September Was Worst Month of The Year, But First Day of October Was Strong

Key Takeaways

– S&P 500 closed at 4,357.04 this week, which was down from 4,455.48 last week.

– We explain why, like many things, the piece of wisdom that stock valuations have to decrease in the face of rising rates is not as simple as you’d like to think. Look at data.

– The market had the worst month of the year, losing nearly 5% in September. The VIX has behaved pretty well and has now collapsed to just over $21 after peaking at $25.

– As we said last week, we saw evidence that there would be elevated volatility. The strength in cyclicals and Epicenter is encouraging and Merck therapeutic bullish.

________________________________

“That Professor Goddard, with his ‘chair in Clark College and the countenancing of the Smithsonian Institution, does not know the relation of action to reaction, and of the need to have something better than a vacuum against which to react – to say that would be absurd. Of course, he only seems to lack the knowledge ladled daily in high school.” -The New York Times, January 13, 1920

Robert H. Goddard is considered the father of modern rocket science. He built and tested the first liquid fuel rocket amongst other things and is the namesake of NASA’s Goddard space flight center in Greenbelt, Maryland. The ridicule he received above is a great lesson that many of our greatest innovators have been treated like pariahs or idiots before we collectively accept their counterintuitive wisdom.

He is now considered a titan of innovation and one can only imagine his delight if he were alive to see recent mind-bending strides in the science he was instrumental in founding. However, Goddard and his insights can give us a good lesson about how innovators can sometimes be treated by a misinformed consensus. As Ulysses S. Grant, savior of the Union and one of our country’s greatest military heroes, once said, “The most confident critics are generally those who know the least about the matter criticized.”

In 1919, Goddard wrote A Method of Achieving Extreme Altitudes, which has become an important and formative text in physics and rocket science. It was an extremely technical paper. He postulated in this paper that rockets could be used to change direction effectively in the vacuum of space, something which we take for granted with hindsight.

There were some editors at the New York Times who thought themselves experts on Newton’s third law, the most ridiculing portion of their criticism is above. On January 13, 1920, the editorial on page 12 of the New York Times attacked Goddard’s ideas viciously and impugned his intellectual integrity.

This should not be plastered on to today’s political disputes, rather it should let you know that, just because an opinion is widely held or comes from a source that is trustworthy, sometimes the innovators and leading minds who help save humanity from stagnation and internecine madness are those who view things differently than consensus is even capable of imagining.

Leonardo Da Vinci said, “All our knowledge has its origins in our perceptions.” So, if you’re not recognizing the limitations caused by your individual perception and you are not learning from and listening to people with different perceptions, you are likely going to make some very big mistakes in investing. Media has gone toward becoming an echo-chamber. Consuming media in this way on your investments can be disastrous. You have to hear both the bear and bull case to make an informed decision, in our opinion.

It’s easy to pillory the New York Times, but they were making a human mistake that literally every single one of us can make. It’s not easy to come through with breakthroughs about the laws of physics. For every Newton, Einstein and Goddard there are millions of people incapable of ever having such insights and ultimately these rare treasures of our society contribute through their idiosyncratic perspective that can sometimes be caused by the rarest alignment of circumstances in time and space.

The New York Times opinion reminds us of something that’s been widely quoted as knowledge that is simply wrong. People have been saying, “Well, stocks have to go down because interest rates have risen quickly.” Balderdash say we. We also have spent some time doing the homework on what has happened in the past to support this conclusion.

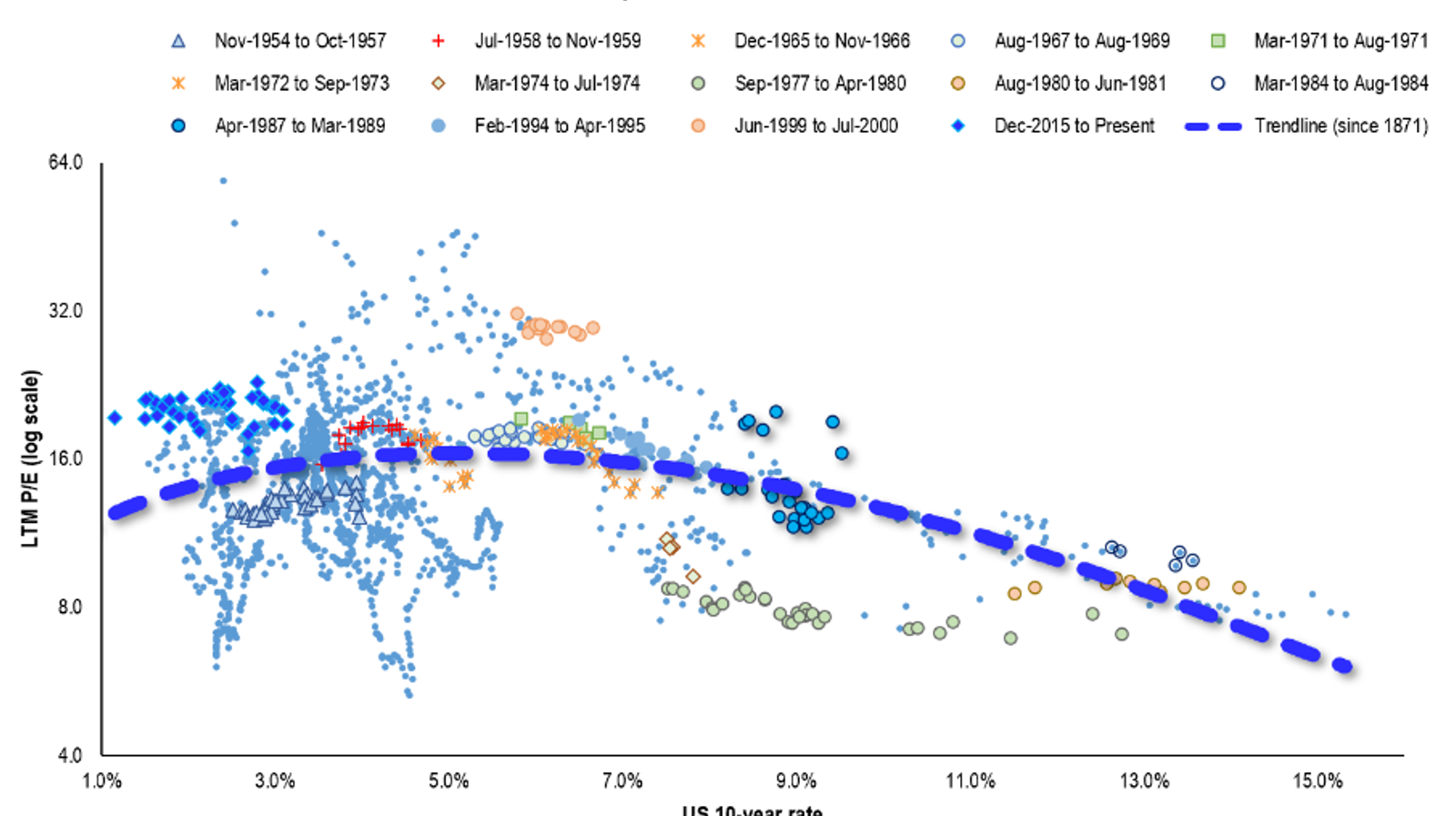

Many in financial media have been giving you an authoritative explanation seeming to pass logical muster about P/Es going down because rates are going up. It sounds right, but it’s not. Even when adjusted for tightening cycles, the relationship is supported by historical data. P/E ratios have historically risen with interest rates

until about 5% on the 10-YR.

Not only do stocks generally continue rising with rates in history until a much higher level, we also had our new Quant-In-Chief, Adam Gould, do some analysis showing very reasonable paths to FAANG continuing to expand their margins despite increasing rates.

So, when you hear what is common knowledge and you think you might be an idiot for disagreeing, remember what the New York Times said about Robert Goddard. Don’t expect if it takes people who were so certain a while to apologize or admit the error of their thinking, many might wait until the last possible minute.

“A Correction. On January 13, 1920, ‘Topics of the Times’ an editorial page feature of The New York Times, dismissed the notion that a rocket could function in a vacuum and commented on the ideas of Robert H. Goddard, the rocket pioneer. Further investigation and experimentation have confirmed the findings of Isaac Newton in the 17th century, and it is now DEFINITELY established that a rocket can function in a vacuum as well as in the atmosphere. The Times regrets the error.” – The New York Times, July 17, 1969

Definitely a satisfying piece of humble of pie for Dr. Goddard, but we’d also note the date of the correction. It was printed on July 17th, 1969. By the time of the correction Neil Armstrong, Buzz Aldrin and Michael Collins were already well on their way to the Moon and only three days away from making one of the most significant achievements the human race has ever accomplished. The apology, we’d say was a little late. Don’t ever expect them to be early, you should be the early one if you want to make money investing ahead of the crowd.

The recent volatility certainly has to do with rates. They did rise quickly, but maybe they rose quickly not because of disco stagflation fears after Powell’s admission of persistent inflation above estimates, but because the growth story is not done playing out. We think peak growth is ahead. The Merck news today of a therapeutic is the best news we’ve gotten in a while on the Healthcare front. Even our staff see a thriving and vibrant Las Vegas. Everyone has masks on, and guess what the place is still popping like it’s 2005.

The bond market is sending a different message than the paper-hands panic in equity markets. We still, decidedly see things as glass-half full. We don’t think Epicenter sectors would have held up as well as they did over the past month, particularly Energy, if there were major concerns about an economic slowdown. We would reiterate the data is saying pent up demand is being shaken up like a soda can, not destroyed.

We know September was tough, but we think it’s a mere squiggle. Are the inflationary pressures strong demand or stagflation? This is a key question for markets. We think strong demand. The concerns about vaccine penetration have largely been alleviated by new therapeutics now. This is a decidedly bullish development that makes us seeing the glass half full even easier than it was before.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In e1efa0-60e538-8149db-112822-516135

Already have an account? Sign In e1efa0-60e538-8149db-112822-516135