Key Takeaways

- Monday’s follow-through is carrying US benchmark indices up to near initial resistance

- Financials look to be stabilizing and Monday brought about breakouts by JPM, BAC, C

- Treasury yields still haven’t broken down; A minor push back to new highs is possible

The US equity market bounce continued on Monday with SPX lifting up to just under initial areas of importance which lie near 4000. While there was evidence that markets were starting to turn back higher, it will be difficult to extrapolate too much higher without some evidence of trend improvement. For SPX this lies initially at 4000, which lines up near a downtrend from early May. Moreover, having confidence of a larger move requires a daily close back over 4114. At present, short-term trends have turned up, as part of the current intermediate-term downtrend from earlier this year, and from earlier this month. Healthcare and Financials strength are certainly near-term tailwinds for stocks but getting Technology back on track is the real key.

Financial strength is worth paying attention to as JPM, BAC, and C have all made short-term breakouts

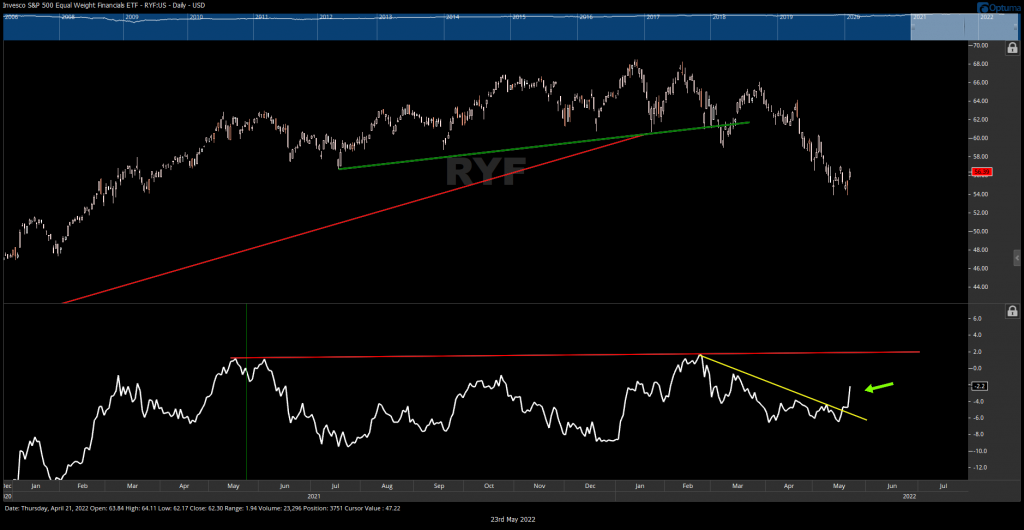

Financials look to be slowly but surely stabilizing after turning in some of the worst performances of any of the major S&P SPDR ETF’s over the last three months. Outside of Consumer Discretionary, XLF proved to be the second worst of any of the major Sector ETF’s, when eyeing both SPDR Select ETF’s along with Invesco’s Equal-weighted ETF’s over the past month.

The rolling 5-day return for XLF 0.77% is now +2.23%, making this the best-performing of the major Sector ETF’s over the last 5 trading days. As mentioned, JPM, C, BAC all made very strong movement on Monday to the tune of nearly 6% which has helped the relative chart of Financials turn sharply back higher. While KRE and KBE have not yet broken out like some of the stronger performing Banks on Monday, I anticipate this should be forthcoming.

JP Morgan has lifted to break its Downtrend on heavy volume

In one of Monday’s biggest technical developments, many of the biggest Commercial banks broke out of two-month (and in some cases larger) downtrends that makes this group attractive for thinking outperformance can happen in the short run.

JPM 1.05% , SYF, C, BAC, CMA, WFC were all higher by more than 5% on Monday 5/23. Of these, JPM, C, BAC and WFC all made convincing breakouts, and volume spiked on JPM and C in particular. Overall, I view these banks as attractive near-term technically, and would buy these names, expecting further upside in the days/weeks to come.

Given that the Financial space has joined Healthcare in recent days, these mark 2 of the top 3 percentage groups which make up SPX. This gives some credence to the idea that this group can turn higher after a lengthy period of underperformance.

While rates look close to rolling over, this has not happened as of yet. Furthermore, one can’t rule out a further rise in both absolute and real rates which might allow for Financials to show some attractive relative strength into the month of June.

Daily JPM 1.05% chart below shows this to have broken out of a trend on heavy volume which had marked peaks back in January. While this was the largest percentage move for JPM since 2020, it looked significant and positive for JPM, and I expect this lifts the stock further to initial targets near $136.

Treasury yields have not turned down just yet

Daily charts of both TNX and TYX have both churned near highs lately and have not yet given the official confirmation of a breakdown in yields. While this is expected to happen over the next month, TNX and TYX require a daily close back under 2.772% and 2.80% respectively before this occurs.

Overall, a “final” push to new monthly highs can’t be ruled out before yields roll over. This would align with a very good risk/reward spot to be long Treasuries, allowing Elliott-wave patterns to complete as yields push a bit higher. Specifically, I view TNX to have a very good chance of turning down, particularly in the bullish month of June, and TNX could pull back to 2.4%. However, until 2.772% is broken, one can’t rule out a quick but short-lived move to 3.25%.

TYX below requires a move back under 2.97% to expect a move lower to 2.5%. Near-term, this recent consolidation has alleviated overbought conditions while TYX has not yet hit 2018 peaks which lie near 3.45%. Thus, the next few days will help to solve this near-term technical dilemma. Bottom line, while an eventual downturn is highly likely in yields, there hasn’t been enough weakness in trend to think this has already begun. Stay tuned.