Ahead of this week’s Fed meeting, Monday’s minor relief rally took prices right back to areas of September’s breakdown, which at SPY 0.41% -389 is thought to be quite important resistance. Given that US 10-Year Treasury yields set new daily 2022 closing highs Monday above 3.475% at 3.49%, it’s thought that ongoing negative correlation with US Stock indices likely limits Equity gains heading into one of the worst seasonal stretches of the year. Industrials, Discretionary and Materials all rose more than 1% in trading, while other groups like Healthcare and Energy dropped off sharply to lag in performance. Moreover, Technology continued to show underperformance and has lagged all other major S&P groups over the last month, with XLK 1.36% lower by more than 12% on a rolling one-month period. Bottom line, this remains a challenging period and should be difficult for bounces to gain much traction between now and early October. Any decline back under SPY 0.41% -382 likely takes prices down to at least 370, but more likely at a zone of support between 362-365 into early October.

Energy stocks starting to weaken, as RYE breaks uptrend

WTI Crude’s recent weakness is directly coinciding with a similar breakdown in Energy stocks which hadn’t been seen too meaningfully until about a week ago.

Energy still leads performance on a YTD and 12-month basis, though has begun to slip on many other timeframes and lags about half of the major groups on a 1-month basis with XLE and RYE both up roughly +5.50% over the past month.

The breakdown of Energy’s two-month uptrend, shown on an Equal-weighted ETF basis as RYE, (Invesco Equal-weighted Energy ETF) is the first technical violation of this trend after two prior successful retests. While prices did manage to rally intra-day to hold early September lows, this support break looks like a technical negative.

Overall, it’s likely that Energy underperforms into the month of October as WTI Crude likely falls to the mid-to-high $70’s. One should hold off on buying dips right away.

For those involved in this space, XLE -1.92% looks like a better bet than OIH -3.12% , XOP -2.44% but is still likely to trend down in absolute terms over the next three weeks.

Healthcare slips under September lows before late rally

One group that’s very relevant to monitor technically is Healthcare, the 2nd largest group by capitalization within ^SPX 0.41% .

Monday brought about abnormal weakness in this group with only some of this attributable to vaccine makers like MRNA 0.25% . Many stocks within the Biotech and Medical Device maker space underperformed, and Healthcare will be important to see stabilize for those wishing for US Equities to find support.

RYH the Equal-weighted Healthcare ETF, briefly undercut early September lows, similar to Energy, before rallying back. Meanwhile the relative chart of RYH to SPY 0.41% broke down back in August which followed a good runup in absolute and relative terms starting in June.

Technically, given that Healthcare vs SPX broke down under a multi-month area of trendline support spanning back since early 2022, this group changed from 1H leader, to 2H Laggard. Moreover, recouping this uptrend will be important before looking to overweight this group again.

Near-term, weakness in Biotech, Medical Devices and also Healthcare services look likely, and outperformance within this group should be found in the Pharmaceutical names. Stocks like LLY -1.69% , MRK -1.39% , JNJ 0.56% , BMY 0.42% are likely outperformers within Healthcare over the next few weeks, while weakness into October would set up counter-trend rally opportunities in the Biotech space from October into December. Biotechs to look to buy on weakness are: REGN 0.95% , VRTX 0.30% , AMGN 2.25% , and GILD 1.33% .

Financials have fared better than expected, and Insurance names, Regional banks and Investment banks look better than traditional Money-center banks in the weeks ahead.

Given the rapid run-up in Treasury yields in recent months, it might come as no surprise that Financials have relatively outperformed. However, this hasn’t been seen across the space.

Defensive sub-groups like Property and Casualty insurance are quite attractive technically, while Regional Banks are preferred over Money-Center banks.

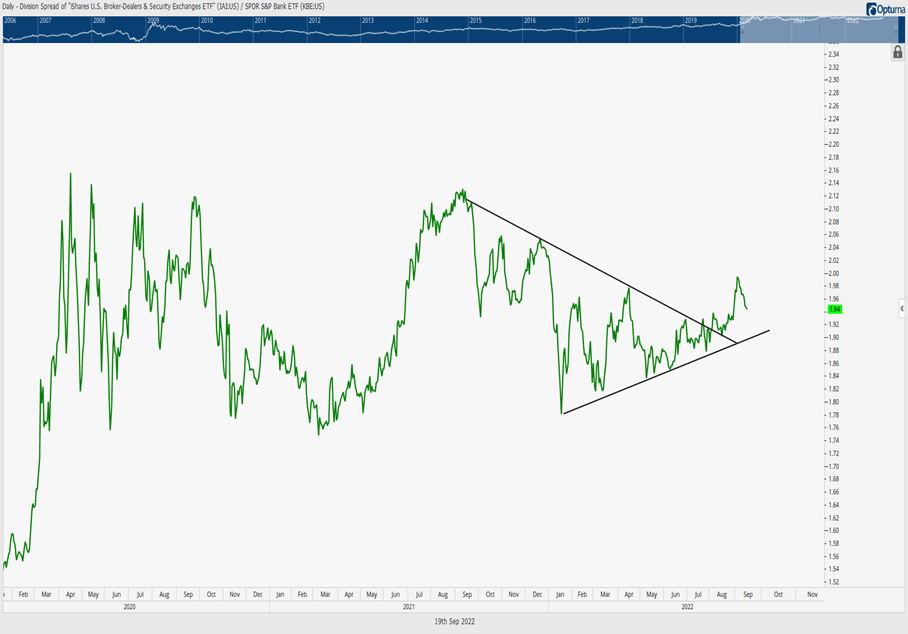

Interestingly enough, the Broker-Dealers have been strengthening lately vs. the broader Financials space, and charts of IAI 0.46% , the Ishares US Broker-Dealer Exchanges ETF, has exceeded an intermediate-term downtrend vs. KBE 0.89% , the SPDR S&P Bank ETF.

Overall, IAI is preferred over KBE, and any weakness into October in absolute terms back to $87-$91 should constitute an attractive area to consider buying dips.