Signal From Noise

Research

Signal From Noise

Research

Summary

- NetApp is a legacy internet company that is probably best associated with its history in the hardware side of the data storage business.

- The company appears to be successfully executing a significant pivot toward being a cloud-focused, software-oriented company with much better growth potential than its hardware history would suggest.

- In addition to increasing profitability and continual beats and re-raising of estimates and guidance, this company is majorly shareholder-oriented. They have reduced the share count through buybacks by 44% over the last ten years.

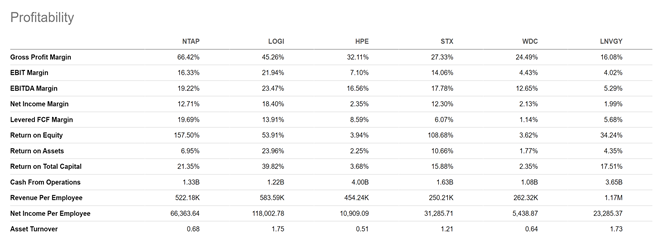

- NetApp has impressive profitability metrics even when measured against the behemoths that inhabit the Information Technology (XLK-1.10% ) sector with it. The company is focussing on margin-expanding areas of its business.

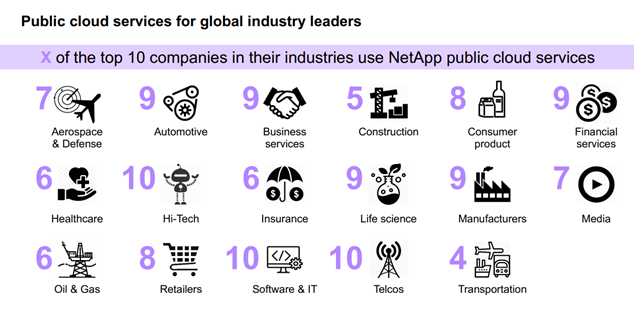

- The company has vital relationships with the major public cloud providers, and its software is actively promoted by Google (GOOG0.33% ), Microsoft (MSFT-1.90% ), and (AMZN-0.99% ). NetApp is a key strategic partner of these firms and has set itself up to be an essential component of digital transformation across virtually every industry.

“Successful investing is anticipating the anticipation of others.”

-John Maynard Keynes

What is beautiful? Is there any universal standard? Beauty is indeed in the eye of the beholder, as they say, but this very fact implies something else; the common, or average, standard of beauty may deviate significantly from that of any individual. John Maynard Keynes is one of the most influential economists in history. When looking at a 1930s newspaper game that asked contestants to select the six most beautiful women, he had a pretty stark realization about the implications of this game for stock market valuation. The insight was if you were to win the beauty contest, you shouldn’t pick who you think is the most beautiful; instead, you should choose what you believe the average opinion will consider the most beautiful. So understanding the other contestants’ conception of beauty is just as important as looking at the pictures.

So, in other words, if you are just looking at the fundamentals of a stock, you’re only getting half the picture. What you also need to consider is what the broader investing community will think about this stock in the future. The ideal candidate for a stock is, therefore, one that may look somewhat homely today but which you are convinced will be an enchanting beauty in the future. Those who had faith in Amazon (AMZN-0.99% ) over the years can probably relate. The low-margin, struggling for profitability company was hated by many on Wall Street for many years. Now, it is titanic in its stature. If you had seen that the future world would think Amazon, despite its despised status on the Street, is a smoke show, as they say of attractive women in Canada, then you’re probably pretty rich.

Coincidentally, the company we are highlighting as homely today but beautiful tomorrow is actually quite essential to the continued growth of Amazon’s primary growth driver, AWS. NetApp is perhaps best known for its role in providing hardware data storage. This section of the technology sector is considered so dull that it was the butt of many jokes in the hit HBO show Silicon Valley. This pop culture reference alone illustrates some of the stigmas the name may face when capturing the affection of the investing public.

Source: Silicon Valley from HBO

NetApp Is Becoming Quite Beautiful From Many Perspectives In Defiance of Its Image

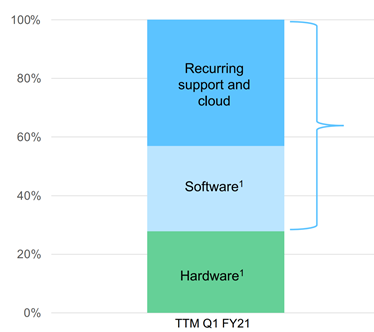

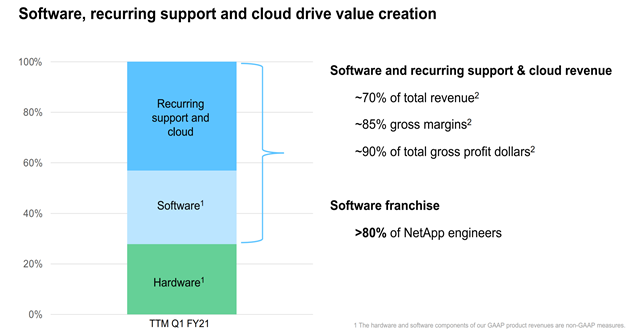

If we were trying to pitch a data storage hardware firm, you’d be right to raise an eyebrow. However, only about 25% of NetApp’s revenue is now derived from hardware. The rest of the revenue is now derived from the software and recurring revenue from lucrative support functions. The gross margins in these business sections are a whopping 85%, and these sections now account for 90% of the company’s total profit. So, as you can see, referring to this company as a hardware company is simply no longer accurate. It is a cloud and software company now, and an incredibly competitive one at that. Categorizing the company as such results in dramatic underestimates for future growth, in our opinion.

Source: Virtual Analyst Day: Driving Shareholder Value With Software and The Cloud

There is also an incentive on Wall Street for hardware analysts not to give up coverage of a name to software analysts, even if that’s what makes the most economic sense based on the profit drivers. This cultural incentive amongst Wall Street analysts can have a real effect on the price of a stock. Lately, though, analysts have begun noticing NetApp and the strong guidance and bold pivot taken by its management. While there still may be a weight-and-see mentality, which is par for the course among ‘legacy internet names,’ we believe this hesitance is your opportunity. If you’re still thinking of NetApp as a hardware company, you’re sorely mistaken.

Source: Virtual Analyst Day: Driving Shareholder Value With Software and The Cloud

The key here is that many may miss just how essential NetApp has become in implementing hybrid cloud solutions at the enterprise level. In cloud and data storage, implementation is also a key advantage and an area where many providers have trouble making the rubber meet the road. The promotional Run to NetApp campaign has been a smashing success that also reaks of a management team with competitive prowess. NetApp’s two-decade-long partnership with Microsoft is also going in some intriguing directions that suggest the name will be as synonymous with enterprise cloud as Nvidia is with AI chips, particularly since it partners with Microsoft’s primary public cloud competitors as well.

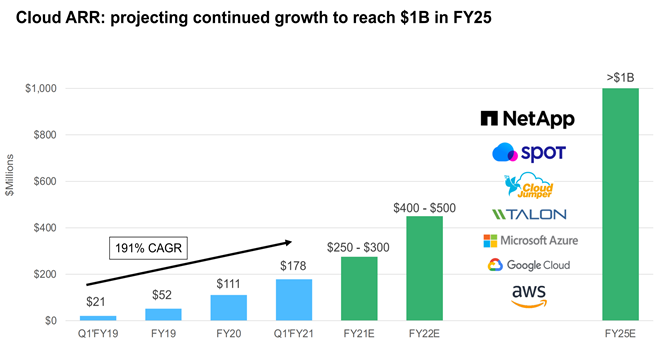

NetApp’s Guidance And Plan Are Very Good, Yet It Could Still Be Very Conservative

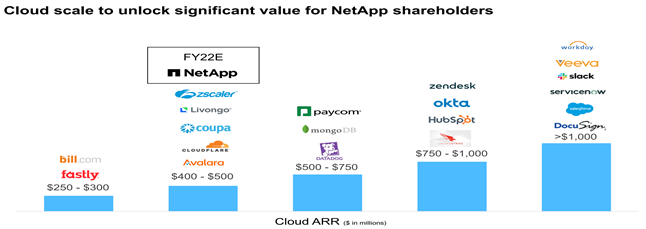

Source: Virtual Analyst Day: Driving Shareholder Value With Software and The Cloud

The benefits of scale in data storage and cloud are immense. This can be seen in the explosive growth that this company has achieved, even during a pandemic. There is ample reason to suspect that when the workforce returns en masse to the office, many enterprises across a wide variety of industries will have to rethink their enterprise-level data storage and cloud strategy. The benefits of the public cloud are severely diminished at the enterprise level without the use of NetApp’s software.

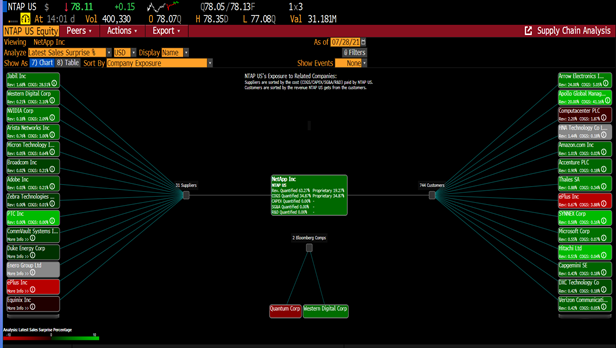

Source: Bloomberg

The company has excellent relationships with the leading cloud services firms, and its software solutions solve many of the problems that enterprises face when shifting to public cloud storage. Being in a symbiotic sales relationship with Google, Amazon, and Microsoft is a pretty enviable position. The ties between the companies are so tight that salespeople can use sales of NetApp products to reduce their sales quotas. The company has deep and sustainable customer relationships that result in repeated and growing revenue, especially on the software side. It is a feature of this business that revenue per customer increases with time retained as data needs inevitably grow.

Source: Virtual Analyst Day: Driving Shareholder Value With Software and The Cloud

As you can see, the company has experienced pretty incredible growth over the last two years, even through the most significant exogenous economic shock of our lifetimes. Here is another thing about their strategy that we think could make these estimates occur on an accelerated timeline. NetApp is gobbling up new customers. That will likely only increase as workers return. The pent-up demand for data storage and all things involved with the digital transformation that unlocks efficiencies in virtually every industry occurs on perhaps a more comprehensive basis than ever before. So, these needs for data and the software and solutions that NetApp provides very well may increase at a more parabolic and rapid pace than estimates solely informed by historical data would indicate.

A Wolf In Sheep’s Clothing

Sometimes movies and pop culture jokes may contain more meaning than we would initially imagine. In the 1999 coming-of-age romantic comedy, She’s All That, a popular jock played by Freddie Prinze Jr. engages in a cruel but illuminating bet with a high-school rival to see if he can transform one of the least desirable girls in school to the prom-queen. Though the movie may seem trivial, this is really quite beautifully illustrating the concept of bounded rationality that is at the heart of the Keynesian Beauty Contest. In fact, a parody movie called Not Another Teen Movie specifically targets the film as a perfect example of how irrational and subjective conceptions of beauty are and that someone is not actually transformed by taking their glasses off, instead our collective perceptions are.

Source: Hollywood.com

Ok, ok, you probably are entertaining the possibility there is a compelling opportunity for the company in the cloud. It certainly appears to be executing on its cloud and software-centric strategy. When only 10% of profits are derived from the hardware business, is it really fair to call the company a hardware company anymore? Especially in a world where companies survived revenue virtually flat-lining, the hardware component of the business seems more and more like an after-thought.

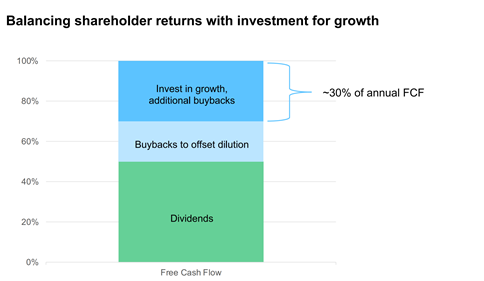

Source: Virtual Analyst Day: Driving Shareholder Value With Software and The Cloud

However, if you’re missing how pro-shareholder and seasoned this management team is, you probably don’t understand just how much of a pony-tail-down, glasses-off moment that we think NetApp is likely to have. As we said before, the company has been aggressively buying back shares, and another thing that makes this firm a definite wolf is its free-cash-flow generating chops. Not only does it generate a far higher FCF margin than its peers, but it also returns it to shareholders religiously, though not so much so to endanger the company’s credit. The company has historically paid a dividend that will also likely be augmented in the coming quarters.

Beauty is indeed subjective. However, we know what Wall Street likes to see, and reducing the share count by 44% over the last ten years shows a management team dedicated to shareholder value. This, combined with the impressive growth, the increasing benefits of scale, and the competitive advantages of the company’s cloud and software products, should mean that the multiple is likely to drift higher and higher as successful execution and growth play out. This name also recently has been added to our Granny Shot’s list. We believe in the success of this company’s strategy and think it is only a matter of time before large swaths of investors see the same.

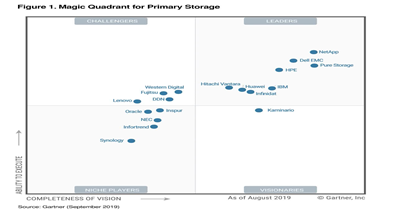

Source: Gartner, Inc

Risks And Where We Could Be Wrong

Cloud revenues can be notoriously volatile and erratic at times. The way billing works means most deals close pretty close to the end of the quarter, so sometimes, if there’s unforeseen deal slippage, it can adversely affect earnings. However, as long as the company’s strategic plan and pivot aren’t derailed, we’d use any temporary earnings weakness to buy stock.

The space NetApp is competing for is not an easy one to attain, much less to hold onto. There is a lot of competitive pressure, and one potential item that could be problematic is if the company’s shareholder-oriented focus puts it at a disadvantage in the intensive R&D and Capex required to stay competitive in a quickly evolving field. Recent competitive developments suggest that chief competitors like Dell imitate core elements of NetApp’s strategy, simultaneously validating its strategy and threatening it.

Dell EMB, IBM, and Hitachi are all established competitors of NetApp that have very entrenched customer relationships with a lot of the most significant data spenders. It may be more challenging to poach the additional business required for successful implementation. These rivals also are very flush with cash and have very competitive R&D capabilities. Xerox could have been Microsoft, which illustrated a perpetual risk in high-technology industries. On the other hand, NetApp seems to have significantly more room for error than its competitors, given its considerably higher margins. This makes management’s claim (bolstered by its track record as well) that it can balance investments needed for continued growth with the lavish buybacks it rewards its shareholders with.

Source: SeekingAlpha

NetApp is certainly not without risks. The company is utterly dependent on NAND chips, which haven’t been as critically affected as some other types, but supply-chain issues can be a serious concern. The burgeoning software business is more insulated from these risks, luckily. The company is a serial M&A participant, and there are always risks with aggressive strategies in this area. Cultural integration or quickly becoming too big for one’s britches is a common problem to the management of growing firms in all industries.

Source: Company Reports

Another idiosyncratic risk to the firm that bears watching is that, despite having hundreds of customers (and that number is likely to grow exponentially), it is pretty heavily concentrated in two of its longest-standing customers; Tech Data and Arrow Electronics. Together these two clients account for over 40% of revenue. Obviously, being concentrated heavily with minimal clients is a risk. However, management appears to have diversification well in hand. As time goes on, revenue from their diversifying client base should help mitigate this weakness.

Prior “Signals”

| Date | Topic | Subject / Ticker | The Signal |

| 07/22/21 | Stock | American Tower (AMT-0.59% ) | Towering Over The Headline Risk |

| 07/15/21 | Stock | Aptiv (APTV) | The Oracle of Aptiv |

| 07/08/21 | Stock | Dexcom (DXCM) | Dexcom: Battle Tested and Data-Driven |

| 07/01/21 | Stock | Alibaba (BABA) | BABA: Rich Country, Strong Army |

| 06/24/21 | Stock | Live Nation (LYC) | LYV: We Love Rock N’ Roll |

| 06/17/21 | Stock | Booking Holdings (BKNG) | BKNG: Workhorse, Not Showpony |

| 06/13/21 | Stock | Nvidia (NVDA) | Nvidia: The Cisco Kid |

| 06/04/21 | Stock | EOG Resources Inc. (EOG) | EOG: The Death of a Salesman |

| 05/27/21 | Stock | American Express (AXP) | DJIA Stalwart American Express Will Likely Flourish…. |

| 05/21/21 | Stock | CME Group (CME) | CME Group’s History Of Growth and Durable Advantage |

| 05/13/21 | Stock | GoPro (GPRO) | Reiterating Bullish Call on GPRO/SFN Update |

| 05/07/21 | SPAC | Mudrick Capital (MUDS) | Mudrick Capital’s Topps Deal Is A Sensible SPAC |

| 04/29/21 | Stock | Cleveland Cliffs (CLF) | CLF: Strong First Quarter Is Likely Just The Start |

| 04/22/21 | Stock | Harley-Davidson (HOG) | HOG: Earnings Blowout Shows Company Moving In Right… |

| 04/15/21 | Stock | ASML Holdings (ASML) | ASML: The Jewel of The Empire |

| 04/08/21 | Stock | Alaska Air Group Inc. (ALK) | ALK: Fortune Favors The Strongest Balance Sheet |

| 03/27/21 | Stock | MGM Resorts Intl. (MGM) | MGM: When Boring Becomes Brilliant |

| 03/19/21 | Stock | Schlumberger (SLB) | A Stalwart Energy Name Well Positioned For Coming Boom |

| 03/12/21 | Stock | GoPro (GPRO) | GoPro: An ‘Epicenter’ Stock With Reasonably Priced Growth.. |

| 03/05/21 | Stock | Deutsche Bank AG (DB) | DB Is On The Mend And Very Cheap Compared To Peers |

| 02/26/21 | Stock | Six Flags (SIX) | SIX: An Industry-Leading Re-Opening Play With Upside Pot. |

| 02/17/21 | Stock | Real Networks (RNWK) | RNWK: From Cautionary Tech Tale To AI Multibagger |

| 02/11/21 | ETF | S&P High Beta ETF (SPHB) | SPHB: Getting to Alpha By Way of Beta |

| 02/05/21 | Stock | Exxon-Mobil (XOM) | Why Exxon-Mobil Is A Buy Despite Mixed Earnings |

| 01/28/21 | Sector | Energy GICS-1 (XLE) | If You Like TSLA’s 2020 Performance, Try The Energy Sector |

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In ccbc8e-4dc6ed-0090b6-955edc-b09a39

Already have an account? Sign In ccbc8e-4dc6ed-0090b6-955edc-b09a39