Markets Sell-Off on Hot Inflation, Bad Consumer Sentiment

- The S&P 500 closed at 3,900.86 after the highest CPI reading since 1981 and the lowest University of Michigan consumer sentiment reading of all time. The VIX closed at $27.75.

- All sectors were down except for Staples which was essentially flat. Discretionary, Technology and Financials led to the downside, all losing more than 3%. The 10-yr rose to 3.154%.

- The US is to end COVID testing requirements for international travel. COVID cases are rolling over in Northeastern states.

- Gasoline was one of the biggest contributors to the high CPI reading. There doesn’t seem to be any immediate relief for high energy prices given the ongoing conflict in Ukraine.

Good Evening:

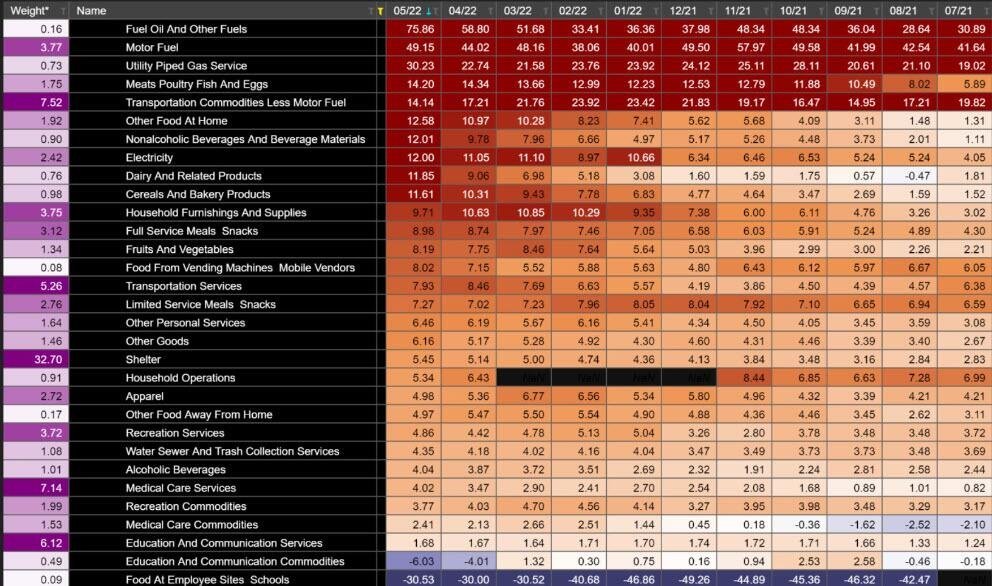

Markets were thrashed on Friday by a white-hot CPI print and also the lowest level for the University of Michigan Consumer Sentiment survey in the entire history of the indicator. Over the last year, Energy rose 34.6%, with gasoline even higher, and groceries jumped 12%, but the levels of inflation were pretty broad-based, even excluding these more volatile items. The print definitely make it a lot less likely that any doves will be taking flight at the Fed soon. Some market commentators even speculated the 75 bps hikes were back on the table for the Fed meeting next week in the wake of the concerning report. You can see below where the biggest increases were:

There were increases across the board. Apparel had a big rise and new and used car prices both continued to increase. Shelter also contributed a hefty portion to the MoM increases. There was a 0.6% increase in OER and rent prices. We’ve long mentioned this area of CPI can be stickier and more problematic because of its prominence in the average consumer’s wallet. There is also a massive travel boom under way. The cost of airline tickets has risen 48% in the last three months. Some had been expecting a mixed report showing progress in some areas mitigated by the hefty contributions of Food and Energy, but there was broad-based strength in price rises across the economy.

Some suspect the inflation debate may move away from whether the upward price pressure has peaked to how long these high levels can stay with us. This is an alarming report in some respects, but we still maintain there is likely some relief coming when we look deep into various data sources like employment and also housing. In some ways, this report may have been a perfect storm where the upward pressure was accentuated by a once-in-a-generation travel boom and of course the highest intensity conflict of the 21st century. There are initial signs of a cooling labor market and if wage inflation tempers, this can mean the Fed has more flexibility. One of the main things the FOMC would like to avoid is losing control of price stability because of a wage-price spiral.

One potentially mitigating factor for inflation was evident earlier in the week. Target pre-announced that it was further lowering its guidance after a devastating earnings report less than a month ago. The firm has inventories that are too copious and will need to begin discounting for the consumer. While this may show some consumers are having trouble with inflation and slashing expenses where they can, it is also a positive for inflation because the company needs to lower prices to burn off excess inventory.

While other pressures remain intact, Target is a massive economic barometer, and the return of a more volatile inventory cycle will likely give consumers some relief. Whether it is enough to turn the tide is something that will only be understood with the passage of time. The return of a more prominent inventory cycle, which had declined because of technology and just-in-time-supply chains, may lead to a reversal in inflation sooner than today’s events would suggest.

As our Head of Research Tom Lee pointed out earlier this week, when Chairman Volcker successfully broke the back of inflation in the early 1980s, the deciding factor was goods coming down. Target and Walmart experiencing the inventory issues that they are is a major factor in alleviating inflationary pressure for the US consumer. These companies have massive real-economy footprints and are a good barometer for how consumers in the lowest three quintiles of income are dealing with rising prices. The consumer is down but not out.

Let’s remember that even if inflation doesn’t subside, as we think is likely from soft data, stocks are still one of the best places to put your capital to work in an inflationary environment. Asset-heavy stocks have been a natural hedge against price pressures. There could be some chop in the coming weeks and recent lows could be tested or broken. Technology and FAANG may struggle over the short term because of the upward pressure on rates. Remember that times when fear is pervasive in markets always pass, and that investors have the best odds when they have a longer time-horizon. We will be working tirelessly to give you the best analysis possible to help you navigate these tricky markets.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 9cf6b0-a6820e-5f4cd9-3efcbe-469997

Already have an account? Sign In 9cf6b0-a6820e-5f4cd9-3efcbe-469997