“We often confuse what we wish for with what is.” ― Neil Gaiman, MirrorMask

Chart of the Day

Good morning!

It’s hard enough these days to make sense of one jobs report. Now imagine what happens if we’re bombarded with two of them and a GDP report and a PPI report, and then let’s not forget the small but mighty retail sales report.

The longest-ever shutdown on record is likely going to be over this week, but much of the chaos it released into the markets and economy will persevere over the coming weeks.

The Congressional Budget Office estimates that the shutdown will shave off annualized real GDP growth in the fourth quarter by 1-2 percentage points and between $7-$14 billion will not be recovered. That’s not what I’m too worried about, because most of that will reverse over time.

The shutdown began just as we started getting concerning jobs reports. Before we could figure out if it was a trend and what it was signaling about the economy more broadly, that crucial data, which normally has the power to move trillions of dollars in the stock market in a singular day, went mostly offline.

Now as we shape up to get bombarded with data points, my take is that we will soon learn that the shutdown intensified the current K-shaped economy, which refers to the widening gap between higher and lower income consumers.

That’s only going to confuse investors more and more when they try to figure out where the economy stands after over a month of little-to-no insight.

Let’s start with the best and the simplest data point that illustrates that.

The stock market, contrary to how some might have expected, ignored all shutdown chaos and climbed 2.4% during the shutdown. Remember that the stock market is always forward looking, so it knew there was no way it was going to last forever.

So, those who own stocks feel great, a topic we’ve discussed before. Data from University of Michigan surveys of consumers shows that the individuals with sizable stock market wealth reported an 11% improvement in sentiment.

If you have stocks – and most of our readers probably do – you’re probably feeling fine. Those who don’t are probably in trouble. Nearly three-quarters of individuals who receive SNAP benefits live below the poverty line, making less than $32,000 a year for a family of four, and a New York Times story this week explained that even their spending is an important part of the economic engine.

A grocery store owner in the story said he has freezers full of turkeys and other Thanksgiving foods, but because SNAP payments are on hold, he isn’t sure what’s going to happen to his inventory. As much as 45% of his store’s sales come from customers using SNAP.

All this to say that sentiment will be slow to recover in the coming weeks.

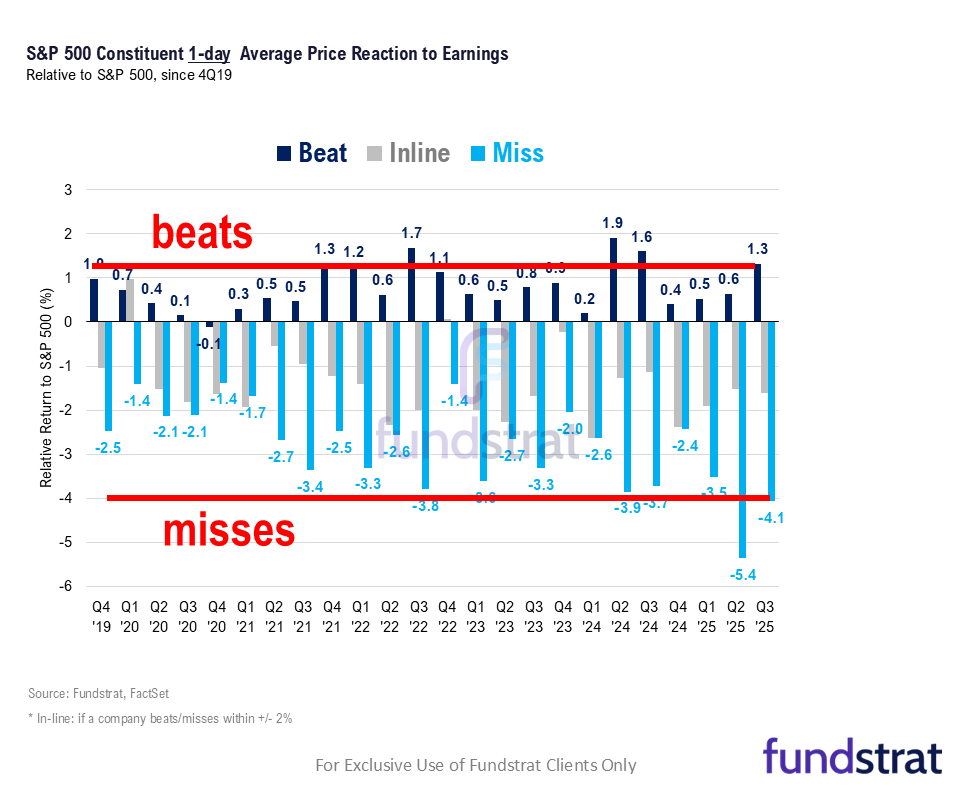

I want to be clear, however, that just because a K-shaped economy has intensified, it doesn’t mean that the market can’t extend its gains. Corporates have successfully passed five tests since 2020, as Fundstrat Head of Research Tom Lee points out every now and then: Covid-19, inflation, higher interest rates, supply chain worries, and tariffs. The recovery from shutdown might just become another test.

Share your thoughts

What impacts your view of the economy the most? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: How are you squishing your cockroach worries?

A: I fear private credit will be a huge problem. Maybe soon.

Catch up with FS Insight

The longest govt shutdown in history is finally over. This is good news, restoring liquidity to markets. And this is setting the stage for stocks to be strong into the end of the month. And partially fueling this is the underperformance of fund managers.

Technical

At present, I am constructive on Equities, but sense that some backing and filling could happen this week before the start of a larger move higher.

Crypto

Coinbase launched a new token issuance platform, the Treasury and IRS issued favorable ETP and staking guidance, and the Senate released a draft market structure bill. Together, these mark meaningful progress for crypto regulation/market structure.

News We’re Following

Breaking News

- A historic shutdown is nearly over. It leaves no winners and much frustration AP

Markets and economy

- The Fed Is Increasingly Torn Over a December Rate Cut WSJ

- The AI Boom Is Looking More and More Fragile WSJ

- Oil and gas demand to rise for 25 years without global change of course, says IEA FT

- Mortgage demand from homebuyers hits highest level since September, despite rising interest rates CNBC

- The shutdown put jobs and inflation data on hold. Here’s when it could be back — and what it might say CNBC

Business

- IBM sees a big milestone ahead for quantum computing — and it hinges on these new chips MW

- McDonald’s and other companies are calling out the impact of SNAP delays on consumers MW

- AMD Stock Jumps on Outlook. AI Growth Is Boosting Margins. BR

- Circle Internet Group’s Earnings Beat Estimates. The Stock Is Falling Anyway. BR

Politics

- Fannie Mae Watchdogs Probed How Pulte Obtained Mortgage Records of Key Democrats WSJ

- The I.R.S. Tried to Stop This Tax Dodge. Scott Bessent Used It Anyway. NYT

Overseas

- Why Factories Will Keep Looking for Alternatives to China NYT

- Giorgia Meloni’s ‘middle-class’ tax cut sparks political row in Italy FT

Of Interest

- Recessions have become ultra-rare. That is storing up trouble ECO

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 11/13 | 8:30 AM | Oct Sep CPI m/m | 0.2 | 0.3 |

| 11/13 | 8:30 AM | Oct Sep Core CPI m/m | 0.3 | 0.2 |

| 11/13 | 8:30 AM | Oct Sep CPI y/y | 3 | 3 |

| 11/13 | 8:30 AM | Oct Sep Core CPI y/y | 3 | 3 |

| 11/14 | 8:30 AM | Oct Sep PPI m/m | 0.2 | -0.1 |

| 11/14 | 8:30 AM | Oct Sep Core PPI m/m | 0.3 | -0.1 |

| 11/18 | 8:30 AM | Oct Sep Import Price m/m | n/a | 0.3 |

| 11/18 | 10:00 AM | Nov Oct Homebuilder Sentiment | n/a | 37 |

| 11/18 | 4:00 PM | Sep Aug Net TIC Flows | n/a | 2.078 |