January’s strong gains suggest that the bullish Pre-election year seasonality trends likely outweigh the bearish forecasts about how dismal earnings should be, and the NASDAQ managed to log its best performance gains since last July.

While many continue to harbor concerns on why the FOMC, Economic and earnings related news in the back half of this week have the potential to bring stock indices down, stock indices certainly haven’t shown much evidence of back-tracking.

Moreover, there remain no concrete signs of the US Dollar nor TNX turning materially higher, and the lack of trend reversals here still presents a bullish roadmap for prices through the back half of this week.

While there has been some minor breadth erosion in the last 5-7 trading days, and bullish sentiment has arguably risen a bit in recent weeks on this rally, there haven’t been any signs of erosion in stock index prices. Additionally, the intermediate-term participation and sentiment picture remain highly conducive towards further market gains with sectors like Technology having staged a big comeback. Moreover, most of the sector positioning still favors those same sectors which have shown outperformance since the beginning of the year.

Meanwhile, defensive groups like Utilities, Staples and Healthcare have been among the weakest parts of the market, and these groups have all broken down to weekly lows relative to the SPX.

While this likely has the potential to reverse course temporarily in the weeks ahead, this doesn’t seem like a time to immediately head for the exits barring any real technical proof. Constituents like AAPL -0.43% , AMZN 3.74% and GOOGL 0.87% all have earnings as of Thursday, making Wednesday-Friday certainly a time to pay attention. Yet, until technical stalling out or a sharp reversal of trend, or a few negative breadth days crop up to warn of any trend reversal, technicals continue to suggest upward bias should be correct.

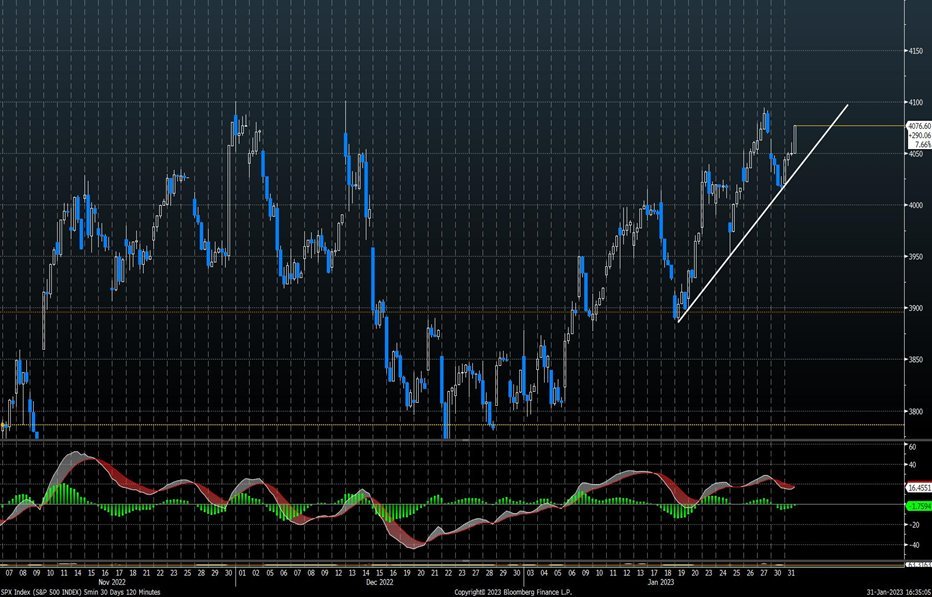

S&P’s hourly chart shows why a push back over 4100 looks to be the correct path of least resistance for the SPX in the days ahead.

Pullbacks held where they needed to on Monday, and minor weakness failed to show any trend violation, or give much of a reason to think trends start to move lower. Bottom line, resistance lies at 4100, then 4138-4140 being important for gains into Thursday.

Breaks of 4015 on a day, while not expected, would be taken seriously as the first evidence of a possible change of trend. Yet, 3885 is a much more important, albeit distant, downside area of support for SPX.

Healthcare looks close to bottoming and should start to mean revert in mid-February

For those looking at positioning defensively, Healthcare stands out as being far superior in the short run as an overweight than Utilities, Staples or even the REIT sector.

Biotech and Medical devices are nearing upside breakouts, while Healthcare Services has (finally) engineered a very healthy rebound after testing prior lows which looks to continue.

Yet, Healthcare has fallen sharply over the last six weeks, and might have another 1-2 weeks to go before finding a meaningful bottom in absolute or relative terms.

Daily charts of the S&P SPDR Healthcare index ETF, or XLV 0.70% , have nearly given up 50% of the entire rally up from last October 2022. Furthermore, prices managed to stall out and reverse course at former peaks from 2022 (Technically, approaching highs which haven’t been tested in six months or more always creates a possible strong level of resistance. In this case, this definitely did prove important).

Importantly, the relative charts of XLV vs SPY look to be roughly one week away from making a possible bottom. This argues that buying dips in Healthcare makes sense into early to mid-February, and this sector appears close to bottoming out.

Specific price levels on XLV charts are found between $129-$131 which are thought to be strong support for XLV. Relative charts of XLV vs. SPY have the potential of generating TD Buy Setups using DeMark indicators as early as next week.

Overall, Healthcare is due for a sharp rebound. Yet, it might take another 1-2 weeks. Buying dips in Biotech, Pharma, Medical Devices and also Healthcare Services seems correct into February.

Two relative sub-sector charts look worth highlighting

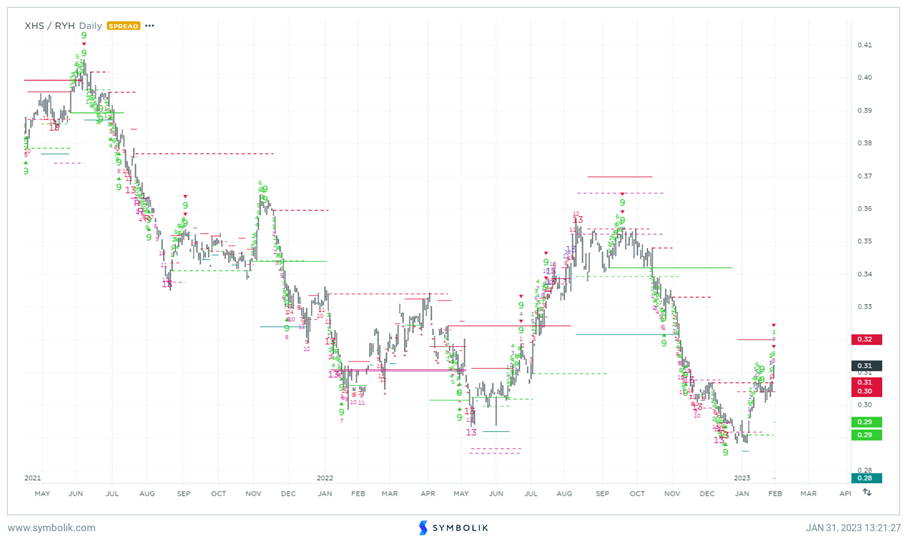

1. Healthcare Services vs. Equal-weighted Healthcare

This Sub-industry group has been among the weakest of all areas of healthcare in recent months, and has shown sharp deterioration since last Fall, at a time when the broader market was bottoming out.

Recently, relative charts of XHS 0.62% , the Ishares healthcare services ETF, vs. RYH, the Equal-weighted Healthcare ETF, managed to bottom out at an exact area near prior lows from last Spring, 2022.

The subsequent stabilization was promising, and now Healthcare services has begun to turn up sharply. This is a short-term bullish development for Healthcare Services.

Bottom line, this looks to be one of the stronger areas near-term to overweight in the near-term, following a 5%+ gain out of Humana HUM 0.89% , along with other stocks like MOH -0.22% , REGN -0.33% , UNH -0.18% , RMD 0.76% , COO N/A% , ELV 0.87% , and ABC all rising more than 2%.

Overall, for those wishing to play the healthcare space before evidence of XLV 0.70% having truly bottomed, XHS 0.62% looks like a great spot to position (While not shown, IBB -0.03% , the Biotech ETF has broken down to new monthly lows vs. XHS, supporting the call for Services outperformance in the short run).

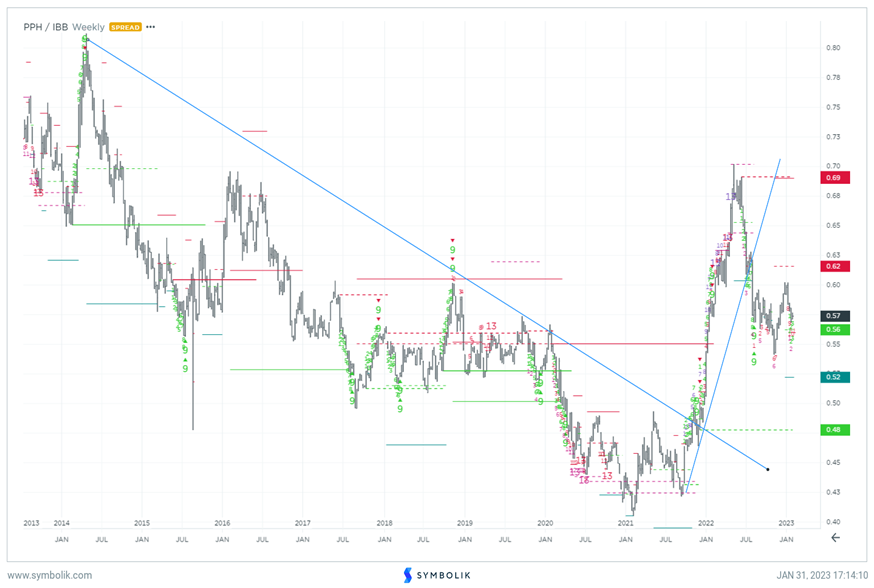

2. Pharmaceutical stocks look to still require a bit more weakness relative to Biotech in the next few weeks.

Interestingly enough, one area of rotation which many might have suspected would be underway to kick off the year was a big pullback in Pharmaceutical names vs. the Biotech space.

“Pharma” tends to be a rather defensive trade, and the US Stock market bottom during the last week of December caused many of these Pharma stocks to trend down sharply.

PFE 0.91% , BMY 0.72% , MRK 0.84% , JNJ 0.87% , LLY 1.79% and others have experienced weakness in recent weeks, while many Biotech stocks have largely stabilized and traded sideways, or higher.

Weekly charts of PPH 0.75% vs IBB -0.03% show the breakdown in Pharma vs. Biotech during the middle of 2022 after a very strong breakout to the upside back in late 2021 into Spring 2022 (Many remember this period as when stocks like PFE and MRK rallied to new all-time highs above previous peaks made two decades ago).

At present, there remains precious little evidence that this ratio is now bottoming. However, another 2-3 weeks of underperformance would signal the first possible time of exhaustion based on the potential lining up of a few different indicators, DeMark counter-trend exhaustion on weekly charts of PPH 0.75% vs IBB -0.03% being one.

Overall, this looks to be good news for the “risk-on” trade, and I suspect that even on a minor hiccup post FOMC or after Thursday’s earnings, that Biotech will continue to outperform Pharma into mid-to-late February before a necessary mean reversion back higher.

Stocks like PFE, MRK, BMY, JNJ, and LLY should all be nearing important support on both an absolute and relative basis into mid-February. Many of these will offer attractive opportunities to buy dips at that time. At present, Biotech is favored between the two.