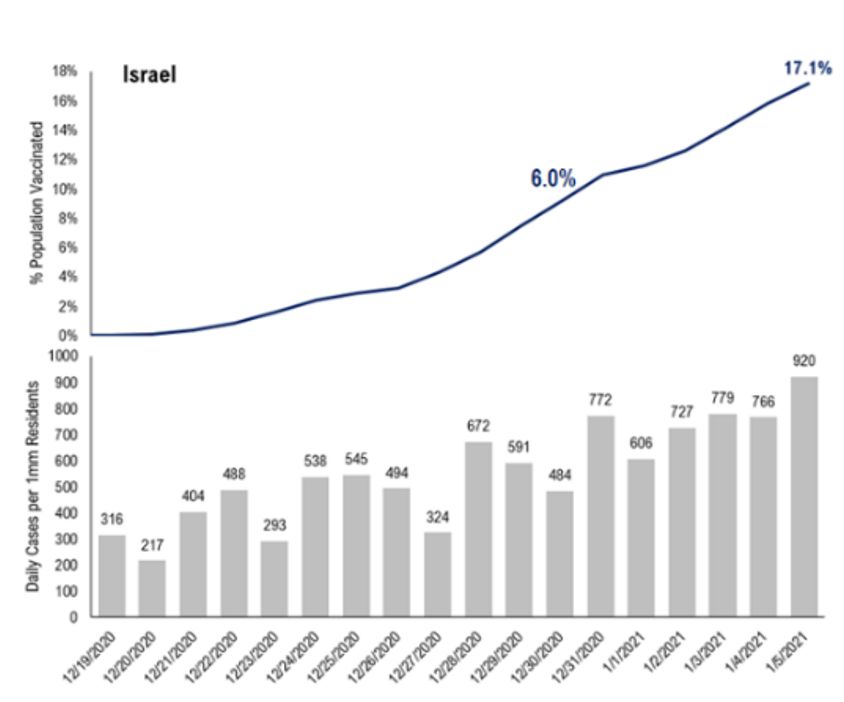

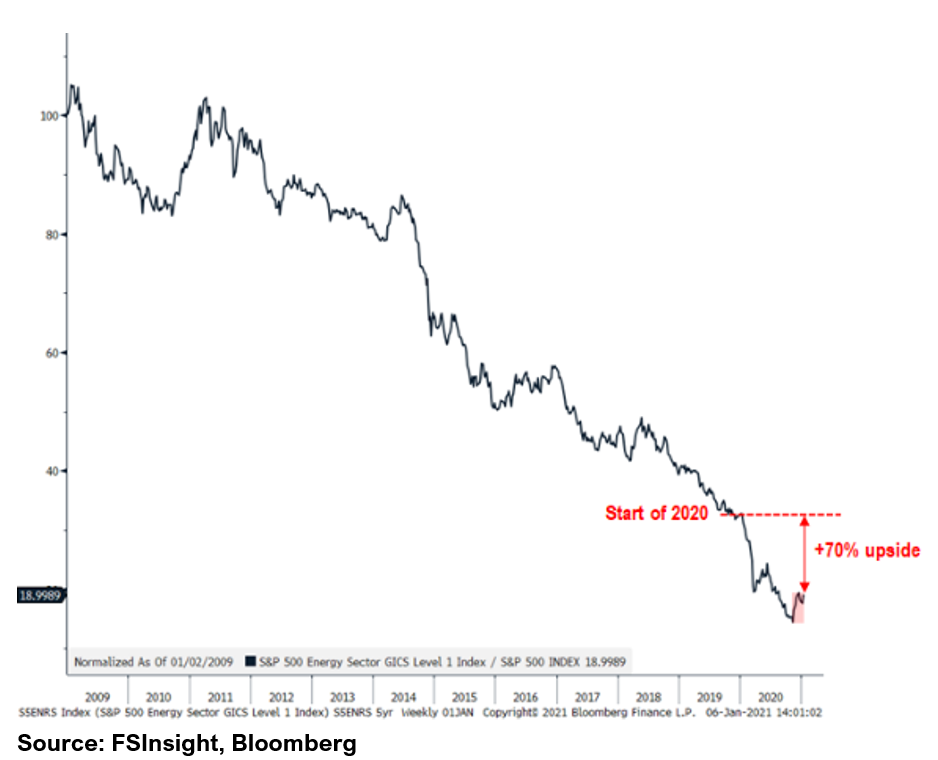

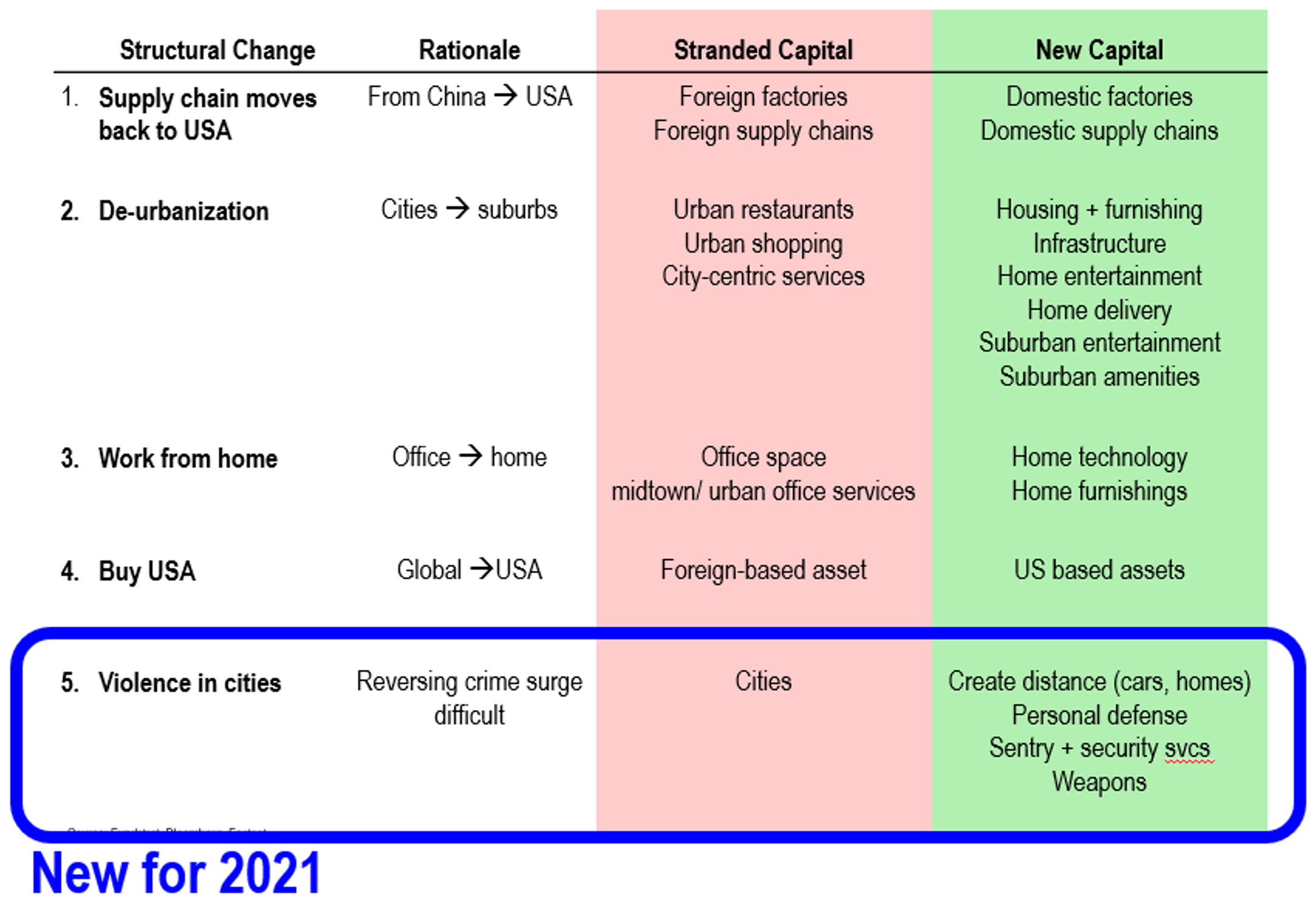

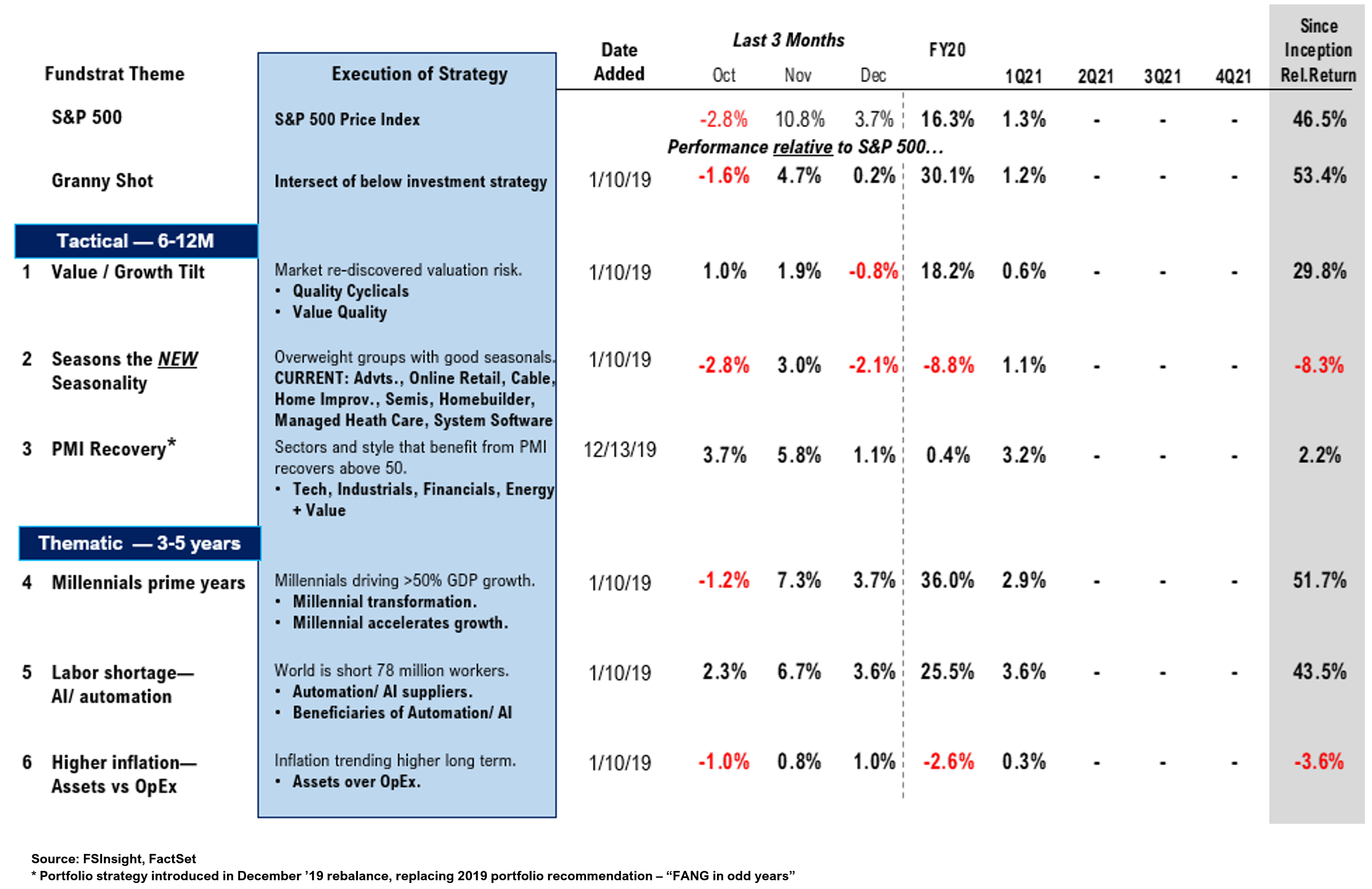

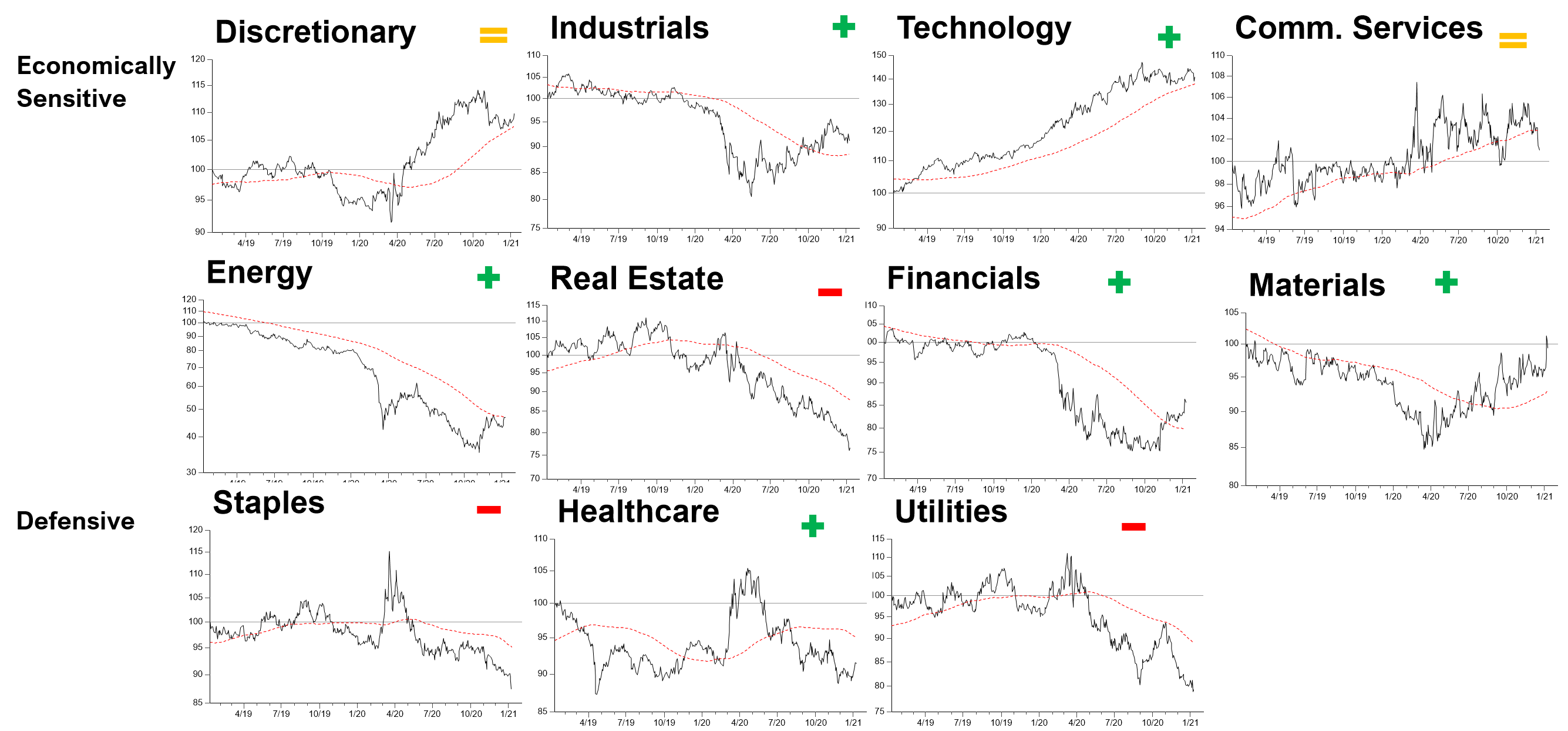

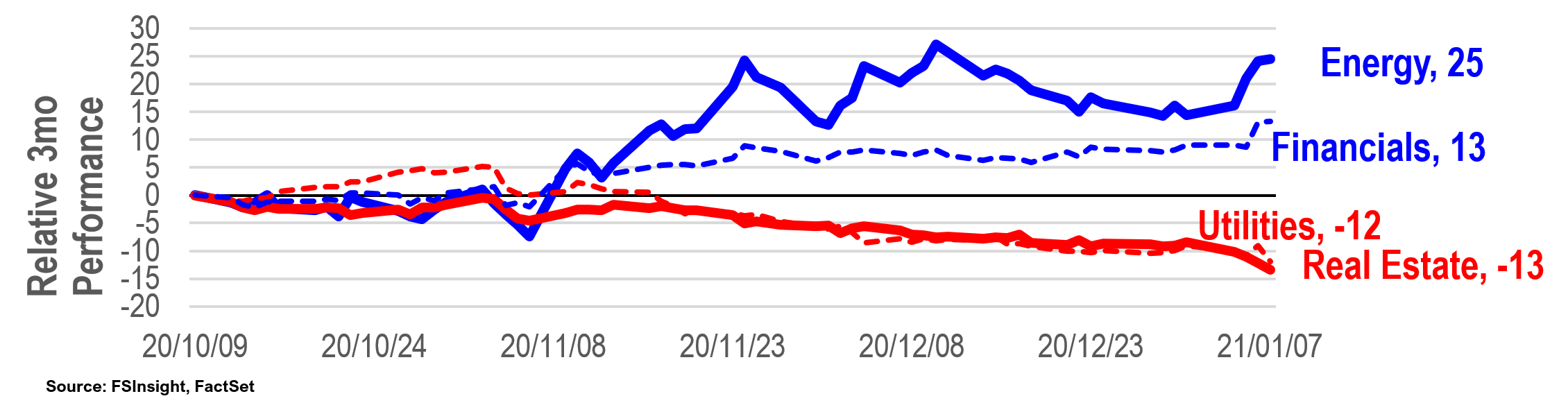

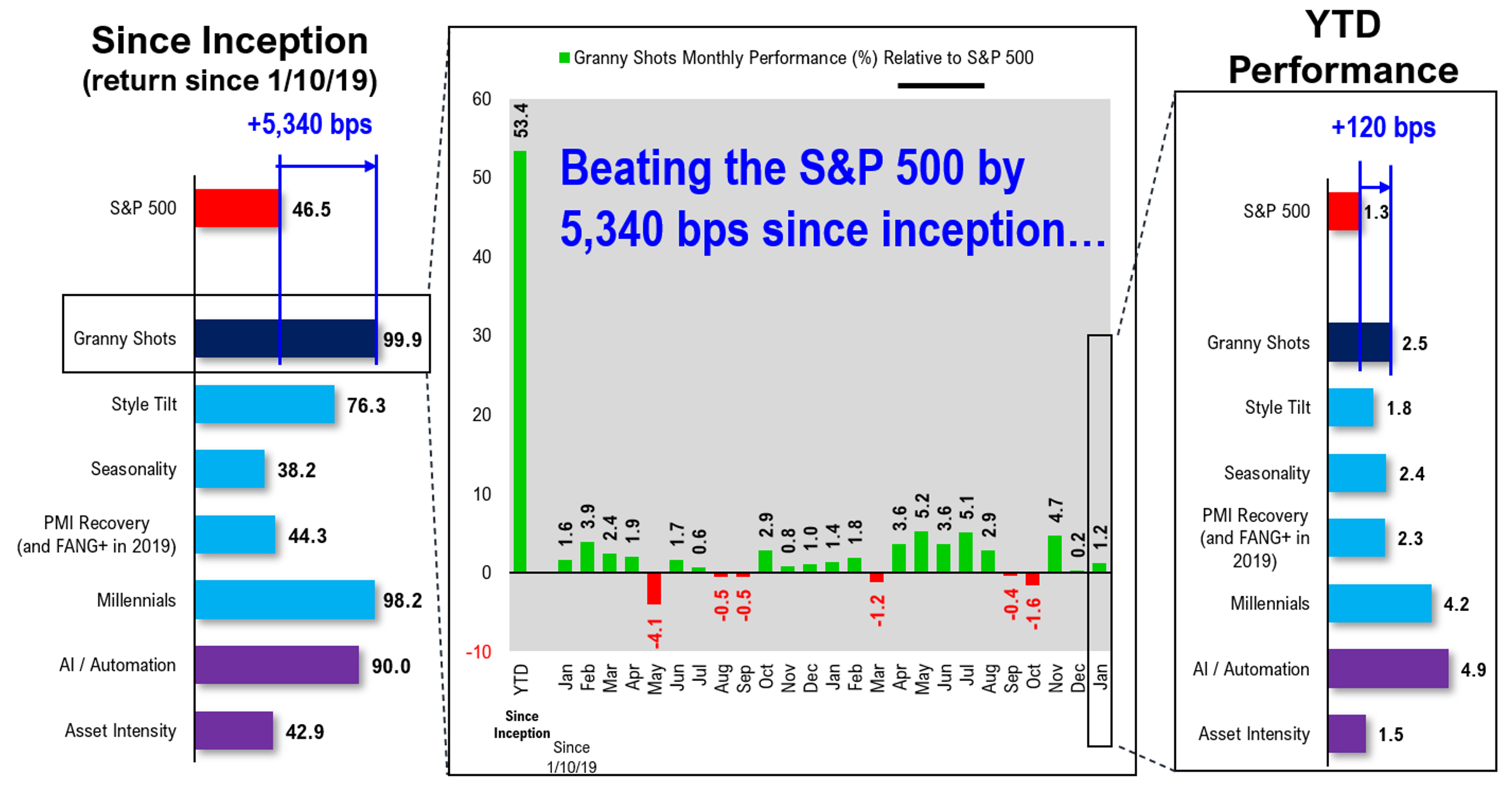

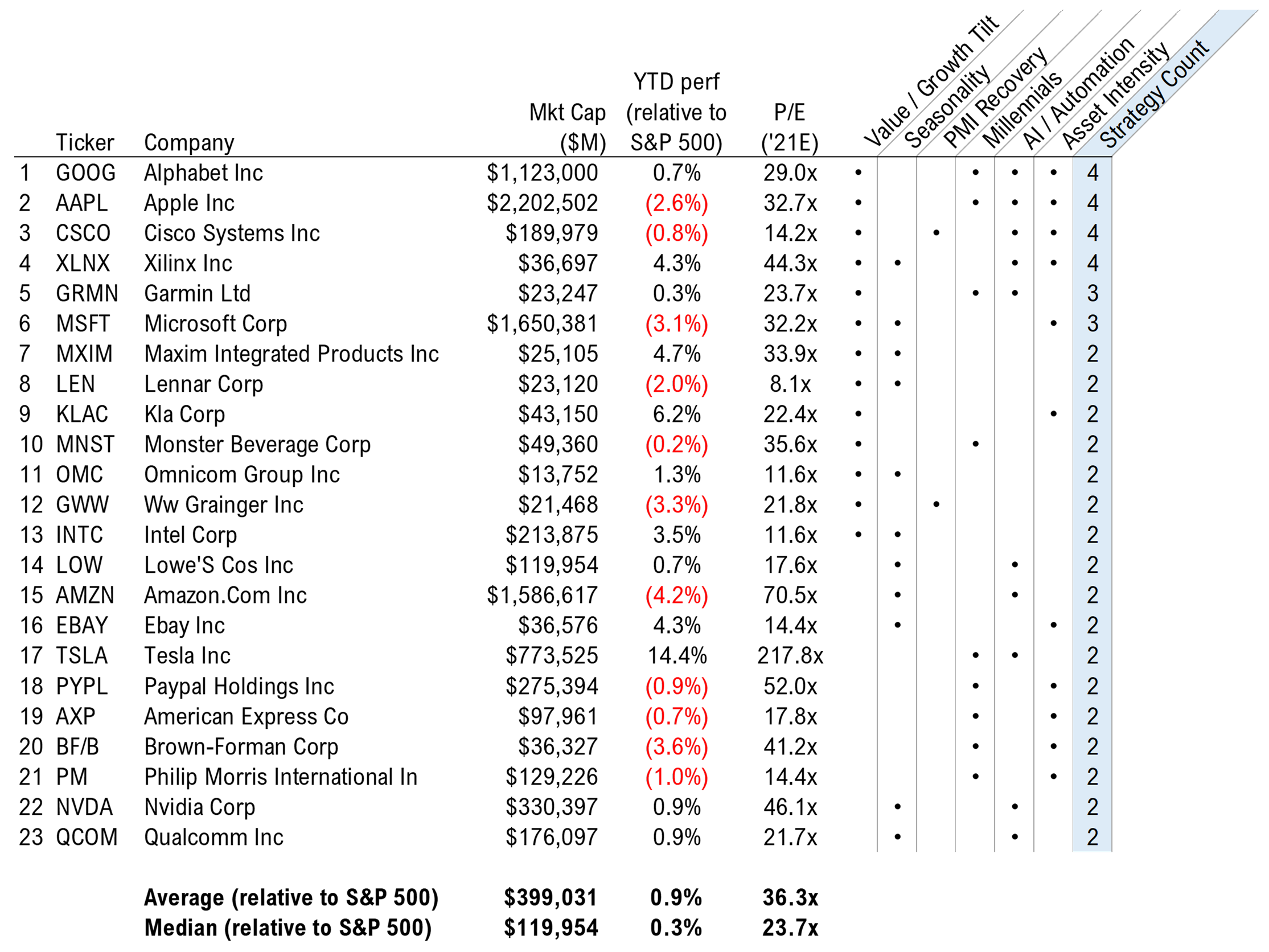

Epicenter Off to Strong Start; Signs of Economic Recovery THIS REPORT IS SENT SOLELY TO MEMBERS OF FS INSIGHT Markets wrapped up their first full week of 2021 and after a sloppy stumble on Monday, the S&P 500 managed to recover and close up 1.2% for the week. There has already been a substantial bifurcation of sector performance. Energy is up 9.3% YTD. And of the Epicenter sectors, five out of five are up on a YTD basis. Equities seem to be telling us to expect a pretty vigorous economic recovery in coming months. And we can see this possibility, given the continued ramp in vaccinations and along with better seasonal weather (starting March), COVID-19 cases could turn down sharply. Nevertheless, COVID-19 is unpredictable and the renewed post-holiday surge in cases reminds us that the virus remains prevalent. Daily cases came in at 261,571 on Thursday, a new all-time high and up +41,113 vs one week ago. Keep in mind that the holiday effect is going to cause distortions for several weeks. Over Thanksgiving, it was not until a full two weeks later that underlying trends were visible. This will be the case with current data, meaning mid-Jan is when we can start to get a better handle on trends. On the vaccine front, the developments this week were clear: vaccinations are ramping up. Yesterday about 580,000 doses were administered in the US. This is an impressive daily rise of 31% and inches the US closer to achieving one million per day, at which point about 30% of citizens would be vaccinated by early April. The vaccines have proven effective in trials, but the “real world” test is whether infections slow after a region has vaccinated >30% or more of its residents. The nation to watch is Israel. As data below nearby shows, the % of citizens vaccinated is 17% (up from 6% a week ago) and is on course to hit 30% within 2 weeks. So, this is the real test. Cases in Israel should begin to slow dramatically in coming weeks. And if they do, we see a roadmap for the end of the pandemic. If cases do not slow, this is worrisome and could be an indication that the vaccine does not work. STRATEGY:Epicenter off to strong start to kick off the year There have been some gains posted by Energy stocks YTD, and the sector is the best performing so far, up ~9.3% YTD (short year so far). But take a look at the 10-year price history of Energy vs S&P 500 nearby. The surge in Energy stocks YTD is a mere blip. Even getting to parity with the start of 2020 levels means a +70% more in Energy stocks. And look at the decline over the past decade. Needless to say, if Energy proves to be a leader in 2021, this is just the beginning. Here are the nine stocks that we consider the Energy trifecta that are rated Overweight by each of the three macro teams: HP, NOV, SLB, EOG, PXD, HFC, MPC, PSX, XEC. But the story does not end at Energy. Five out of five Epicenter stock sectors are in the green on a YTD basis and I continue to view this as a favorable place to deploy capital. That is not to mention that the current economic data has been robust and supportive of the rally in epicenter stocks. Both December ISMs (manufacturing and services) posted very solid beats for the month and are up versus November. In fact, I’d consider these levels to be arguably boomy. Furthermore, investor sentiment remains cautious. The latest AAII Bulls less Bears survey, which is a reliable way to measure retail investor sentiment for older Americans, came in at 12.5 which is a middle of the road reading, and not really indicative of ebullience. And more importantly, expectations for future volatility, as measured by the VIX futures market remain stubbornly high over the next 9 months. As we wrote in our 2021 outlook, periods of high volatility tend to be followed by a collapse in volatility which is supportive for equity markets and suggests a rise in institutional investment. Bottom Line: Investors are not as bullish you may think. Equities seem to be telling us to expect a pretty vigorous economic recovery in coming months and I continue to favor Epicenter stocks. Figure: Way forward ➜ What changes after COVID-19 Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500 |

|