Signal From Noise

Research

Signal From Noise

Research

Key Takeaways

- We provide an update on ASML (ASML1.24% )

- We provide an update on Cleveland Cliffs (CLF-0.60% )

- We provide an update Madison Square Garden Entertainment (MSGE-1.32% )

- We provide an update on Ford (F-2.08% )

- We provide an update on Nvidia (NVDA3.48% )

We received feedback from our subscribers that our Signal From Noise update on the worst-performing picks was welcome and useful so we wanted to tackle the other side of the coin. We’ve had some strong performers in the SFN portfolio and if you’ve been lucky enough to experience the gains of the winners, you may be asking yourself whether it is time to exit.

We serve an incredibly diverse group of subscribers and institutional clients that makes it impractical for us to give specific price entries and exits. We are much more focused on teaching those who use our research to successfully navigate markets and capitalize on an evidence-based approach to investing instead of mere opinions. This is why we wanted to provide an update on the winners. Long story short, we believe all five of these performers in 2021 still have a lot of legs.

ASML Is Not Only The Jewel of The Empire, It Is The Jewel of SFN Picks in 2021

We wrote our SFN on ASML calling it The Jewel of The Empire on April 15th, 2021. In this article we described the company as probably the most important company in the world that you had never heard of. We compared its significance to the technological edge enjoyed by the Western World to the significance of India to the period of history marked by the global dominance of the British Empire.

Many Fundstrat staff attended the SALT Conference in New York this week and one recurring theme across multiple panels was the prevalence and significance of Moore’s Law in the technological advancement of human civilization. If there is one thing that separates our modern technological prowess from that of human achievement in the 19th century it is the humble silicon chip. We live in a silicon era. If there was one company that essentially guarded the gates of Moore’s Law, then don’t you think that would be a pretty good one to own?

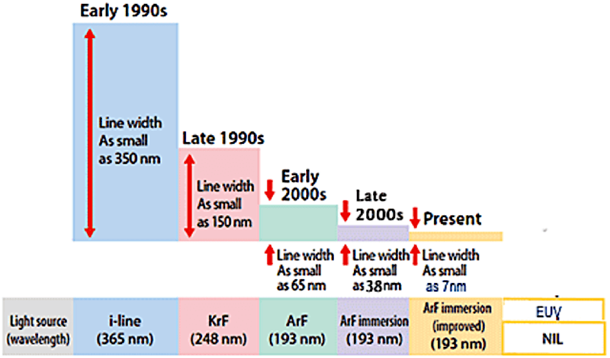

ASML is that company. Their Extreme Ultra-Violet (EUV) is the only technology in existence that will permit the continued, and essential, progression of Moore’s Law with regard to the size of chips. The banning of the sale of this technology to Chinese entities is one of the more effective actions taken to assure continued US and Western dominance in the area of chip design. ASML will also be a major beneficiary of the massive amounts of capital spending, and government subsidization, dedicated to building a domestic semi-conductor fabrication plant capacity.

The back-breaking capital intensity of the semi-conductor industry as well as the intense complexity of the product built by ASML makes the technological moat they have around their competitive advantage incredibly hard to breach. So, not only do they have a monopoly on what is surely one of the most important technologies in the world, the generations slightly behind the leading edge require the use of Deep Ultra-Violet technology. The company also has a near monopoly in this area as well and dominates the market. This technology doesn’t have prohibitions associated with its sale and distribution.

The company was trading at $640.22 when we recommended it to you and it closed on Wednesday September 15th at $889.33, which is a gain of nearly 40%. Is it time to take profits? Have valuations gotten too high. Aces are aces and the durability of the technological advantage that piqued our interest in this company has not been diminished since we recommended it. The company has been beating estimates on sales and margin and the shift toward greater use and reliance on its flagship achievement, EUV, will likely to continue the already healthy gross margin of just under 51%.

We believe this is a stock you want to own. We believe there is a lot of remaining upside. We believe the company will continue exceeding expectations as the secular tailwinds and extreme technological advantage continue to play out in one of the world’s most vital industries. Throw in dividends and buybacks and you have even more reason to own this company, which is of titanic importance.

A Steel Company That Is Still A Steal: Cleveland Cliffs (CLF-0.60% )

We covered Cleveland Cliffs (CLF-0.60% ) on April 29th, 2021 when the stock was trading at $17.39. It closed on Wednesday September 15th at $23.02 which is a gain of nearly 33%. Isn’t steel a late-stage industry saddled with unsustainable labor and pension costs? Well, if you had believed that old wife’s tale then you probably missed out on the prolific rise of CLF.

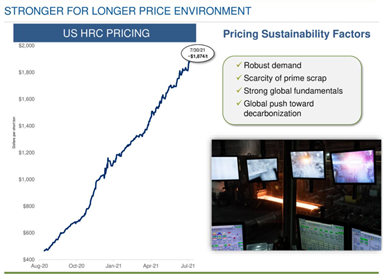

The company’s management has made the right acquisitions to create a vertically integrated steel companies that has a lot of competitive advantage when it comes to pricing, but a company that also has paid down all its debts. Cleveland Cliffs used accretive mergers to elevate itself to the most enviable position in the steel industry. It is the largest company by steel output, and it has been raising estimates like nobody’s business. We predicted correctly when we first covered the company, that despite just having raised estimates to $4billion for 2021 EBITDA, we thought it would be closer to $5 billion. Estimates for long-term steel prices have gone up since this played out and the company makes a strong case that many price dynamics are secular rather than short-term.

One of the key themes at the 2021 SALT conference was the rising prominence and investor focus on ESG impact. Cleveland Cliffs is a leader in its’ industry in these areas, which isn’t just a nice feather in the cap to have, it has also been found to reduce the cost of capital. Cleveland Cliffs has a pristine balance sheet and a no-nonsense manager in CEO Lourenco Goncalves. We referred to him as a steely industry veteran and we will repeat the pun.

The company didn’t just have a once-in-generation secular tailwind when reflationary forces started affecting commodity prices, it used this tailwind to clear off bad debts and seriously increase corporate survivability. The company has happy workers and is an exemplar in labor relations, which is never a bad thing when ‘buying American’ and an extremely labor-friendly administration is in the office. CLF will be a major beneficiary of the first major government infrastructure spending in decades.

As we mentioned, Cleveland Cliffs also has an advantage in the highest margin, highest quality types of steel that will be more and more necessary for major market trends like the rise of EV. Over a quarter of CLF’s revenue is derived from auto companies. Believe it or not, good old-fashioned steel is an essential component for many of the nascent revolutions in technology and innovation that are happening across the economy. Yes, even though the company has risen by a third since we recommended it, we still believe it is still a steal at current levels! Even when we use pretty conservative assumptions, the stock still seems undervalued to us given the tailwinds in the economy for a well-run and vertically integrated steel producer.

Madison Square Garden Entertainment Is The Thirty Under Thirty Of The SFN Portfolio

What do we mean by 30 under 30? We’re not commenting on the fact that MSGE has a lot of dynamic young staff or anything like that. We are pointing out that we recommended the stock on August 19th, less than 30 days ago, but the price of the stock has appreciated 30.80% since we recommended it. This may give some investors cause for concern, and since we recently did the Signal we won’t spend as much time on this name.

We will say that we don’t believe the recent price spike was driven by problematic factors that suggest a reversal of the gains. These gains were driven by hefty outperformance on earnings partially driven by a merger with MSG Networks that significantly increased assets. The regional sports network that is the primary asset of MSGN is one of the strongest in the world given the lucrative New York metro market and the stock was already trading well below book value. We believe the market is stated to see through the Delta variant and we also believe that vaccination rates, which are high in the markets the company is concentrated in, will help continue growth.

The MSG Sphere project is also an innovative and fascinating undertaking that has real potential to disrupt the live entertainment business. It fundamentally alters the profitability equation in significantly upping potential revenue by facilitating multiple events a day derived from original content. The company has many options to potentially expand the project through asset-light methods more reliant on IP than expensive construction costs.

Ford: An Oldie, But a Goodie

Ford is one of your grandfather’s stocks that has proven pivot is possible. The company may be unfairly associated with the US auto bankruptcy in the wake of the financial crisis, even though it and Tesla are the only American Auto manufacturers to never have declared bankruptcy. Ford has had its share of failures of the years, but arguably it has entered a second and more important phase of the transportation revolution it helped launch.

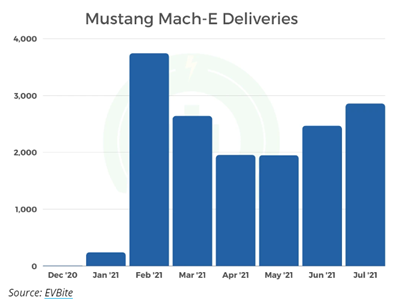

Ford actually sold 6,614 units of the Mach-E in the first quarter which was a greater number than Tesla was able to sell of its competing Model 3. As we pointed out in the first article we did on Ford on January 14th 2021 when the stock was at $10.17. It closed on Wednesday, September 15th at $13.22, which is just a hair under 30% price appreciation. Ford has a comprehensive strategy being led by a former Toyota man, Jim Farley. If there’s one reason you want to own Ford it is because of its exceptional management. We think this guy is one of the better and more under-rated managers of the day. He has managed to guide the company through a potentially crippling chip shortage admirably.

He is also a long-term thinker and he is guiding the company toward the auto-business model of the future. Ford is a major player and competitor in autonomous driving software and it is positioning itself to move away from sole reliance on the hyper-competitive and complex manufacturing side of the business to be more diversified and to capture recurring revenue from things like industry-leading software. Its’ ability to do over-the-air updates on its eco-system should facilitate this transition nicely.

We pointed out that not only has Ford proven its prowess in EV, but also that much of its new ICE lineup like the Ford Bronco are cash cows. The Bronco sales have proven the point and they are very in demand. We like the combination of EV and ICE because constraints that may hamper production and adoption of EV, like the inability of the power grid to support full adoption at this time, means that ICE vehicles will stay a part of the product mix for the foreseeable future. Also, in the tight margins that auto companies make on cars, commodity costs are far lower in ICE models than often required for EV production, unless you have a capable partner like Aptiv (APTV-2.76% ).

As we mentioned in the first article, we expect the exciting events at Ford to help investors realize that the company will deserve a higher multiple in the future. It is quite impressive that Ford is a leading pick of this column despite the many headwinds facing the auto industry. We laid out the chip shortage as one of the primary risks to the company and we think their management team has proven itself more than a worthy steward of your capital. Your investment is not going to paying unsustainable pension plans, it is going toward revolutionizing one of the most influential companies in human history. The strength of a strong legacy helping to facilitate a bold new direction is a key feature of many companies we choose to highlight in this column, and there is perhaps no better example of that kind of turnaround then what is going on at Ford!

Nvidia: The Cisco Kid, Indeed

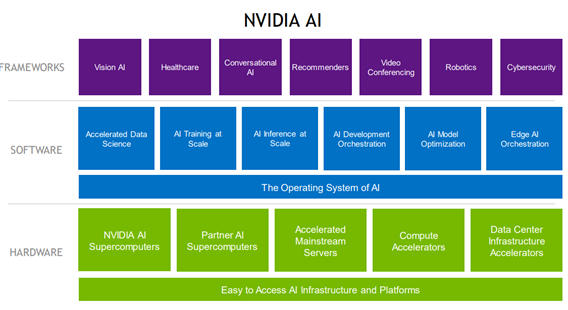

When we call a stock the Cisco Kid, we urge you to pay attention. Cisco always got the girl, always got the villain and always ended the victor. It’s hard to see the world playing out in a way where Nvidia does not prove a good analog for this character given its increasing durable advantage in the crucial area of chips that power artificial intelligence.

Even headwinds about the potential acquisition of ARM coming from European and British regulators shouldn’t give you too much concern when this company continues to exceed expectations and deploy capital adeptly. The company’s CEO is a legend in the semi-industry and has had hit after hit. These guys are likely early in their growth if you take time to pay attention to where the world is going. Perhaps more than any buzzword, the term Artificial Intelligence crossed the lips of almost every presenter. Well, the bold and efficient future we can envision as being partially enabled by this exciting new trend is not possible without Nvidia.

Nvidia is undoubtedly a juggernaut of a stock that has been on an epic run. Adjusted for the recent split, when we recommended it on June 13, 2021 it was at $178.25 and it closed on Wednesday September 15th at $223.41. This is a gain of over 25%. The stock had an incredible run before that though and some may be wondering if the gains are simply too much, too quickly. As we said the first time when we covered the stock a few months ago, sometimes picking winners is as easy as picking winners. When you go from a company making ancillary videogame products to a company that is essential to the AI-enabled future of humanity, which will unlock incomprehensible value across the entire economy, well you’re going to have a great run on your stock.

The other point is here that growth in stock price for a leading technology and growth play like Nvidia creates a virtuous cycle. Talent in the valley follows the primary fulcrum of wealth in the industry, stock options. So, the momentum Nvidia is enjoying is not just about it price. It relatively quickly changed from a video game company to a company that is quite indispensable if humanity wants to enjoy a better and more productive future.

As we have mentioned, we spent a lot of time at the SALT conference this week and much of the content was focused on a bright future for the world. Nvidia has made itself an essential piece in the advancement of humanity. It exemplified excellence on many levels and the company continues to fire on all cylinders. This is a keeper. As our subscribers know, we are also huge fans of cryptocurrency and see a lot of value and innovation in the space. Nvidia is still heavily exposed to the space and will be a part of the growth in this exciting area as well.

The valuation is high. The valuation was also high when we recommended it at 25% below its current price. Winners are winners and the seemingly indomitable market position, durable advantage and favorable momentum for the name make us very confident that this stock is one you want in your portfolio, and also one that you can feel comfortable accumulating on price weakness. If the deal does go through, it will result in the fortification of an already virtually impenetrable advantage.

For example, if the ARM deal doesn’t go through and there’s negative price action, we would be buyers. There has been recent speculation amongst some analysts that Nvidia could exceed the market-cap of Apple in five years. We believe this is plausible and if this were to occur it would make the stock about a five bagger from current levels.