After yet another volatile start to the week, equity markets have resumed their uptrend following the Georgia election with cyclicals accelerating. Many managers have had to scramble to add risk back to their portfolios raising the question “has anything changed technically?”.

The simple answer is no. As I wrote last week “The first few days and weeks of January are notoriously volatile so I would caution readers of overreacting to headlines too quickly at the beginning of the year. It’s possible equity markets pivot lower early in January but my expectation is for an additional move higher into late January-early February before our weekly momentum data peaks signaling a tactical top.”

Looking through January, the technical roadmap that has the highest likelihood for success is further upside as more managers add risk and more cyclical exposure in anticipation of further stimulus. However, in the same way I’ve cautioned readers from turning overly cautious to negative headlines through the summer and fall, particularly around politics, I will be cautioning investors from becoming excessively bullish, at least from a tactical, multi-month perspective heading into late January and early February. I can’t state for certain that we will see the market pullback, but many of our trend and momentum cycle indicators are working toward overbought levels that suggest preparing for a pullback into Q2. I’ll be looking for divergences/weaknesses in some of the recent leading areas, such as small-caps and emerging markets, and strength in more defensive areas, such as staples and healthcare, as a sign the market’s internals are changing. The bottom line here is to remain patient and to pay attention to the market’s technical changes more than ever, particularly as headlines become more optimistic.

What to do? Every portfolio should hold a core list of stocks that are in strong price and relative performance uptrends but I look for stocks that are bottoming intermediate-term as ideas to allocate new capital to. What do I mean by bottoming intermediate-term? Take a look at the eBay chart above. The weekly momentum indicator in the top panel is a useful technical tool to track the intermediate-term or 1-2 quarter trend shifts. After peaking in July, it is now showing evidence of bottoming and turning up just as EBAY bottoms at support near its rising 40-week (200-day) moving average.

Bottom line: I view EBAY as a timely idea to increase exposure to in a portfolio. I recommend investors remain patient and pay attention to the market’s technical changes more than ever, particularly as headlines become more optimistic.

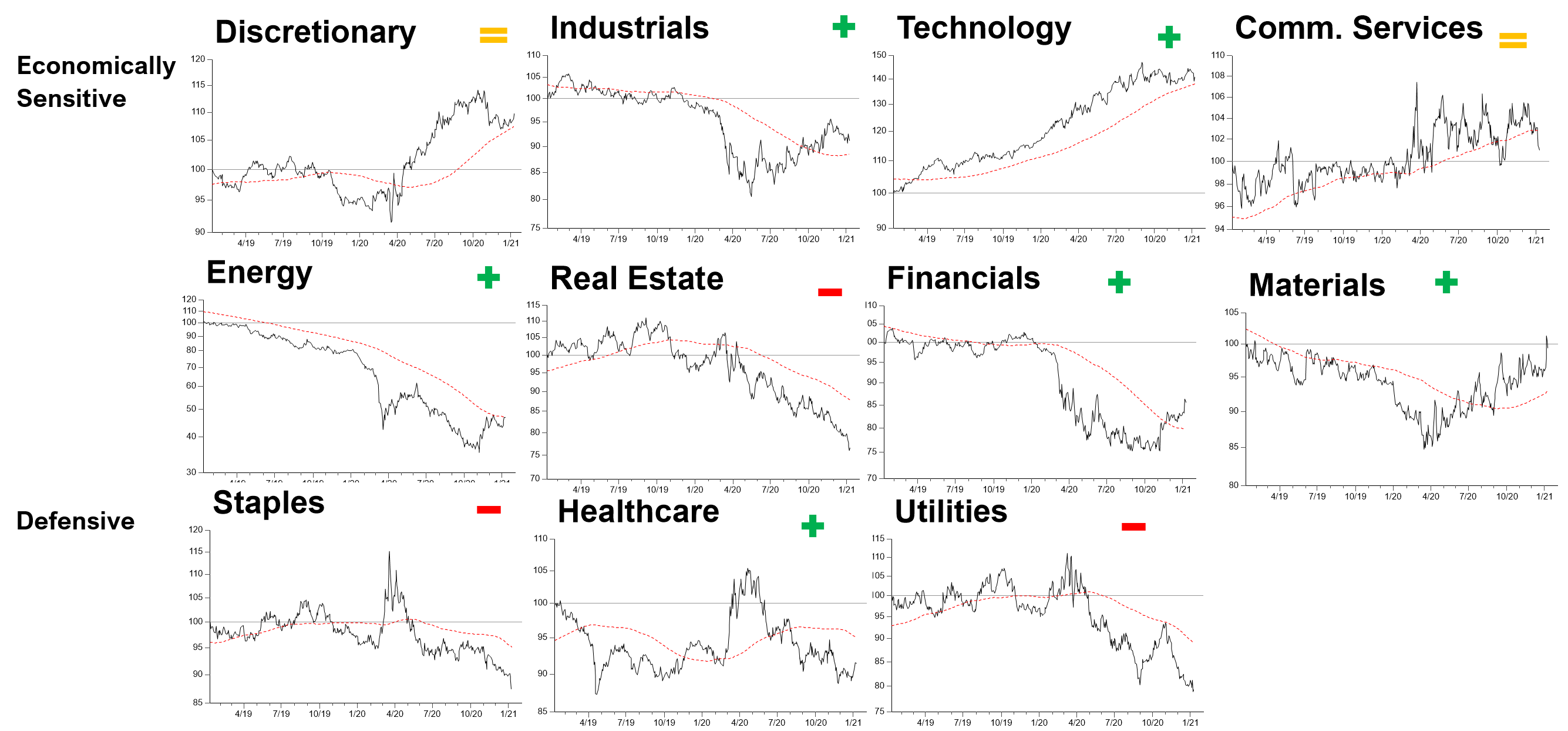

Figure: Weekly Sector Review

Source: Fundstrat, FactSet

- The Technology and consumer discretionary sectors continue to trend sideways relative to the S&P 500 while cyclical sectors continue to emerge and safety underperform.

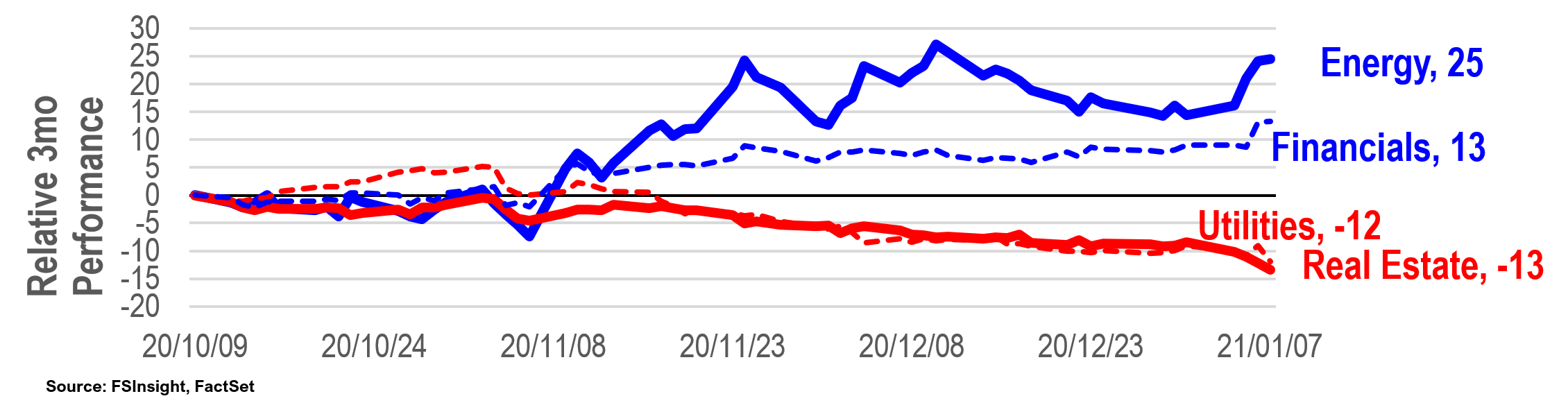

Figure: Best and worst performance sectors over past 3 months