COVID-19 remains a global crisis and we realize that many people need to keep up with COVID-19 developments, particularly since we are moving into the more critical stage (“restart economy”), so feel free to share our commentary to anyone who has interest.

Some new milestones were achieved today. California, the largest state in the US, announced plans to open the economy (Stage 2) this Friday, making 24 states with phased opening and 54% of GDP. And NY state saw daily cases CRASH to 2,538, capping 5 days of declining cases and bringing total cases down 76% below peak. NY state has made much progress in the past week and the recent data, including hospitalizations down, decisively show sustained slowing of COVID-19. NJ also saw cases fall 50% today (1,525 from 3,027) so NY is not necessarily a “fluke”– is it the weather?

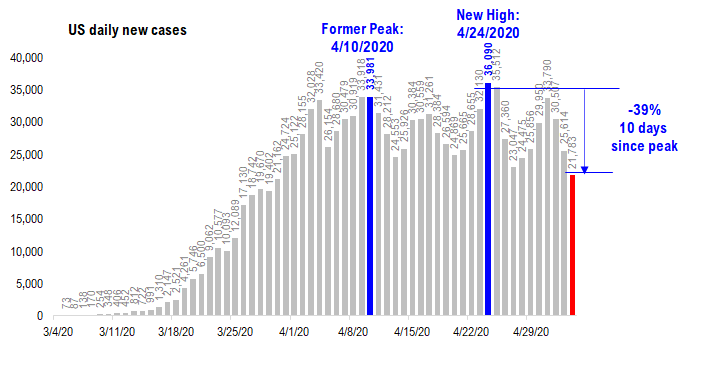

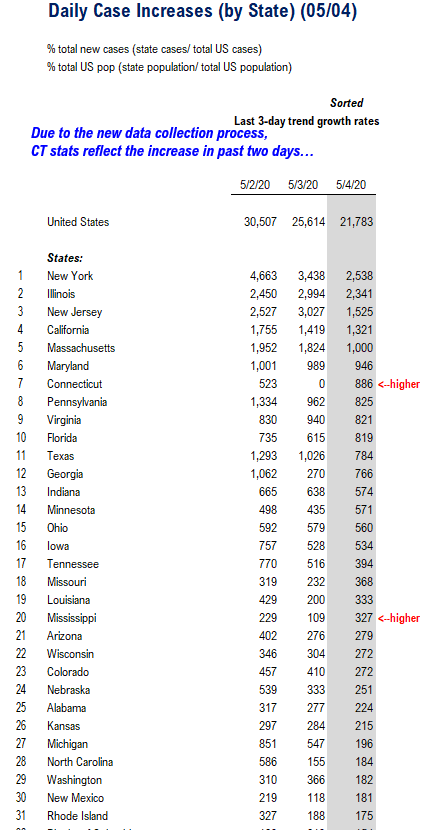

In any case, so many states saw a decline that the total new cases in the US fell to 21,783, which is down from 25,614 yesterday, 30,507 two days ago (you get the picture) and is down 39% from the 4/24/2020 peak of 36,090 cases.

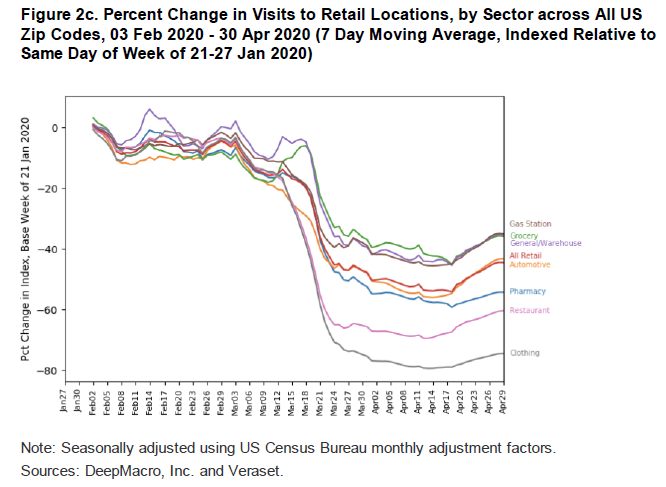

By the way, the big data provider, Deep Macro, posted updated consumer movement, and it looks like retail visits, even to automotive retail, is rising. As more states open, the question of how consumers re-engage will be answered. But so far, it looks better than what many feared (see below).

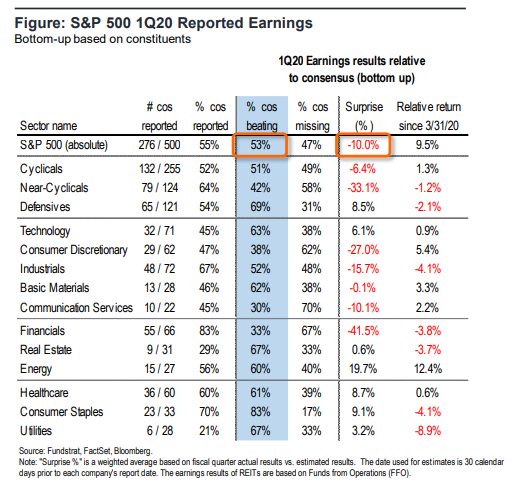

Equity markets today posted an interesting reversal, opening down 1% and closing up. Stocks are holding up exceptionally in what we can only describe as the worst earnings season in modern financial times. Companies are missing 1Q2020 EPS by ~10%, worse than any time during the GFC and most are withdrawing guidance.

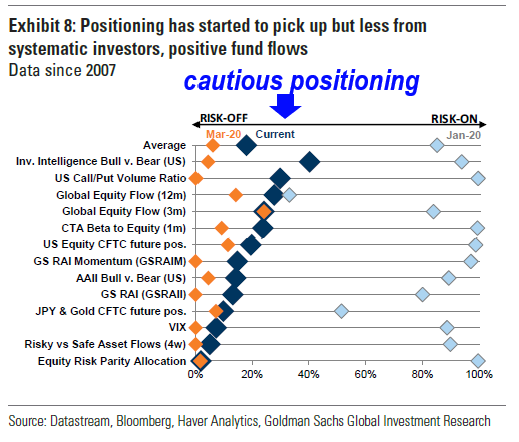

This is not a bearish observation. This is highlighting something apparent for some time, stocks are looking past the bad data and one could argue, sensing upside and good news ahead. For those saying stocks are ignoring bad news is simply ignoring what happened between 2/19/2020 and 3/23/2020. And as Goldman Sachs and JPMorgan proprietary positioning data shows (see below), retail is a seller and risk-parity funds are very bearishly positioned. And everyone else is “uncertain” = bearish.

The state openings and case counts peaking, and also “earnings confessions” are all acting to reduce uncertainty. And this is, in our view, the primary reason stocks are drifting higher and shifted into the hands of buyers (half full) — that is, the market was overwhelmed with sellers, causing the fastest crash ever. So we think risk/reward still favors buyers.

POINT #1: WOW! Good news from both coasts. CA is opening this Friday (Now 24 states –> 54% GDP). NY state cases crash to 2,538 and now 76% off-peak. Also Nebraska opened today.

California is the biggest state in the US and many of the top states are opening –> CA, TX, FL…

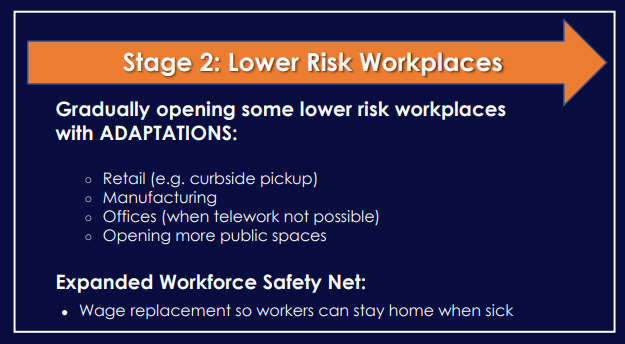

CA Gov Gavin Newsom announced the state will begin easing restrictions this week, as the state moves to “Stage 2.” The state had already eased rules around elective surgeries and this move is allowing many ‘low risk’ businesses to resume operations. California is an economic giant, representing 15% of US GDP. So this is a big deal.

The guideline for Stage 2 is listed below from the CA state roadmap.

But from what we understand, the following are allowed to open, per Stage 2. The Stage 2 “Lower risk” workplaces and certain businesses can open:

Low risk workplaces

– many workplaces (see above) including offices without telework

– Manufacturing

– Public spaces

Retailers w/curbside pickup

– bookstores

– clothing shops

– florists and

– sporting goods stores,

Not included…

– Offices

– Seated dining at restaurants and

– Shopping malls

So it looks like many people can return to the office, assuming telework is not an option. And manufacturing facilities as well.

Offices, seated dining at restaurants and shopping malls are not included.

https://www.gov.ca.gov/wp-content/uploads/2020/04/Update-on-California-Pandemic-Roadmap.pdf

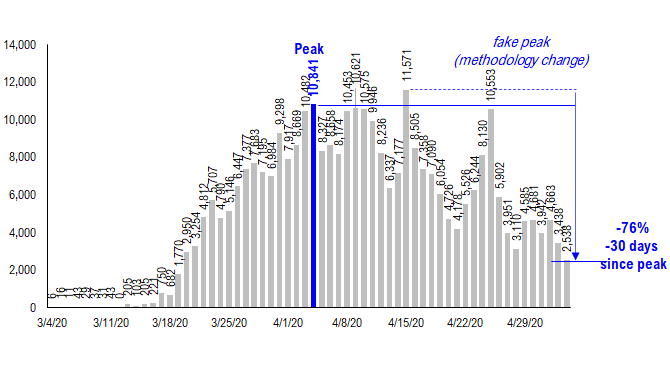

NY state cases CRASH to 2,538 which is 76% below peak… finally, reaching the true turning point (is it weather?)

NY state reported 2,538 cases today, from 3,438 the day prior and now a new low and 76% off the peak. If sustained, and a big IF, this is a huge turning point for NY state. The state has finally seen cases down 75% from the peak (our arbitrary yardstick).

– With CA opening at a somewhat advanced timetable, and with NY state seen progress on cases, perhaps NY may also accelerate its timeline, even for NYC.

Source: COVID tracking project + Johns Hopkins

Total US cases fall to 21,783 which is 39% below peak and total tests are flat, so this is a good sign…

Total US cases fell to 21,789 which is building on a steep drop seen over the past 5 days (see below). And this brings total cases down 39% off the peak. So far, this is a cycle low.

Source: COVID tracking project + Johns Hopkins

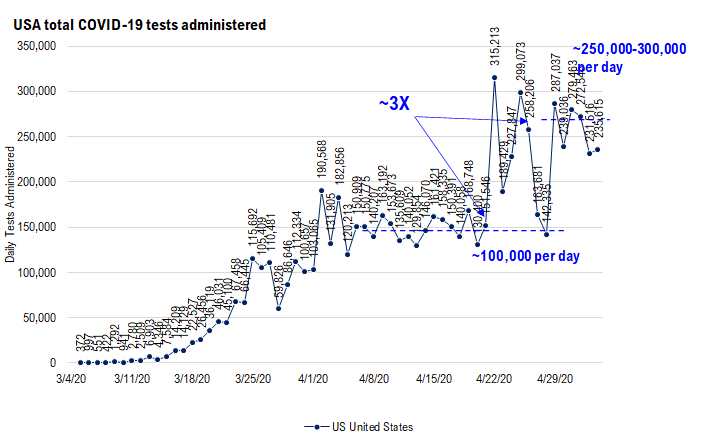

Total tests in the US have been stable the last few days, so lower tests is not accounting for this drop. Basically, the drop in cases is a good sign.

Source: COVID tracking project + Johns Hopkins

And as shown below, no single state is seeing a breakout. Notably, though, NJ and NY posted big drops. Big drops.

Source: COVID tracking project + Johns Hopkins

Nebraska, home of Bushwood Country Club (more famous than the Oracle of Omaha), opened parts of the economy today.

Nebraska governor, Pete Ricketts, held a press conference today as Nebraska opened up parts of the economy, including daycare centers and other businesses. A key part of the decision was also to open up the hospitals for elective surgeries and the state is receiving $272 million for critical access from the Federal government. He did ask for residents to not move between counties.

– Nebraska is best known for Warren Buffett/Berkshire and perhaps Omaha steaks.

– But for me, Nebraska reminds me of Caddyshack (which was on cable this weekend).

If you have not ever watched Caddyshack, ESPN describes it as “perhaps the funniest sports movie ever made.

Caddyshack: the fictional “Bushwood Country Club” with Bill Murray and Chevy Chase (pictured)

source: Caddyshack

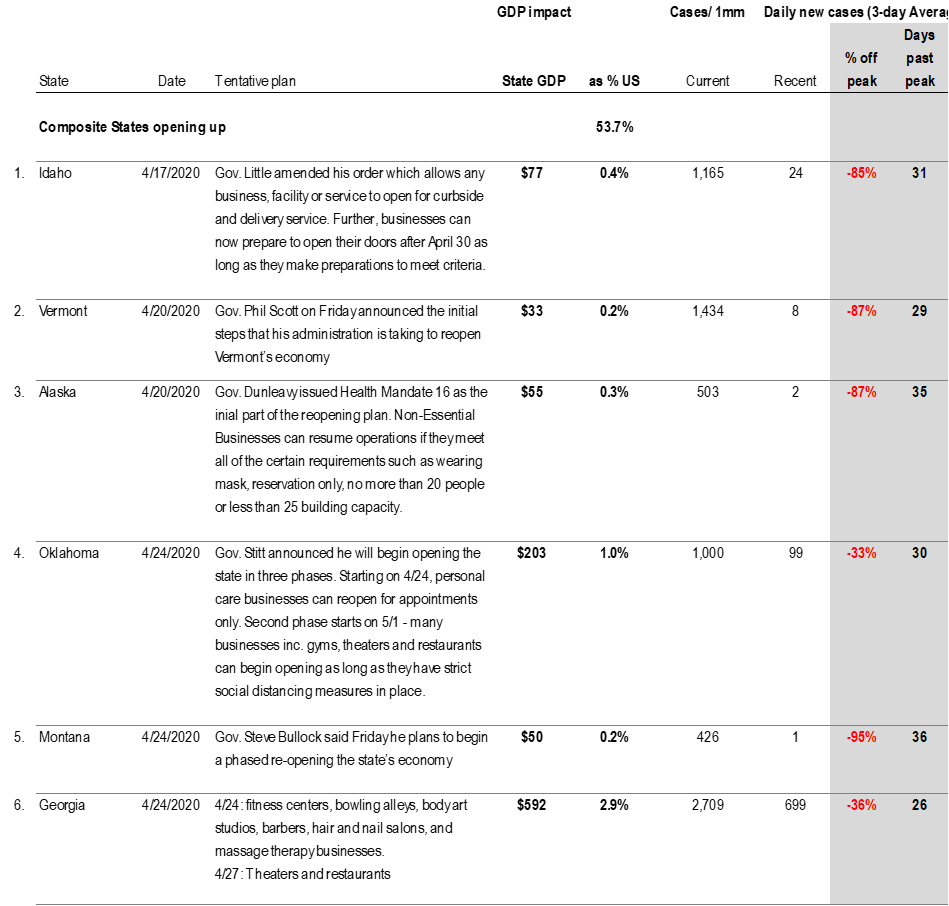

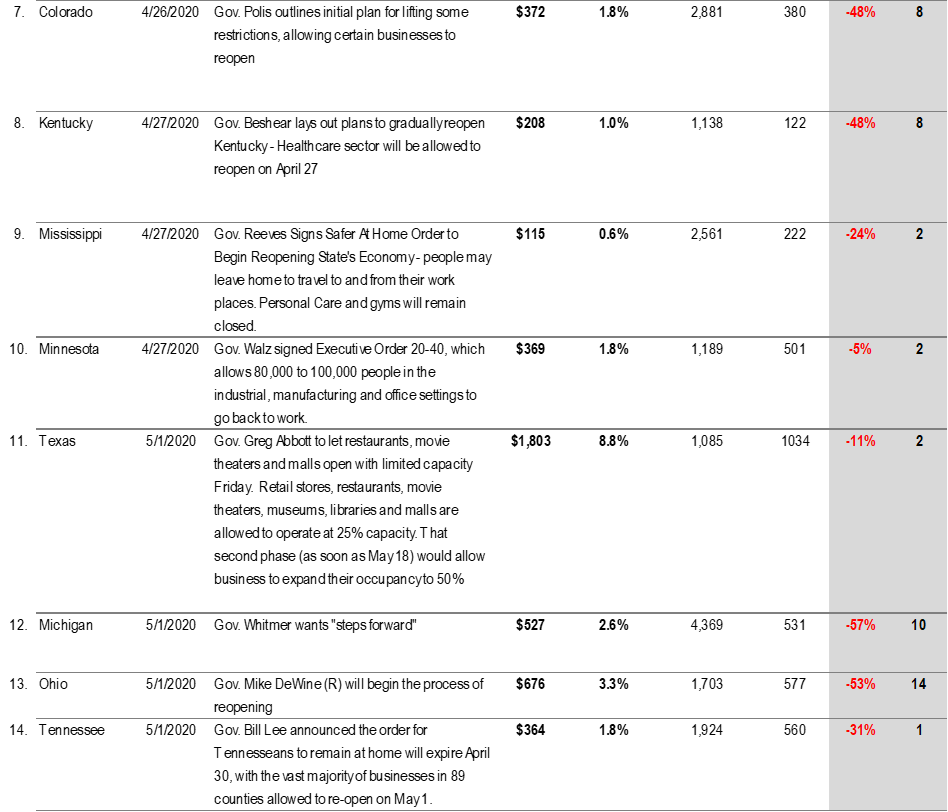

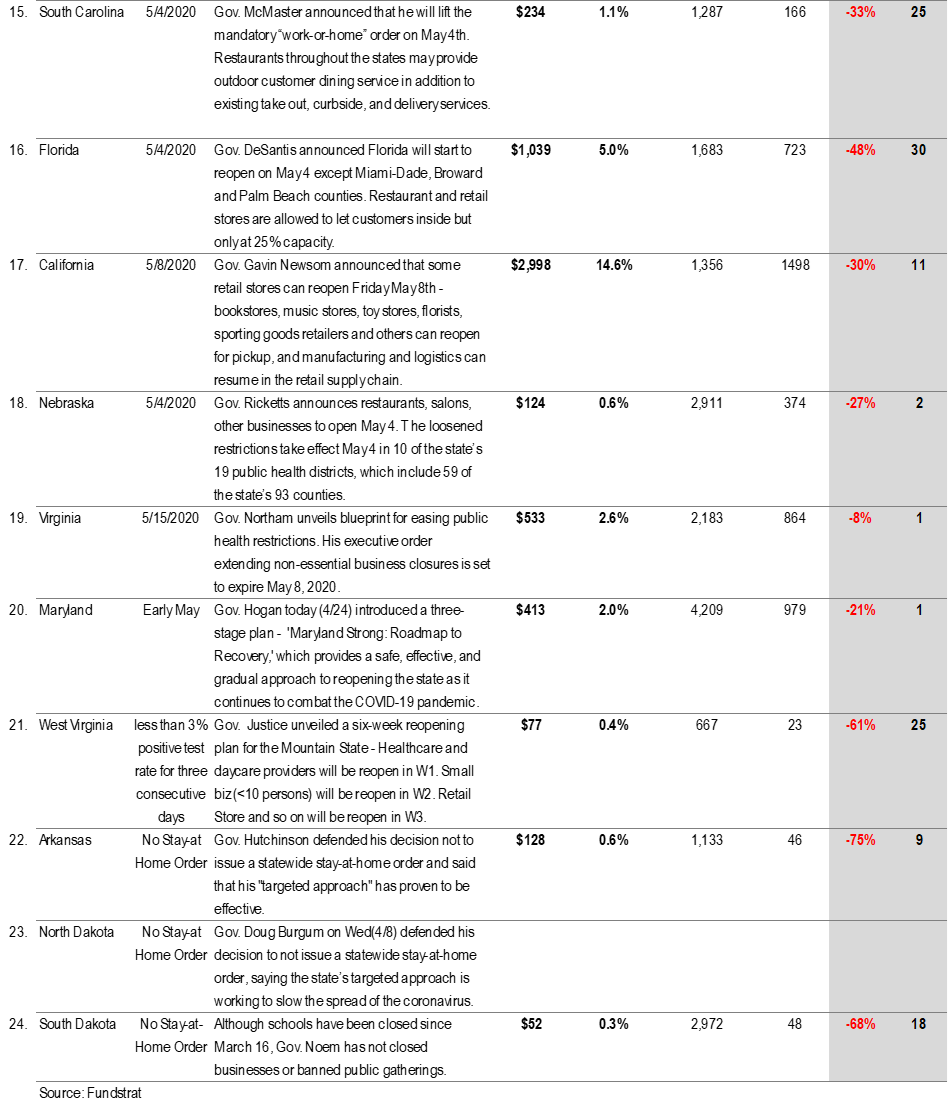

24 states now open, representing 54% of US GDP…

Now over half of the US has announced plans to re-open the economy, with many starting this week. This increase in ‘open economies’ coupled with Americans showing less fear (see below) is a step towards resuming economic growth. The natural question is whether this is appropriate (second waver risk) and whether the consumer will recover.

We do not know the answer, but without an open economy, we will not know the answer.

POINT #2: Retail location data shows automotive and general retail lifting off the bottom… economic activity clawing back

Deep Macro, headed by Jeff Young, and Veraset, have provided updated information about consumer visits for the past two weeks, across all zip codes in the US. They group the movement data by category and the broad picture shows a consumer emerging from hibernation.

– the biggest pickups have been in gas stations and grocery.

– the biggest 2-week increases are actually in automotive and ‘all retail’

– and some signs of recovery in restaurants and clothing.

How consumers will behave into the remainder of 2020 and post-lockdown is simply not discernable. But as each set of data is shown, particularly mobility (based on cell phone pings) from Apple, Google, Deep Macro/ Veraset, the picture is emerging of a consumer with fatigue from staying at home.

And one that is potentially venturing out again as fear abates.

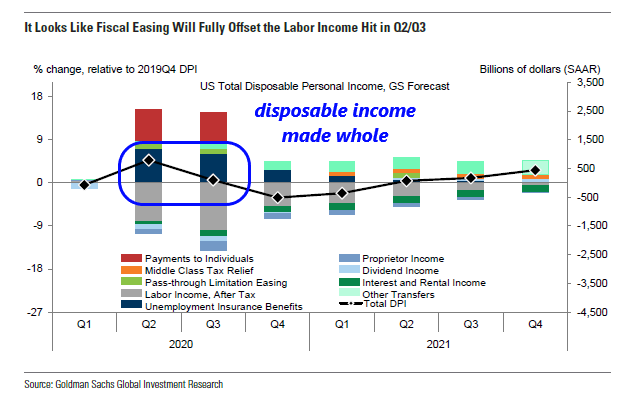

Goldman Sachs economics team posted a chart, highlighting something they have been saying for sometime — that the Federal credit for unemployment is going to lead to an actual rise in consumer disposable income (DPI) in 2Q and 3Q2020 (see below). In other words, the extraordinary actions of the White House are indeed acting as a major buffer to the consumer buying power in the next 6 months.

– this further supports the idea that the economy may be more resilient in 2H2020. After all, by preserving the consumer income, the future confidence (level) of consumer is preserved.

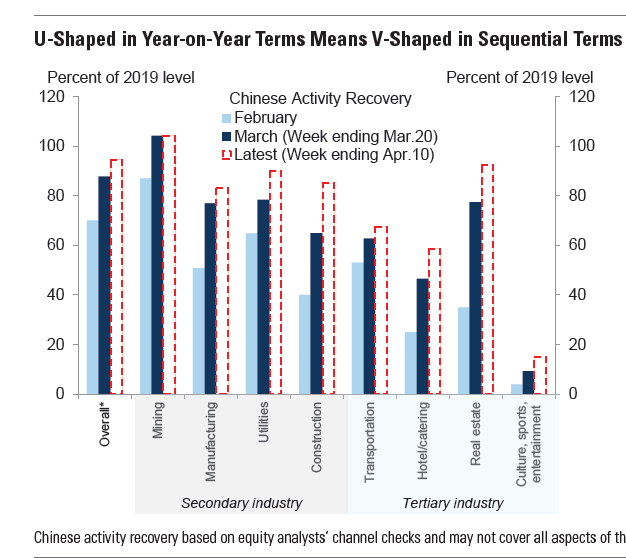

Goldman Sachs economists show that China Economic April activity is back to 80% of the 2019 levels pre-COVID…

POINT #3: NOT HIGH ANXIETY: Americans searching for things to do (google) and LESS pandemic/fear…

We all wonder what Americans are doing now, during this quarantine, and what new habits/interests they might develop over time. The future is uncertain and it is not clear if the habits of Americans will change post-pandemic. But we decided to plug in a few words into Google Search Trends to see if any words are showing unusual increases or decreases. We plugged in dozens of words, and perhaps our data scientist, tireless Ken, could plug in thousands. But here is our unscientific observations:

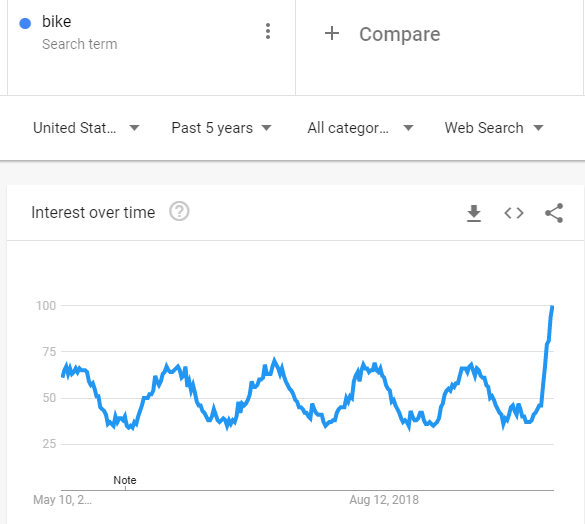

Notable 5-yr upside breakout in rising interest…– bike (and cycling, bicycle, etc)

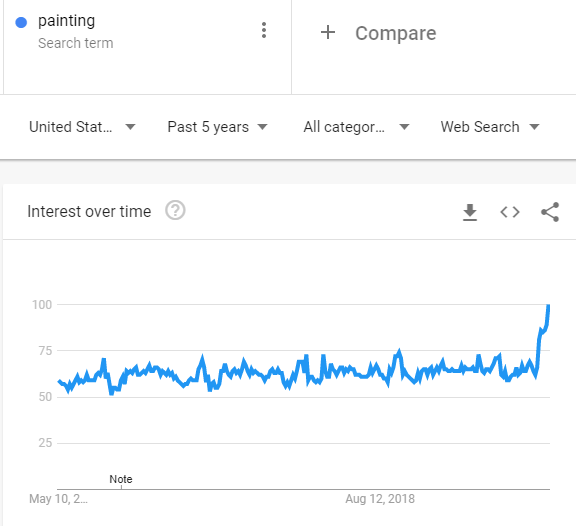

– painting

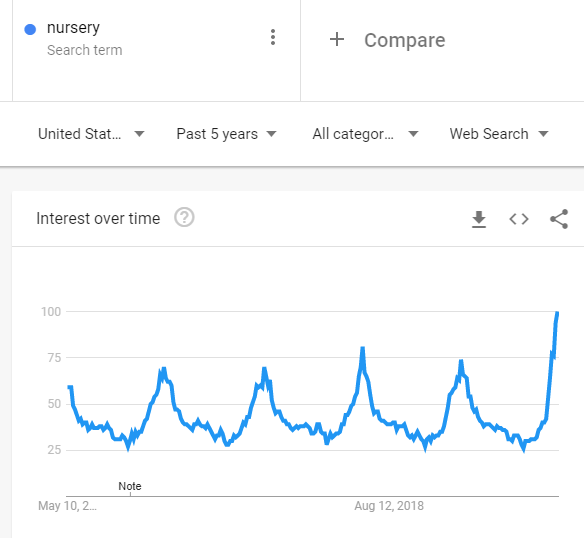

– nursery

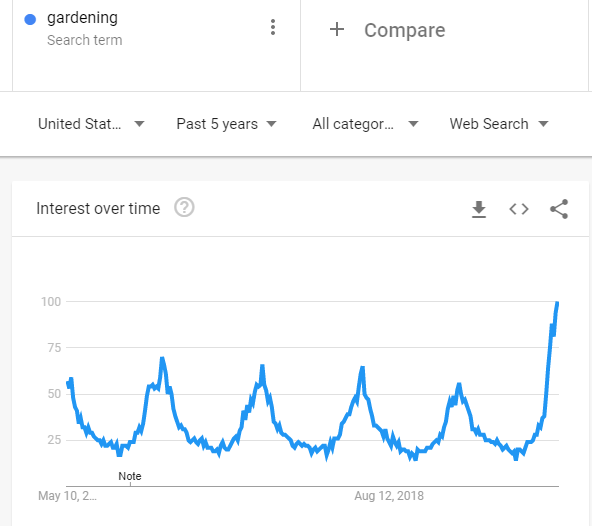

– gardening

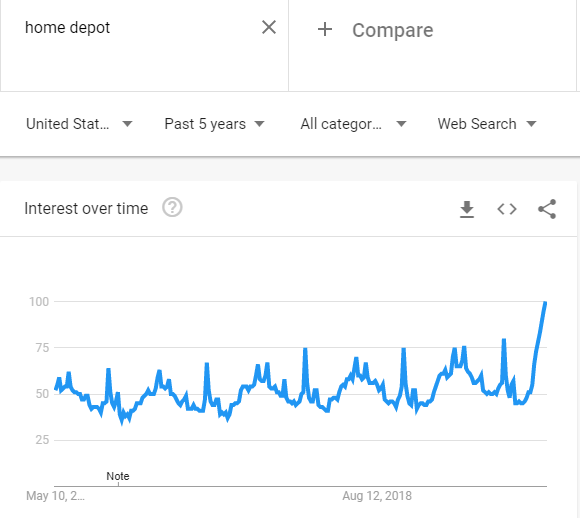

– home depot

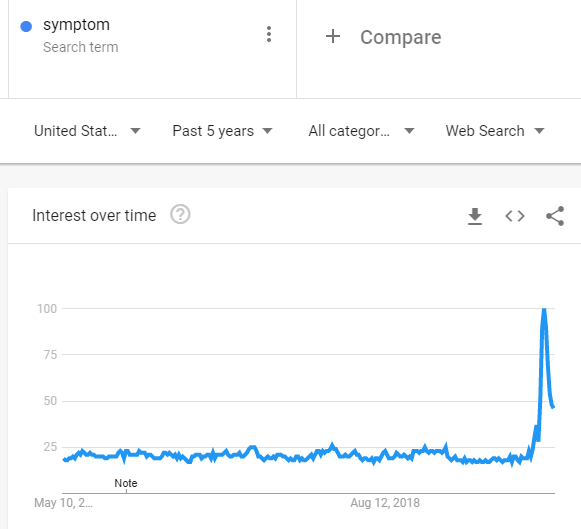

Downside breakdowns in interest…– symptom

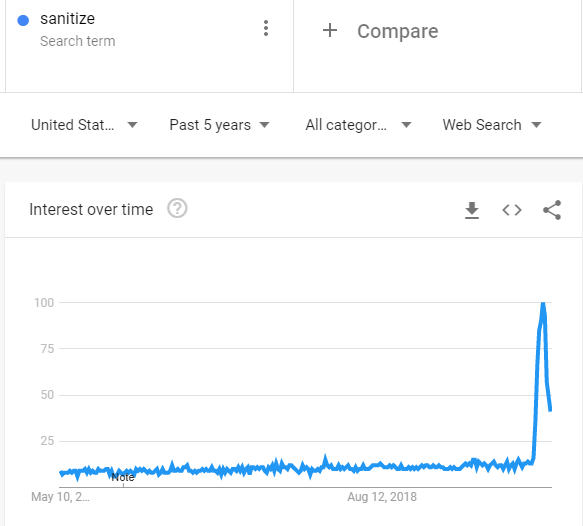

– sanitize

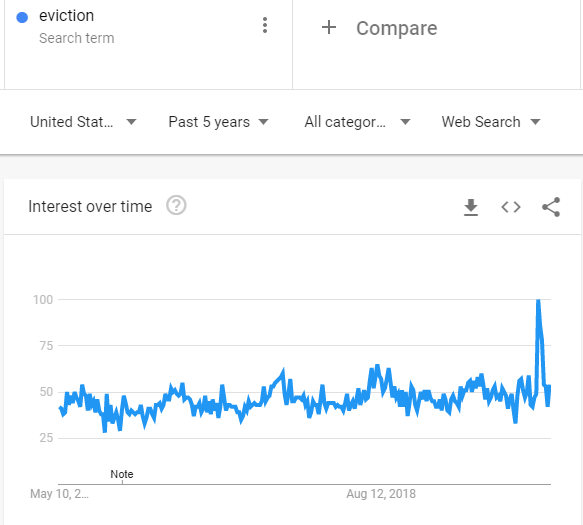

– eviction

– bored

Cooking vs takeout?– takeout crushing ‘cooking’

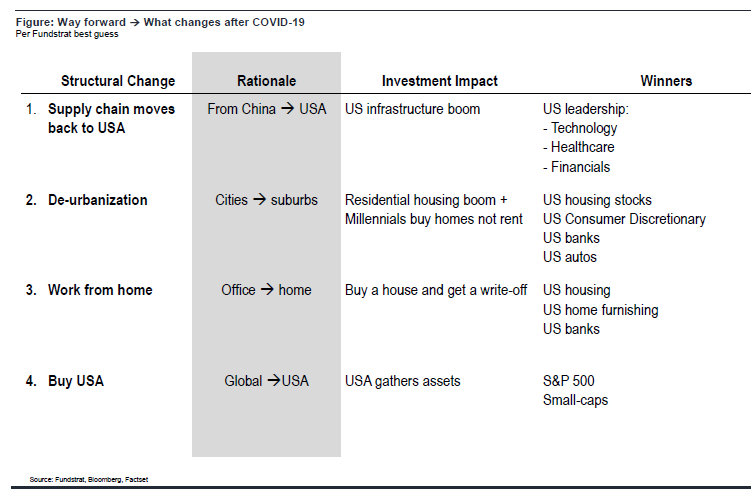

It seems like the anxiety of Americans is actually declining (good) and interests in activities is picking up. This is purely anecdotal but seems to affirm the notion that people post-COVID 19 might be seeking de-urbanization (move to the suburbs). It is clearly too early to tell. But the search trends for the words noted above is striking.

– The scale is suggesting a 3X above all-time highs for the “upside breakout” words.

Upside breakouts…

The first word (related not included but looked the same) is “bike” and as you can see, this is a 5-yr breakout. The scale for Google sets the “high” = 100. So the current is the high. The other 4 words follow and you can see the 5-yr breakouts associated with those as well.

Google search trend –> “bike”

Source: trends.google.com

Google search trend –> “painting”

Source: trends.google.com

Google search trend –> “nursery” (we believe as in ‘gardening’ not ‘baby’)

Source: trends.google.com

Google search trend –> “gardening”

Source: trends.google.com

Google search trend –> “home depot”

Source: trends.google.com

DOWNSIDE: What people used to search for but not any longer…

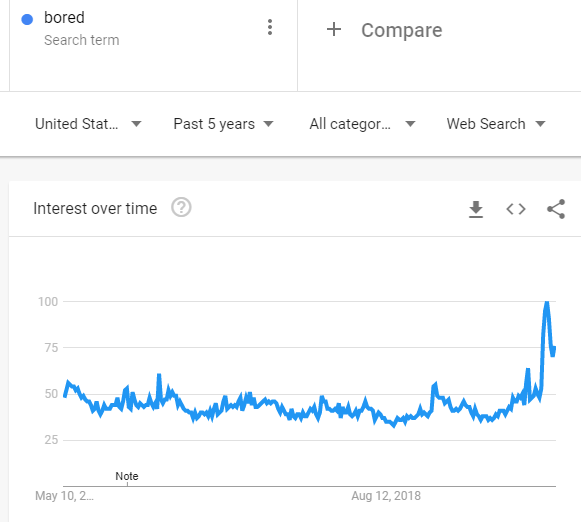

We looked for terms that were associated with the panic of the early days of this crisis. Everything from symptoms, to sanitize, to eviction and even bored. The results show a consistent pattern of massive surge in early days and now diminishing levels. This is a sign, in our view, that Americans are less fearful.

Google search trend –> “symptom”

source: trends.google.com

Google search trend –> “sanitize”

source: trends.google.com

Google search trend –> “eviction”

source: trends.google.com

This last word is a good sign. It does not look like America is bored.

– Even without sports, concerts, vacations, travel, shopping, restaurants, bars, etc.Google search trend –> “bored”

source: trends.google.com

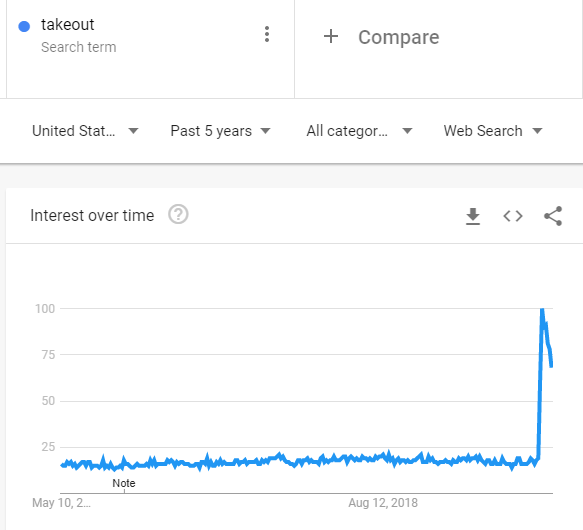

Cooking vs takeout –> Take-out is winning…

Interestingly, it does not seem like America is doing that much more cooking. Searches for cooking/recipes have not really picked up. But searches for take-out reached ATH in 2020.

– I guess Americans still prefer to eat someone else’s cooking.

Google search trend –> “cooking”

source: trends.google.com

Google search trend –> “takeout”

source: trends.google.com

source: trends.google.com

STRATEGY: Positioning and margin data show few investor cohorts “positive” on equities –> good sign for rally health

1Q2020 EPS season is the biggest miss in the history of reporting seasons… it is that bad, but stocks are resilient.

The S&P 500 remains remarkably resilient. In the past 2 weeks, companies have reported terrible results, withdrawn guidance, a few have filed for bankruptcy and yet the S&P 500 has remained solidly above 2,800. Many investors have scoffed at markets, noting stocks are ignoring “bad news” — but this is not true. The S&P 500 had its fastest ever decline in 2020, so the stock market was not ignoring bad news, it was actually moving way ahead of the bad news. So in retrospect, the crash in markets was “discounting” the massive surge of COVID-19 in the US.

Keep this in mind. 1Q2020 is the worst ever reporting season in history. In no other time have companies missed EPS by ~10% vs consensus and THEN withdrawn guidance. This is fundamentally horrific. And yet, stocks are not focused on the “current” EPS results. By this same transitive notion above, the relative resilience of markets in the past few weeks, shows markets are potentially sensing better times ahead.

Goldman Sachs positioning data shows FEW investors are constructive and dead last (most bearish) are risk-parity style…

Investors are not that bullish, which is conversely, quite positive. After all, markets peak when the “last person” is bullish.

– but their positioning data shows few constituents are even Neutral.

By the way, the data below is consistent with our observations –> uncertainty = bearish. Few investors are positive. Most are “uncertain” because of the great unknown created by the pandemic. And positioning stemming from uncertainty is the same as bearish.

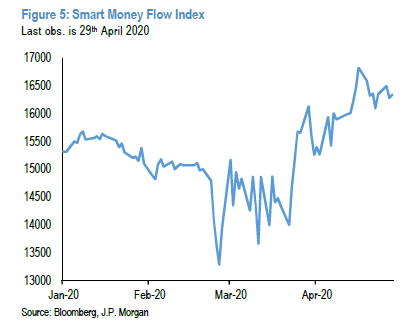

JPMorgan Flows and Liquidity analysis shows retail is also bearish…

And JPM Flows and Liquidity report shows that NYSE margin debt has fallen, evidence, in their view, that retail investors are not driving this rally.

Source: JPMorgan Flows and Liquidity

And instead, it looks like the institutional (long-only, we can surmise) is driving the upside, since the “smart money” index shows that institutions are accounting for the majority of the price increase. The Bloomberg Smart Money Flow index looks at the price action at the “open” (retail) vs the “close” (institutions). And since the March 23 bottom, the close has been stronger.

Source: JPMorgan Flows and Liquidity

Source: JPMorgan Flows and Liquidity