BitDigest March 16 · Issue #615

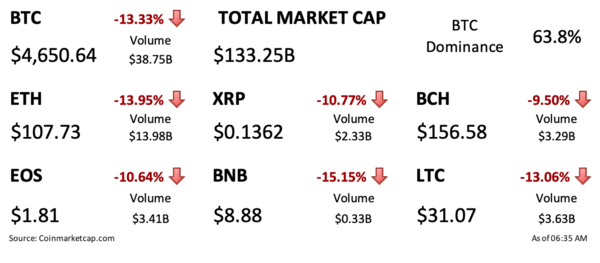

- Crypto stocks continue to lack buyers falling another $28 billion since Friday. Bitcoin (BTC) traded between a Sunday evening high of $5,823 to this morning’s low of $4,601 while ether (ETH) declined from a high of $131 to a current low below $107.

- The Bank of England issued a Discussion Paper asking for feedback on its central bank digital currency efforts

- HODLs be ware. Illinois passed an amendment allowing unclaimed digital currencies to be seized and liquidated.

The Headlines

BoE Looking for Feedback on Digital Currencies

Unclaimed Crypto to Be Seized and Liquidated in Illinois

Consensus 2020 Going Virtual

Market Data

Bitcoin Hashrate Fall Below 100 Ehash/s

Coinbase Volumes Reach YTD Highs

USDC Hits New Circulation High

Exchange, Custody and Product News

Poloniex Introduces Off-Chain Transfers

Binance.US Adding Tezos

Coinbase Pro Adds Orchid

Thoughts on the Ecosystem

Crypto Sell Off Was Not Institutional Traders

Crypto Leaders Questioning Market

Reports you may have missed

After significantly outperforming equities leading up to its halving event on Friday, BTC0.30% continued its upward trend over the weekend, now trading just below $66k. ETH-0.93% has generally followed suit, although continuing to lag behind BTC, with its current price around $3200. SOL0.61% , meanwhile, has continued its strong rebound from the recent price slide, reaching $156 yesterday, currently trading slightly below that level. The crypto market is broadly performing well...

Happy Halving Day to all. It has been another volatile 24 hours for crypto markets, with war-related headlines sending risk assets lower overnight. BTC0.30% briefly dipped below the $60k mark but has since recouped all its losses and is now trading above $64k. ETH-0.93% followed BTC's initial drop, trading below $2900 last night, but it has now rebounded to above $3000. SOL0.61% has shown remarkable resilience amid the turmoil, now...

Tether Outlines New Organizational Structure, Aptos Partners with Microsoft, Brevan Howard, and SK Telecom

Traditional markets are finding some relief in Thursdayâs trading after four consecutive sessions of losses. The SPY and QQQ have gained approximately 0.30%, while the IWM (+0.99%) is showing outsized gains. Crypto markets are finding larger relief, with $BTC rising 3.92% to $63.7k, and $ETH gaining 2.71% to exceed $3,050. Injective ($INJ) is one of the leading tokens today, gaining 9.37% following news of a partnership with JamboPhone to bring blockchain-powered financial solutions to emerging markets. JamboPhone...

Equities and crypto assets are selling off in tandem today as inflation and geopolitical fears have spooked risk assets. The SPY and QQQ have decreased by 0.46% and 0.92%, respectively, while crypto is selling off more aggressively. $BTC (-5.49%) has tested the high $59,000s and $ETH (-4.42%) is trading below $3,000. Among a sea of red, $SUI is showing relative strength, gaining 6.44% on the back of a partnership announcement with...