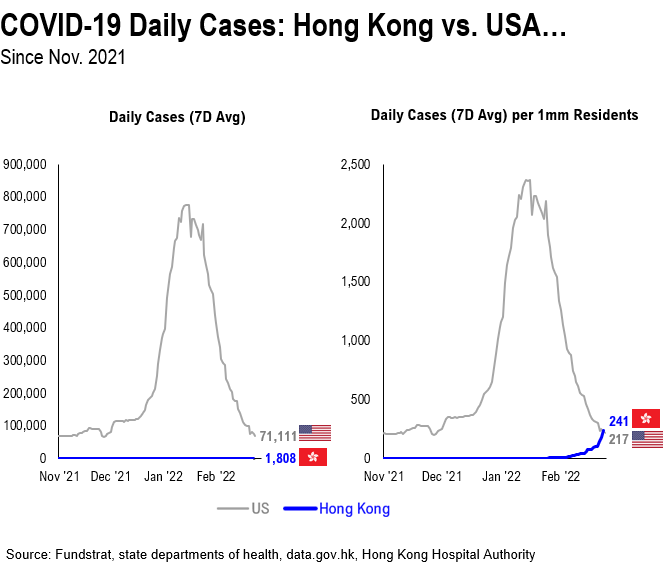

Hong Kong COVID-19 surge matching US surge…

While COVID-19 is on a very visible retreat in the US, COVID-19 is surging in parts of Asia. Hong Kong’s population is 7.8 million, compared to 330 million in the US, or US is 40X larger. Thus, the case figures and even hospitalized need to be compared to equivalent US figures.

- Daily cases in USA is 70k per day vs HK at 1,800

- Adjusted for population

- Daily cases per 1mm, closer at 217 vs 241, USA vs HK

So the surge in HK is far greater than one might realize. And hence, HK is testing every citizen.

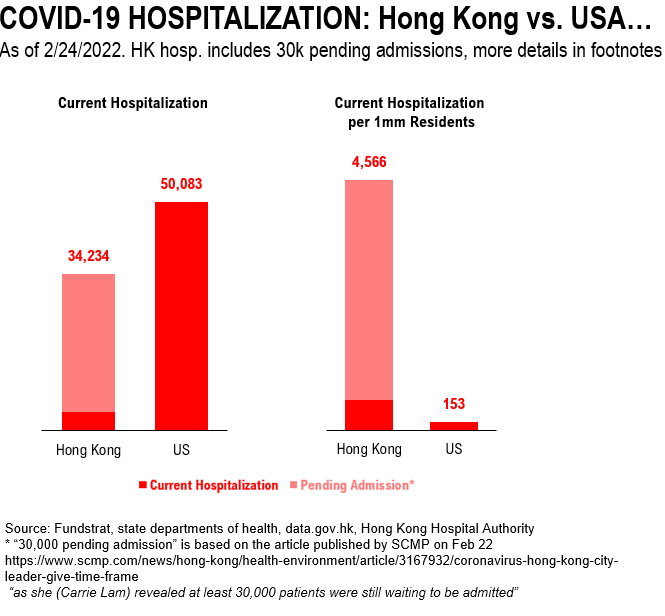

Curiously, hospitalizations are high in HK both absolute and relative to the US. Take a look below:

- US hospitalized 50,000 versus 34,300 in HK

- The figures on an absolute basis are pretty close

- Despite USA being 40X larger

- on per 1mm residents

- US is 153 versus 4,566 in HK

- starting difference

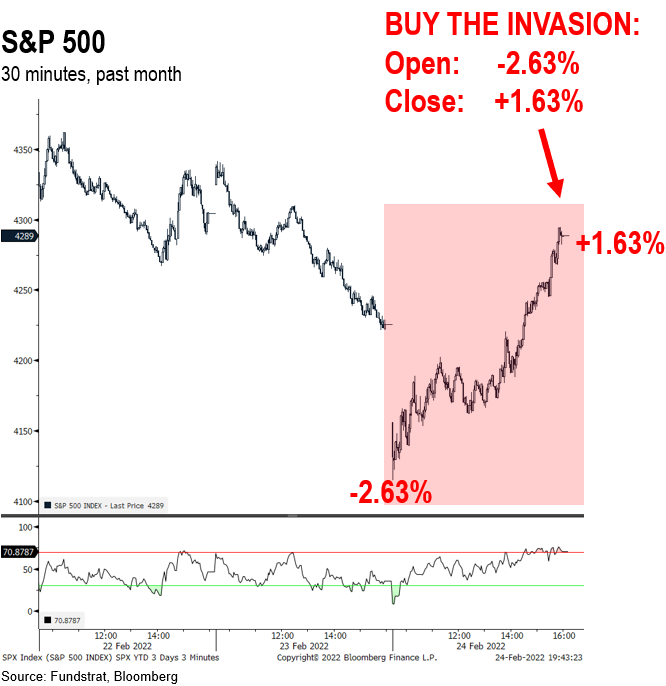

STRATEGY: Buyers’ Strike takes a pause, as investors “buy the invasion”

Stocks have suffered terribly over the past few weeks under the cumulative pressures of inflation fears, Fed hawkishness and now the dramatic escalation of tensions with Russia-Ukraine. This has taken a large toll on stocks YTD:

- at the lows yesterday

- S&P 500 was -15%

- deep in correction territory

But as we can see below, the market had a “buy the invasion” moment:

- opened down -2.63%, meeting overnight futures lows

- close up +1.63%

This is a massive 426bp reversal and about 174 handles (points) on the S&P 500. A major reversal. Is this the end of the selling? The future is uncertain. But as Fundstrat has outlined both fundamentally and technically (see Mark Newton), there are reasons to have been expecting markets to bottom around here. The follow-through we saw on Friday was incredibly helpful and helps to validate Newton’s assertions.

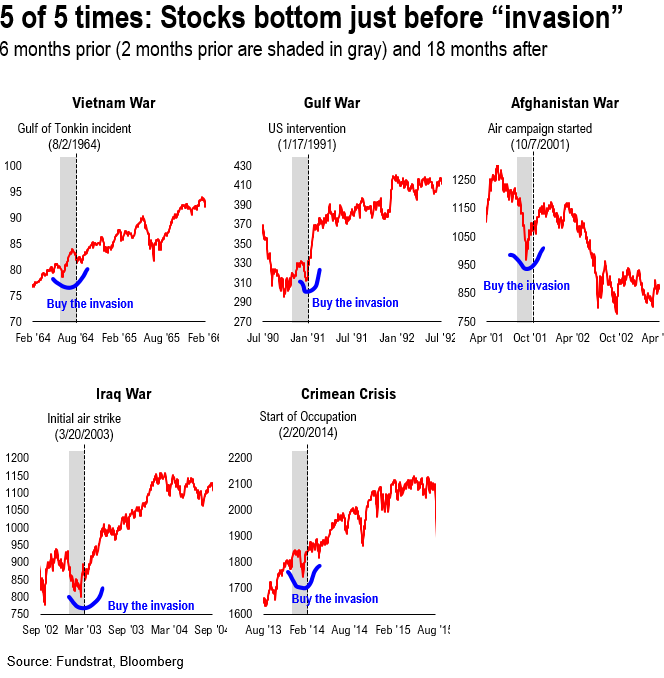

Fortunate to see that prior war analogs provided proper framework

And it was fortunate to see that prior war analogs were applicable to the current environment. While the Russia-Ukraine escalation is a terrible tragedy, the market reaction to this, is similar to prior periods:

- markets sell off into the buildup

- but rally on the day of the invasion

Again, the “buy the invasion” seems to have happened.

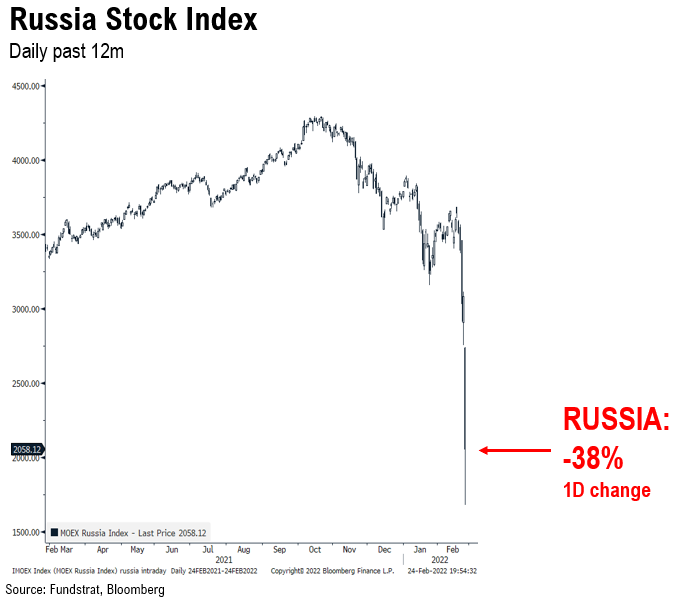

…Russia’s stock index has a historic selloff

Russia stock market fell sharply yesterday declining > 38% and this is consistent with the pattern of 2014 (Crimea). The aggressor has seen its stock index fall.

- US and Europe announced painful sanctions

- these will be amplified in coming days with new sanctions

- hence, Russia economy will suffer a toll

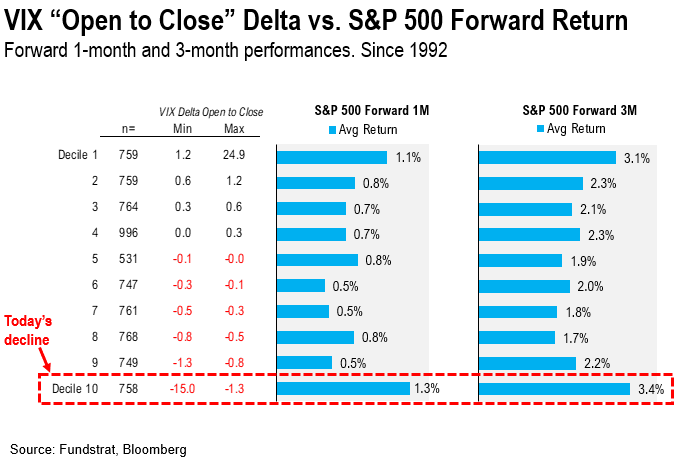

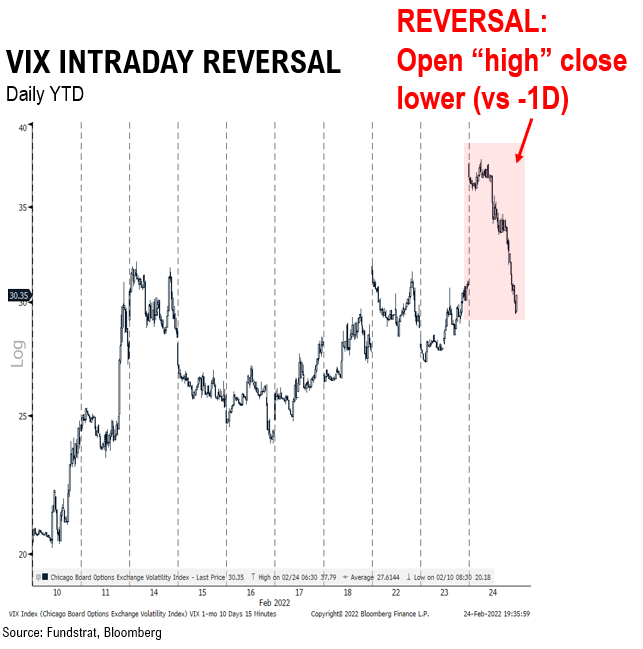

VIX reversal was encouraging and often points to further gains 1M and 3M later

It looks like the VIX might have signaled an upside capitulation yesterday. That is, the seeking of protection got to a level yesterday that could be a sign of exhaustion.

- The VIX opened at > 38 yesterday

- and closed lower for the day at 30

- VIX delta was -8 points lower

Our data science team, led by tireless Ken, compiled data around large VIX point swings. And it turns out that this VIX reversal is signal.

Based on looking a deciles, the -8 delta on VIX is a 10th decile event. And the forward returns for S&P 500 1M and 3M are positive and strong. Take a look below:

- 1M forward returns +1.3%

- 3M forward returns +3.4%

High-yield is above 2/14 lows, while equities are lower = opportunity

One of the more positive incremental developments is that interest rates are not rising any longer. The interesting divergence is the fact that long-term bonds started rallying on 2/16. As shown below, the TLT -0.75% (long-bond ETF) has risen even as S&P 500 has fallen sharply since 2/16.

- two reasons bonds rally

- “risk-off” and this is plausible given war risk

- inflation risks are falling = bonds rally

So, bond vigilantes are winning this battle as rates are falling.

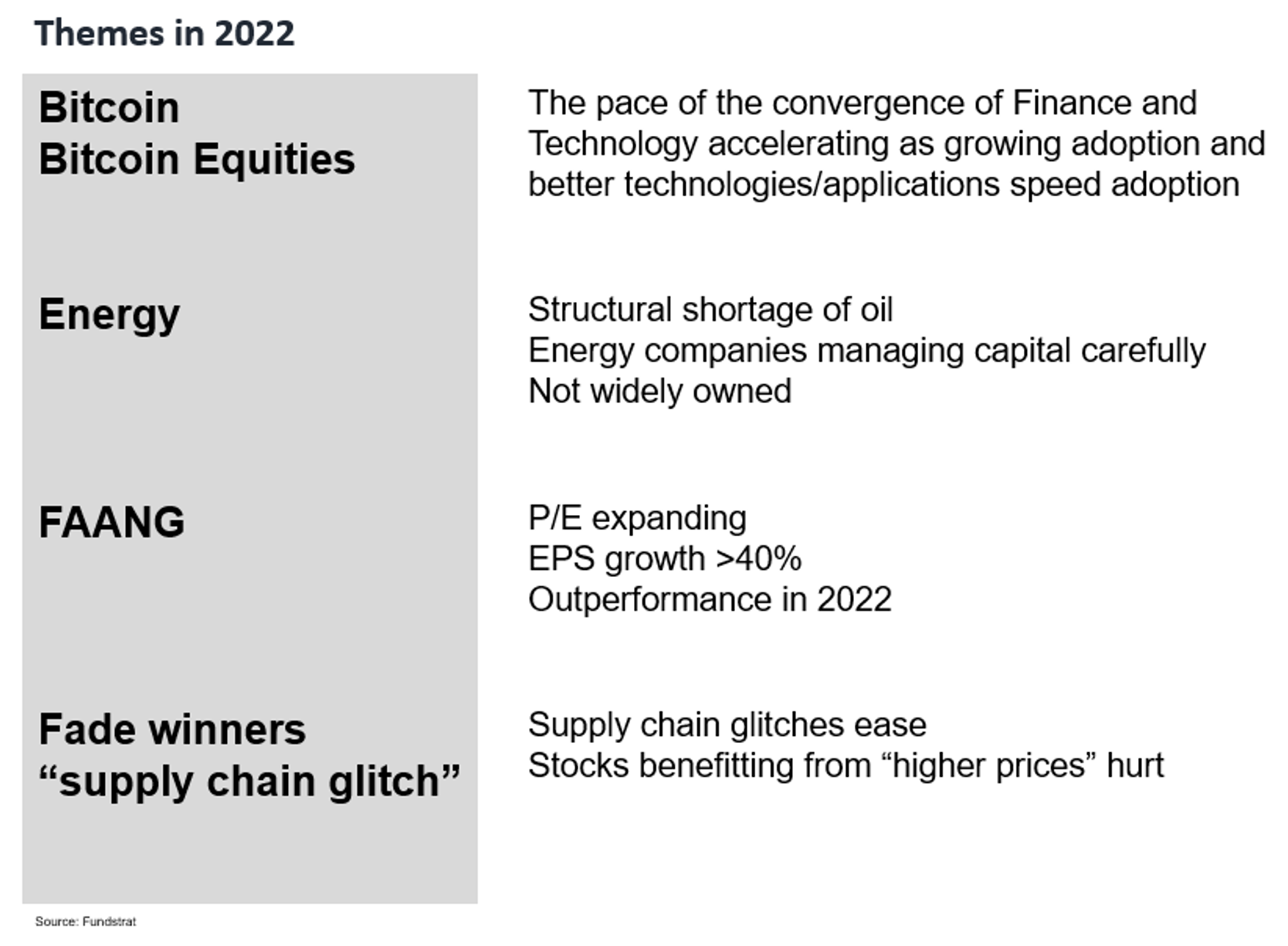

Figure: Themes in 2022 – “BEEF”

Per FSInsight

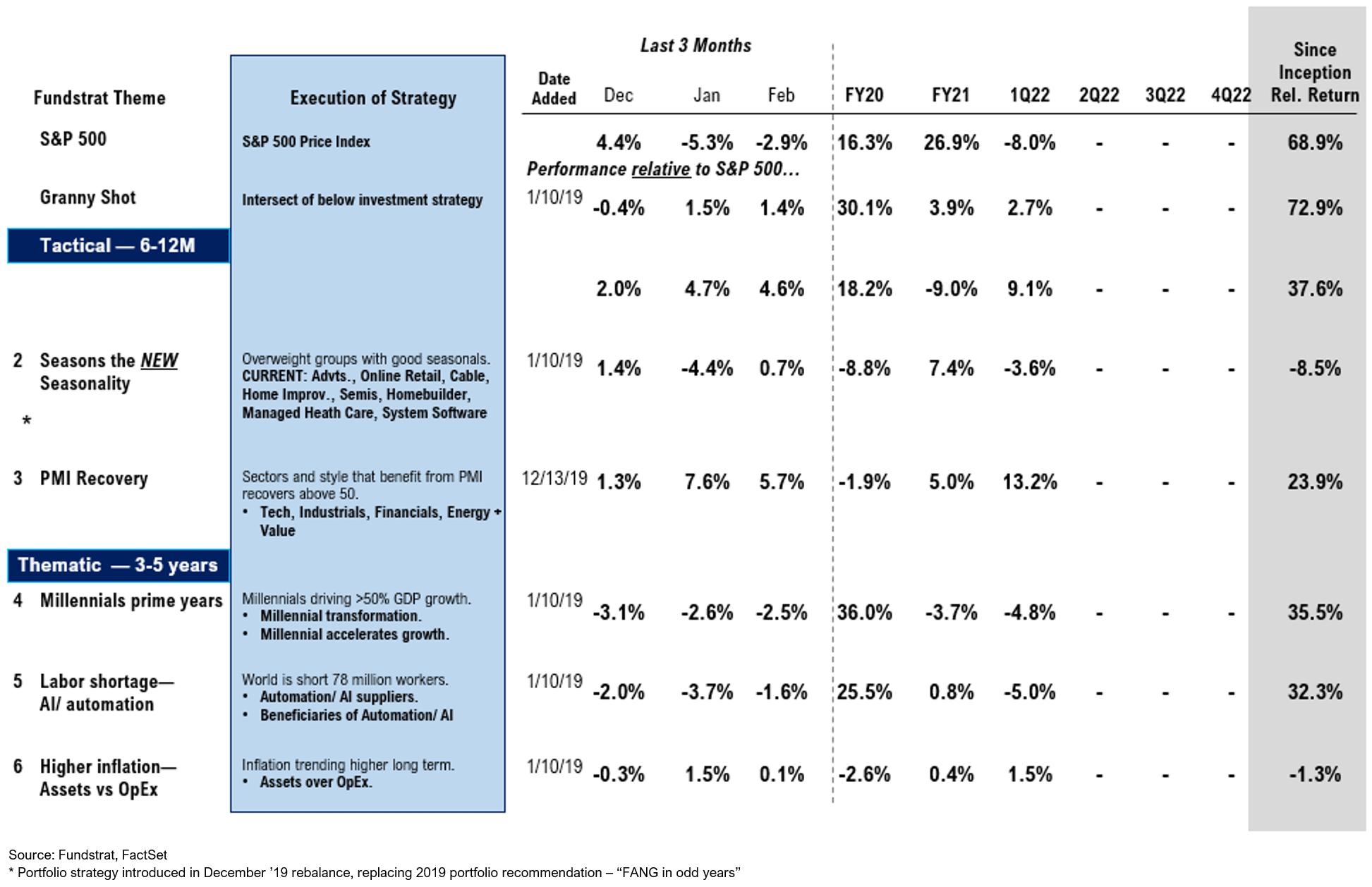

Figure: Fundstrat Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019