The lower than expected CPI report coincided with many risk assets moving sharply higher on Wednesday to levels right near the 50% retracement of the entire ^SPX 0.91% selloff from January into June. As written in last night’s note, “Wave structure cannot completely rule out one final push higher post CPI, though this should prove short-lived and reverse course.” Given that Treasuries reversed sharply lower Wednesday after early gains, my expectation is that S&P also should be close to reversing, and it should be wrong to press long bets given that Elliott wave counts look nearly complete while DeMark exhaustion is present on several intra-day timeframes. While I’ve stated that ^SPX 0.91% likely pushes up into 4350 into mid-September, I am skeptical that this proves to be a straight line, and consolidation looks necessary by Friday.

Overall, it’s worth noting that my defensive stance in recent days has not yet proven correct as the sideways consolidation/stalling out which was discussed has now led higher, not lower.

Importantly, I don’t think much has changed based on Wednesday’s rally. First, DeMark counts on 60, 120, 240 minute ^SPX 0.91% charts are now showing exhaustion. Second, Elliott-wave patterns now show Wednesday’s rally as being the fifth (and final) wave up from mid-July. Third, momentum is now growing stretched, and failed to confirm Wednesday’s minor consolidation breakout. Fourth, Treasury yields have turned back higher and reversed Wednesday’s early decline. Fifth, most of the largest moves on Wednesday happened in some of the worst technical groups like Cruiseliners and Airlines. Sixth, my cycle composite shows consolidation likely into next week.

Overall, given that I have discussed in my intermediate-term outlook ^SPX 0.91% moving higher in the back half of 2022, I do not wish to dig in my heels too dramatically on a short-term tactical basis in trying to forecast a 5% pullback. Yet, increasingly, lots of factors are present which suggest this should happen. Bottom line, I will remain defensive for this week (over the next 2 trading sessions) expecting a reversal by Friday’s close. If this does not materialize and ^SPX 0.91% is over 4250, then potentially the ^SPX 0.91% could defy expectations further and push straight up to 4350 before stalling in and reversing in September. This latter scenario is a much lower probability in my work, yet something I’ll accept if/when price and time considerations run past the normal time band of producing a reversal of trend.

Treasury reversal worth watching carefully

Treasuries should be watched carefully in the days to come as Wednesday’s trading showed a fairly big reversal despite 10-year auctions proving strong. Importantly, the Treasury advance halted in its tracks as yields turned back higher and eclipsed the all-important 2.77%, an area which took on significance following the opening gap down on Wednesday.

As I’ve spoken about in these reports before, it’s always important to keep a close eye on yields when reversals back higher happen. The relationship of Treasuries and Equities continues to show fairly strong positive correlation. Thus, it’s expected that a push back higher in yields in the days ahead might also coincide with Equities peaking out.

Overall, I’m expecting that 2.87% and 3.08% are important levels to monitor. Movement over 2.87% should drive yields up to test the all-important 3.08%. However, moving above 3.08% in US 10-Year Treasury yields would have little to no yield resistance ahead of 3.50-3.60%, a level that’s over prior highs.

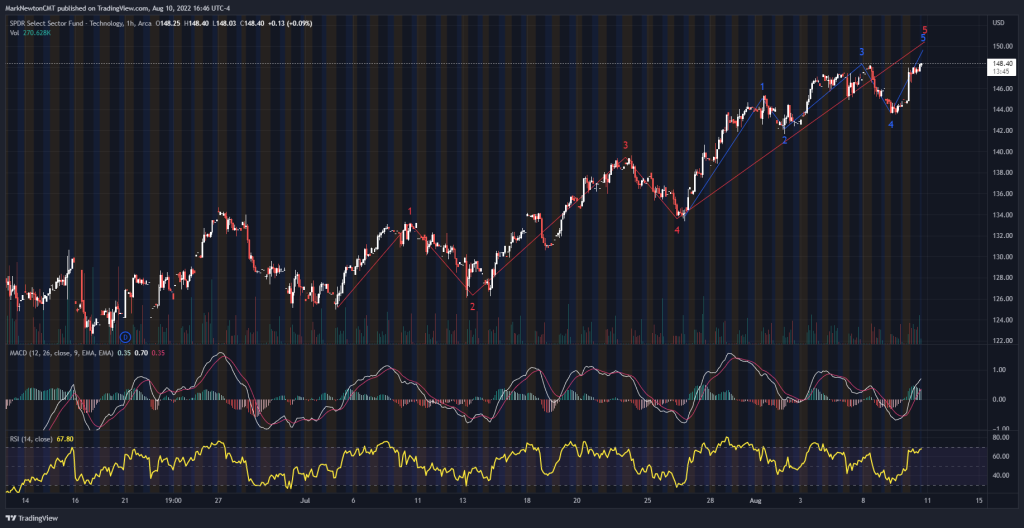

Technology’s lift above this week’s highs also looks to be nearing key levels

In the last few weeks, XLK 1.35% , the S&P SPDR Select Technology ETF, has shown some impressive ability to push higher in a very impulsive bullish manner.

That positivity now might give way to a stalling out with XLK 1.35% prices nearing resistance, which lies just below $150 at the 50% retracement area of its December 2021-June 2022 decline.

While Technology’s move should continue higher in the back half of this year, the Elliott-Wave count looks near completion along with some short-term negative momentum divergence on this latest push higher.

Overall, of the four sectors I listed as overweights for 2022 back in January (Technology, Healthcare, Energy, and Materials), three of the four might weaken over the next one or two weeks. Healthcare, to its credit, is a larger overweight in the short run than any of these other sectors with a special focus on Pharmaceutical names and Biotech.

Following brief corrections, both Energy and Technology should translate into Overweights for upward progress into September, and then into end of year (EOY).

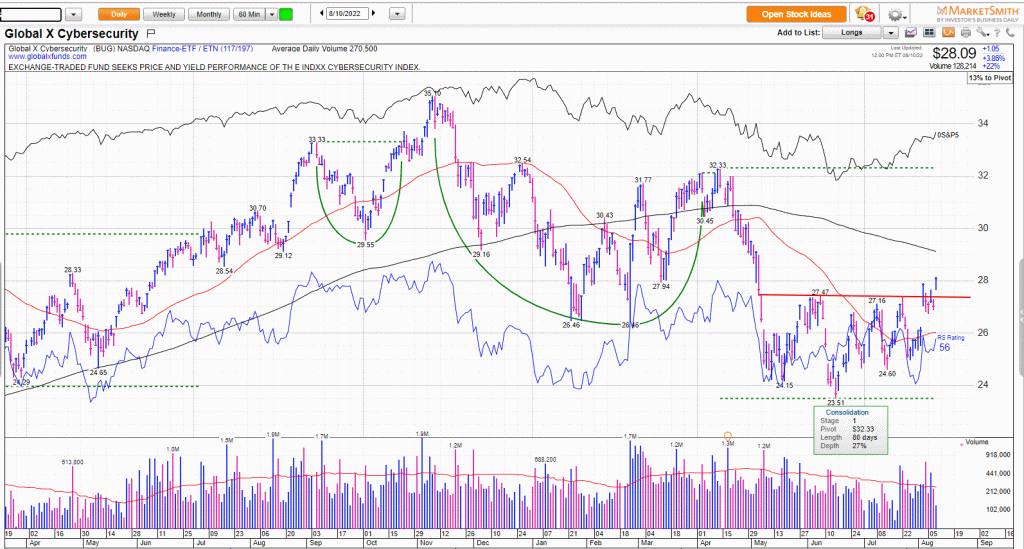

Cybersecurity stocks following through on last week’s breakout

The Global X Cybersecurity ETF (BUG N/A% ) needs to be reiterated as a positive in this market after its recent breakout last week failed to give much back before turning back higher in Wednesday’s trading.

Stocks like ZS 1.37% , FTNT 0.58% and CHKP 0.46% all showed attractive pattern breakouts as the BUG ETF pushed up above last week’s highs.

While I’m expecting some consolidation to take place in the broader market, this ETF looks like an attractive long to favor in the near-term, and one should consider being long and buying dips when given the chance in the days ahead.

Near-term technical targets lie near $29.50-$30 and would initially be an area for profit-taking with the goal of buying dips on pullbacks back down to $28 with eventual targets at $32 near April peaks.