1962 All Over Again?

- SPX volatility post Fed not a surprise, but trends remain bearish & lows premature.

- Discretionary outperformance has been impressive, while Staples REITS lag.

- 2022 is shaping up to be a near replica thus far of 1962 which showed an October low.

Note: I am unable to make a video today due to travel plans. Thank you for your understanding.

The key technical takeaway from Wednesday’s FOMC meeting was that Equities continue to follow the movement in Treasury yields. Rates and the US Dollar continue to push higher and despite the roller-coaster swings, stocks finished sharply lower across the board. The sudden intra-day “Headscratcher” of a move in stocks higher shouldn’t have been much of a surprise to anyone watching yields. The abrupt About-face in TNX from 3.60 down to 3.50% was a big intra-day swing and stocks dutifully followed suit higher, echoing the Treasury rally. Overall, it’s thought that dropping back down under 3800 following several days of attempted stabilization in S&P futures could drive the final leg down in Equity prices and up in DXY and TNX which ultimately culminates in a pullback under 3700 for SPX and near 3.70-5% in TNX. Once October, the so-called “Bear-Killer” gets underway, there should be an excellent chance of a bottom in many asset classes, brought about by bearish sentiment getting capitulatory, cycles turning higher and Yields, US Dollar rolling over. At present, “Cash is King” and it remains early to take a stab at trying to buy dips. Value Line Geometric Composite is shown below.

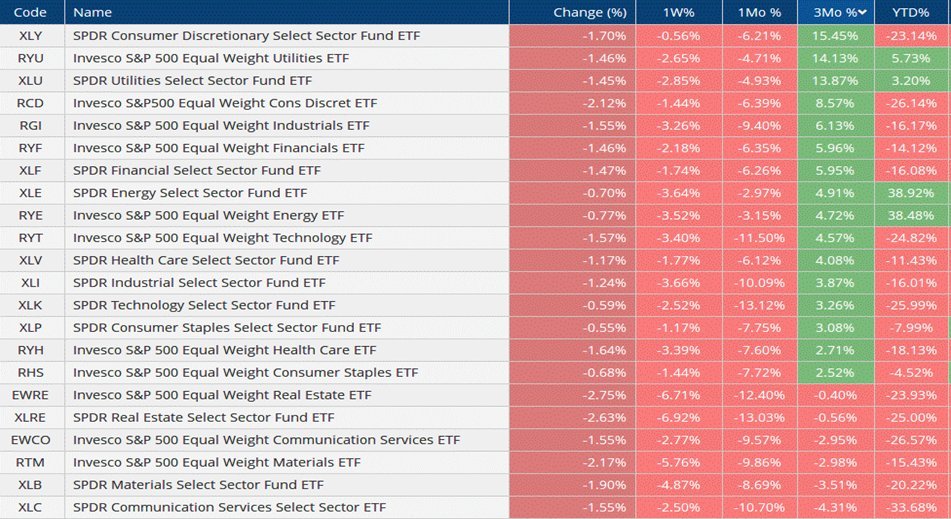

Sector Performance offers some interesting clues

Looking back at performance of both SPDR S&P ETF’s along with Invesco’s Equal-weighted ETF’s in recent months, we see a few interesting developments that are worth highlighting.

First, Consumer Discretionary continues to be a top performer of the rally off June lows. The extent that Retail and Homebuilders have tried to stabilize is encouraging. Furthermore, other areas like the so-called “Re-opening Trade” have done quite well lately, with strength out of many of the Epicenter stocks which had been so badly beaten up into June lows. While stock indices have turned back down sharply over the last month, this group has been holding up quite well and many of the stocks associated with post-COVID travel and entertainment have offered good pockets of strength.

Second, despite the drawdown since 8/16/22, Consumer Discretionary has actually outperformed Consumer Staples. While there has been a notable flight to Defensives in recent weeks, it’s largely been a push towards Utilities in relative strength, not really Staples, nor Healthcare, nor REITS, all of which are down greater than 6% on a rolling 1-month basis.

Third, Financials and Industrials have shown some outperformance on a three-month basis, and interest rates ticking higher would explain the outperformance in Financials.

Fourth, healthcare has fared much poorer than might have been expected during a volatile, defensive time. While Biotech and Medical Devices sub-sectors have been hard hit, Pharmaceutical stocks have also broken down (which was discussed in yesterday’s note)

Technology has proven to be the worst of all the major sectors in performance on a 1-month basis, which might make sense given rates ticking higher and Growth rolling over compared to Value. However, even within Tech, various stocks have held up quite well, such as AAPL1.26% and TSLA12.11% (arguably part of Technology in various ways).

Overall, keeping a close eye on Defensive performance in the weeks ahead will be key towards helping identify a market low, as often these stocks tend to wither ahead of a larger market turn.

Let’s revisit 1962, as 2022 shares many similar characteristics

Many who have followed my study of Gann’s Mass Pressure index know that several cycles are involved in the construction of this composite. One of the most important concerns the 60-year cycle, or three cycles of 20 years. This was considered by legendary Wall Street traders like W.D. Gann to be as he called it, his “Master Time Factor” and should be considered quite important as a cycle to pay attention to during any given year when making forecasts.

As shown below, the mid-term Election year 1962 has shared several similar times of the year which have worked quite well in producing highs and lows to the stock market, not unlike 2022. Looking at this chart below, we see that markets bottomed in the Summer, made a brief rally into August before reversing lower into October.

The resulting rally off those lows was spectacular and lasted into year-end. While it’s difficult to ascertain whether US markets can show this degree of strength off the lows, I do believe October will be important as a turning point for Stocks, and very well could materialize in the next couple weeks. Factors like sentiment, cycles, DeMark exhaustion and fewer stocks hitting new lows all seem to be compelling technical reasons towards buying a dip in the coming future. We’ll see.

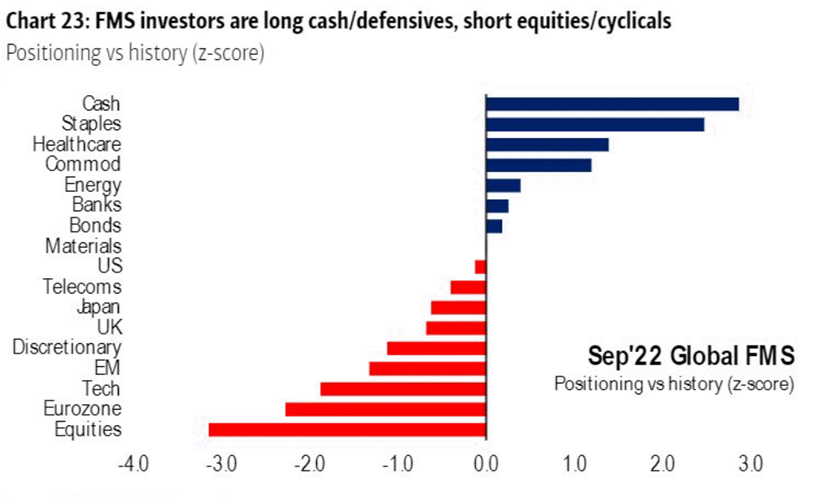

Bank of America Global Portfolio Manager Survey shows “Cash is king”

I always follow Bank of America (BofA) polls regularly for their insights on positioning, largely for contrarian reasons. The big Over/Underweights often can be useful to fade for trading purposes, and one should monitor these results when possible.

The latest poll results give readings which might make sense given the current drawdown. Cash and Staples are very big Overweights, while Technology, Eurozone and Equities in general are underweights.

While it’s been right to avoid overweighting Equities or Technology in recent weeks, it’s rarely correct (in my view) that when a group “en-masse” has a certain degree of positioning, that they’re right for an extended period of time. These results generally speak to the degree of defensiveness that’s being seen these days. While sentiment remains bearish but not extraordinarily fearful, my view is that failure to rally post FOMC likely steers that sentiment towards an even more bearish view that should drive a market low within the next few weeks.