We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

SKIP WEDNESDAY

SKIP THURSDAY

Friday

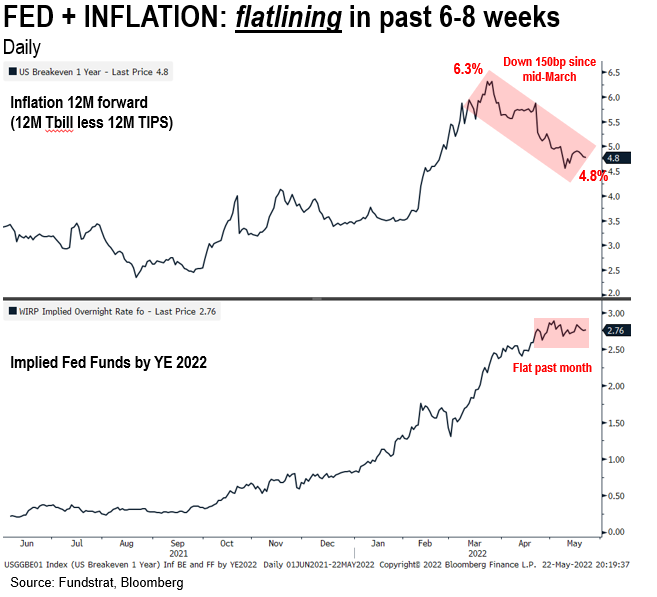

Inflation expectations (market-based) falling past 6-8 weeks…

Inflation and fears of surging inflation are top of mind. There are many causes behind this rise in inflation from supply chain woes, war-related disruptions, COVID-19 policies, China lockdowns, worker fear and of course, strong economic growth. And because there are so many factors, it is difficult for markets to assess where the Fed’s fight against inflation stands. And this uncertainty weighs heavily on markets. From the Fed’s standpoint, they are using tools to try to slow down aggregate demand, while many of the roots of the inflationary pressures are supply related.

But here is the interesting thing. Market-based measures of inflation, using 12-month T-bills less 12-month TIPS (USGGBE01 on Bloomberg) have been falling since mid-March. As shown below, this figure peaked at 6.3% and has since drifted towards 4.8%.

- While still not close to the “2%” goal of the Fed

- this inflation metric is 70% on its way back to 4%-ish, which is the level seen in most of 2021

Similarly, the market’s expected implied Fed Funds rate by YE 2022 has been pinned at 2.75%.

- 8 additional hikes into YE

- multiple Fed officials have reiterated 50bp for each of next 2 meetings and “assess”

- thus, Fed hike expectations are anchored by this somewhat “forward guidance”

In short, from a market’s perspective, incoming data in the past 6-8 weeks has not accelerated market’s fears of inflation. In fact, forward inflation expectations have actually been falling.

- there is some circularity to this, obviously

- after all, 12M forward inflation expectations could be tanking if the US is in recession next year

- but the fact this inflation rate is “pinned” and Fed Funds target rates are flat

- suggests that Fed communication strategy is tamping down market-based inflation

- that is a good thing

…But in that same 6 week period, equities are down 18%…overshoot?

But in this exact same timeframe, the S&P 500 has tanked 18%. Financial conditions have tightened, measured by credit spreads, market liquidity and depth and investor confidence.

- But given Fed funds YE has been pinned at 2.75% (8 more hikes), it means

- monetary policy in the past 6-8 weeks has been solely communications

- in essence, the Fed has been jawboning to tighten financial conditions

- in turn, to slow aggregate demand

- as one of my macro PM clients stated “this is the first ever use of communication channel to slow the economy”

While many might think the Fed is satisfied with this result, how does the Fed keep equilibrium? Will they keep jawboning whenever asset prices stabilize? And in the meantime, credit conditions are worsening. Moreover, this could trigger a larger scale selloff.

Curiously, the 10-year has been remarkably flat at this time as well. Mortgages and corporate credit (longer duration) is priced off the 10-year. So the fact this is pinned is also standing in contrast to the movement in equity prices.

- in other words, there are several scenarios where equities have overshot to the downside

- stocks have fallen far faster than other channels for tightening conditions

- and while some might argue this is a good channel because of the wealth destruction

- it is an unstable equilibrium, as stocks could fall far faster and trigger Fed reversal — overshoot

- incoming data could show labor market weakening, not due to higher rates, but due to COVID-19 ending

- and thus job market could be cooling (see below) at a pace faster than implied by tighter financial conditions

…lots of incoming data this week but we think indeed.com labs data shows job market rolling over

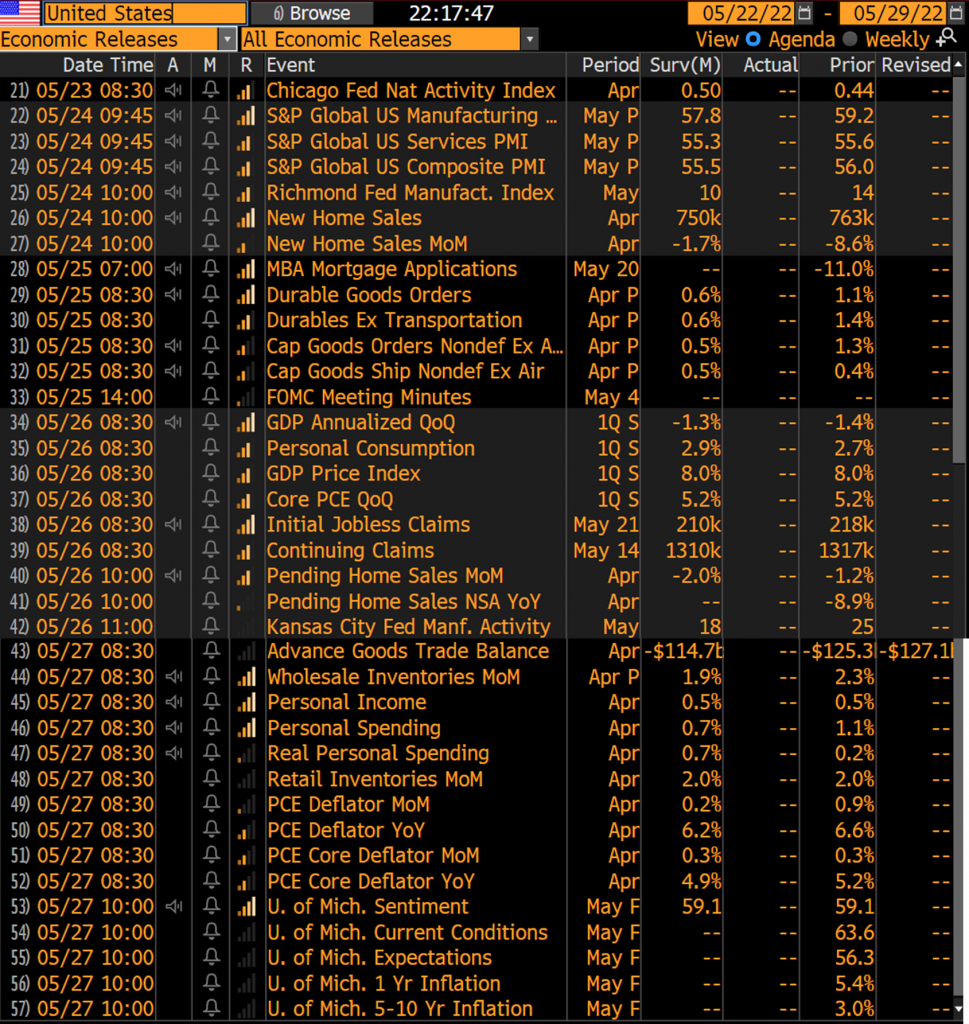

There is a ton of incoming data this week, as the US release calendar shows:

- tons of regional survey

- new home and pending home sales

- PCE deflator for April

All of these are important and the two areas markets seem most focused upon are inflation-related (PCE 5/27 plus regional surveys) and labor markets (no official data for a few weeks).

JOLTS vs Indeed.com: JOLTS is 6 weeks lagged, and indeed.com already showing significant weakening

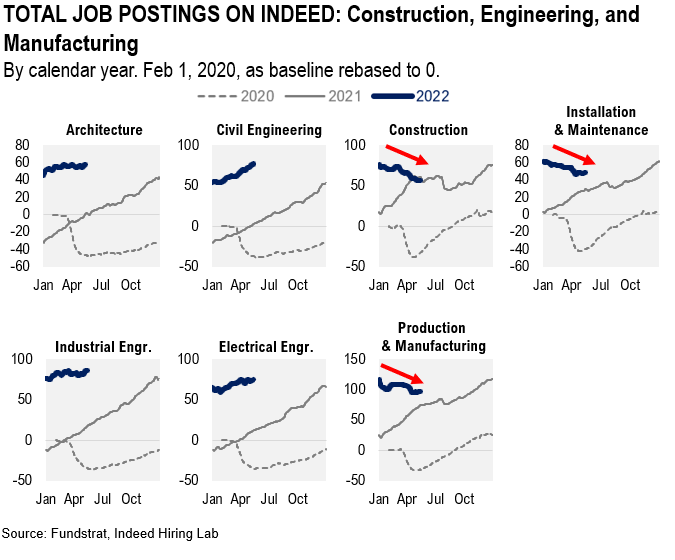

Our data science team, led by tireless Ken, has compiled indeed.com labs data on job postings. This is a more real-time measure of the jobs market:

- indeed.com data is posted with daily information, updated weekly

- this coming Wed/Thu we will have job postings data through 5/19

- the BLS JOLTS report is only through 3/31 and with 6 week lag

- next JOLTS report is not for 2 more weeks (1st week of June) and only thru April

- See the picture?

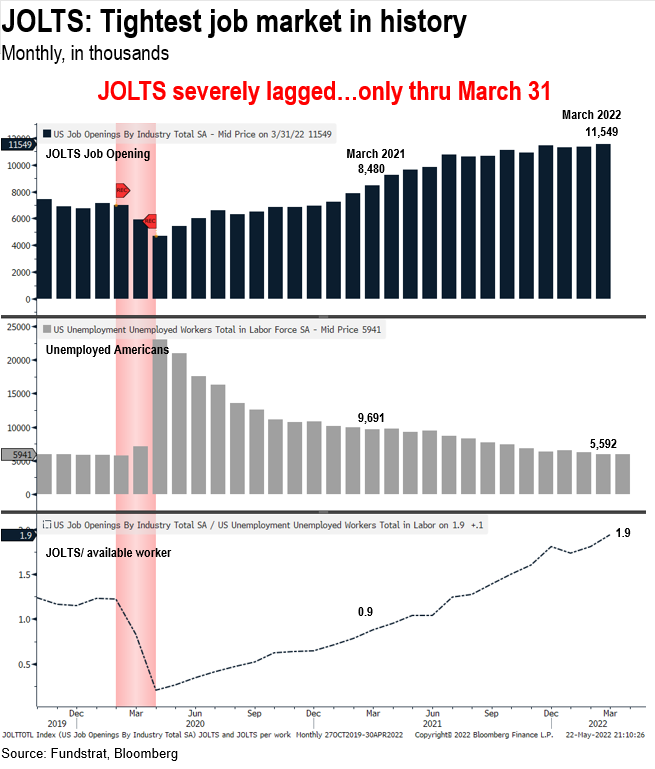

JOLTS shows job posting rose by 3 million in the past year, while unemployed Americans fell 4 million

The JOLTS data (thru March 31, 2022) shows the tightness of the jobs market today. As the Fed has mentioned, there are 1.9 job postings for every 1 available worker. The math is shown below.

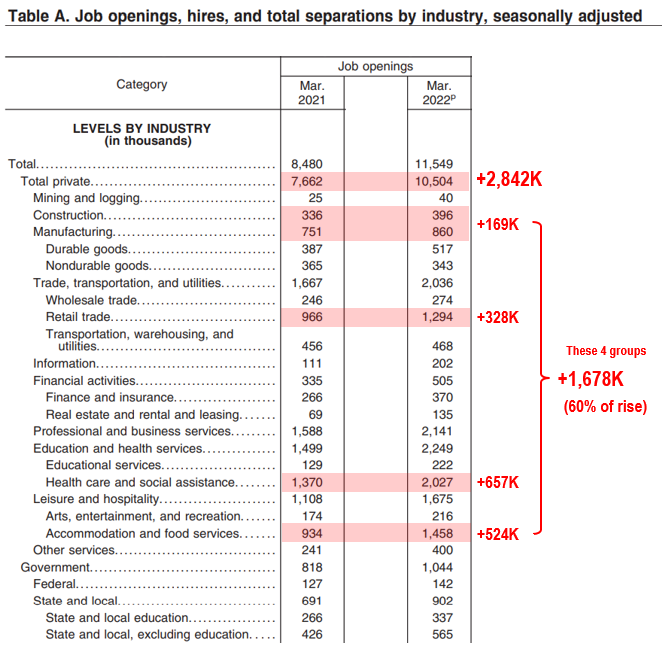

FED FOCUS: Of the ~2.8 million increase in job listings, 4 industries account for 60% of listings

We took a look at the JOLTS data more closely and 4 industries accounted for 60% of the rise in posting in the past year:

- Healthcare +657,000

- Leisure/Hospitality +524k

- Retail +328k

- Construction +169k

- These 4 total 1,678k job posting increase, or 60% of postings

In other words, if the Fed goal is to soften the labor market, these 4 industries should be the areas where postings should fall. There needs to be a large drop to bring labor markets back into equilibrium. But it should start here.

…Indeed.com data shows these 4 industries seeing a VISIBLE softening of postings

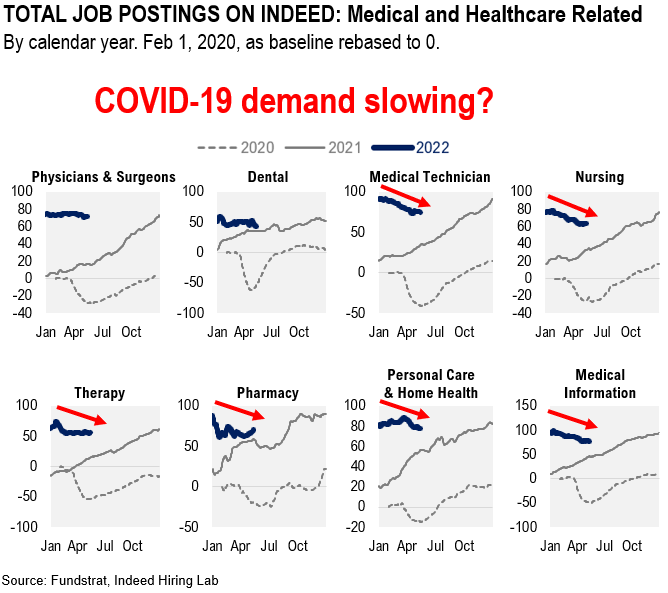

As the data compiled below shows, these 4 industries are indeed showing signs of weakening postings. This softness is for data through mid-May. And this should be appearing in upcoming JOLTS and other labor surveys:

- most surprising is the drop in Healthcare postings

…is fading COVID-19 behind healthcare postings falling for many categories?

The weakening of postings here surprises me the most as I have heard multiple stories of healthcare demand soaring as elective surgeries, etc are now being booked.

- visible drops in Medical technicians, nursing, therapy, pharmacy, personal/home care and medical information

- is this due to the collapse in severity of COVID-19 cases?

- this might make sense as hospitalizatons from COVID-19 continue to contract sharply

- we think this is counter to consensus views on the strength of healthcare labor

- Healthcare was the largest category for a surge in postings in the past year

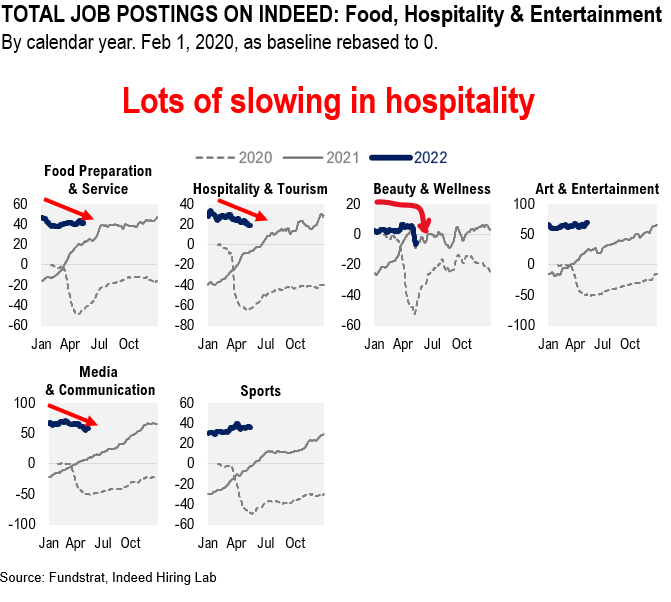

…Leisure showing a steady decline in postings

Leisure was the second largest category of job postings growth versus a year ago. And this is another category where we can visibly see softening postings.

- it is broadbased

- declines in food prep and hospitality/tourism

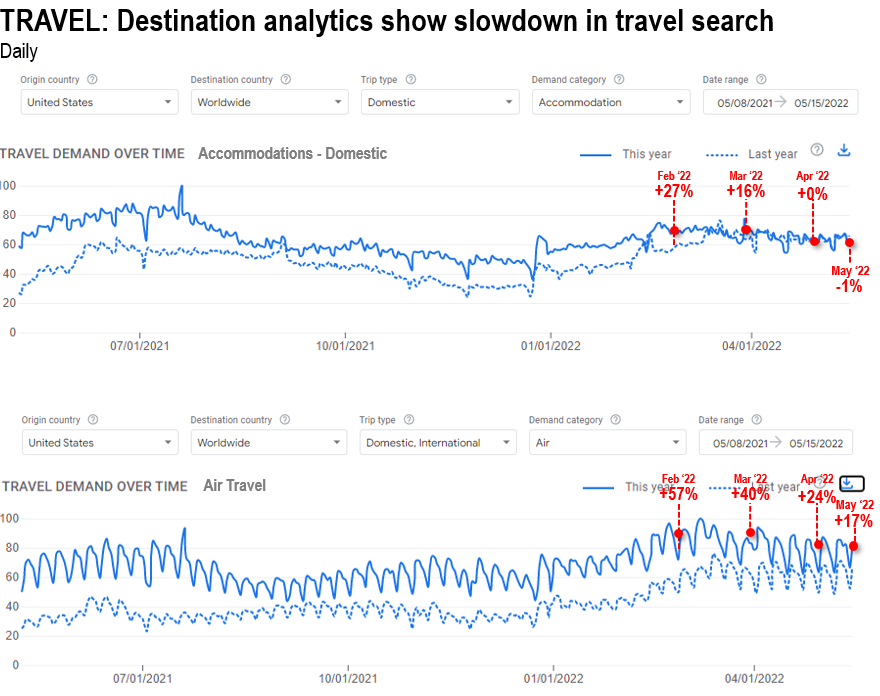

Leisure travel searches are slowing as shown by destination analytics by Google.

- searches for accomodation have slowed sharply in the past month

- Feb +27% vs year ago

- Mar +16%

- April +0%

- May -1%

In other words, this “revenge travel” dynamic might be coming up against tougher comps. And this could slow the need for hiring.

In fact, even Opentable.com reservation data shows that reservation requests hit a wall. This could be:

- this could be inflation means cutting back

- this could be weaker jobs means cutting back

- this could be wealth effect cutting back

- but it means food service hiring should be softening

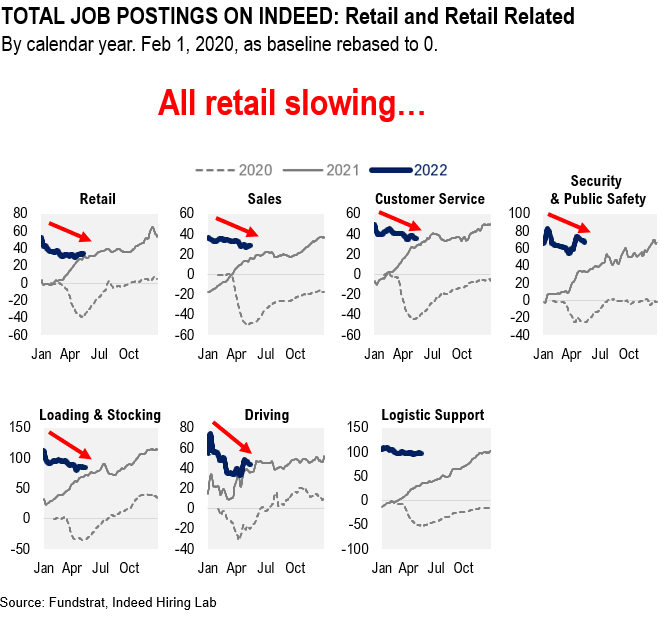

…Retail is softening as well, affirming the message from Amazon.com, Walmart, Target and others

Take a look at retail. As we noted in prior notes, this is where the greatest increase in jobs has taken place since 2019.

- in 6 of 7 categories

- postings are down

- as we previously noted, excess hiring likely took place due to COVID-19-related protocols

- retailers did not want interruptions

- but as COVID-19 severity and cases fade, retailers are overstaffed

I like this tweet by Michael Arouet. I don’t know if this is true, but given the wealth destruction YTD, I would not be surprised. More reason to expect retail hiring to weaken.

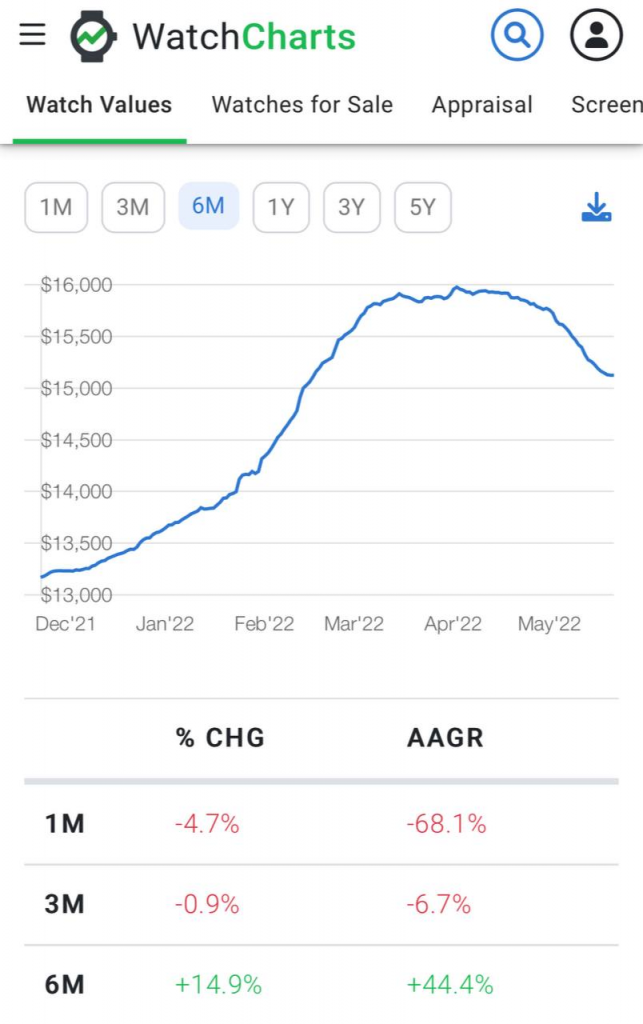

And even luxury watch market is softening. As this chart shows, watch values are down in the past 6-8 weeks. This is also a sign that retail labor markets should be softening.

And lastly, we can see construction slowing as well. Major projects are going to be victim to “wealth effect” risks. That is, cost of capital rising and diminishing confidence means projects can be delayed. This in turn could weaken hiring, etc.

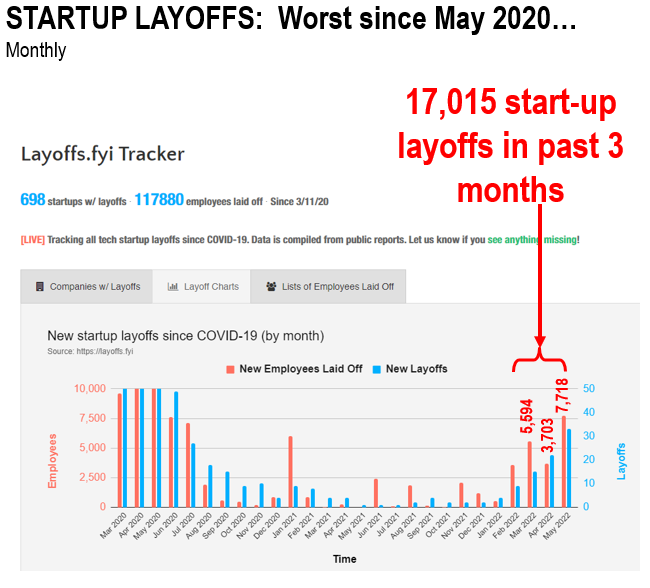

…start-up layoffs highest since May 2020

Layoffs continue to accelerate at start-ups. Start-ups are prone to rises in cost of capital because they are inherently lower ROIC endeavors. And as shown:

- layoffs are accelerating

- hitting 7,700 so far in May

- highest since May 2020

- we expect this to soon go parabolic, based upon anecdotal comments we have heard

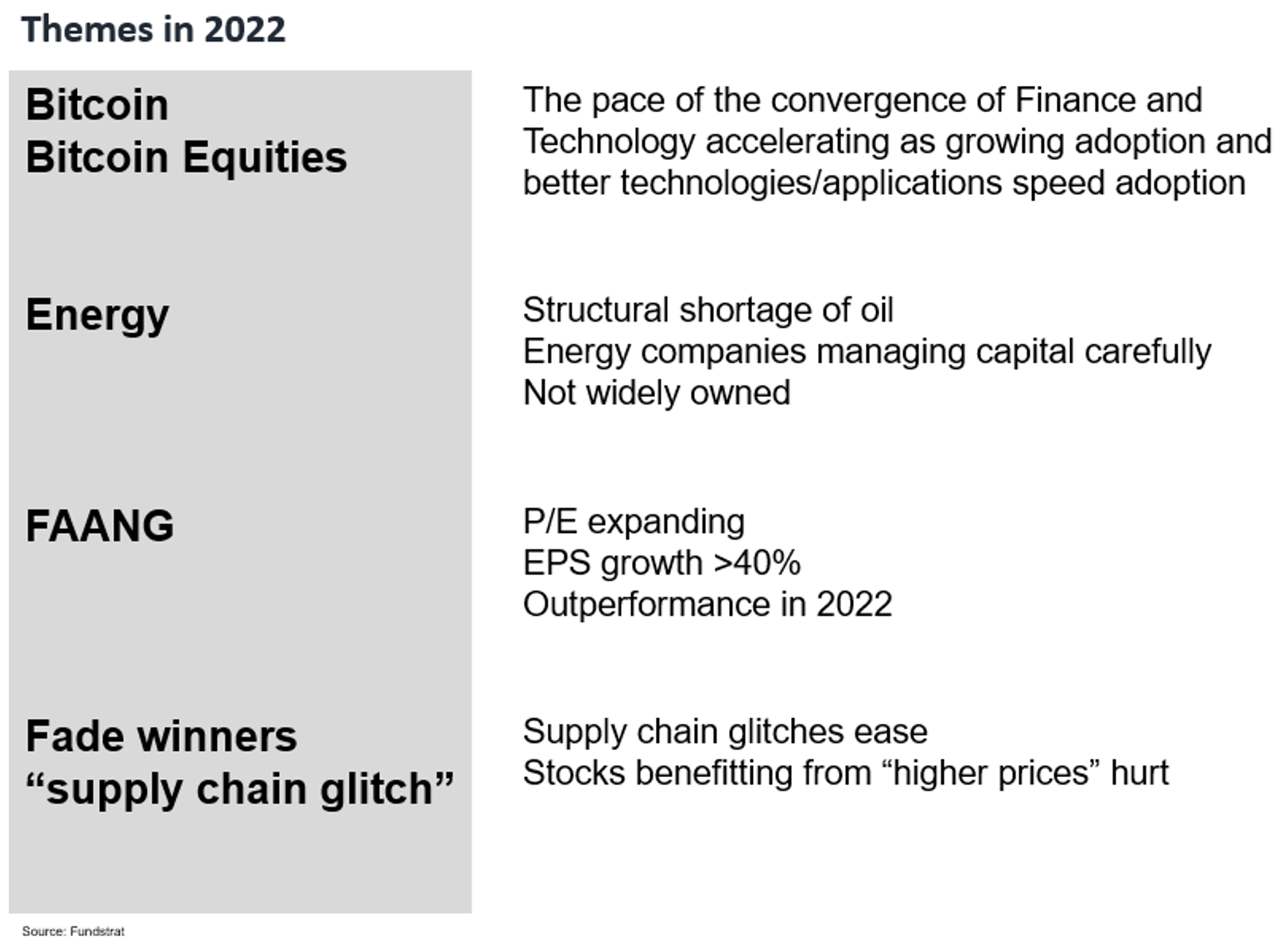

STRATEGY: We lean relatively “bullish” into 2H2022 (but also 2Q22), but warn of jagged next few months… Stick with BEEF

To recap on equity strategy, we are leaning bullish into 2Q2022.

Stocks have continued to be treacherous in 2022. Investors are on a hair trigger.

– this is in context to a challenging 1H2022

– so jagged next 3 months

Broadly, our existing sector strategy of BEEF remains valid. Even in war. Even with inflation. In fact, the last few weeks are strengthening the case for our “BEEF” strategy. That is, BEEF is

– Bitcoin + Bitcoin Equities BITO -0.78% GBTC -0.97% BITW -2.01%

– Energy

– FAANG FNGS 1.35% QQQ 1.15%

Combined, it can be shortened to BEEF.

Why is this making stronger BEEF?

– Energy supply is now a sovereign priority

– this helps Energy stocks

– Ukraine and Russia both want access to alternative currencies

– this strengthens case for Bitcoin and bitcoin equities

– if Global economy slows, growth stocks lead

– hence, FANG starts to lead FB AAPL -0.43% AMZN 3.74% NFLX 1.11% GOOG 0.88%

All in all, one wants to be Overweight BEEF

_____________________________

31 Granny Shot Ideas: We performed our quarterly rebalance on 4/5. Full stock list here –> Click here

_____________________________