Markets Have Second Consecutive Week of Losses; Investing Lessons from The Yom Kippur War

Key Takeaways

– S&P 500 closed at 4,432.99 down from 4,458.58 last week. The VIX again spiked just above 11% to settle under $21, just like last Frida

– There was a spike in bearish sentiment in the AAII survey and a lot of analysts have been turning negative on equities.

– Oil continued to show strength and settled well above $70 on Friday

– The data picture continued to be muddled on inflation. Consumer inflation expectations rose to a post-crisis record while the Consumer Price Index showed a slowdown in August

__________________________

Firstly, we’d like to wish a belated Happy Yom Kippur to all who celebrated it. This week we will be reflecting on how the IDF snatched victory from the jaws of defeat decades ago and how this epic struggle teaches lessons about investing. There’s a lot more wisdom here that can be applied to investing then you might think. As Mike Tyson once famously said, Everyone Has A Plan Until You’re Punched in The Face.

One group who is definitely dealing with a punched in the face moment is Chinese authorities with the Evergrande fiasco. For a party who controls the country on a trade-off of freedom for prosperity, a financial crisis can be a very serious wrench in the gears. Keep an eye out on how this situation pans out to monitor what could end up as quite a big story.

The market is experiencing its 13th streak of 300 days or more without a five percent correction since 1928. A lot of strategists have been gaining a bearish tone and predicting a correction. One may happen, but how should respond when your screen is red? Do you retreat and sell everything or do you re-engage? Can you make sense of the fog of war and panic like Ariel Sharon did in October 1973? If you can, you’ll be infinitely better off. Panic is your enemy if you are panicking. If everyone else is panicking and you keep a cool head, well then it is your friend.

When you’re investing, you definitely will get punched in the face from time to time and how you respond, or don’t, will be crucial to whether you successfully manage these situations or allow them to result in catastrophe. Sometimes when you least feel like taking a risk is exactly when you should take one.

Fundstrat/FSI Staff attended the first major conference in New York City since before the pandemic. The SALT 2021 conference was a bullish event. Our staff and many people there noted feeling the value of human connection and gathering. Dr. Scott Gottlieb himself commented on the good protection measures made at the conference and it was a special thing to be a part of. Please check out our last two daily notes for summaries of the conference events and key issues for the markets of the future, which is what we should all, always be trying to prepare for.

The inflation debate remains undecided with very loud voices on both sides of the argument. For what it’s worth we saw many distinguished panelists at SALT, such as Steve Cohen, say he thought inflation was situationally dependent and likely transitory. The monthly rate of CPI change slowed down by about 40% from .5% to .3% and was only a third of June’s .9% rise.

You hear a lot of people and market commentators talking about competition. Competition is the lifeblood of capitalism and markets. The most extreme form of competition is war and thus it offers valuable insights for investing.

Many are familiar with the high competency and fearsome reputation of the IDF. Many may not be familiar with just how perilous the fate of Israel was during the early days of the Yom Kippur War in October 1973 when they were on the receiving end of a dastardly surprise attack on two fronts. Unlike the last war, the Egyptians enjoyed an umbrella of sophisticated Soviet SAMs.

The Israelis had achieved a decisive and quick victory 6 years earlier during the Six Day War. Perhaps because of this dramatic success, the Israeli military leadership underestimated the threat from their adversaries, who significantly outnumbered and surrounded them. Like the Israelis, we can be looking directly at a risk and miss the significance of it. The Egyptians hid their invasion movements under the guise of military exercises and chose to attack on one of the most sacred holidays. New technology like Saggar anti-tank missiles wielded by Egyptian infantry mitigated the prior dominance of Israeli armor. The consensus thought was divorced from reality on the ground, and only those who could see through the Fog of War, like wily General Ariel Sharon, could possibly help such a dismal situation.

The early days of the way were disastrous for the Israelis, and they suffered heavy losses. Sinister Arab-coalition goals to ‘wipe Israel off the map,’ looked as if it was becoming a real possibility. The situation looked so strategically dire that Israeli leadership seriously considered using nuclear weapons to beat back what seemed like an unstoppable tide. The Israeli Airforce, which had proven so dominant in the last war, had suffered extreme losses and only had enough resources to support one more offensive move, otherwise the nations’ population centers would be too vulnerable.

The Southern Front in the war is where Israel faced the far more numerous Egyptians. The setbacks of the following days had led the Israeli leadership that a 1967-type victory was unattainable and that they had to produce some turn of events against the Egyptians to even get a ceasefire. The Israelis needed a strong and risky offensive move to avert disaster and General Ariel Sharon. He had made disastrous and unauthorized attacks days before his famous maneuver and had even lost the confidence of his commander.

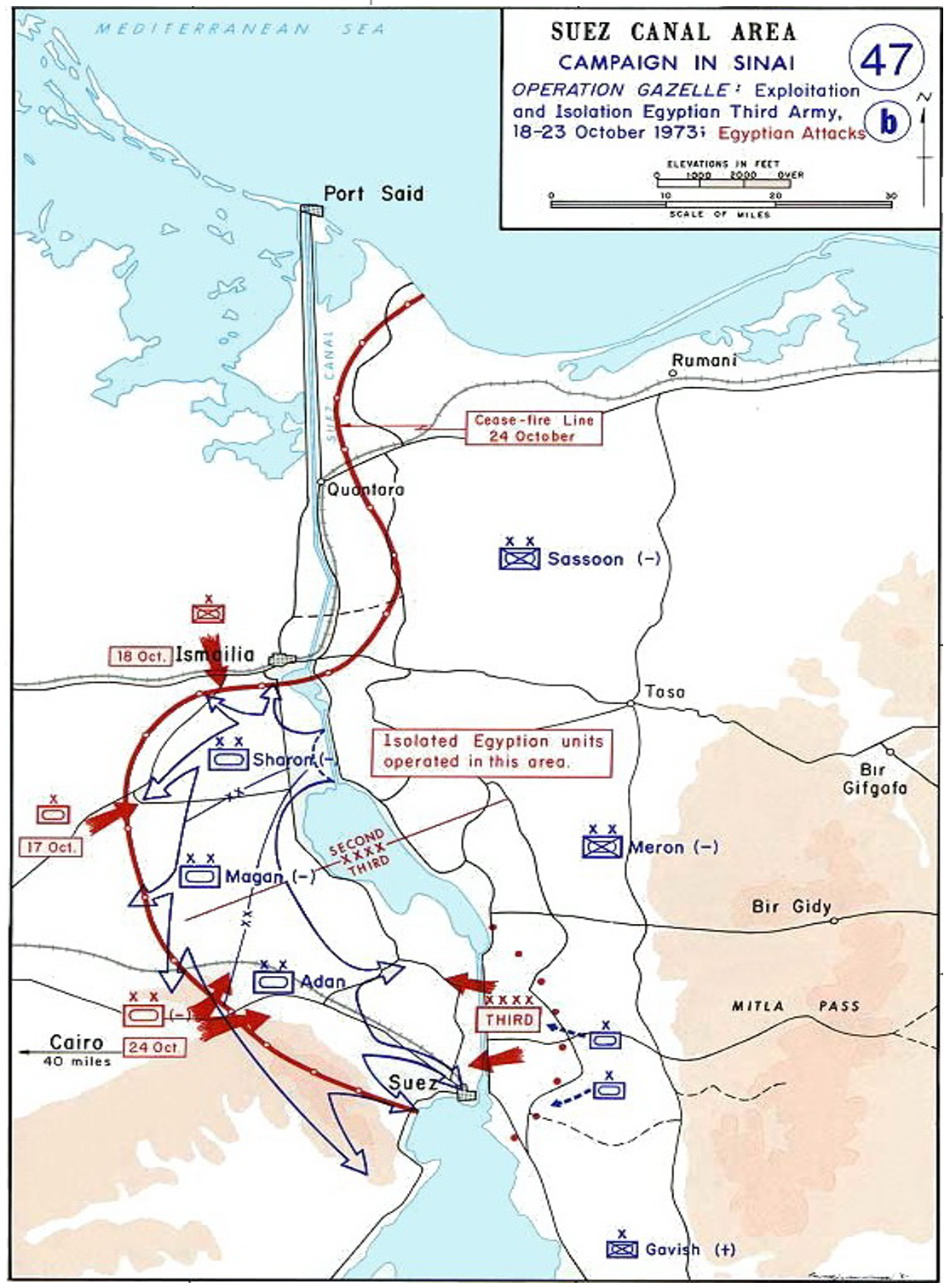

Israeli political leadership needed a victory on the ground to alter the situation. Despite recent failed attacks Sharon boldly and riskily crossed the Suez Canal with hundreds of tanks and thousands of men and against all odds surrounded the more numerous Egyptian third army. This bold move which many of his commanders chided saved the day and turned the tide of the war.

Ariel Sharon exhibited the traits of bold thinking that was against the grain. He didn’t wait until everything was certain and clear and knew that he couldn’t lose the initiative, or his country might lose everything.

The uninhibited competition of warfare is different than the tamer world of investing, but competition is competition and some of the same traits that lead to military success in tough situations are very much akin to the type of thinking, and understanding of you ‘enemies,’ or the things that can cause you losses.

Ariel Sharon perhaps takes the old saying of buying [attacking] when there is blood in the streets to an even more extreme level than the saying was made for, but we see congruence in successful investing and his vitally successful campaign that likely saved Israel from destruction, or at least a far longer war of attrition that it was not well equipped to weather.

How do we apply this logic? Well, the market is getting back signals. Delta has a foothold in the metaphorical Sinai and Epicenter stocks have undoubtedly suffered bad attrition. You may be feeling, like some in the Israeli defense cabinet did, that you should retreat and sue for peace before things get worse.

However, as history and Ariel Sharon have proven, this sometimes is the exact wrong instinct. When the risks you’ve taken has you on your heels, perhaps the exact right answer is to take bold and calculated risks to get yourself back on the right foot and to achieve victory in investing.

We know there is so much noise, so much data, so much conflicting opinions. This situation is like the Fog of War experienced during the heat of combat. Losing wealth isn’t the same as losing life, but the stakes are nonetheless of great consequence. Often our orientation gets challenged when we are operating in times of high risk and emotion, but it is important to remember that keeping a cool head during the times that are the most stressful and challenging is perhaps one of the most important skills that any investor can have.

While there are many headwinds to markets and a cornucopia of potentially problematic risks to choose from there are also amazing pieces of data that suggest we are building the foundation of a sustainable bull market helped along by generational factors, increasing wages, and the highest margins for non-financial margins since well-before the fateful conflict we just discussed.

Welcome to the jungle of human competition, friends. Never forget that you are competing, and you are fighting many simultaneous fallacies and shortcuts of thought whenever you are investing. You must control your instincts and keep your eye on the objective. Understand the bad, but also understand how to liberate yourself from groupthink, despondence and defeatism.

Delta has been bad, but YoY GDP Growth expectations have only gone down from 6.2% to 5.9%. The economic data is saying something different than the levels of fear investors are displaying. Things are much better than they were in March, yet people have the same level of fear. Perhaps this is a perfect opportunity to make your pincer move around an overly pessimistic consensus, or perhaps it is not. We see a lot more positives than a lot of the growing chorus of bears do.