Signal From Noise

Research

Signal From Noise

Research

- Younger and wealthier investors have driven interest in ESG investing in the last decade, with many indicating they are willing to accept slightly lower returns in exchange for strong ESG performance.

- The increased popularity has led to criticisms from those who adhere to Milton Friedman's argument that a company's only social responsibility is to increase profits.

- Many ESG advocates claim that companies with strong ESG performance are more likely to deliver higher returns, but the inadequate quality of data measuring ESG performance means that studies that support this are inconclusive at best.

“Without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals. We are not, and will not be, a ‘climate policymaker.’”

Jerome Powell, Chairman of the Federal Reserve, January 10, 2023

Regardless of whether you agree with Mr. Powell’s assertion, the very fact that the head of the U.S. central bank felt the need to address the issue (when frankly most of his audience was waiting for him to talk about inflation) is a telling indicator of how prevalent the issue of Environmental, Social, and Corporate Governance (ESG) investing has become recently.

In the past decade, there has been a growing interest in ESG investing. Many firms have taken to almost boasting about their commitment to environmental, social, and corporate governance principles in investing. For example, BlackRock made sustainable investing and investor activism a hallmark of the firm’s overall philosophy and strategy, while Salesforce’s top executives in June 2022 issued a letter to stakeholders to talk about “leading with [their] values.” They are far from alone.

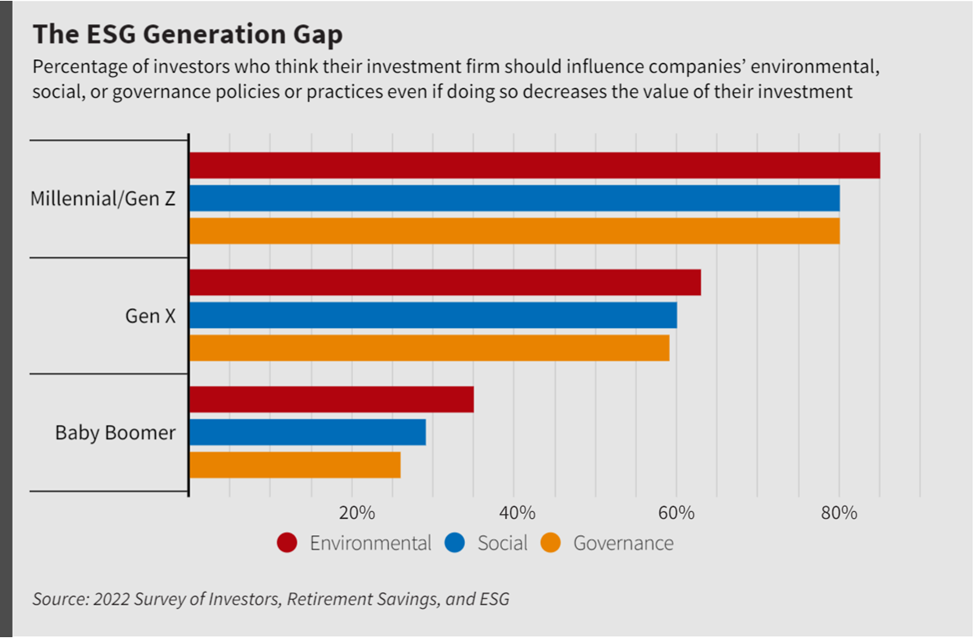

It’s no wonder that ESG business practices are front of mind for corporations: ESG matters to most people, especially in the demographics that matter the most to businesses. A survey conducted in October 2022 found that 80% of millennials and Generation Z investors found a company’s ESG practices to be “very important” to their investment decisions–even if it means accepting slightly lower returns. The percentage remains reasonably high for Generation X (around 60%) but drops off for the older demographic. For businesses hoping to attract positive attention from younger customers and investors, paying attention to ESG practices has become imperative.

To be fair, other studies dispute the generational gap in attitudes about ESG, suggesting the age-related differences almost disappear after adjusting for household wealth, with wealthier investors placing a higher priority on ESG attributes. But the opinions of the wealthier cohort also matter to corporations.

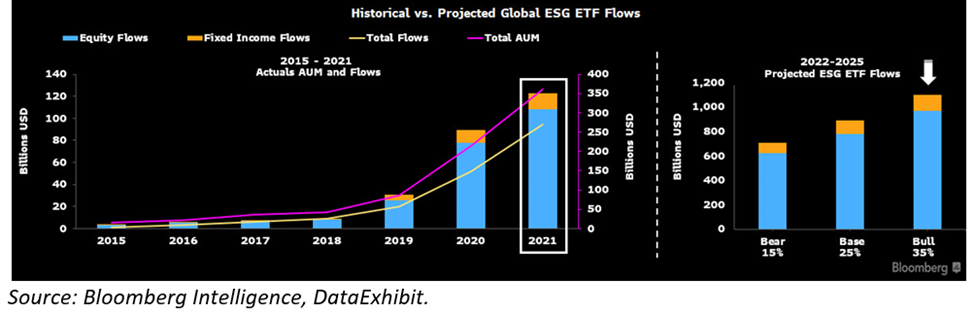

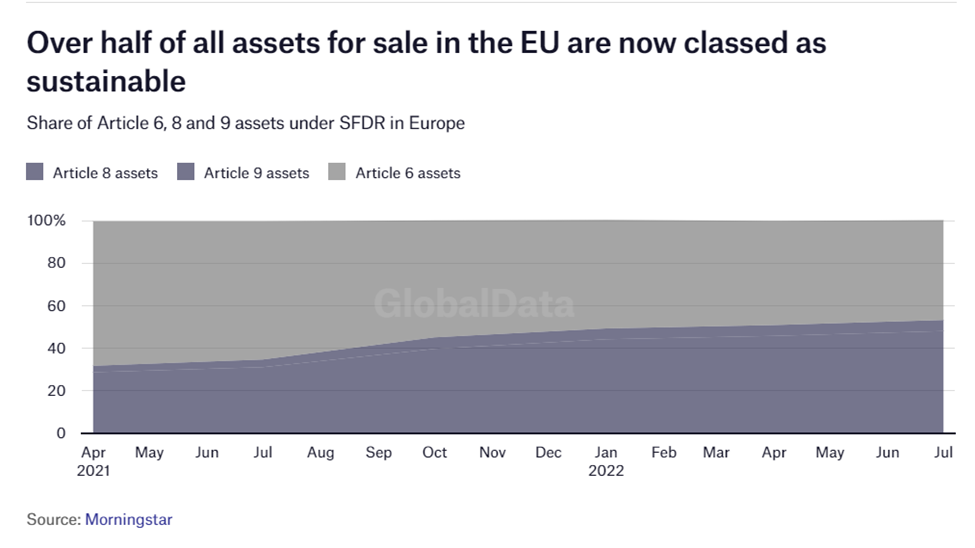

Small wonder that asset flows into ESG-related products have grown rapidly over the past decade, both in the United States and Europe.

However, the growing interest in ESG integration and adoption has also led to a backlash from those who argue that any deliberate consideration of ESG values in business decisions is a likely breach of fiduciary duty. These critics sometimes quote the late Milton Friedman, who famously said that the only “social responsibility of business is to increase profits” for shareholders/owners.

ESG advocates counter by noting that in the same article as Mr. Friedman’s famous quote, he clarifies that business owners generally want to “make as much money as possible while conforming to their basic rules of the society, both those embodied in law and those embodied in ethical custom.” Even Mr. Friedman conceded that while making money is the priority, businesses cannot be myopically focused on maximizing profits to the exclusion of all other considerations.

In recent years, this debate has taken political overtones. In August 2022, 19 state attorneys general – all Republican – wrote to BlackRock CEO Larry Fink, asserting that BlackRock’s ESG commitments were a deliberate breach of the firm’s fiduciary duty to seek the best possible investment returns. They also claimed that BlackRock’s climate-change stance could “weaken the national security of the United States.” The signatories took special issue with BlackRock’s call for asset managers “to help deliver the goals of the Paris Agreement.”

Democrats have long sought to enshrine ESG-related considerations into regulation and law. For instance, they spent years pushing the SEC to implement a rule that would require publicly traded companies to disclose their exposure to climate change-related risks, as well as aspects of their operational greenhouse gas emissions.

The rule was loudly opposed by Republicans, and the proposed SEC rule remained in limbo at time of publication. However, with Republicans taking control of the House and Rep. Patrick McHenry (R-NC) set to take control as chair of the House Committee on Financial Services, opposition to broadening ESG acceptance and regulatory requirements is expected. Congressman McHenry had previously said of the proposed SEC rule: “The SEC’s proposal to require disclosure of information related to climate change that is not material for most companies is tone-deaf and misguided […].” While acknowledging the “threat climate change poses to communities across America,” he argued that “the SEC should focus on its core mission […] rather than a far-left social agenda.”

With the vocal decibels escalating higher, both in support and opposition of ESG practices, it is no surprise some companies have begun “greenwashing” while others have begun “greenhushing.” Greenwashing refers to the actions a company might take to make itself seem more committed to ESG principles than it really is, hoping to attract ESG advocates – or at least avoid their criticism. Greenhushing is the opposite, a practice in which a company tries to avoid drawing attention to its efforts to adapt ESG practices. Greenhushing is a company’s attempt to avoid the notice of those who oppose ESG business practices, or ESG advocates who might criticize the company for not doing enough.

What is ESG Investing?

Values-based investing (sometimes known as ethical investing) is a very old idea that involves choosing investments based on values for the sake of those values. Religious orders have long engaged in values-based investing. For example, in the 1700s, US Methodists would refuse to invest in companies involved in the slave trade, gambling, or the production and sale of liquor or tobacco, based on their religious values. But for them, the values were the primary objective, and a nice return on investment was secondary.

The 1960s saw Vietnam War protesters opposing investment in defense contractors. In subsequent decades, a divestment from apartheid-era South African interests became one of the most prominent examples of ethical investing tactics. Today, we can see similar ideas with some ETFs promising to eschew so-called “sin stocks” (those involved in industries such as liquor, tobacco, adult entertainment, cannabis, gambling, or firearms).

Interested in investing with ETFs?  FSI Sector Allocation Rebalanced Monthly

|

ESG investing is different. ESG investing rests on the idea that the pursuit of profits and a healthy return does not need to take a backseat to a desire to pick socially responsible investments. In fact, many proponents claim companies that consider environmental, social, and corporate governance issues in their operations are likely to be more profitable over time. In addition, they assert that investors who consider them are likely to enjoy better returns—particularly in the long run. JPMorgan CEO Jamie Dimon in 2018 said that for companies, this is “the only way to be successful over the long term.”

Some Approaches to ESG Investing

ESG investing is for investors who believe that it can pay to be good, however one wants to define “good.” Unsurprisingly, there are many ways to define “good” when it comes to evaluating the ESG performance of a company or investment.

For instance, one can choose to use negative criteria or positive criteria. An investor focused on positive criteria might limit themself to companies that do specific “positive” things from an ESG standpoint. That could mean only considering companies with adequate diversity and independence on their boards, corporations that have transitioned to sustainable energy sources, or businesses offering subsidies for employee education and training.

Alternately, an investor could refuse to consider investing in companies with certain negative criteria. For example, companies that have been repeatedly sued for discrimination, incurred regulatory fines for pollution, or done business with dictatorships might be excluded from consideration.

Some methodologies measure a company’s ESG performance relative to peers in the industry. Elon Musk once questioned the S&P’s ESG methodology after it removed Tesla from its ESG index. How, he very reasonably asked, could a company devoted to sustainably powered vehicles and related products be left off an ESG list when ExxonMobil was included?

It seems more understandable once we look at S&P’s methodology. It measures companies relative to their peers, and Tesla lost out when compared to other automakers, which have improved by expanding their presence in the EV space while avoiding some of the non-environmental issues weighing on Tesla recently, such as allegations of racial discrimination and unsafe working conditions. Concerns about how Tesla responded to deaths linked to its driver-assistance/automated driving feature also hurt Tesla’s rating. Musk’s recent controversies since his purchase of Twitter are unlikely to help Tesla’s governance metrics.

With the increasing demand for ESG-friendly investments, one problem has arisen: there is no widely accepted way to assess the ESG performance of a company or investment, no agreement as to which criteria to use, no objective way to assess many of the policies and metrics, and a multitude of institutions offering their own take on these questions.

The Principal Claim: ESG is Good for Your Portfolio Performance

They might disagree on the details, but ESG advocates all agree on one assertion: companies and investments with high ESG metrics tend to do better for investors over time.

There are certain theories as to why companies and investments with strong commitments to ESG principles and best practices might deliver better profitability and investment returns. One of the most popular theories proposes that managements that can successfully implement ESG practices are more capable. They need to be more efficient or more innovative, or to be better at managing risk. And capable managements just so happen to be more likely to deliver higher returns.

Another popular theory asserts that ESG principles themselves lead to a competitive advantage. For example, a company embracing diversity has a broader talent pool from which to draw upon, and is thus likely to attract more skilled and talented employees. A company that implements sustainable manufacturing practices might be better able to weather volatility in energy prices.

Still another group of ESG advocates argues that voluntary compliance with ESG principles is positively correlated with consumer demand and negatively correlated with regulatory oversight and government restrictions. That is, companies acting as moral citizens will attract more customers and are less likely to incur costly fines or restrictive regulatory actions.

All of these assertions might be true. Or they might be just … assumptions. But what concerns us in this discussion is investment performance. Everyone likes to feel like they’re doing a good thing, but performance drives ESG investors. We know this because unlike in the years preceding it, 2022 saw outflows from ESG investments. Why? Part of it has to do with Russia’s invasion of Ukraine, when the energy sector started to outperform in response, and investors flocked to reap the benefits.

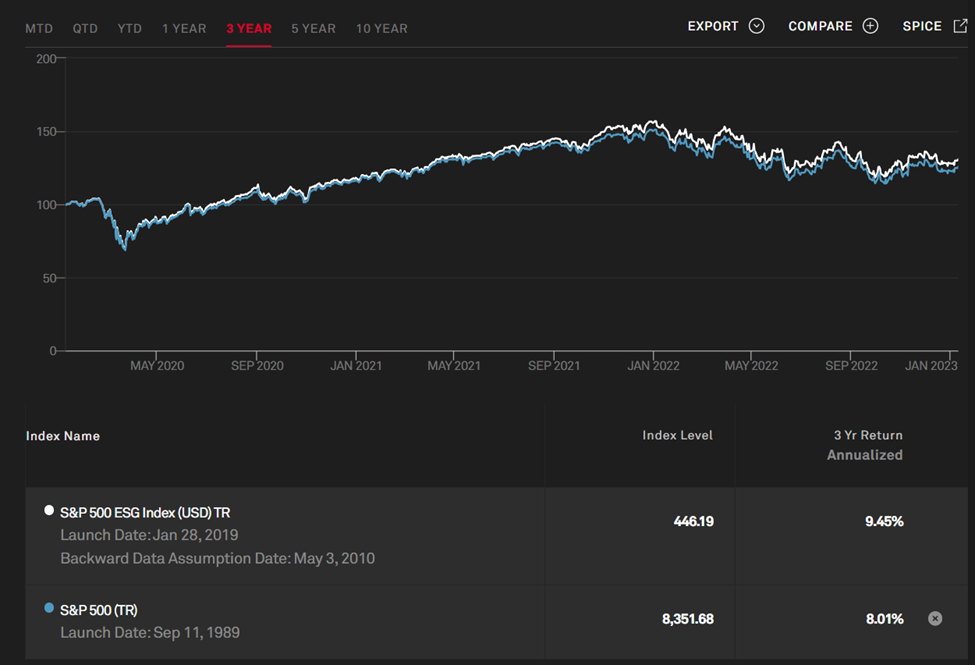

If we were to look only at the S&P’s ESG methodology, it would appear that ESG performance does in fact correlate to outperformance.

S&P uses a methodology aimed at creating an ESG index aligned with the S&P 500’s risk/return profile, incorporating similar industry weightings. The SPESG index is rebalanced annually, and the ESG criteria are updated as prevailing views as to what constitutes good ESG performance change. For example, in 2022, the index added negative criteria, excluding companies for involvement in military contracting, the manufacture and sale of small arms, and oil sands. Such factors previously had not been grounds for exclusion.

In the three years since the SPESG index was created it achieved a small but significant total-returns advantage over its S&P 500 benchmark. Case closed, right?

Not So Fast

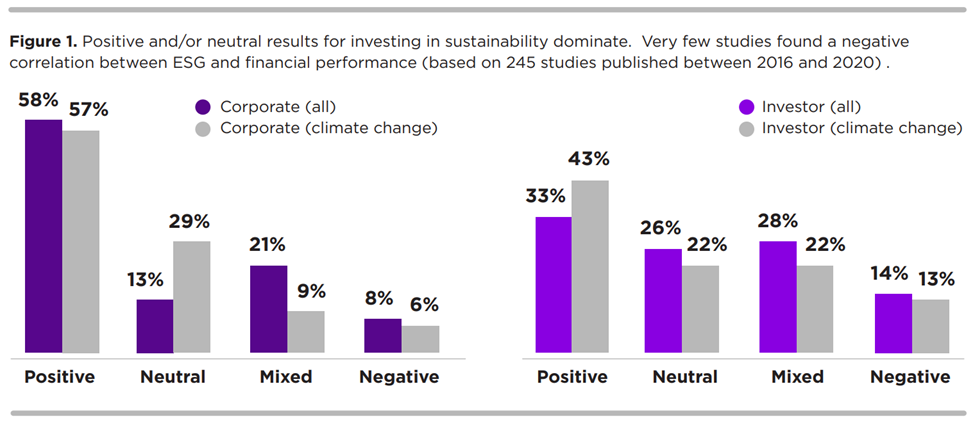

One comparison is not enough to reach a conclusion. Luckily, many researchers have also investigated whether there is a positive correlation between returns and ESG performance. A meta-analysis of those studies might provide some insight. In 2021, researchers at the Center for Sustainable Business at NYU’s Stern School of Business examined the findings of more than 1,000 ESG investment and corporate performance studies.

Research only available to banks & hedge funds, now available to individuals

|

The researchers found that when adjusted for risk, 59% of studies showed similar or better performance relative to conventional investment approaches while only 14% found negative results. Sounds like a solid endorsement for seeking out companies with high ESG performance, or investment products offered by asset managers focusing on such companies.

There is one problem, however: as the authors of the meta-analysis admit, there is a serious “lack of high-quality data about the performance of companies on their material ESG factors.” This is a longstanding problem that others have recognized. Angel Gurria, secretary-general of the OECD, noted in October 2020: “Despite the proliferation of ESG data and tools, ESG performance is still difficult when trying to compare between companies, projects and financial products, and users are still getting a fragmented and inconsistent view of ESG.” Unfortunately, a solution has yet to present itself.

The problems with the general quality of ESG data are numerous. For one thing, there is no widely accepted or regulatorily mandated standard for data formats or reporting. Often, the kinds of data an ESG-oriented investor might want to see are not tracked by companies. Even when companies report useful ESG data, those reports are unaudited and unverified, so reliability is suboptimal. Finally, ESG-related investment decisions are often based mostly on third-party scores from data providers who do not adequately disclose how they standardize the multitude of ways in which companies report on ESG criteria for comparison.

For investors who believe ESG is material to a company’s potential returns, the obvious problem is that this impedes their ability to assess prospective investments. However, it also impedes investor demand for ESG-compliant shares in general. Surveys show that one of the leading reasons for investor reluctance to integrate ESG criteria into their investment decisions is the inadequate volume and quality of ESG-related data. This has an obvious potentially inhibitory effect on the prospective returns of ESG investments.

Our Recommendation

The hypothesis that investments with strong ESG fundamentals have potential to generate higher returns is far from proven. The many studies on this question suggest it is possible, but if performance is your priority—and we assume it is, since you’re here reading this—then focusing on solid, deep evidence-based research is the superior philosophy. ESG characteristics can be used when trying to choose between a set of equally compelling prospects, but if you really want to impact the world meaningfully (whatever that means to you), we suggest pursuing this goal separately from your investment pursuits.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 9a4381-0ccf8e-792b8f-c8978c-1707b5

Already have an account? Sign In 9a4381-0ccf8e-792b8f-c8978c-1707b5