Signal From Noise

Research

Signal From Noise

Research

Everybody knows that fast is good, but what about big and fast? Better in most cases of competition, right? We think so. We have been recommending ‘Epicenter’ stocks since the nadir of the pandemic. Our Head of Research Tom Lee was chastised for saying these imperiled names were buys, the S&P 500 is up roughly 75% since then, and his reasoned call at the depths of a ‘blood in the streets’ moment has been hailed as one of the best contrarian market calls of the last decade. As the market realized these stocks were sources of significant alpha, they piled in, but many investors never truly listened to our narrative. As the pandemic recedes, consumer wallets will take a massive shift to the in-person socialized activities that there has been an unprecedented absence of. However, just as important is what these companies have done to boost operating leverage and amend their business models in the meantime. MGM somehow has pivoted to a position where it will almost certainly be one of the leading names in the rapidly developing Sports Betting and i-Gaming markets and we believe it’s traditional assets make it a play with a lot more upside and a lot less valuation risk than pure plays Draft Kings and Fan Duel.

On the traditional side, it appears demand and occupancy are returning. We cannot yet know the effects of massive cost cuts, new efficiencies, and innovations in business practices on EPS until demand returns. There’s a lot of reason to think shareholders will like what they see when those three and a half-day trips that tens of millions of Americans take every year start to be booked en masse again. However, the real opportunity for MGM lies in what those customers will be doing with the remaining 362 days of their year. It is making a big bet that it can capture more of their time, and money over this usually out of reach universe for the company. The key is in their BetMGM partnership with Entain, a British sports betting giant. MGM recently made an 11.1$ bn bid for the company that was rejected, however, we wouldn’t be surprised to see the deal close at a higher level eventually. The synergies are compelling. An industry expert, Howard Jay Klein said “A merged casino and sports betting database is pure gold.” We would have gone with Bitcoin, but you get the point.

Source: Company Reports

Casinos will be a major beneficiary of the resumption to normality. However, more than that, as an investment they are great hedges against inflation; bet sizes and room rates rise but the table-hold is constant. If you feel like gambling, maybe you should take half of your allocated funds and buy some MGM stock instead? That way when the house inevitably wins, you do too! Casinos are great because they have incredibly unique assets and very loyal clients. MGM is better because in true ‘Epicenter’ fashion it is leveraging its existing boring assets like its huge loyalty program and top notch government affairs shop to make a high-growth play into online sports betting and i-Gaming. Companies who used COVID-19 changes to revamp and modernize business models are a special focus of ours and is why we LOVE this name.

MGM states in its corporate materials that it believes entertainment is more than fun. It’s a fundamental human need. They will likely soon be vindicated in that sentiment as pent-up demand for various foregone products and services will rush back with the ahead of schedule vaccine penetration in the United States. In the era of space SPACs and exciting developments in a range of advanced technologies that could change the economy forever, we tend to forget about the ‘real economy’ that is here in the present. It will be pretty hard to ignore quite soon. That old thing is about to start humming, and current above-market rates of EPS growth will ALWAYS be worth more than future growth. That’s what we think is in store for MGM soon with its old school assets alone, but it also presents an opportunity for astronomical growth. We think it’s a sweet spot when real economic growth is paired with high-growth opportunities in the future. How management deploys free-cash-flow is of the utmost concern to shareholders, and by the looks of what MGM’s management team is doing, you want in. We think this stock shows why Epicenter names can often be a lot more than a trade or mere rentals; you want to own this stock for the long haul.

Why MGM is A Solid Bet

We believe Vegas is poised for a big comeback, and there are few names set to benefit more than MGM, which owns 45% of the available rooms in Vegas. Indeed, occupancy and EBITDAR trends are already moving faster than anticipated. On March 11, MGM’s CEO said he thought recovery was moving faster than he did on the Feb 11th Q4 call. We know MGM is a complex corporate structure that turns off a lot of investors. The company has had a lot of headaches over the years that appear to be moving in the right direction. MGM Springfield is doing well after initial problems, National Harbor is as well and even in the previously problematic Macau, things are definitely moving in the right direction.

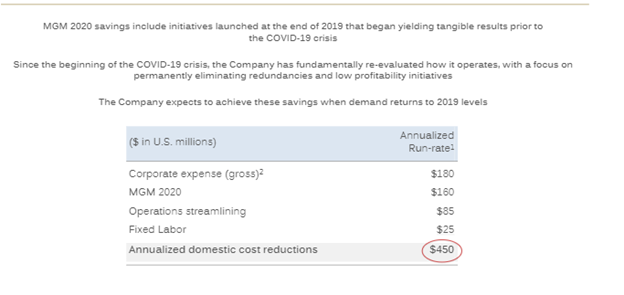

MGM’s revenue mix is likely different than you think it is, and direct Vegas gaming revenue is only third highest in importance. Are we betting on a big comeback for brick-and-mortar casinos? Yes. Has MGM slashed their costs and operating leverage, and will they have greater earning potential when volume returns to pre-COVID-19 levels? Yes, absolutely. The company began restructuring before COVID due to the aimless strategy of its’ last CEO and increasing corporate complexity (still a problem). It’s new one; Bill Hornbuckle is brains and brawn and an up from the bottom guy who knows the Gambling business about as well as anyone. The management team just got a great new CFO in Jonathan S. Halkyard who did great things over at Extended Stay America as CEO. Listening to earnings calls and presentations, this team appears to have hit a stride.

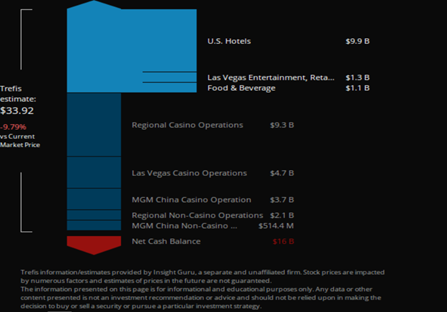

As you can see below, MGM’s primary revenue segment isn’t even from gambling, it’s from the many ancillary activities like entertainment, conferences, and food and beverage that it has at it’s hotels in Vegas. The centers of excellence in these areas which have been implemented by the company make us think this section could be poised for explosive growth. The CFO expects margins to expand up to 500 bps over the coming quarters in its core areas due to savings in labor and other areas.

The secondary revenue source is it’s market-leading and already profitable regional casinos like MGM Detroit, Springfield and National Harbor. These properties give the company a lot more diversification within in the US market than you would think and they make the prospect of positive cashflow nearer than you may think. Even more importantly, these properties are proving avid feeding centers of customers for the company’s new growth project in sports betting and i-Gaming. The powerful strategy of partnering with regional actors like the pro sports teams cement this synergy into something that looks unstoppable. In addition to this, Vegas may be in a uniquely advantageous position as domestic restrictions on travel likely clear up quicker than international ones. Volumes have been steadily increasing and some events are beginning to return.

Source: Trefis, Thinkorswim

There are a few good names to choose from in the Gaming Industry; Wynn comes to mind. However, we like to focus our Signal From Noise column on exceptional companies with unique top-line drivers for success; even better when powerful bottom-line tail winds are added to this like in the case of MGM. We love stories of stocks considered previously obsolete by Growth and TAM obsessed investors, and we have a doozy for you here. In an article about MGM, a supposed legacy casino operator, you were not expecting to hear about network effects, the potential for astronomical digital growth, and a ‘once-in-a-decade E-commerce opportunity. All these terms accurately describe what’s going on at the company.

MGM’s Future Through Barry Diller’s Eyes

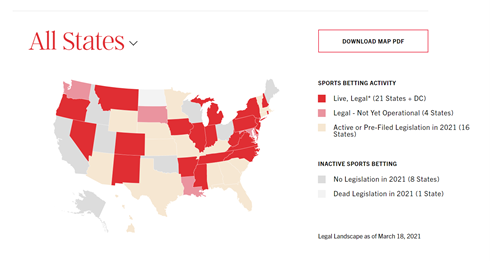

Source: American Gaming Association

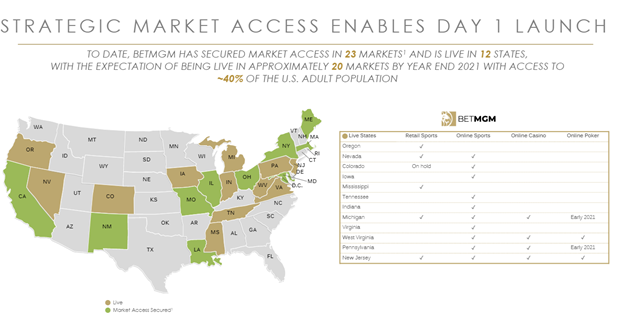

Sports betting and i-Gaming has become a popular way for states to meet revenue shortfalls. While 12 states have currently legalized these to varying degrees it is expected to expand to 38 states by 2025. Each time a state is added, MGM’s opportunity increases and you better believe that they have both the Gaming and Government Affairs infrastructure to be one of the first to market in every state going forward and with the best options and UX. There are a lot of competitive aspects to this market that favor a big established player with a recognizable brand like MGM. If only they had some of the best e-commerce expertise in the world on their team!

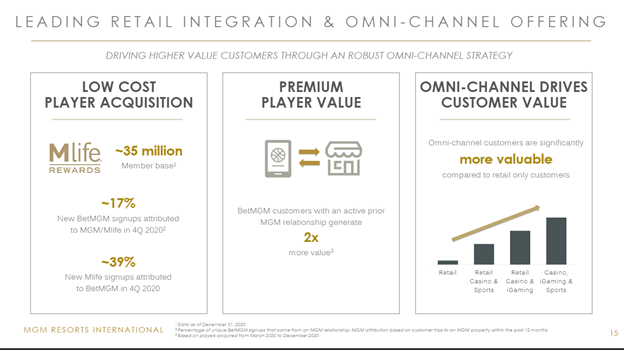

In August 2020, a cash-rich Barry Diller and IAC surprised the investing world when they used cash from recent sales to purchase 12% of MGM’s and will be partnering with them on the expansion and strategy for BetMGM. Diller’s letter outlines both reasons we want to own MGM. He notes that they have the cash, brand and staying power to ride out even the worst cases for demand, probably better than anyone else. More importantly though, Diller focuses on the massive ‘once-in-a-decade’ opportunity he sees to expand online users synergistically with the return of brick and mortar business. In other words, MGM’s massive presence on the strip, which could have been considered cumbersome before is now a powerful source of customers the high-growth initiative. Customer acquisition costs through the 35 million user strong M-Life loyalty program are not only significantly lower, these customers also spend significantly more. So, MGM is doubly exposed to the Vegas comeback, whenever it materializes. Not only that, the convention business which will also comeback will provide another nice source of revenue as economic normalization enabled by increasing immunity from previous infection and vaccination progresses.

MGM has a solid strategy to become a massive leader in a burgeoning and exciting area and has a great management team that really appears to be hitting the right notes. The ability to be first in markets is compelling and if you’d like more detail on the amazing opportunity that COVID and fortune presented MGM with out of what seemed like certain ruin then we urge you to check out this Fireside Chat from a JP Morgan event on the hospitality and leisure industry.

Risk And Where We Could Be Wrong

MGM is still incredibly complex. If MGM Resorts and MGM Growth Properties listed their relationship status on Facebook, it would definitely be under the ‘It’s Complicated’ category. However, this arrangement actually proved to be a source of financial strength during the pandemic. MGM has a significant amount of cash to see it through worst-case scenarios because of selling off some of its stake. The companies CFO has stated that the general direction will be toward simplification after the current arrangement becomes less financially viable.

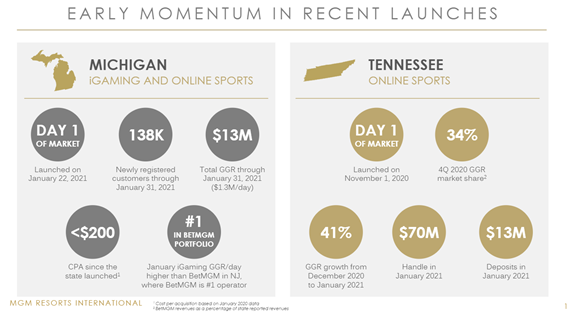

The biggest risk we see materializing is of course the great uncertainty associated with the legislative calendars and imperatives of various states. There is a whole other world of ‘wagering’ by the Gaming Industry trying to square for advantage in whatever hypothetical state moves next. MGM has some great growth opportunities potentially in Japan and definitely in New York as it’s leniency toward aleatory contracts for fun increases. However, the definite ace of the hand is MGM’s ascension to a behemoth in the world of digital gambling. This is what we meant by big and fast. Look at MGM’s progress in Michigan and Tennessee which just opened as markets.

The biggest risk for casino operators is clearly associated with the timeline to a return to normal occupancy and revenues. MGM is certainly one of the best insulated from this risk given its size. However, like many casino operators indebtedness is a huge risk if market conditions deteriorate. Its complex corporate structure likely hides weak spots that could be severely exasperated in the event of market stress. The company’s revenues are far more diversified than many operators so a regional setback in one market could likely be compensated for in others.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 6cacc8-a7029a-7f512e-7cfe48-79265b

Already have an account? Sign In 6cacc8-a7029a-7f512e-7cfe48-79265b