Stocks End Three-Week Losing Streak Despite Challenges From Surging Yields, Seasonality

Our Views

Looking at equity market behavior post-Jackson Hole (JH) since 2003, our analysis suggests there is a >80% equities rally post-Friday: Since 2003, there have been 7 instances of the S&P 500 down 2 weeks prior to JH.

- In 6 of 7 instances, equities rose in the week post-JH

- The range of gains was +0.5% to +5%

The one exception was in 2022 when S&P 500 fell by 7% in the week post-JH, but we know Fed Chair Powell’s comments were uber-hawkish then. The context is different in 2023, as inflation is not only on a glide path lower, but the surge in 10-yr yields threatens a potentially greater tightening of financial conditions.

While rates could be pushing higher (my colleague Mark Newton thinks we are near a turn), equities are showing early signs of diverging from higher rates. Our view is a calculated bet that stocks are rising, despite higher rates, because the stock market is sensing this turn that Newton believes could happen in the next week or two. In other words, we are saying the last push higher in rates will not proportionately hit stocks.

A huge slate of key macro data is on deck to be released next week, and our view is those releases will support the picture of a glide path to lower inflation and a softening labor market. Given the hawkish shift in investor expectations, I think this would further support a rise in equities. Our constructive stance is that the bull market is intact and this August sloppiness is at its highest level of messiness.

- Despite our Friday bounce materializing, trends still require improvement

- SPX cycles show a short-term low in early September

- Natural Gas looks to show gains in the week ahead which should benefit UNG

- In the past week, OP has risen 20% relative to BTC, driven by increased user activity and bolstered by the success of Base (Coinbase’s Layer 2). Though unlikely to maintain this pace, OP’s potential is underscored by the upcoming EIP 4844 update, making it a promising longer-term hold.

- RPL began the year strongly, boosted by the Shapella upgrade, but has recently stagnated. However, with fundamental advantages, planned Q4 improvements, and strategic investment from Coinbase Ventures, we still view it as a promising long-term opportunity with the potential to rebound.

- We continue to await the verdict in the Grayscale vs. SEC case, currently delayed beyond the usual timeframe. The next possible release date is Tuesday, the final Tuesday in August. If we do not receive a verdict before the end of August, it may be appropriate to reassess the expected timeframe of a decision, since September will be the start of a new term for the DC circuit court.

- After what I would characterize as a rather neutral speech from Fed Chair Jay Powell (with lots of hedging), we are seeing a reversal of the initial dovish interpretation of his comments. Bonds are now selling off, the DXY is rising, and the coins are obviously negatively affected by the prevailing direction of rates. Further, the Fed Funds futures market is now pricing in one additional 25 bps hike at the November meeting. While we will need to see how rates perform for the rest of the day, as of now, we think it is worth being cautious over the weekend in anticipation of continued negative price action during an illiquid trading period.

- Fed Chair Jerome Powell’s speech at Jackson Hole maintained a middle-of-the road stance that left all options on the table for the next FOMC meetings, as expected.

- No candidate stood out at the first Republican Presidential debate, and former President Trump continues to dominate his GOP rivals in both the polls and the news cycle.

- Congressional staffers continued seeking a way to avoid an October 1 shutdown, with 12 bills – or a Continuing Resolution – needing to be passed when Congress returns after Labor Day.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 inched up 0.82% for the week to close at 4,405.73. The Nasdaq climbed 2.26%, ending the week at 13,590.65. Bitcoin slipped 0.89% to about 25,956.40.

- August continues to challenge equities as rising yields and China woes worry investors.

- Fed Chair Jerome Powell’s Jackson Hole speech sustained the market’s confidence that the FOMC will not raise rates in September.

“Science is the great antidote to the poison of enthusiasm and superstition.” ~ Adam Smith

Good evening:

August has been a challenging month, and we opened this week with the S&P 500 down around 5% for the month. China’s economic woes, rising oil prices, and surging yields here in the U.S. have only added to the challenging seasonality associated with the month of August. Although the market ended up on Friday and slightly higher for the week, Head of Research Tom Lee said he was resigned to August “likely [being] a down month.”

At our weekly huddle, Head of Technical Strategy Mark Newton agreed that this was a possibility. “Rates need to back down to support a bullish view for equities,” he asserted, while warning that his work did not show rates doing so in the immediate-term. “I think rates are still in a peaking process,” he said. “When I look at sentiment, seasonality, Elliott wave, DeMark, all of that – the cycle shows a downward pattern in rates really September and October of this year to next spring or summer.”

Yet, Lee said that despite this, now might be the time to begin to add risk – though still “timidly” due to August seasonality. He explained, “Equities are showing early signs of diverging from higher rates.” Though he admitted that this might be a case of stock investors sensing rates are about to roll over – a somewhat circular situation, Lee suggested that “the last push higher in rates will not proportionately hit stocks.”

Newton couldn’t rule out that possibility. “After three weeks of being down, this week’s price action has been very good,” he admitted.

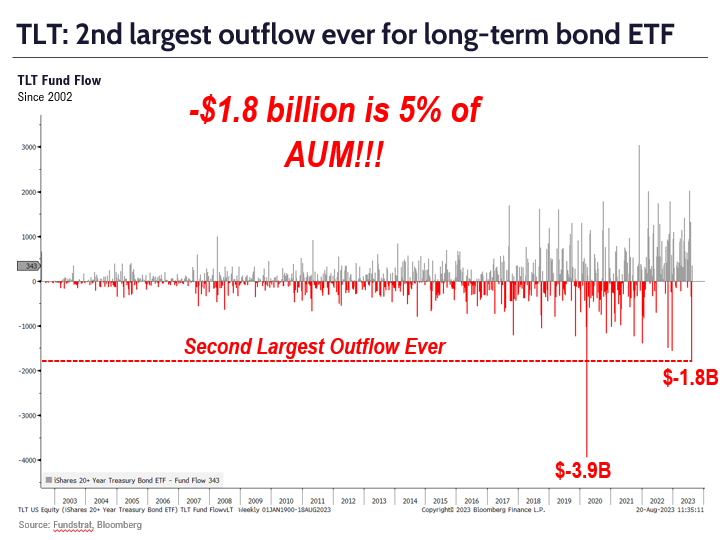

Another thing Lee pointed out: While yields were surging, the iShares long-term ETF TLT -0.75% saw $1.8 billion in outflows in the week preceding this one. “That is a massive liquidation. It’s a staggering 5% of TLT’s assets,” he said, noting that the last time we saw a greater outflow was on March 20, 2020. “And that marked the bottom for stocks,” he reminded us.

TLT’s outflows are seen in our Chart of the Week:

He also noted that the last time yields surged 50 bp like this was back in February 2023. This triggered a financial crisis at regional banks, but that in turn caused the Fed to make a dovish pivot. The Fed likely remembers that as well: Lee suggested that the sharp rise in yields, along with its potential to tighten financial conditions, probably has the Fed concerned. “I mean, does the Fed really want to risk something breaking again” like it did six months ago, he asked rhetorically.

With the next FOMC meeting nearly a month away, the annual Jackson Hole symposium – already a highly anticipated event for investors, took on added significance. Many investors will recall that the last time Powell spoke at Jackson Hole, markets plummeted in the days afterward. Lee and his team argue that this will not be the case this time. Back then, Powell made uber-hawkish comments, and inflation was not on the glide path lower that it is now.

Washington Policy Strategist Tom Block, who has had dealings with Powell in his previous career on Capitol Hill, said the Fed Chair gave “a balanced speech signaling a hold in September and a flexible, data-driven approach to November’s decision.” Powell mentioned the risks of inadvertently doing “unnecessary harm to the economy,” which Block saw as an allusion and a nod to concerns that some FOMC members had raised in the July FOMC minutes.

Newton noted that Fed Fund Futures implies that the market agrees with Block’s interpretation of Powell’s remarks regarding the likelihood of a pause at the September meeting. But the expectations for no hike in November slipped after the speech. Still, Newton thinks that this week’s weaker-than-expected PMI data “very well could have been a tipping point in the endgame of Fed rate hikes.”

Aside from the Jackson Hole symposium, the other event we were anticipating at the beginning of this week was Nvidia’s quarterly results. Nvidia posted a massive beat last quarter, and on Wednesday evening they did it again, beating on the top and bottom line, raising forecasts for the rest of the year, and announcing a $25 billion stock buyback. And while NVDA 1.39% shares initially spiked after the results, they failed to spark the broader market rally they did last time. Instead, they later gave back those gains. This did not concern Newton, who said that the pull back “does not take away from the attractiveness of this stock, technically speaking.”

Regarding the broader market, Newton argued that “equities have shown initial signs of bottoming out. After three weeks of being down, we saw things like market breadth getting down to levels that were near prior lows. On a daily basis, QQQ 1.15% broke out of a downtrend the other day based on Technology strength, and the S&P did the same on Thursday.”

But Newton was quick to temper expectations. “But on the flip side, we're seeing weakness out of Financials, and Healthcare remains a laggard. That’s problematic because Healthcare and Financials are number two and three in the S&P. So we do need to get these sectors going.”

“It’s not going to be all guns a’blazing back to new all-time highs. It’s going to take time and we still have some work to do,” he said.

One last takeaway from this week’s huddle:

Head of Data Science Ken Xuan pointed out that durable goods orders came in stronger if excluding Transportation – which as he put it, “basically means excluding Boeing.” Xuan argued that “this suggests PMIs have bottomed.” In our view, this has implications for Industrials stocks.

Elsewhere

The European Union’s Digital Services Act took effect on Friday, requiring large Tech companies to enhance user privacy, make it easier for users to report illegal or harmful content, and respond more quickly to such reports. The DSA affects 19 companies, including major social media platform, online sales (Amazon, Alibaba, etc.), and providers of certain online services (search engines, navigation, mobile apps, etc.). Although the rules only affect the companies’ operations in the EU, most believe they are likely to affect how they operate elsewhere as well.

Members of the United Auto Workers (UAW) voted to authorize the union’s leaders to call a strike at any or all of the Big Three automakers – GM, Ford, and Stellantis. The union’s current contract expires September 14, and negotiations over the new contract have been acrimonious thus far. The union is demanding 46% raises over and above cost-of-living increases, a restoration of traditional pensions, and a 32-hour work week.

Turkiye raised its interest rate by 750 bp to 25%, a startling turnaround after President Recep Erdogan’s past unorthodox attempts to fight inflation by cutting rates. Inflation in Turkiye approached 48% in July, and the Turkish lira continues to hit new all-time lows.

There will be new BRICs members next year, when the bloc will welcome Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE into the group. Officials say 40 other countries have expressed interest in also joining, and China, for one, would welcome new members to help its diplomatic objective in countering the dominance of the Western-centered G-7.

A federal judge ruled that artwork created solely by AI cannot be copyrighted, finding that a “human guiding hand” is required for copyright to be granted. One precedent cited was a previous lawsuit that found that a monkey (specifically, a macaque) who had inadvertently taken a selfie could not own the copyright to the photo. “Human authorship is a bedrock requirement of copyright,” the judge wrote.

And finally: India became the fourth country to successfully land a vehicle on the moon, joining a select club with the U.S., the former Soviet Union, and China. Its Chandrayaan-3 spacecraft, which launched on July 14, touched down near the southern lunar pole, an unexplored part of the moon that is of particular interest due to the recent discovery of traces of water (ice, to be specific) in the vicinity.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Prev. -1.70%

A measure of the change in home prices in 20 major metropolitan regions in the U.S.

Est.: 117.3 Prev.: 117.0

A leading indicator measuring consumers’ forward expectations about their own personal financial situations and the economy as a whole.

Est.: 0.2% Prev.: 0.2%

A measure of U.S. consumers’ spending on goods and services.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+18.83%

|

+4.08%

|

+86.53%

|

View

|