Markets Post Best Month Since November 2020

- The S&P 500 closed at 4,130.29 the same week that nearly $8 trillion in Big Tech market cap reported earnings, which were largely positive. The VIX fell once again, this time to $21.42.

- The S&P has climbed more than 11% from its low point in mid-June, and both Tom Lee and Mark Newton believe we have already bottomed for the summer. Meanwhile, Bitcoin has hit a six-week high, and the Nasdaq had its best month since April 2020 by climbing nearly 13% in July.

- The Fed hiked interest rates by 0.75 percentage points for the second consecutive time to fight 41-year-high inflation, though the market has rallied on expectations of shallower Federal Reserve monetary tightening.

Good evening:

Markets moved higher for the second consecutive week — and it was a big one. The Federal Reserve hiked interest rates. Big Tech reported earnings, and Apple has reached its highest level in nearly four months after posting FQ3 results that were better-than-expected and saying sales should “accelerate” in the current quarter despite U.S. economic uncertainty. “There is no obvious evidence in our data that there is macroeconomic effect on iPhone sales… and we’re continuing to hire,” CEO Tim Cook said on an earnings call. “The situation on supply is improving,” added CFO Luca Maestri.

Buoyed by high oil and gas prices, the energy sector is expected to have swelled earnings by more than 250 percent in the second quarter. Exxon Mobil and Chevron, the U.S.’s two largest oil companies, reported record profits Friday, with Exxon’s profit more than tripling from a year ago. All told: The S&P 500 gained 3.9% on the day of the Fed hike (Wednesday) and the day after (Thursday), the best rally after a hike going back to 1970, according to Bloomberg.

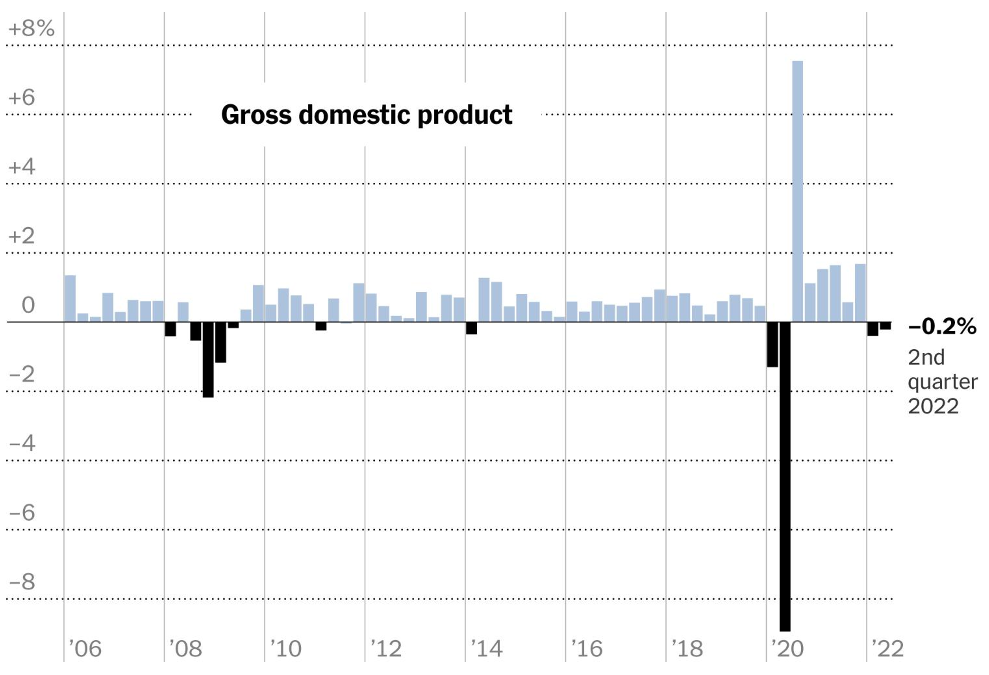

Bitcoin also has rallied from its June low, and Ethereum has nearly doubled since its mid-June low. Real GDP shrank at a -0.9% annual rate in Q2, driven by a decline in consumer spending and private inventories, as well as weaker housing and business investment. But markets are shrugging off the recession fears that dominated headlines earlier this summer. Investors are now betting on a slightly more dovish Fed, with a more moderate pace of rate hikes.

On Thursday, several of our research heads gathered for our weekly discussion to discuss the Fed, earnings, and their outlooks for August. Here are the highlights:

Mark Newton, Head of Technical Strategy: ‘We’ve seen the bottom for the summer’

Newton said there has been such a bearish level of sentiment in the market that the confusion around what the Fed is doing could drive stocks higher, which we’ve seen over the last month. Technology and Discretionary have been two of the best-performing sectors. Though GDP surprised again to the downside, markets climbed higher Thursday.

“The bigger picture is that stocks have been acting a lot better, and people are still largely in denial because of all the correct statements about revisions coming down,” Newton said. “Those are accurate, but that doesn’t really tell you how to make money in the short run. For the time being, I still think Equities are fine. S&P likely gets to 4085, we might pull back to 3800 into the middle part of August, but then I think we’re going to move up to 4200. The trajectory should still be higher into September-October and should not move immediately back to new lows, in my view.”

Newton continued: “I don’t see the benefit in being all that negative because people clearly seem to be caught flat-footed and aren’t participating in this move. FAANG has led. Apple has done very well. If you’re not involved now, a defensive tone is probably fine. Value could outperform over the next couple of weeks, but I would view pullbacks in Growth as a buy opportunity into the middle part of August. I’m expecting Tech to lead us higher in September/October.”

Newton noted that we already have bottomed for the summer, a view he shares with Tom Lee, and his work shows we could rally into the fall. An area to keep an eye on is solar and clean energy, which is breaking out. TAN, the solar ETF, is up about 23% in the last month alone and up 9% YTD, well outpacing the broader market.

Brian Rauscher, our Head of Global Portfolio Strategy, interjected when Newton said we have bottomed out. Rauscher asked what makes the latest low different from the previous lows amid the 2022 downtrend.

Newton listed 3 reasons:

1) The technology move off of the lows has been more explosive

2) Sentiment is more negative than in February and May, both about the market and economy (recession fears)

3) The move off lows has been more broad-based: Various groups have moved higher, including Discretionary

Added Newton: “People seem to be all in confusion as to what the Fed is doing, and that’s a recipe to be long in my view. You can make money investing when everybody else is confused or negative.”

Adam Gould, Head of Quantitative Strategy: This rally could have more legs

Gould’s models show the market is still slightly overvalued, but not nearly as much as it was. Much of where we go next, he says, depends on earnings estimates. In the short term, Gould agrees with Newton in that the market rally could “have some more legs.” The retail sentiment indicator he tracks remains low, which could be a contrarian signal we will continue to move higher.

“Positioning wise, there’s really not a lot of demand for out-of-the-money puts, so investors, in terms of options positioning, are not positioning for downside,” Gould said.

Gould’s valuation framework shows the market is overvalued. But the 10-year yield falling corresponds to an increasing multiple, which in turn corresponds to a higher fair value for the market. That’s now about 3850, Gould said.

“It all comes down to consensus earnings estimates,” Gould said.

Brian Rauscher, Head of Global Portfolio Strategy and Asset Allocation: The story hasn’t changed

“The big story for me hasn’t changed. The revisions keep weakening.”

Rauscher, who turned from bullish to bearish this spring, has continued to reiterate his view that the next move is around 3500, which is at odds with Lee’s and Newton’s views. Rauscher said he has spoken with many investors, economists, traders, and equity strategists this week, and “the views are all over the board” about the Federal Reserve and Chair Jay Powell’s plan into the fall.

“Three-quarters of the people do not actually think Powell was dovish,” Rauscher said. “All told, I’m going to stay where I am. We still have some unfinished business to go down. The higher we go up maybe lowers the odds of my scenario that we go through June lows. I don’t see anything changing. The employment data we will get in a week won’t show the labor market deterioration.”

“I’m sticking with it,” Rauscher said of his call that the market is headed to the 3500 range. “You can hear from my tone; my conviction level isn’t the same as what it was in recent weeks. But it’s going to be hard to stick this landing perfectly.”

Thanks for reading. We’ll see you next week.

By the way, we’d like your feedback. Please email thoughts and suggestions to inquiry@fsinsight.com.