- The S&P 500 roared into the close Friday, closing positive on the day at 3,901.36. The VIX closed at $29.43.

- The S&P 500 has still fallen seven weeks in a row, its longest losing streak since 2001. It recovered from its plunge into bear territory, but it’s still down 18% this year.

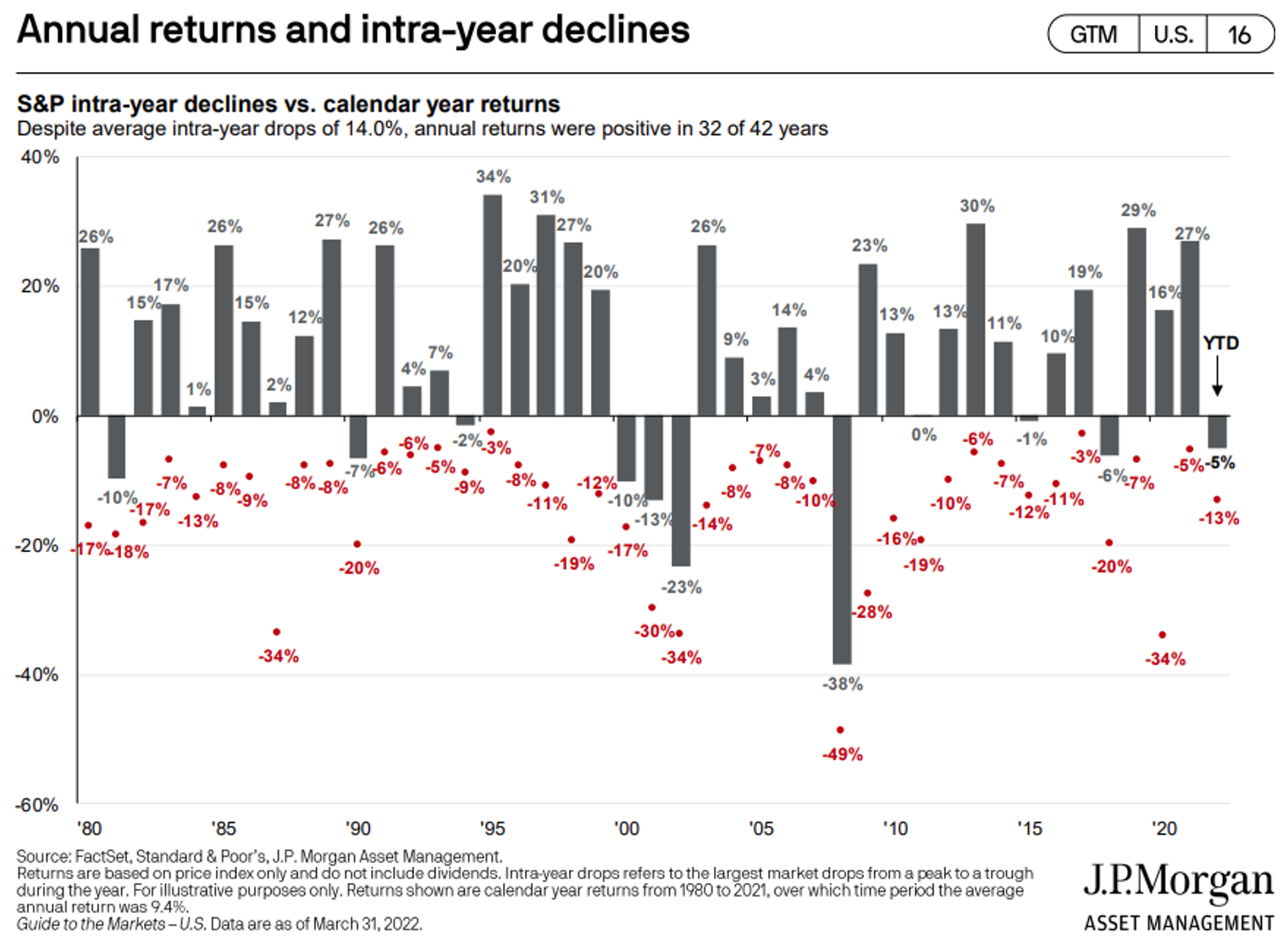

- 2022 is a midterm year, which typically experience a 17.1% average drawdown from peak to trough. When considering market cycles, this midterm year isn’t much of an anomaly.

- Our research heads gathered Friday morning to make sense of this market and identify key trends as we approach the summer.

Good Evening:

“If you’re invested in security and certainty, you are on the wrong planet.” – Pema Chödrön

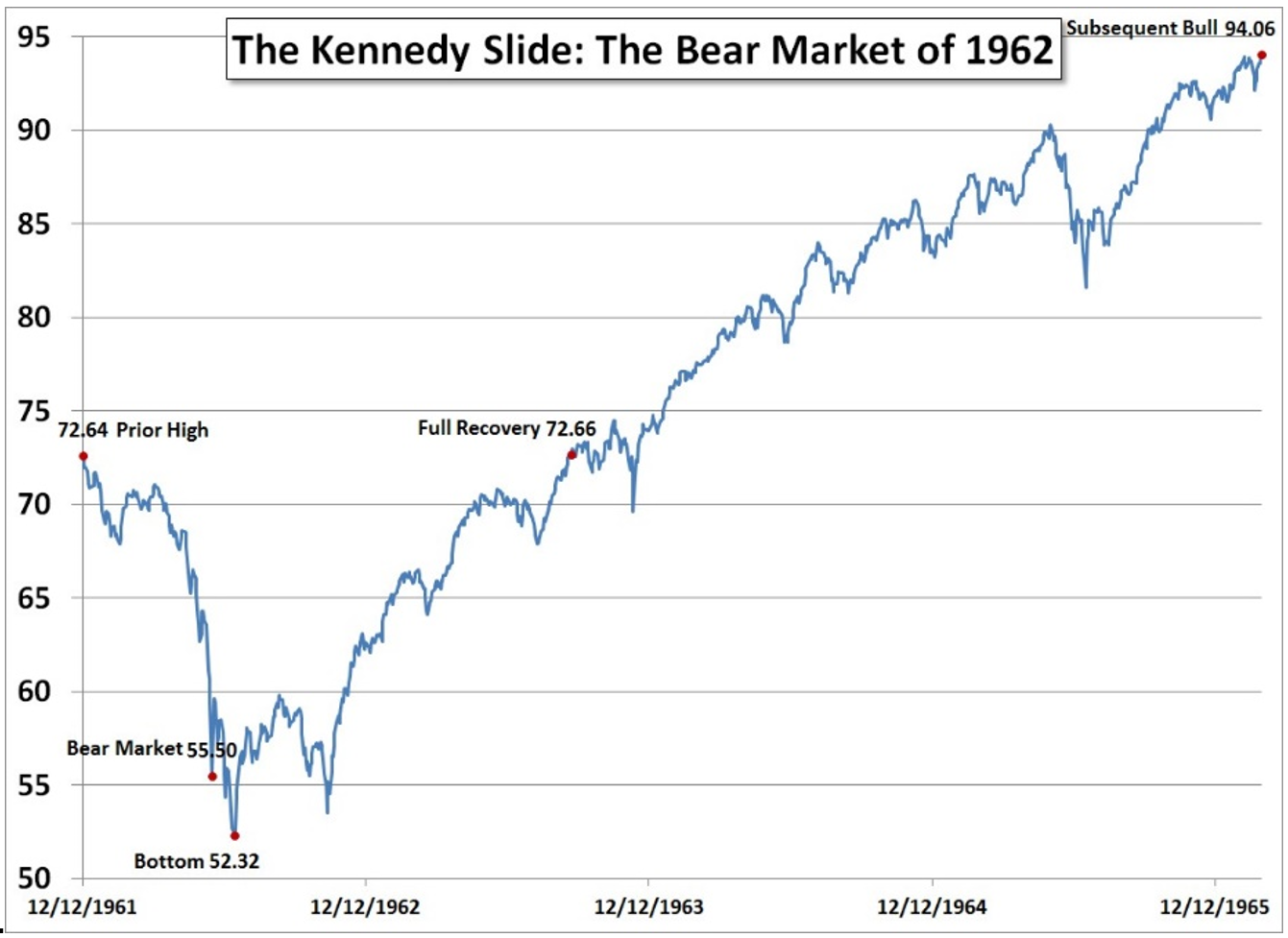

During our Friday morning meeting in New York, Mark Newton, head of technical strategy, drew a fascinating comparison between this environment—one of the more treacherous we’ve seen—and that of 1962. It was President John F. Kennedy’s second year in office; midterm years are historically a rough year for the stock market, and 1962 and 2022 are no outliers. Consider that from 1900 through 2021, the median annualized returns were:

–12.7 percent in year 1

—3.1 percent in year 2 (midterm year)

–14.8 percent in year 3 (pre-election year)

–7.4 percent in year 4 (election year)

It’s no surprise, then, that the Kennedy Slide of 1962 was marked by a 22.5% decline in the S&P 500 before it came roaring back higher. It’s also no surprise, then, that we’ve encountered declines in the first five months of 2022. A large chunk of our research is rooted in cycles, which makes these similarities noteworthy. The past is no indication of the future.

But there’s reason to believe we will experience a similar year to 1962: choppy first half, strong second half, a view our research heads have held since the beginning of this year. They’ve believed the first-half turbulence would precede clearer skies. As our Tom Lee said in December, the first half of this year would be “treacherous.” At FSInsight, our consensus remains: The turbulence will continue in the short run, but the ensuing few weeks will set up long-term investors with attractive entry points, especially if they’re able to stomach short-term downside.

“My cycle work suggests June 24 is when this whole pullback should bottom,” said Newton, who predicted in January that the S&P 500 would fall to 3815 by mid-year. “I think we stay choppy for June then rally into September. I think June to September is literally straight up… We’re in the eighth inning of this decline. But you still need to be careful. A lot of the cycle work that has led us down should start to bottom and turn higher. This year should be a spitting image of 1962.”

“I still think the second half of the year will be much, much better. I think the second half of the year, stocks will be higher. Trying to pick lows in this downtrend, though, is a sucker’s game. You must let breadth and momentum stabilize. I am not a doom-and-gloomer for the year. I think we’re three-fourths of the way through the selloff for this year.”

A few other notes that stuck out from our Friday meeting, an assembly of our talented research heads:

1. As the saying goes, markets often take the stairs up and the elevator down, and we’re on the elevator right now

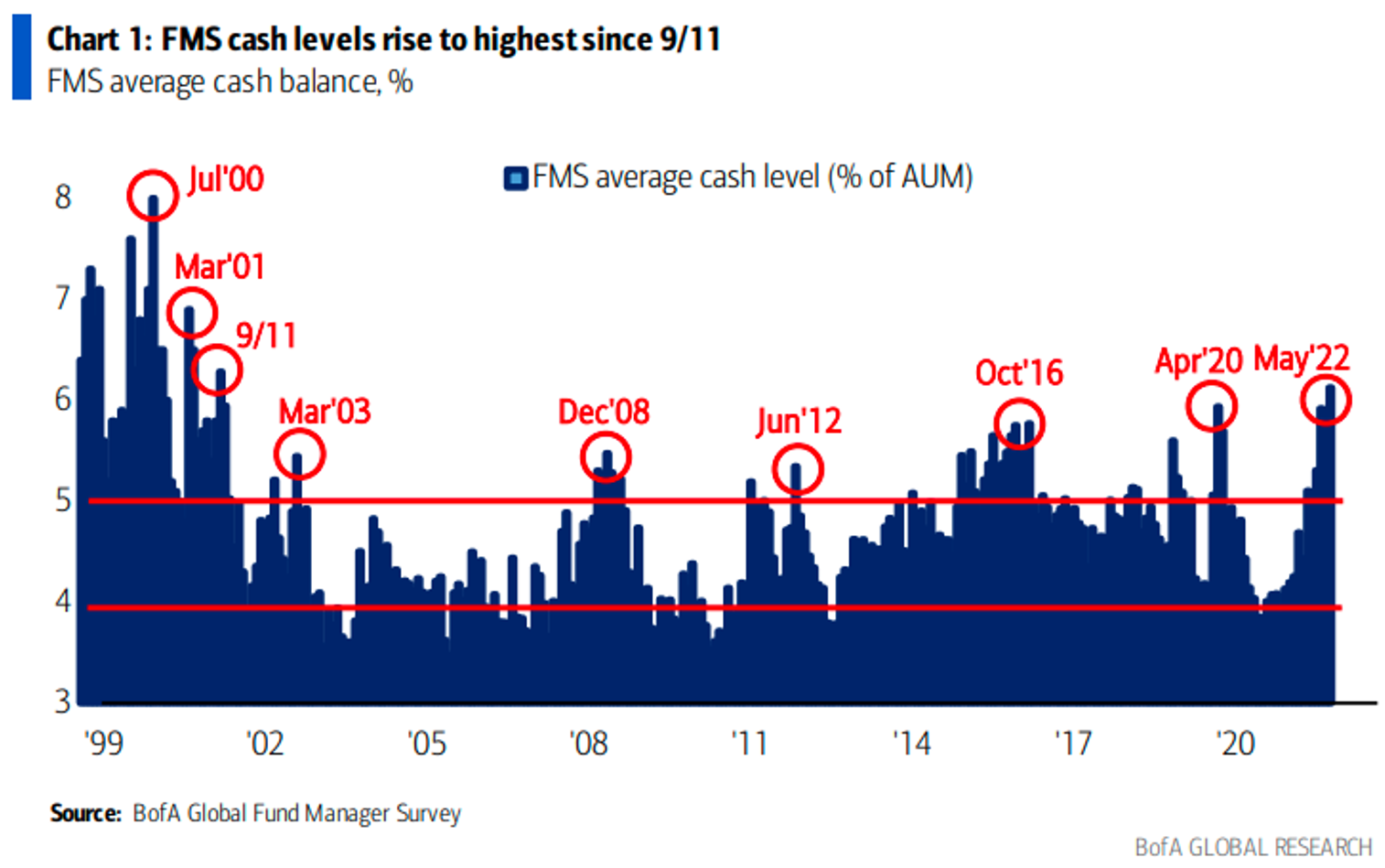

As the Federal Reserve continues to signal its hawkish stance for 2022, the American Association of Individual Investors (AAII) survey shows significantly more bears than bulls. The most recent BofA Global Fund Manager Survey shows we have the lowest reading of “managers expecting a stronger economy” since the Great Financial Crisis. The last time average cash balances were this high? The dotcom bubble burst, back when stocks like Yahoo went from $237 to $11 in 15 months. Ouch. Still, the pain persists across markets, with seemingly nowhere to hide.

This week, Walmart had its biggest daily decline since 1987. Target also missed on earnings, and its stock sunk 30% this week. The entire retail sector was hammered, including traditional safe havens like Costco. One day the Dow Jones is up 800 points, the next day it’s down 1,000. As Charlie Munger recently said: “If you’re not confused right now, then you don’t understand what’s going on.”

The good news for optimistic long-term investors? Every recession and bear market has paved the way for good fortune, with economic expansion and new all-time highs. Since 1928, for example, the S&P 500 has averaged one bear market every four years. If you round up this year’s decline (S&P peak to trough drawdown this year hit 20% briefly on Friday), this is the third bear market in less than four years. Late 2018, March 2020, and early 2022 have all seen declines.

Yet over the past 73 years, there have been 13 bear markets with declines averaging 25.8% before markets recovered. Fourteen bull markets have transpired since 1949, lasting an average of 50 months and gaining an average of 136%. Patience usually pays, and downturns historically have represented the greatest opportunities to buy quality U.S. Equities. The question, though, is when the bottom is in.

“My No. 1 message to clients: Until I see change in my work, all rallies are to be sold,” says our Brian Rauscher, head of global portfolio strategy and asset allocation. “Once rallies start, we’ll use some tactical tools to find when these rallies will fail and those rallies can then be faded, shorted. I continue to have the message that this is not a hide-under-your-desk scenario where you need canned foods and water like I was saying during the Financial Crisis.

“The bigger message is this: We still have a lot of headwinds in front of us. We have the Fed; we have these estimate cuts. The economy will slow. These headwinds are not going away anytime soon. You must have comfortable shoes. The tug of this market is still down. This market is going lower. Where Tom (Lee) and I have diverged is this: He’s still looking for choppy and volatile, and I’m looking for that but to a greater degree. But we both agree there will be a great opportunity in the future.”

2. Short-term bets include Healthcare, Pharmaceuticals

While there might not be anywhere to hide this month, both Rauscher and Newton believe Healthcare is the best place to be for the next couple of weeks. Pharmaceuticals are leading the way, with stocks such as Pfizer (7% in last month) and Amgen (9% YTD) performing relatively well. June and July are historically strong months for healthcare, months in which the group almost always outperforms.

Pharma names are an excellent spot to hide,” Newton said. “If I had to pick one spot, I’d be in healthcare. You can start to nibble on technology when we get evidence rates are rolling over, which might take a couple of weeks. For the time being, you hide out in healthcare.

“Technology has started to outperform on a relative basis, which is a new development. We could see a shift where Tech bottoms quicker than the other parts of the market, and we could see a rotation where growth starts to rally. I think it’s a little early for that, but I think we’ll be there within a few weeks. Further, I do think we’re closer to a short-term low in the market, which could appear around the beginning of June. I don’t think the bottom is in now. I do think we have another flush before we move higher.”

3. Bitcoin is still holding up relatively well

“Be fearful when others are greedy. Be greedy when others are fearful.” – Warren Buffett

Sean Farrell, our Head of Digital Asset Strategy, dialed into our Friday meeting from West Palm Beach, Fla., where Permissionless 2022 is being held. The largest DeFi conference in history, Permissionless 2022 comes at any interesting juncture in Bitcoin’s emergence, with inflation at its highest levels in decades. Last week, institutions funneled $299M into Bitcoin funds, good for the largest inflow since October 2021 and the 19th biggest since records began in 2015. An all-time high 65% of BTC hasn’t moved in at least a year, despite BTC being down about 40% YTD, hoovering around $29,000.

“A lot of people who bought in November, October, when Bitcoin was in the 50s and 60s, they’re selling now,” Farrell notes. “But with a time horizon beyond a few months, there’s no reason to be cute here. You can go shopping for Bitcoin, Ethereum, the Solano’s and Avalanches of the world. There’s still a lot of near-term risk, and we probably get another peak down before we go back up. With a longer-term horizon, this is a good opportunity.”

Newton, our technical strategist, also chimed in, noting the Bitcoin price has fallen for seven straight weeks, a new record. BTC fell to around $26,000 last Friday, a decline of around 60% from November’s all-time high. We can’t predict the future, but there have been five major market resets since BTC’s launch in 2009. Investors with a long view have been handsomely rewarded every time.

“If the S&P falls some more, that should create one final flush and a great buying opportunity for BTC,” Newton said. “There’s a lot of bearishness, and we should be approaching a time when you really want to buy into that in the next couple of months.”

Wishing everyone a wonderful weekend,

FSInsight Team