Signal From Noise

Research

Signal From Noise

Research

Not Too Late To The Party: Why Energy Could Continue Its Incredible Run

- Energy, one of our top picks for 2021 and 2022, has continued to dazzle with outperformance, up 39% YTD, outpacing the broader market by a mile. Our research suggests that despite the past week’s pullback, the sector has more room to run.

- We highlight insight from four of our research heads, who detail the factors that could drive continued strong return. They believe the next few years are structurally bullish for the Energy market, and demand has strengthened.

- We analyze the risks associated with the Energy trade, where we could be wrong, and ways in which you could play it.

Last December, when the S&P 500 was sitting near all-time highs, Tom Lee made another non-consensus forecast: While warning the first half of this year would be “treacherous,” he highlighted Energy as a key component of his 2022 strategy. On Dec. 21,2021, he told more than 1,000 members that the sector still had plenty of room to run.

“There’s a structural shortage in oil,” Lee said six months ago. “No matter how much drilling starts now, we have a two-year deficit of falling production, so it’s going to take quite a long time to bring supply and demand into alignment. Energy stocks are trading cheap to oil. They’re managing capital very carefully. So, you’re in a win-win situation as an equity holder, and they’re not widely owned, so it’s still very non-consensus. We like Energy. We see improving relative performance.”

Mark Newton, our head of technical strategy, echoed Lee a few weeks later, sharing that he believed Energy would outperform and enjoy a multi-year bull run. “It’s a phenomenal group for the next few years,” Newton said in January. “Energy is going to be the right place to be.”

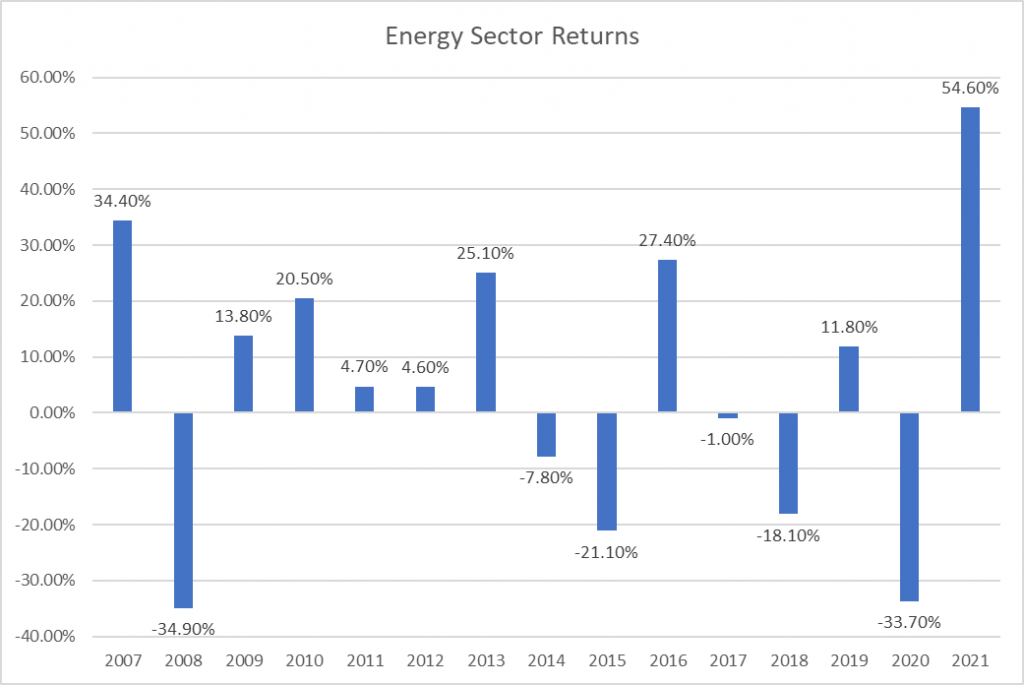

At the time, much of Wall Street had braced for a pullback, given Energy’s outperformance in 2021. But nearly six months later, oil and gas prices have continued to elevate. Even still, there remains a demand-supply mismatch, and Vladimir Putin’s senseless invasion of Ukraine has thrust energy prices even higher, forcing many countries to reconsider their energy supplies. Now, as summer travel season approaches, our four research heads believe the sector could enjoy further upside. We might be 20 months into a generational Energy bull market following the sector’s lost decade of the 2010s. Remember, as late as 2011 Exxon Mobil was the largest company in the world.

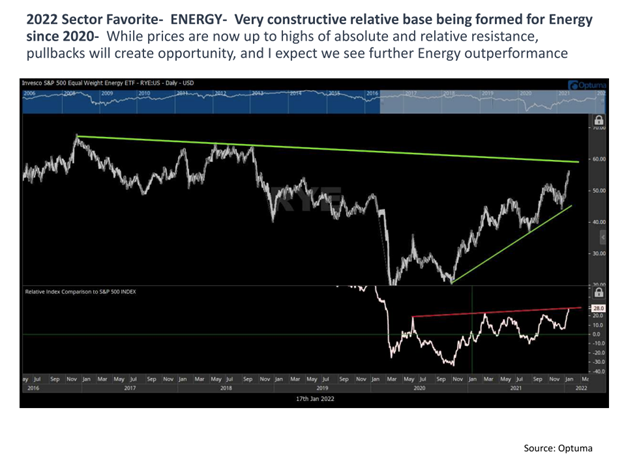

Added Newton: “My work is still very constructive on Energy, with a relative base being formed since 2020. Pullbacks will create opportunity. It’s really going to be important to be in this group. I’d rather take an intermediate-term bullish position than get too cute timing peaks. It’s going to be a great area, and I like it for a long time.”

Here’s Newton’s chart analysis from January:

An Energy Super Cycle

Energy is a cyclical industry, where losses in bad years are recouped in good years. The industry has been by far the worst performing sector over the past decade, despite a doubling in production. It has long been an under-invested area because of poor past returns (blowoff tops in 2008, 2014 and 2020) and ESG concerns, as well as divestment initiatives, restrictive access to bank lending, and combative Energy policy decisions, such as the Bill C-69 in Canada and the ending of the Keystone XL pipeline in the U.S. On the ESG front, a misconception is rooted in the idea that EVs will hit the road en masse and drive down the demand for oil. But from China to India to Africa, billions of humans need oil for almost everything — no matter how many people are driving a Tesla next year.

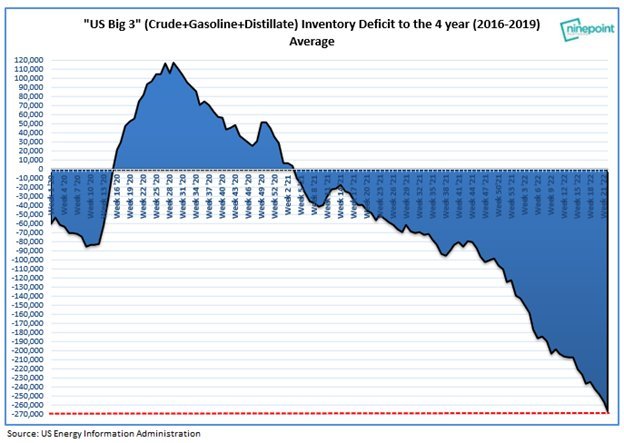

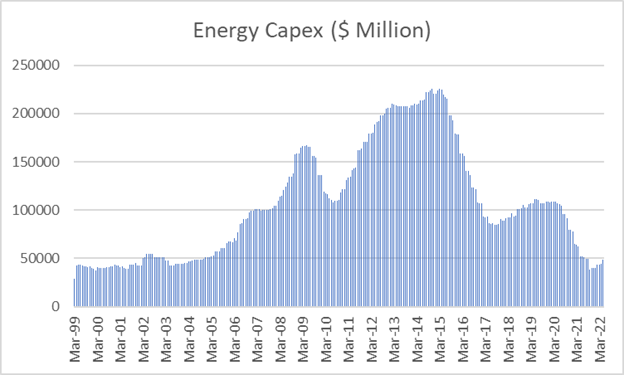

We’re also amid a supply crisis that shows no signs of easing, and Energy still hasn’t seen a real influx of capital. The pandemic killed demand for oil and gas, leaving the world vulnerable to Putin’s supply-side punch. As Russian energy disappears from the market, prices are expected to continue surging until the global economy slows down enough to reduce demand. At its core, our Energy thesis is rooted in supply and demand: A lack of supply is coinciding with a structural shift in demand. Capital expenditure was already low before COVID-19, and it has plummeted further in recent months as producers prioritized maintaining existing operations.

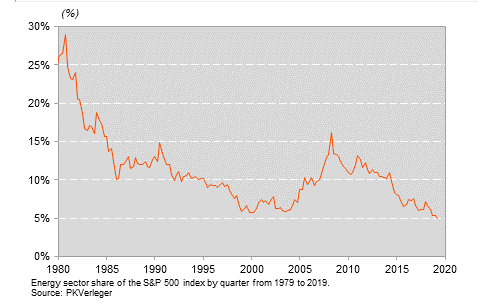

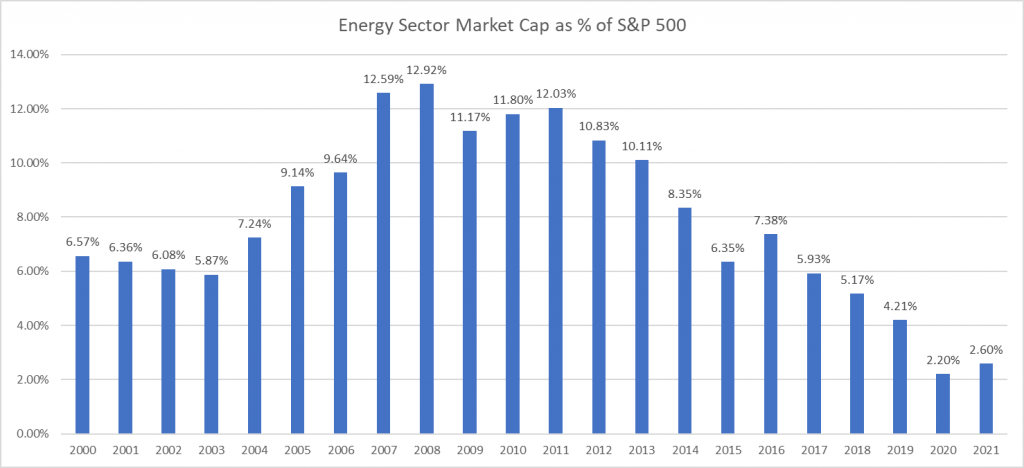

Energy companies have gone from comprising about 1% of the S&P to about 5%, which historically is still low. When oil peaked in the summer of 2008, the energy sector made up nearly 17% of the S&P 500. Consider that in 2021 Energy made up less than 3% of the S&P 500, which means Energy’s 53.3% total return last year contributed to less than 2% of the S&P’s 28.7% gain. As a percentage of the S&P 500 market capitalization, Energy is about 60% lower in 2022 than it was in 2010.

Energy investors also endured a six-year bear market starting in 2014, then a pandemic-induced demand shock. Investment in oil projects peaked in 2014 and is now only half that level despite the oil price having fully recovered. And even with a U.S./Iran nuclear deal that could potentially unlock 700,000 barrels per day of production in the next year and relaxing Venezuelan sanctions to unlock up to 500,000 barrels per day, the oil market would remain in deficit.

Says Newton: “I can see a (Brent crude) pullback down to probably 100 from where we are. A minor pullback in crude maybe, but the bull trend is still very much intact, and that’s going to be bullish for Energy probably for the next couple of years. Oil is in a new bull market.”

We believe persistent demand growth in the next few years, slowed production growth from global super-majors, and the exhaustion of OPEC’s spare capacity are all tailwinds for Energy stocks. Last week, Mohammed Barkindo, the secretary general of OPEC, spoke at the Royal Bank of Canada’s Energy conference in New York, warning that “OPEC is running out of capacity,” and that “with the exception of two or three members, are all maxed out.” Further, “the world needs to come to terms with this brutal fact” and that it is a “global challenge.”

In 2021, our top sector was Energy, which was met with skepticism because it had been a laggard for more than a decade. But we believed it would deliver for your portfolio. And despite the recent pullback — signifying the area might be over-extended in the short-term — we believe the long-term setup remains strong.

“For 3-5 years, I think Energy has the power to be transformative to someone’s portfolio,” our Head of Research, Tom Lee, said last year. “Oil is strengthening with some of the best supply-demand dynamics we’ve seen. Energy is under-owned, it’s a meaningful percentage of GDP, the companies have fantastic balance sheets, and global demand is increasing. Oil pushed the economy into a recession in 2008 at $133 oil. In the last 14 years, the U.S. economy is less energy intensive, and we’ve had general price inflation. For oil intensity to hit the economy the way it did in ‘08, crude would need to get to $252. There’s a lot of room for Energy to ascend from here without damaging the economy.”

Lee continued: “Oil has risen faster than Energy stocks, so there’s still a substantial catch-up trade for Energy equities to catch up. Energy is one of those dark horse sectors where almost anything you do will be a profitable trade. One of the challenges people have today is they think oil is irrelevant, because of ESG. But this is a secular growth trade. Growth managers who bought oil in the 1990s are coming back to this.”

No Signs of Rollover, Still Relatively Cheap

In a recent note, Brian Rauscher, our Head of Global Portfolio Strategy and Asset Allocation, said Energy continues to be favorable, grinding “toward extreme positive with few signs of rolling over. We are on high alert for rollover signs in the coming months.” Rauscher notes that the lack of a peace deal between Ukraine and Russia is keeping pressure on Energy prices. He saw strength recently in the revisions of Oil and Gas Equipment & Services names in the S&P 500.

Adam Gould, our Head of Quantitative Strategy, says his models are showing Energy “is definitely still cheap, using a five-year rolling z-score” that indicates it’s the cheapest sector based on both forward P/E ratio and FCF yield. Gould added that the sector is dealing with underinvestment, and capacity continues to be strained. Capex is just starting to ramp up again, and it usually takes two to three years before we see meaningful expansion in capacity. The cheapness of the sector, combined with the significant reduction in capital spending, makes the sector attractive.

Even if oil peaks, there are other bullish trends: Free cash flow

Consider that during 2020, when the entire world shut down — almost nobody was flying or driving — the world still consumed more than 70 million barrels of oil per day. This underscores the global demand for oil and gas. Necessary shifts to renewables and sustainable Energy doesn’t negate the need for oil, which is critical for everything from global transportation to goods production to heating homes.

The national average price at the pump has surpassed $5.00 per gallon. The rapid pace at which the price has climbed is staggering: We began the year below $3.50. A year ago, prices sat around $2.50. Two years ago, many oil and gas companies struggled to survive amid years of low to negative cash flow. Now profits are soaring, and Energy has emerged from the pandemic bear market looking better than ever.

While the U.S. Energy Information Administration forecasts gas will average $3.87 a gallon at the end of this year, that’s far from a sure bet as domestic inventories continue to fall, and geopolitical tensions persist. Goldman Sachs has upped their forecast for Brent crude prices to an average of $140 (up from $125) a barrel between July-September. Even as the price at the pump rises sharply, Memorial Day road travel surpassed its 2019 levels, and air travel demand is strong, per AAA, which believes summer travel isn’t just heating up — it’s on fire. Many people are overdue for a vacation, and they aren’t changing their behavior despite the high prices. As Bank of America said in a recent note: “Stay long Energy. With China reopening, peak driving season here, and favorable positioning/valuations, we see more upside.”

Many Energy companies are adopting a low- to no-growth strategy and, therefore, experiencing a free cash-flow bonanza. That free cash flow insulates them even if the price of oil drops. Nick Dell’Osso, CEO of Chesapeake Energy, said: “We produce a ton of free cash flow and trade at a high yield on that free cash flow. We just couldn’t be more confident in that cash flow. The market backdrop we’re operating in today is so strong. We know that as we continue to show results to the market, investors can have a real opportunity to see that yield compress and see the stock price elevate.”

Similarly, Chevron CEO Mike Wirth recently noted on Bloomberg TV that “we’re in a cycle that is different from past cycles. In the depths of the pandemic, demand collapsed at a rate we hadn’t seen before, and activity contracted because it had to. Now we’ve seen the reverse of that.” Asked if he saw signs of demand destruction, he didn’t waver. “No, quite the opposite,” Wirth said. “We’re still seeing real strength in demand, a lot of signs that demand continues to be very strong. Demand typically in our industry moves faster than supply. We saw that in 2020 and we’re seeing that today.”

To Wirth’s point: The rate of change in free cash flow has been so profound given the rise in the price of oil that many oil stocks are cheaper today than they were at the lows of 2020. Even if oil prices decrease, the valuations are largely justified, and investors can collect solid dividends, especially relative to the market.

Warren Buffett’s Entry Further Signals Long-Term Bullishness

Buffett’s Berkshire Hathaway bet on the sector has topped $40 billion this year. He’s been doubling down on his Energy investments while trimming his tech and banking holdings. This is unusual for Buffett, who wrote in his annual letter this year that Berkshire found “little that excites us.” But it appears he has found an investment that excites him: Energy. Despite a 100% appreciation in Occidental Petroleum shares over the past year, Berkshire loaded up, which is an illuminating move for a man who doesn’t typically chase stocks that have already seen substantial gains.

But many Energy stocks are reasonably valued, which fits Buffett’s style as a value investor. It’s also apparent that Berkshire realizes buying Energy stocks during periods of high inflation and rising sanctions has proven to be successful historically. There are attractive valuations, solid fundamentals, quality dividends yields, and excellent cash flow, signaling a further upward trend. Oil prices are ‘“nowhere near” a peak yet, OPEC member UAE said recently, and China’s recovery from COVID-19 will bring greater energy consumption.

For Berkshire, this is clearly not a short-term trade. A Ukraine peace deal could drive Energy stocks down 10-15%, but that wouldn’t change the long-term trend: Demand growth will exceed supply growth, cheap valuations, and positive momentum. While some may argue the Oracle of Omaha is late to the party, the rally might be far from over. This isn’t a one-week, one-month or even one-year trade for Berkshire, and short-term fluctuations based on a Federal Reserve decision or CPI data is unlikely to impact the long-term structural trend.

This isn’t a direct buy signal. As always, much depends on an investor’s risk profile, time horizon, objectives, and overall portfolio allocation. What’s clear is the outlook for Energy prices is expected to remain high, and there’s a possibility of even bigger distributions to shareholders that could make the following Energy plays worth a look. (Each stock idea below, except XLE1.48% , is on our Granny Shots list that has outperformed the S&P 500 by more than 73%since inception.)

The index represents Energy in the S&P 500, with Exxon and Chevron making up 43%. XLE1.48% benefited from oil prices that rose more than 50% in 2021 as investors gained confidence in the world reopening. When global mobility fully returns and manufacturing bottlenecks ease, crude consumption of roughly 96M barrels per day in 2021 could rise in 2022 to surpass the pre pandemic record of 99.6M in 2019. At the same time, supply will be restricted by environmental considerations. XLE is up more than three-fold from its March 2020 low and approaching its all-time high price in summer 2014. XLE1.48% is one of the better ways to gain exposure to the Energy space without taking on individual stock risk.

XOM: Exxon Mobil

Exxon Mobil recently closed at its highest price ever, with shares gaining 44% YTD. Exxon said it generated $48 billion in cash flow from operations in 2021, its most since 2012. Analysts expect it to raise its dividend later this year, and Exxon has said it would buy back as much as $10 billion in shares over the next 12 to 24 months. High inflation could persist, and Russia’s oil industry is likely to enter a period of long-term decline, which presents opportunities for quality companies such as Exxon. The stock has tripled from its pandemic low, and it’s still relatively cheap, trading at under 10 times this year’s EPS estimates. Read more about XOM, a Signal From Noise selection in early 2021, here.

CVX1.80% : Chevron

Chevron is among the companies sticking to its promise to moderate growth and return cash to shareholders. Chevron said it generated $21.1 billion in free cash flow in 2021, its most ever. But it’s not planning to invest into new oil and gas production. Instead, it decreased its dividend by 6% and said it would buy back as much as $5 billion of its stock this year. Despite its 45% rise in the past 12 months, CVX1.80% is still cheap, trading at about 10 times this year’s EPS estimates. The most recent Berkshire’s 10-Q report revealed that Warren Buffett increased his CVX1.80% position by more than three times during the past quarter.

DVN1.48% : Devon Energy

DVN1.48% has enjoyed a sensational run: 39% gain YTD, 129% over 12 months. It was the top performing stock in the S&P 500 index in 2021, rising by a hefty 168% in just 12 months. The stock is up 10-fold since its March 2020 low. Even if oil prices were to pull back to the $90s where they were prior to the Russia-Ukraine war, Devon Energy would still be quite profitable. The stock is priced at less than 7x free cash flow, and its capital return program of about 9% yield via dividends and share repurchases is strong. Its excellent dividend payout increased again in the first quarter by 27 percent to a record high of $1.27 per share.

PSX1.73% : Phillips 66

Not only is the company trading at a lower valuation than it has traded in the last five years, it is also trading at a significant discount to the broad market. The company is an integrated oil and gas giant with midstream, refining, chemicals, and marketing operations. While its midstream business is less prone to fluctuations in prices of fossil fuels, rising oil prices is a major headwind for the company’s refining business that converts crude oil into end-use products such as gasoline and aviation fuel. Phillips 66’s Q1 earnings report showed the company has recovered from the pandemic in a resounding way, living up to its history as one of the best dividend growth companies in the S&P 500. Earnings were reported at $582 million, or $1.29/share, with $1.1 in operating cash flow. It repaid $1.45 billion in debt during the first quarter and announced plans to restart its share repurchase plan. With a 4.4% dividend yield, it appears poised to continue to grow on a long-term basis thanks to high free cash flow and a healthy balance sheet.

Risks in Energy and Where We Could Be Wrong

Risk management is always critical. Howard Marks believes “investing scared” can help in the long run. Worry that you can make high-quality decisions but still be hit by bad luck or surprising events. Worry about the possibility of loss. Worry that there’s something you don’t know or can’t anticipate.

Thus, here are several risks with Energy:

- Demand destruction if prices move well above $125-$150

- The sector could be overheated and due for pullbacks; such rapid and substantial rallies, combined with overall market sentiment, could trigger large price volatilities in the short term

- Ukraine war could end and result in an Energy selloff

- Energy has experienced blow-up tops, notably in 2008 and 2014

- President Biden to visit Saudi Arabia in July; can he convince Mohammed Bin Salman (MBS) to increase production? Possibly, but we see it as unlikely

- Long term, climate concerns are risky for the sector overall, and companies could be negatively impacted by lawsuits, regulations, and tax laws

- The sector historically has underperformed the broader market

Final Thoughts

Even if the war ends in the near-term, Russia’s invasion of Ukraine is likely to have a long-lasting impact on Russia’s oil industry, which impacts the global oil market given the country’s status as the world’s second-largest oil exporter. Despite strong year-to-date performance, Energy stocks remain mispriced and offer a way to insulate a portfolio from inflationary risk and high oil prices. A global transition to renewables is in the works, but it’s a long process that’s years away from materializing in a significant way. At present, relatively cheap valuations and nice dividend yields continue to make Energy attractive.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 5b7aee-13965c-514e8f-c3f0e5-09e0d6

Already have an account? Sign In 5b7aee-13965c-514e8f-c3f0e5-09e0d6