Signal From Noise

Research

Signal From Noise

Research

Alibaba ($BABA): Rich Country, Strong Army

Summary

- While political risk has significantly eroded BABA’s share price, the recent actions by the CCP against the company, including the largest ever anti-trust fine in China’s history, likely mark the interim extreme and bottom for political risk and outcomes will likely improve from here.

- On the 100th anniversary of the CCP, we analyze recent actions by Xi and the CCP in their full context and explore prospects for future activities in the context of the global anti-trust push against influential technology firms.

- Political risk or not, the prospects for growth and the significantly discounted price relative to peers suggest that the fears of political risk are an opportunity to get exposure to very cheap growth and one of the most solid durable advantages in ALL of tech.

- We compare Alibaba’s business and unique brand place in the Chinese psyche to explain why the CCP needs Alibaba. There is no company more synonymous with the “Chinese Dream.” Also, few companies have improved the everyday lives of Chinese citizens as substantially.

- We explain the Ant IPO debacle and Jack Ma’s speech in a little bit of context to help explain why this action by the CCP is likely isolated. We also explain Alibaba’s unique position in Chinese venture funding and why much potential upside from investments may remain opaque.

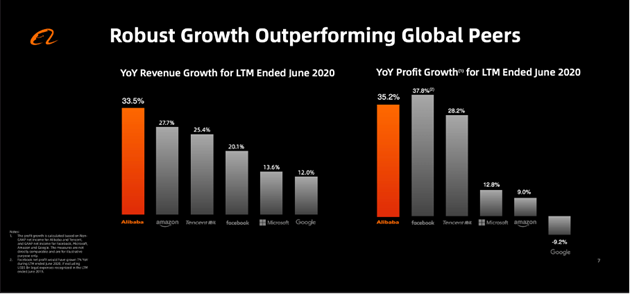

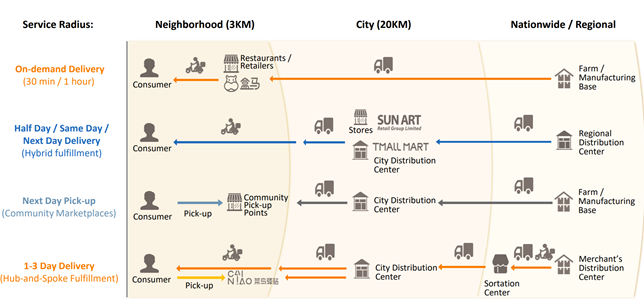

Alibaba is one of the world’s leading technology companies and has experienced incredible growth since its record-setting IPO. Its founder Jack Ma embodies Chinese entrepreneurialism, and shareholders have prized its asset-light business model since its inception. In many ways, China’s leading technology pioneer has experienced its Microsoft Moment. Undoubtedly this looks quite different than it does in America but similar to those who proclaimed a premature end to Microsoft’s relevance and viability; we think those pre-maturely proclaiming the demise of Alibaba and Chinese technology are not doing so from a place of informed analysis. Alibaba’s levels of growth have consistently outperformed its global peers. Aside from the short-term effect on earnings, these fines or the Ant IPO not transpiring as expected do not change that reality.

Source: 2020 Investor Presentation

When you look at the political risk bearing down on the Global Technology Sector instead of just the Chinese one, you actually are left with a picture where the political risk in its practical applications doesn’t seem so diminished for American Tech companies versus Alibaba, mainly since Tech firms have earned the ire of both sides of the aisle. In this day and age, if one of the few areas of bipartisan agreement is that your wings should be clipped, you should start hiring the expensive anti-trust lawyers (American tech is way ahead of us on this one). What just happened to Ant and Jack Ma was more an internecine Chinese issue that is outside of the more significant global push to counter the unprecedented power of Big Tech. But comparably, Chinese firms currently look slated to lose less of their competitive edge and government support than their US counterparts. Valuations don’t reflect this reality.

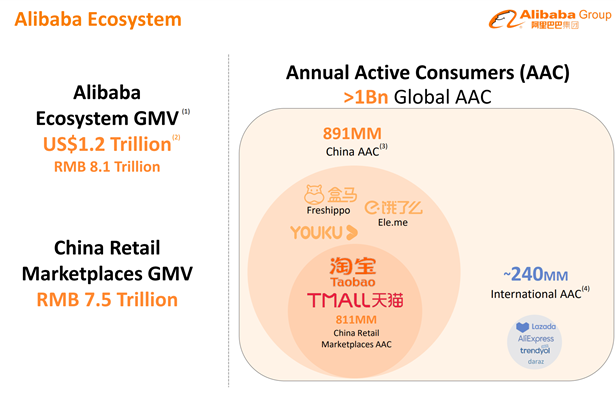

Alibaba has a vast and diverse ecosystem whose fortunes are primarily derived from the domestic Chinese market. What does this mean? It means that the breakdown in the trade relationship between the United States and China shouldn’t have as dramatic an effect on profits as it will for some of the firm’s competitors who are more tied to trans-Pacific commerce. The sheer size, diversity, and potential of the massive network that Alibaba’s continued innovation and customer-centric approach to business have fostered make this firm one of the few whose durable advantage matches that of the US Tech greats. While its initial focus was on the marketplaces business model, it has established a duopoly over Chinese venture funding with JD.com. It has one of the most voluminous and valuable portfolios of technology investments with growth potential on the planet Earth. Despite having a similar valuation to JD, Alibaba has much higher margins.

Source: Company Reports

Political Risk: It’s My Party and I’ll Fine If I Want To

Today is the hundredth anniversary of the Chinese Communist Party (CCP). Many observers worldwide have recently been alarmed at the aggressive actions of a powerful and resurgent China. Undoubtedly, the “New Maoism” being implemented by Xi is alarming and antithetical to many of our most cherished Western values. Nonetheless, understanding recent actions that occurred through an informed understanding of the Chinese Communist Party and its goals and relationship to the Chinese people should give those concerned primarily with China’s commercial future some reason for relief. A Chinese political saying that may offer insight into how the CCP views their Tech firms should help investors understand why these firms are indispensable to the ruling party: Rich Country, Strong Army.

You know you’re operating in a very different system than the United States when the company contritely thanks the government in the wake of massive regulatory action. The system in China is very different, but the Chinese technology sector should be thought of as a pillar of China’s success and transformation, not a renegade force within an oppressive Chinese system. The Chinese companies have a vested stake in the current political order, although they’d probably prefer to see a different direction than Xi is taking. The penalties exacted on Alibaba, Ant, and Jack Ma are to be seen in a different context than a rogue anti-capitalist regime stifling free enterprise.

It is true that Xi is making moves toward a command economy and away from the approach of Deng and recent rulers. However, Xi’s brand of Socialism withChinese Characteristics is predicated upon having advanced productive capacity on par with the West. Alibaba is one of the nation’s shining achievements in this area, and it’s unlikely they want to undermine it. Its business practices are not the problem (although its vast data advantage is of interest to CCP), its founder who has a public persona on par with Xi’s own (never a comfortable position in a Communist country) questioning the logic of the government on an area in its purview was the problem. It didn’t help that his message to banking regulators was essentially that they should shoulder the risk of his asset-light model in the name of development. Chinese authorities, particularly wary of letting a 2008-like crisis undermine the prosperity that their political legitimacy rests upon, were praised for their actions by leading communist thinkers like Charlie Munger. We jest, of course, to illustrate the alarmism of those forecasting the recent events around Ma and Ant as the death-knell to Chinese Tech. This simply does not seem to be a realistic assessment of what happened.

I Get Knocked Down, But I Get Up Again

Jack got the message, and since he erred, his other public appearance was speaking about one of Xi’s main priorities, poverty reduction. China is making it very clear that the American tradition of assigning political capital to billionaires will not be permitted in their society. However, this does not remove the state’s interest in continuing to promote the considerable success of its technology sector.

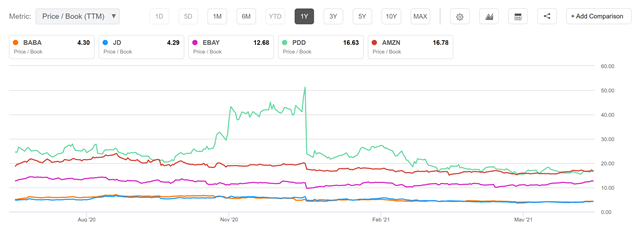

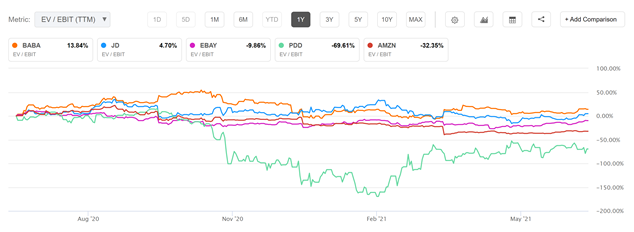

Thus, the alarmism about the Chinese government dismantling Alibaba and other internet firms is likely erroneous and should be taken with a grain of salt. A recent collaboration between the Chinese government and Alibaba throw water on this notion. We think that Alibaba’s valuation being so similar to JD.com and so much less than American counterparts and PDD, shows a massive opportunity. Alibaba’s continued growth and execution and not running afoul of the authorities seem to be the recipe for correcting this divergence in valuation.

Source: SeekingAlpha.com

What’s the worst that can happen concerning regulatory risk? The government could impose fines that eliminate a profitable quarter. That’s precisely what happened when Alibaba received the most significant anti-trust fine in China’s history at $2.7 bn, which turned a quite profitable quarter to one eight figures in the red. However, the decline in share price (especially when considered relative to peers) suggests the market is pricing in even worse political risk. We believe this is partially due to information asymmetry. The risk of de-listing has likely diminished but remains, and we’ll discuss below.

The violation of previous agreements regarding the autonomy of Hong Kong and the crackdown on free speech has alarmed many, as have the reckless military exercises that Beijing is conducting with greater frequency in Taiwan’s backyard. However, if you think for a second, the American military couldn’t make life very difficult for the PLA crossing dozens of miles of ocean, then think again. China is likely less willing to test this than nationalist rhetoric would indicate. While this may be in some ways akin to an “Iron Curtain” moment in the standoff between China and the West, it is also a competition occurring between two global super-powers whose economic enmeshment is unprecedented in the annals of history. There are many forces within both societies pushing for continued collaboration and mutual economic benefit. This dynamic is relatively new in great power politics.

Competition Breeds… Tech Anti-Trust Issues a Global Concern

One must consider that since the competition between China and America is more technological and commercial than the primarily military-oriented decades-long confrontation with the USSR, it may produce some positive effects and innovations, such as the space race did. While recent actions around Alibaba’s anti-trust fines and the delayed Ant IPO have spooked investors, the CCP taking more measures to materially impair the profitability and success of its most iconic firm doesn’t make a lot of sense even from the “New Maoist” perspective.

Without the likes of Alibaba’s competitiveness and contributions to advanced productive capacity, the party loses its legitimacy, particularly now since the majority of Chinese, especially those in the coastal hubs, have gotten accustomed to a higher quality of life. As one Shanghai businessman said, “When I was growing up, textbooks tried to convince us about the decadence of rich Americans’ pets enjoying air conditioning, a luxury few Chinese dreamed of having in those days. Today, my neighbor’s dog will only drink Evian.”

Source: https://vdata.nikkei.com/en/newsgraphics/patent-wars/

China and the United States are both reckoning with very similar social issues, a growing disparity of wealth, and the unprecedented power and reach of new technology firms. While there are many pitfalls to China’s system, the orientation between the government and the firms makes it a higher likelihood that US companies will eventually experience more significant obstacles to their competitive prowess than Chinese ones. Current legislation in Congress goes much further toward potentially even breaking up larger Technology firms than anything the Chinese Government has thus far hinted at.

The party’s aggressive posture and the reinstitution of a Maoist cult of personality around Xi undoubtedly shake many investors, and rightfully so. It’s a precarious development for the peaceful rise of China. They are even more disturbing to a society with central values of free political speech and individual freedom, but we also must remember that stocks are apolitical. Despite the recent regulatory actions, the prospects for very high growth (particularly given the company’s massive size) and its robust investment and diverse assets have not been changed by these actions.

It is a tricky philosophical and mental task to understand how a regime dedicated to the violent overthrow of capitalism has mastered the art of economic development and achieved miraculous strides toward improving the quality of life of the Chinese people, primarily with unabashed help from the toolbox of Western capitalism.

However, one thing we must focus on when analyzing Chinese Technology companies is the similarities in profound achievements and connections with consumers they have made. If you think technology has revolutionized and simplified our daily lives, think about what it has done for the hundreds of millions of people that have been elevated out of illiteracy and rural poverty over the past forty years in China.

Source: Company Reports

So, when you think of political risk in China, you should remember it is an authoritarian state. There are downsides to this but also upsides. One upside is that when you take the time to understand the goals and imperatives of the CCP, it is pretty hard to see anything that the party would gain from the demise of Alibaba and the vibrant digital commerce revolution it has unleashed in their country. Indeed, the outcomes Alibaba has brought to fruition are very much in line with the party’s goals since it has dramatically increased the quality of life for the Chinese, particularly those in rural areas. The euphemism Too Big Too Fail would start to approximate the CCP put that exists on Alibaba, but it wouldn’t fully capture it either.

How Do You Say Growth at A Reasonable Price in Chinese?

We’ve spoken about the fact that we find BABA very cheaply priced compared to its peers. It seems to have taken a hit both from the idiosyncratic political risks it faced and from a general rotation from growth to value over the last few months. Compare Alibaba to JD.com, the other company with which it shares the virtual duopoly on Chinese venture funding. It is positioned way better than this company because of its significantly higher margins. These should provide additional flexibility and advantage when it competes for the best technology investments with JD. Price-to-Book isn’t the only valuation metric where BABA looks competitively priced compared to peers.

Source: SeekingAlpha.com

In 2020 the company’s China Retail Revenue was $12.18 billion. It is projected to be $168.85 billion in 2028. Until then, you can expect a 25% CAGR which is nothing to sniff at for a core piece of revenue at a $600 billion company. This type of growth, coupled with the significant brand value and durable advantage that Alibaba has, simply cannot be found for comparable prices elsewhere in the market. The Trefis price model, which is usually pretty conservative by our estimation projects based on historical data regarding growth (the primary input informing their forecast), the implied price of the stock is 45.13% higher than current levels at northward of $320. Alibaba looks to be at the lower end of its historical valuation metrics on several dimensions, including EV to revenues, EV to EBITDA, PE Ratio, and Price to Free-Cash-Flow.

Source: Thinkorswim

Risks And Where We Could Be Wrong

We have beat a dead horse on the main risk facing the stock and affecting the price recently, which is regulatory risk. However, the relevant threats to this company probably involve two different scenarios playing out. One is the immense competitive pressures from other competitors (either international or domestic) significantly out-innovate or out-compete this juggernaut in its dominant areas. The company also operates under the assumption that its core marketplaces business will slowly recede and thus needs to invest in new areas such as cloud and media.

The company has been making massive capital expenditures and investments in its future growth and competitiveness. As with any company in such a specialized and highly competitive industry, there is always the chance that management poorly allocated capital to the detriment of shareholders.

There were some rumblings that the CCP may be looking at Alibaba’s vast media empire. However, it seems that efforts here wouldn’t undermine profitability even in a worst-case scenario. As we have said, we think the worst-case scenario has already played out. We expect several positive catalysts, such as the delayed IPO of Ant. While Jack Ma’s speech was expensive, it likely will only cost a fraction of the originally slated $37 billion IPO instead of the whole balance.

One of the primary risks is the de-listing risk which could adversely impact investors in some circumstances. The elevated tensions between US and Chinese authorities could result in problematic disclosure/audit issues and compliance with relevant laws. For example, it is still pretty tricky for investors in mainland China to easily invest in BABA shares; If it is approved HKSE’s Stock Connect, it would likely enjoy access to investors with a better understanding of Chinese Political risk and more eager to own the stock.

The Holding Foreign Companies Account Act bans OTC trading in companies that don’t meet specific requirements. While Alibaba is confident it could comply with necessary regulations, this could be further complicated by continuing US-China tensions. The impact of a de-listing would likely severely impact BABA’s price but could be a source of some of the recent sluggishness in returns, so maybe partially baked in.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In c53413-d33d85-cc4b86-fb029d-dd751a

Already have an account? Sign In c53413-d33d85-cc4b86-fb029d-dd751a