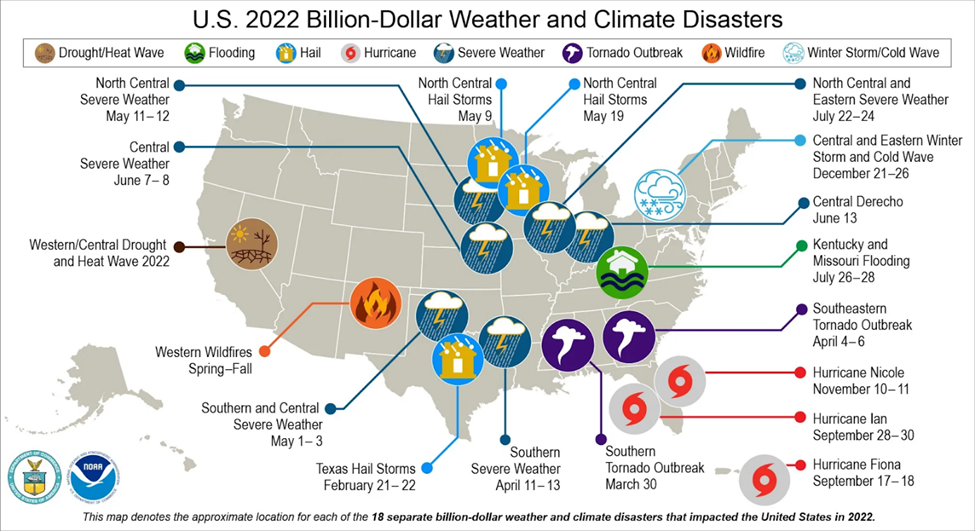

NOAA reported $165 billion in weather-disaster costs in 2022, including 18 events that each caused in excess of $1 billion in damage. By far the most costly was Hurricane Ian, which caused $112.9 billion in damage when it hit Florida, South Carolina, and elsewhere at the end of September. A yearlong drought throughout the western and central states was next, causing an estimated $22.2 billion in damage.

Reminder: In observance of Dr. Martin Luther King Jr. Day, our offices—and U.S. markets—will be closed on Monday, January 16, 2023.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com.

Important Events

Est.: -5.0 Prev.: -11.0

Surveys the opinions of about 200 business executives in New York State regarding business conditions. Conducted by the New York Fed, the survey uses 0.0 as a neutral-opinion reference point.

Est.:-0.8% Prev:-0.6%

Measures the change in the total value of retail sales – an indicator of consumer spending.

Est.: 0.0% Prev.: 0.3%

Measures the change in selling prices received by companies for their output.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+6.45%

|

+1.34%

|

+102.14%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||